Investment Rationale

June 2023

Supercharging Sales Teams

Why we're investing in Kush and Ahmed of Vartana

Read moreMarket Perspective

May 2023

6 minutes

Note: This perspective was first published in Activant's newsletter, The Greene Street Observer. Sign up here for more insights and updates from Steve and the Activant team.

Market Perspective

May 2023

6 minutes

Over the last decade, high burn rates became the norm in Silicon Valley. Look no further than the Software-as-a-Service, or “SaaS” market. Investors and founders had an unspoken pact. Investors were ok pushing out profits, as long as management teams delivered on growth. This worked swimmingly well because of two long-term trends. First, interest rates declined for the better part of 30 years, decreasing the cost of capital. Second, the cost of managing cloud infrastructure decreased, as we shifted from single tenant to multi-tenant, and then to AWS, Azure, and the like. Now that both of these trends have reversed, we believe that many of today’s SaaS companies are headed straight into a storm if they don’t take a hard look at their business model.

The SaaS business model it isn’t new. While Salesforce may have popularized the term SaaS, you could buy an allocation of time sharing for a computer starting in the 1960s. In the ‘90s it was called “application service providers,” or “ASP’s.” These ASPs hosted software centrally and charged customers on a recurring basis for access. Prominent ASPs that survived include Citrix and Concur. We don’t hear about 99% of ASPs, because investors held them as close as Cleopatra – just about everyone got bit (with a few exceptions).

First, interest rates declined and remained at nearly zero from 2009 to 2016 – which increased the value of a dollar in the future. This made investors much more willing to push out profits, so investors championed a SaaS revolution and put profitability in the back seat. As we know, rates have been rising, and have brought back a renewed focus on cash flow and business model.

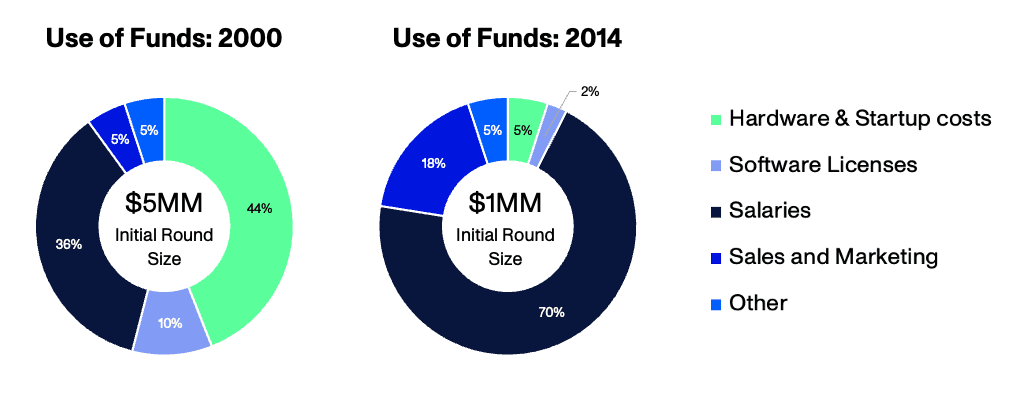

Second, the cloud moved from single tenant to multi-tenant, which dramatically reduced the cost of operating a SaaS business. From 2000 to 2014, the average first round of investment fell 80%, from $5 million to $1 million. In 2000, early startups had huge infrastructure costs - by 2014, much of that was handled by outsourced cloud infrastructure providers like AWS. Use of proceeds in a round for hardware and start-up costs (the green slice) fell from 44% of the round to about 5%. This reduced the capital and risk required to get started, and allowed for a proliferation of new companies, along with growth in seed funds to invest behind them. More on this in another issue.

Source: Activant Research, CB Insights Venture Roundup

The best way to move forward is to take a page from the past. The most common business model for software companies anytime before the last 15 years was called license and maintenance. In this model, software companies charged a large upfront license fee, typically 3-5x a comparable annual SaaS fee. Then they charged an annual recurring revenue, or maintenance, which was typically priced at 20% of the upfront license fee. Customers paid this in order to keep updated with patches, upgrades, and support. Maintenance often had annual increases or accelerators for keeping the latest product up to date.

The upfront lines fee ensured the software company could be profitable as it covered the cost of production and sales. The recurring maintenance revenue resulted in high margins, especially since the cost of delivery was low - which is still true today. Up and cross-selling resulted in a new license fee for additional products and extensions.

This model was brilliant, as it allowed software companies to run profitably and maintain recurring revenue. We forget, but many of the great technology companies were profitable in their first year, such as Microsoft and Hewlett Packard. They charged for services as well as license and maintenance fees - and if you want to blow someone’s mind in Silicon Valley, posit that services are stickier than software.

Eventually, though, most companies transitioned to SaaS, as investors - both public and private - essentially forced the change by valuing SaaS companies at a premium to license and maintenance.

We’ve been encouraging our companies to revisit a license and maintenance model, or something similar. Given rates are high and customers could be more likely to cancel contracts, pulling as much cash forward is the absolute best thing a software company can do in this environment. In addition to helping the software company get to profitability, the up-front license fee creates a massive sunk cost that is actually less likely to be canceled by a customer (as long as they don’t run out of money). And back to services, they create more stickiness than software alone.

My view is any answer you are looking for in any business, has already been asked and answered in the past. We all stand on the shoulders of giants.

Latest perspectives

Investment Rationale

June 2023

Why we're investing in Kush and Ahmed of Vartana

Read more

Market Perspective

March 2023

Today, the Biggest Risk to VC-Backed Startups is Themselves

Read more