Published

August 2025

Reading time

29 minutes

The Playbook for Winning in Market Consolidation

Insights from our Research Desk: A Five-Part Series

The Playbook for Winning in Market Consolidation

Download ArticleResearch

Editor’s Note to the Reader:

To be clear from the outset: We at Activant believe AI represents one of the most significant platform shifts of our lifetime, creating a generational opportunity to build market-defining companies. Our conviction in the future of AI has never been stronger.

But that conviction demands intellectual honesty. The era of easy money and fragmented innovation could already be coming to an end. A new, more challenging chapter of consolidation looks to have begun, and the old SaaS playbook for building a startup could be obsolete.

This five-part series is a direct response to what we see in the market. We will dissect the market's shifts and the strategies of the tech incumbents to deliver a playbook for survival and victory. We are publishing this not as a warning to stay away, but as a roadmap for how to win.

Day 1: Is the AI Gold Rush Over? We examine the data that signals an end to the initial boom, exploring the dynamics of a now hyper-competitive market and the imminent consolidation to follow.

Day 2: Does the House Always Win? Inside the Tech Giants' AI “Gravity Wells”. Next, we turn to the tech incumbents. This piece explains how widespread "app fatigue" among enterprise customers is creating a strategic opening for giants like Microsoft and Google to build powerful "gravity wells," posing a challenge to the broader startup ecosystem.

Day 3: The Filtration: Why a Rational Market Is a Founder's Greatest Opportunity. This piece examines the consequences for startups facing the "wrapper challenge". We then detail the mechanics of the "acqui-hire"- a controversial talent acquisition strategy where a larger company hires a startup's core team, fundamentally altering the outcome for its investors.

Day 4: The Durable Moat: An AI Founder's Playbook for Winning. Here, we provide the solution to the challenges outlined in the first three parts. This is our guide to building a durable company in the current AI landscape. We detail the three pillars of a defensible moat-Relationship Capital, Model Stack Strategy, and Distribution Ownership.

Day 5: A New Mandate for the AI Market. In our conclusion, we consider the significant wildcard of regulatory intervention. We then deliver our final mandate for succeeding in this landscape, where the traditional venture capital playbook no longer works.

Part I: Is the AI Gold Rush Already Over?

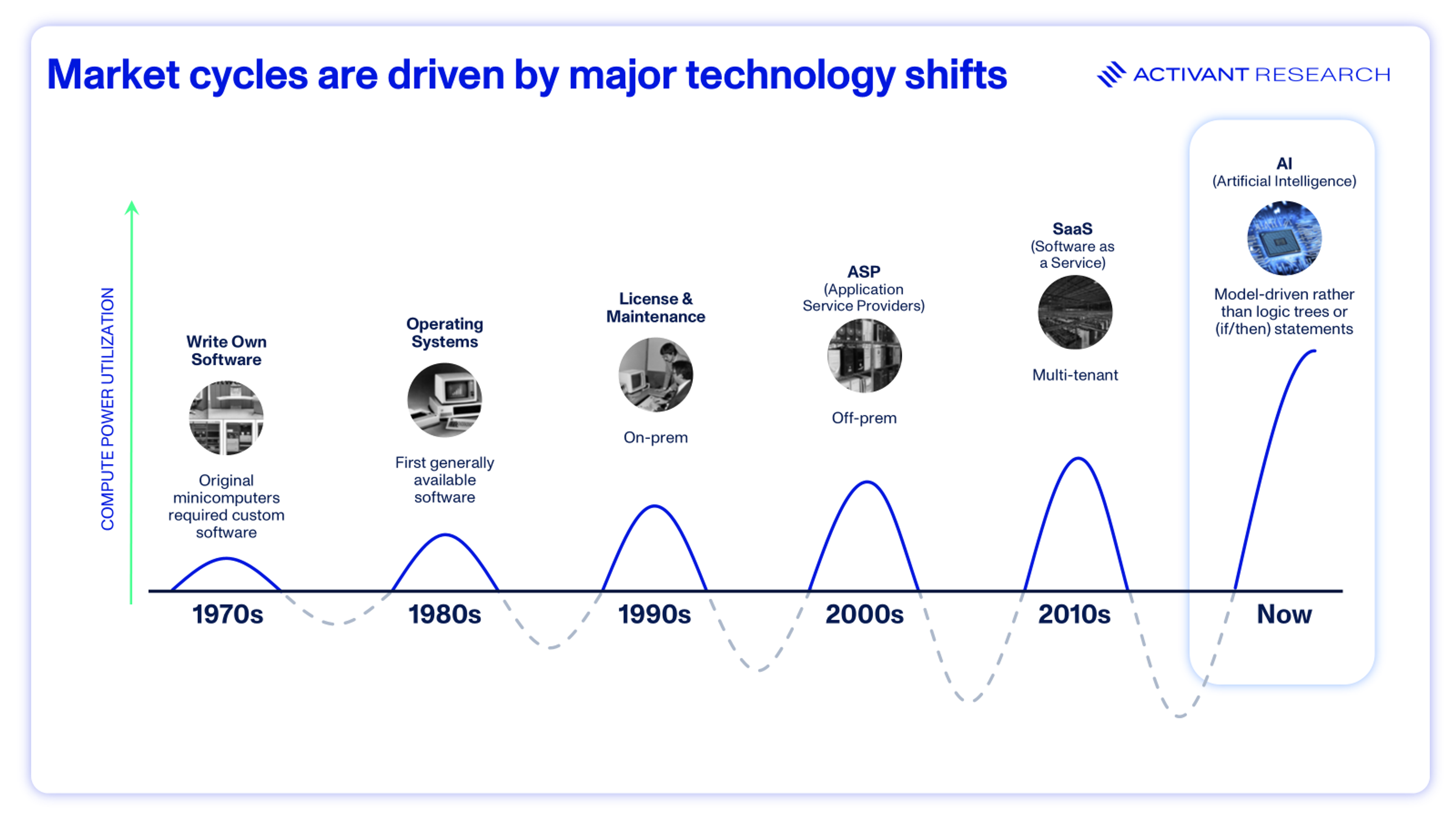

Market cycles are driven by major technology shifts, and we are currently amid the most dramatic one yet. AI is not merely an incremental improvement but a fundamental platform transformation, akin to the dawn of Operating Systems in the 1980s or SaaS in the 2010s.

Over the past several years, the AI ecosystem has been a whirlwind of creation–a modern-day gold rush fueled by accessible foundation models and a flood of venture capital. It was and is a veritable Cambrian explosion of new "apps", but for some built on a thrillingly simple playbook: find a niche, wrap it in a GPT-4 or now 5 API, and ship it.

That era of unrestrained, fragmented innovation could be coming to an end. Signals of a consolidation are underway, creating an incredible opportunity for those who understand the new rules of defensibility.

The dynamics of the market are shifting. The speculative “party” of the initial AI gold rush is concluding, and now the real work begins: building durable, defensible companies designed to last.

An Ecosystem Consumed by Capital

The scale of this recent boom is difficult to overstate. In the first half of 2025 alone, AI startups raised a staggering $121.9 billion in venture funding–more than doubling 2024’s $55.3 billion and 2023’s $51.8 billion.1

This influx of capital has fundamentally reshaped the venture landscape. In the second quarter of 2025, AI- and machine-learning-related deals surged to 49.2% of the total VC deal value, but only 29.5% of the deal count. That’s a increase from just 33.3% and 24.6% respectively in the same period of 2024.1

This is not merely a popular category; AI is consuming the entire venture ecosystem, drawing capital away from other sectors, as seen above.2,3

While the total number of global venture deals has fallen from its 2021 peak, Pitchbook shows the proportion of AI/ML deals grew. In Q2 2021, "other" deals outnumbered AI/ML deals by more than four to one (11,048 to 2,533). By Q2 2025–in a much tighter market–that ratio had compressed to just over two to one, with AI/ML deals at 2,146 versus 5,126 across all other sectors. The takeaway is clear: as the proportion of AI/ML deals grows against a backdrop of fewer overall deals, capital and founder attention are inevitably consolidating into the AI sector.

The Catalyst: Democratization Meets Hype

This capital tsunami and democratization of technology fueled a proliferation of new companies. In 2024 alone, over 1,800 new AI startups were funded, most built on the same handful of foundation models. The accessibility of the technology was a key catalyst. Open-source models like Meta's Llama, Google's Gemma, and Microsoft's Phi-2 dramatically lowered the barrier to entry, enabling startups and researchers to leverage cutting-edge AI capabilities at a fraction of the upfront cost.4 This wave of accessibility has enabled the launch of countless new ventures.

The composition of accelerator batches provides a clear signal of this phenomenon: in Y Combinator's Spring 2025 cohort, a remarkable 46% of the startups (67 out of 144) were AI agent companies.5

Concluding Thought for Day 1: A Darwinian Shakeout

However, this explosion of creativity could carry the seeds of its own demise. The low barrier to entry and the intense hype cycle led to an oversaturated market, with thousands of startups built on the same commoditized technological foundation.

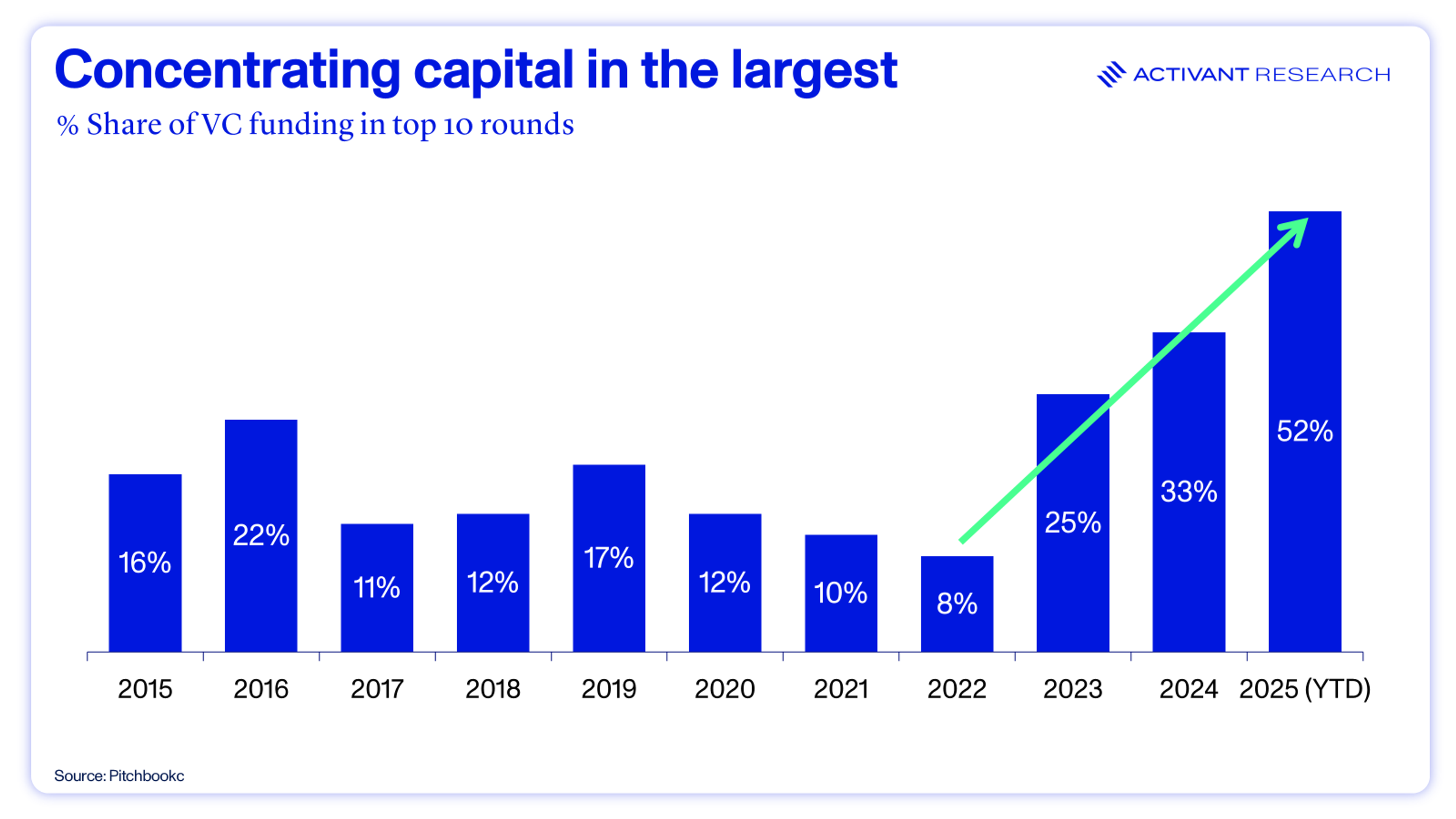

While it seemed money was flowing to everyone, the reality is: 2025, an astounding 52% of all VC funding to date was captured by just the top 10 funding rounds. Revealing a consolidation of capital, up from 25% in 2023 and only 8% in 2022.

As the market becomes crowded and the initial excitement wanes, a period of Darwinian selection is inevitable. The very forces that enabled the boom–accessible models and abundant capital–have created a hyper-competitive environment that is now paving the way for a potential platform-led consolidation.

Next: With the market dynamics established, we’ll analyze the key players driving this potential consolidation. Tomorrow, we examine how tech giants are building "gravity wells" to reshaping the landscape from the top down.

Part II: Does the House Always Win? Inside the Tech Giants' AI “Gravity Wells”

The consolidation of the AI market isn’t a random event; it is a calculated response by the technology giants to a clear demand signal from their most important customers. Microsoft, Google, Amazon, and Salesforce are no longer content to simply sell shovels in the AI gold rush. They want to claim the mines, building "gravity wells" designed to attract and retain enterprise spend.

For investors, understanding these platform “gravity wells” is critical, they can either accelerate a startup’s scale or quietly cap its upside.

The Driver: Enterprise “App Fatigue”

This shift is being driven by pervasive "app fatigue" among Chief Information Officers (CIOs), who are overwhelmed by vendor complexity and under pressure to deliver measurable returns on their technology investments. A PwC survey found that 82% of tech leaders say their companies are struggling to realize value from these investments.6

As a result, enterprise leaders could be rationally choosing to consolidate. A Microsoft survey revealed that 86% of business leaders and employees point to a single, centralized platform as the ideal solution for collaboration and efficiency.7

This sentiment is echoed in a Deloitte survey where 88% of leaders identified cloud as the foundation of their digital strategy, indicating a desire to build upon existing, trusted platforms.8 CIOs are rationally choosing to consolidate their spending with the major cloud providers, viewing their integrated AI offerings as a lower-risk path to achieving the productivity gains their organizations demand.

This is why the giants are pulling disparate AI functions - like translation, data analytics, and image generation, as metaphorically shown in the graphic above - into their core platforms.

The Strategic Advantage: Agentic AI on a Dominant Platform

The mechanism for this platform-led consolidation is the rise of "agentic AI" - systems capable of acting autonomously on behalf of users and business units. This is the new strategic battleground. Gartner projects that by 2028, AI agents will execute 15% of daily work decisions, up from virtually 0% in 2024.9 The tech giants are building the infrastructure to own this agentic layer, leveraging their existing dominance in cloud computing as a significant distribution advantage. In the second quarter of 2025, Amazon Web Services, Microsoft, and Google collectively controlled 67% of the global cloud market (excluding China).10 Their individual market shares in Q4 2024 stood at 33% for AWS, 20% for Microsoft Azure, and 11% for Google Cloud.11

This existing infrastructure, combined with a vast customer base, enables the giants to deploy new AI capabilities to millions of users with a simple software update. They are weaving AI into the very fabric of enterprise work, transforming it from an application one opens into an ambient layer across the entire software ecosystem.

The Platform's Blind Spot: Winning on the Giants' Turf

While the gravity of the major tech giants is undeniable, it creates its own blind spot. These giants are optimized for building massive, horizontal solutions—a "one-size-fits-all" approach that often becomes "one-size-fits-none" for customers with deep, industry-specific needs. They are structurally too slow and too generalized to serve every niche effectively.

This is where the opportunity for startups emerges. The incumbents' platforms are not just fortified walls; they are also home to the largest marketplaces in software history, such as the Salesforce AppExchange and Microsoft Azure Marketplace.

For a specialized startup, these marketplaces represent a powerful distribution advantage. They offer:

- Direct Access: A channel to a massive, aggregated pool of enterprise customers who are already qualified and have budget authority.

- Reduced Friction: A trusted environment where discovery, procurement, and integration are streamlined, dramatically lowering a startup's customer acquisition cost (CAC).

Think of it like a race car drafting behind a large truck to conserve energy and gain speed. A savvy startup can "draft" behind an incumbent's massive go-to-market engine, using the marketplace to reach customers that would be impossible to acquire independently. The goal for some is not to compete with the tech giant’s platforms head-on, but to become an indispensable, value-adding component within its ecosystem.

Concluding Thought for Day 2: The Platform Paradox

For certain startups, one of the primary threats is no longer just another startup, it’s the "good enough" feature bundled for free into a core platform. However, this same dynamic creates a new opportunity. The platform's marketplaces have become valuable distribution channels in software.

The critical question for founders has evolved beyond "can you build a better product?" to "Can you build a moat so deep that even a platform update can’t erode it?" In this era, success requires a playbook for winning on the giants' turf, either by becoming a specialized, indispensable solution within their ecosystem or by building a stand-alone platform so deeply embedded in a customer's workflow that it creates its own gravitational pull.

For founders, the challenge is to decide: Are you building to integrate deeply within a giant’s ecosystem, or to compete from the outside with a differentiated, standalone platform?

Next: The Tech Giants “gravity wells” are reshaping the startup landscape in unexpected ways. We’ll break down the so-called “wrapper challenge” — why it could determine which AI products survive—and uncover the mechanics of the controversial “acqui-hire,” a strategy quietly redefining founder and investor outcomes.

Part III: The Filtration: Why a Rational Market Is a Founder's Greatest Opportunity

The initial, frenetic phase of the AI gold rush is coming to an end. The Cambrian explosion of apps built on third-party APIs was a thrilling moment of innovation, but that era of fragmented, easy wins is closing. A new, and ultimately more rewarding chapter has begun. We are now in the midst of “A Filtration”—a necessary and healthy market rationalization. This process is separating features without a clear path to defensibility from durable companies, clearing out the noise, and creating a clearer path for those building with discipline and foresight.

For the strategic founder, this filtration isn't a threat. It's the ultimate advantage.

From Hype to Substance: The End of the Wrapper Playbook

A simple playbook has dominated: wrap a thin user interface around a third-party API and ship it. This led to an oversaturated market where thousands of startups were built on the same commoditized foundation, all competing for the same niches.

That playbook is becoming increasingly difficult to sustain. As major platforms bundle similar AI capabilities into their core software for free, the strategic vulnerability of a simple "wrapper" is being exposed. The market is no longer rewarding hype; it's rewarding defensibility. The core issue lies in the lack of sustainable business models. Many AI tools’ function as features rather than standalone companies, making them challenging to monetize at meaningful scale. Without a deep, defensible moat, these products can be replicated and bundled for free by tech giants’ platforms, making it harder to establish a recurring revenue model. While some wrappers can evolve into defensible businesses, often face headwinds without proprietary data, workflow integration, or unique moats.

The Next Wave: Reinforcement Learning From Live Workflows

A quiet but important shift is taking shape in the AI race. While much of the discussion still centers on larger, more capable models, leading labs are increasingly investing in systems that improve by learning from live, real-world usage, not just static, historical datasets.

Over the past year, companies like OpenAI, Anthropic, and Google DeepMind have been building high-fidelity simulations of widely used digital environments, from major websites to enterprise systems of record. These virtual testbeds allow AI agents to practice complex, multi-step workflows and learn from delayed success signals. This could mean closing an enterprise sale, completing a lengthy debugging session, or running a multi-day campaign, scenarios where the outcome only becomes clear well after the first step.

This approach, combining reinforcement learning with human and AI feedback (RLHF and RLAIF), is beginning to influence where competitive advantage sits:

Real-Time Data Is Becoming a Key Differentiator

Defensible training signals are increasingly coming from live interaction loops rather than static archives. Companies that capture a steady flow of user decisions, workflow completions, and edge-case resolutions can create feedback systems that refine performance in ways general-purpose models may struggle to match. OpenAI’s integrations with Microsoft Copilot, ChatGPT, and its API network give it broad visibility into usage patterns, insight it can apply to product improvements and vertical-specific features.

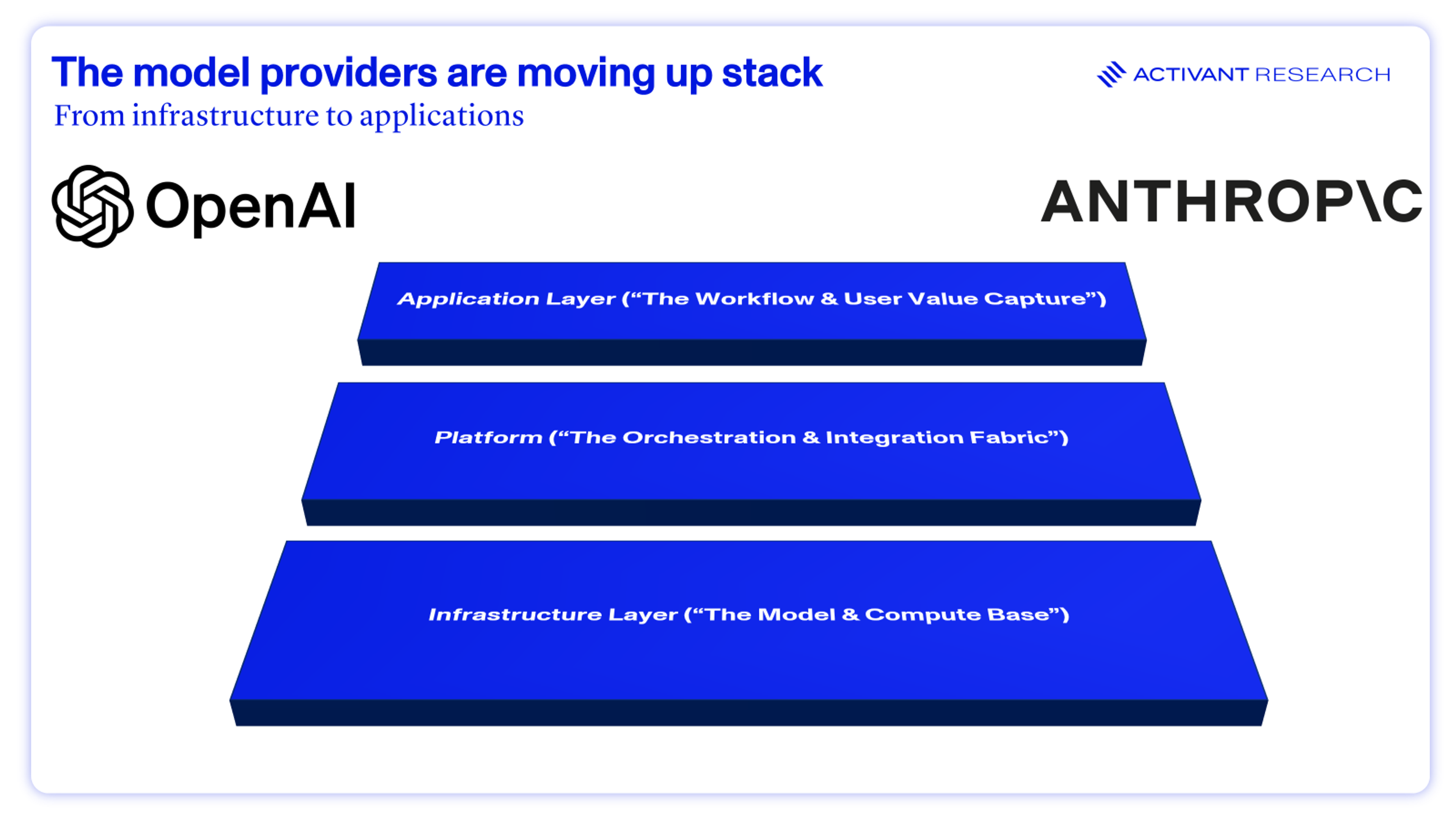

The Line Between Infrastructure and Applications Is Blurring

Recent commercial results point to this shift: Reportedly OpenAI doubled ARR from $6B to $12B in six months, while Anthropic grew from $1B to $5B over a similar period. Notably, $1.4B of Anthropic’s API revenue comes from just two customers — GitHub Copilot and Cursor, both application-layer products that could face competitive pressure if the model provider moves further up the stack.12,13,14

Rapid Model Preference Changes

In developer tools, for example, Claude 3.5 Sonnet has quickly become the default in certain contexts, overtaking GPT-4 for specific use cases. Anthropic’s expansion into end-user products, such as Claude Code, reportedly generated $400M in ARR within weeks. This shows how quickly a platform provider can identify high-usage patterns in its API and integrate similar functionality into its own offerings.14

For companies building on top of these platforms, the strategic challenge is how to maintain an advantage when the infrastructure provider has both visibility into product traction and the ability to act on it.

The defensibility playbook is evolving. It now includes creating proprietary reward functions, developing domain-specific evaluators, and designing reinforcement learning systems tuned to the nuanced workflows in your target market. In the current market environment, the companies that endure will be those whose moats remain strong even if the platform itself steps into the same territory.

This technological shift is mirrored in how capital is now being allocated. Investors are concentrating their resources on companies that not only have defensible technology, but also the ability to capture and sustain these real-time data advantages.

Capital Precision: Why Mega-Deals Are a Bullish Signal

The venture landscape is reflecting this shift. While headline investment figures remain high, capital is concentrating in a handful of mega-deals. In the second quarter of 2025, the top 10 venture deals accounted for over 45% of all capital invested. This isn't a funding drought. It's capital precision. The story is in the widening gap between the value of AI deals and the count of AI deals. In the first half of 2025, AI's share of total deal value soared to 53%, while its share of deal count was a much lower 29.2%.1 This concentration of capital is part of the filtration at work, investors are doubling down on companies that can clear the market’s defensibility bar.

This chart doesn't show a lack of funding; it shows a flight to quality. Investors are no longer spraying capital across a wide portfolio of undifferentiated apps. Instead, they are making disciplined, concentrated bets on companies that demonstrate true, defensible moats. For founders who can prove they are building a durable platform rather than a temporary feature, the capital is more focused and more committed than ever.

But for companies that are still working toward this defensibility bar, alternative outcomes are becoming more common, including strategic acquisitions and “acqui-hires” that allow teams to continue their work inside larger platforms.

Redefining the Exit: The Rise of the Strategic Acquisition

With the IPO market largely frozen, mergers and acquisitions (M&A) have become the primary exit path for startups. Analysis of this trend reveals how the market is evolving. In 2024, nearly 90% of exits involved companies that had raised no further than a Series B round.16 These should not be seen as failures; they are strategic acquisitions and talent-first exits.

In a consolidating market, being acquired by a larger platform while not the first outcome most teams envision, “acqui-hires” have become a pragmatic reality. This has given rise to the "acqui-hire", a talent-first acquisition where a major firm hires a startup's core team, prizing their expertise above a product. Recent headlines are filled with high-profile examples of this. Perhaps the most notable are:

- Google – Windsurf, Google reportedly entered a $2.4 billion licensing and hiring deal with AI coding startup Windsurf. This involved hiring the CEO Varun Mohan, co-founder Douglas Chen, and parts of the R&D team into DeepMind to work on agentic coding projects, while licensing Windsurf’s technology reportedly under non‑exclusive terms.17

- Meta – Scale AI, Meta agreed to invest $14–15 billion investment in Scale AI, taking a ~49% stake. This deal lured Scale’s founder, Alexandr Wang, and key team members into Meta’s newly formed AI group.17

- Microsoft's – Inflection AI, where it hired the startup's co-founders and the majority of its technical team in an unconventional transaction valued at around $650 million.19

- Shopify – Shopify executed several strategic “tuck-in” acqui-hires/team hires, onboarding entire startup teams to accelerate its AI and product innovation. The acquisitions included Peel Insights (e-commerce analytics), Ritual (mobile ordering), Threads (workplace communications), ChannelApe (inventory operations), Stellate (developer tooling), and Checkout Blocks (checkout customization).20

While not the celebrated unicorn exit, it's a testament to the quality of the team, often a startup's most valuable asset. In some cases, these can provide a productive path forward where elite talent is scarce. Our mandate, however, is to help founders build beyond this. While strategic acquisitions can be valuable outcomes, the goal is to create a company so highly valued, so deeply embedded in a customer's workflow, that an acquirer desires the entire business model, the team, the technology, and the irreplaceable market position.

Concluding Thought for Day 3: The Advantage of a Rational Market

The Filtration is creating a landscape where substance trumps hype. It is clearing the field for serious founders, focusing capital on truly defensible ideas, and creating pragmatic exit pathways. This rational environment is not something to be feared, it's something to be prepared for. The critical question for founders is no longer just "What can you build?" but "What can you build that lasts?"

Next: Now that we understand this new, rational landscape, how do you build a company that thrives in it? In our next piece, we unveil the playbook for building the durable, defensible moats that this new market demands. As we saw in Part II, the gravitational pull of the tech giants’ platforms is strong — Part IV, we show how to build the moat to withstand it.

Part IV: The Durable Moat: An AI Founder's Playbook for Winning

The New Doctrine of Defensibility

As the AI landscape consolidates, a battleground emerging is the rise of the agent marketplaces. These, often controlled by the tech giants, are strategic ecosystems designed to lock in enterprise customers and commoditize third-party features. In an era dominated by platform “gravity wells” and the constant threat of commoditization, the old SaaS playbook could be insufficient. Founders must adopt a new doctrine of defensibility; one built to withstand the pressures of consolidation. Survival, let alone success, requires a rigorous focus on creating a durable competitive advantage. Our research has identified three core pillars for building a durable moat: relationship capital, model stack strategy, and distribution ownership.

Pillar 1: Relationship Capital – Build a True Data Flywheel

This pillar is about creating a sticky, indispensable bond with the user, where the value of the relationship compounds over time. This is achieved not just through a good interface, but through deep intelligence and autonomy. The architectural components include:

- Learning Loops & Personalization: The agent gets smarter with every interaction, creating a bespoke experience.

- Protocol/API Leadership: The agent becomes the standard for communication within a niche.

- Agent Orchestration & Autonomy: The agent moves beyond simple commands to manage complex, multi-step workflows.

Together, these components form a true data flywheel. A "data moat" is not simply about having access to data; it’s about building a product that generates a proprietary, compounding advantage through a self-reinforcing cycle. The flywheel works by capturing unique data from user interactions, using that data to fine-tune the AI model, which improves the product and in turn attracts more users who generate even more unique data.

Pillar 2: Model Stack Strategy – Go Vertical or Go Home

While Relationship Capital builds your foundation, Model Stack Strategy ensures your product delivers unique intelligence competitors can’t match. This pillar focuses on creating unique, proprietary intelligence that cannot be commoditized by a generic model. Key architectural components include:

- Context & Modality Mastery: achieving superior performance with specific types of data (e.g., legal contracts, engineering diagrams).

- Data Networks: creating proprietary datasets inaccessible to competitors.

- Domain Expertise: embedding deep, industry-specific knowledge and logic directly into the model.

This strategy manifests as going vertical. The horizontal, general-purpose layer of AI will be owned by the platforms. A strong path forward lies in creating a solution that is tailored for a specific industry, building a product that understands its unique data, workflows, and regulatory nuances.

But even the most advanced model stack needs a way to reach and retain customers at scale, which is where distribution ownership becomes critical.

Pillar 3: Distribution Ownership – Embed into Critical Workflows

This pillar is about controlling the channels through which your agent is delivered and integrated, creating structural barriers to entry. The underlying architecture relies on:

- Integration Lock-In: deeply weaving the agent into a customer’s existing critical software.

- Security & Safety Frameworks: building trust by providing superior data protection, a key purchasing criterion.

- Memory Architecture: developing a sophisticated system for recalling past interactions to create a long-term, personalized relationship.

This architecture allows a startup to become an indispensable part of a customer's critical business operations. This requires delivering deep workflow automation and unique integrations that create prohibitively high switching costs.

These pillars apply to all markets, but the way they’re implemented varies significantly depending on your target customer.

Tailoring the Playbook: Market-Specific Moat Strategies

While the foundational pillars of defensibility apply broadly, the most effective strategies are tailored to the specific market a company serves. The path to building a moat in a consumer application is fundamentally different from that in a regulated enterprise environment. Founders must sharpen their focus and deploy tactics that align with their target customer.

Consumer: Viral Network Effects

The primary moat is built by creating a product that grows organically and becomes increasingly valuable as more people use it. This requires context simplicity, protocol-native viral mechanics, and a sticky, personalized experience. Key components include:

- Context simplicity: The product should be highly intuitive and easy to start using, lowering the barrier to mass adoption.

- Protocol-native viral mechanics: Sharing and invitation capabilities are embedded directly into the core product loop, encouraging organic growth.

- Mass-scale performance mechanics: The underlying technology is engineered to handle explosive user growth without degrading the experience.

- User identity persistence & agent memory loop: A sticky, personalized experience is created as the agent remembers and learns from every user interaction.

B2B: ROI Validation Moats

Defensibility is achieved by proving and delivering demonstrable return on investment (ROI). This requires measurable business impact, deep workflow integration, and strategic use of private customer data to drive performance improvements. Key components include:

- Measurable business impact: The product provides clear, quantifiable data that improves the customer's bottom line.

- Deep workflow integration: The tool is embedded so deeply into essential business processes that it becomes difficult and costly to remove.

- A professional service ecosystem: A network of third-party implementation partners and consultants is fostered to support and extend the product's value.

- Embedded agent-to-agent workflows: Specialized AI agents coordinate to solve complex business problems.

- Leveraging private data for ROI improvements: Customer’s data is used to generate unique insights and a compounding performance advantage that no competitor can access.

Enterprise: Trust Fortress

In the enterprise market, the most durable moat is trust. Building this "Trust Fortress" requires a security-first architecture, mastery of governance and compliance, and flexibility for customers to host the solution within their own secure infrastructure. Building this "Trust Fortress" requires:

- A security-first architecture: The entire system is designed from the ground up to meet the stringent standards of data protection and privacy.

- Mastery of governance & compliance: The product deeply understands and embeds the specific regulatory and compliance requirements of target industries like finance or healthcare.

- Executive relationship capital: Strong, strategic, and trusted relationships are built with key executive decision-makers within the customer's organization.

- Optionality for on-prem/VPC deployment: Customers are given the flexibility to host the solution within their own secure cloud or on-premises infrastructure.

- Agent explainability & compliance audit logs: Clear, auditable records of how the AI makes decisions are provided, which is a crucial requirement for regulated industries.

Concluding Thought for Day 4: There’s Value in Real Value

This three-part framework of Relationship Capital, Model Stack Strategy, and Distribution Ownership is the direct answer to the market pressures of platform “gravity wells” and the commoditization of undifferentiated applications. When these moats are combined effectively, they enable one of the most effective moves a company can make: to use AI to fundamentally disrupt an incumbent's business model. By delivering a service at a fraction of the traditional cost, a startup can create an order-of-magnitude improvement in value that incumbents are structurally unable to copy.

Next: Building a moat is the best defense, but what if the rules of the game themselves are about to change? In our final installment, we’ll reveal the one ‘black swan’ that could derail the giants’ dominance and deliver our, clear mandate for every founder and investor in AI.

Part V: The New Mandate: A Research-Led Approach for a Rational Market

The Regulatory Counterbalance:

The narrative of inevitable platform-led consolidation now faces a significant and growing counterforce: regulatory scrutiny. While the tech giants are currently winning the market battle, they could face growing headwinds from regulatory action. Antitrust authorities in both the United States and Europe are investigating these novel consolidation tactics and are launching inquiries that could fundamentally reshape the competitive landscape.

In January 2024, the U.S. Federal Trade Commission (FTC) opened an investigation into investments and partnerships between major cloud providers and leading AI companies, issuing compulsory orders to Alphabet, Amazon, Microsoft, Anthropic, and OpenAI. This scrutiny is not limited to the U.S. In April 2024, the U.K.'s Competition and Markets Authority (CMA) announced preliminary inquiries into the partnerships between Microsoft and Inflection AI, Amazon and Anthropic which have since concluded, with both cleared. The agency specifically examined whether the Microsoft/Inflection deal constituted a "relevant merger situation," indicating a willingness to challenge the asset-light structure of these “acqui-hires”. This escalating regulatory pressure is a material regulatory counterweight to the consolidation thesis.

While founders and investors wait to see if regulators will reshape the external landscape, they must also address the urgent need to fix their internal models. The giants' strategic dominance has not only changed the market, but it has also broken the traditional investment playbook.

Why the Traditional Venture Model Is Being Challenged

The last 18 months have set a trap for many investors. Intense market hype and low barriers to entry have unleashed a flood of AI startups, many delivering applications built largely on public APIs with limited proprietary differentiation. While this approach enables rapid product launches, it often leaves companies vulnerable to replication by larger platforms, making defensibility and long-term value creation much harder without unique data, technology, or domain expertise.

In many ways, “.ai” has become the new “.com.” A slick demo can be the modern equivalent of a flashy Super Bowl ad, attention-grabbing, but not necessarily supported by meaningful revenue or a sustainable business model. This dynamic has created a dangerous illusion of progress, though there are, of course, notable exceptions where teams are building truly differentiated and defensible platforms.

In this environment, where some investors have adopted a broad “spray and pray” approach across portfolios of quickly assembled, API-dependent products, the risk of underperformance in a consolidating market is high.

The Failure of Traditional Signals

Many elements of the VC playbook from the mobile and SaaS booms no longer translate effectively to today’s AI market. In that era investors chased signals like user engagement metrics and top-line growth; but in the AI era, these indicators can be dangerously misleading.

This is where the strategy of pattern-matching fails. A VC might see a product with a low customer acquisition cost (CAC) and rapid initial adoption, believing they've discovered the next unicorn. More often, they've likely found a compelling feature, not a durable company. Tech giants can replicate and distribute this feature for free to millions of users, causing the startup's long-term value (LTV) to erode and undermining its business model. Without a research-led approach, the traditional venture model is at high risk of underperformance in this environment.

The Mandate: A Research-Led Approach

A research-led investment thesis is not just an advantage, it’s a prerequisite. It acts as a filter against the hype, replacing gut instinct with a rigorous, first-principles analysis of the market's new physics. It demands a deep understanding of the entire technology stack to distinguish between a temporary feature and a durable platform.

Instead of chasing superficial signals, a research-led doctrine focuses on the foundational pillars of defensibility outlined in Part IV: Relationship Capital, a coherent Model Stack Strategy, and a path to Distribution Ownership.

For those who haven’t read Part IV, here’s a quick recap:

1. Relationship Capital → Building trust and integration with customers that creates a compounding data advantage over time.

Key question: Does the company have a genuine data flywheel that generates proprietary, compounding advantage with every user interaction, or is it simply passing data through a third-party API?

2. Model Stack Strategy → Owning the right layers of the technology stack, often with deep domain expertise and proprietary datasets.

Key question: Has the company gone “vertical,” building deep domain expertise and proprietary datasets for a specific industry that horizontal platforms cannot easily replicate?

3. Distribution Ownership → Embedding into critical customer workflows to create high switching costs and genuine integration lock-in.

Key question: Is the company embedded so deeply into critical workflows that replacing it would be disruptive and costly for the customer?

This framework is the direct answer to the challenges we detailed earlier in this series. The "gravity wells" (large platform ecosystems that draw customers inward) of the tech giants? They can be countered by Distribution Ownership. The "wrapper Challenge"? It's mitigated by a real Model Stack Strategy. The threat of the "acqui-hire"? It is mitigated by building sticky Relationship Capital that makes a team and its product inseparable.

Answering these questions takes more than a 30-minute pitch. It requires deep technical diligence and a thorough grasp of industry-specific workflows. It's about pre-emptively answering the critical question that public-facing product roadmaps make relevant: "Why can't this be a feature in Microsoft Copilot or a Google Workspace update next quarter?" In a market defined by the “gravity wells” of giants, this disciplined, research-led approach is the most reliable path we’ve found for avoiding the traps of the past and identifying the truly durable companies of the future.

Concluding Thought for Day 5: Capital is Cheap, Insight is Rare

Capital itself is a commodity; actionable insight, forged through deep and rigorous research, is the only scarce resource. This new reality where the "acqui-hire" phenomenon has exposed that valuation does not always mean value, makes a disciplined approach essential. The road ahead is likely to be more challenging. We expect to see a wave of M&A—mostly “acqui-hires”, and a string of companies’ wind-downs. But we will also see the emergence of a new class of resilient, market-defining companies. The central question is no longer just "What can you build?" but "What can you build that lasts, and what evidence can you show today that it will?"

Endnotes

[1] PitchBook, Q2 2025 Global VC First Look, 2025

[2] PitchBook, AI continues to push consumer fintech funding out of favor, 2025

[3] Crunchbase, Q2 Global Venture Funding Climbs In A Blockbuster Quarter For AI And As Capital Concentrates In Larger Companies, 2025

[4] PitchBook, DeepSeek Might be Just What the AI App Space Needs, 2025

[5] PitchBook, AI Market News & Investment Trends, 2025

[6] PwC, Technology leader insights from the PwC Pulse Survey, 2025

[7] Microsoft, Four Ways Leaders Can Empower People for How Work Gets Done, 2025

[8] Deloitte, US Future of Cloud Strategy Survey Report, 2025

[9] Gartner, Intelligent Agents in AI Really Can Work Alone. Here’s How,2024

[10] Synergy Research Group, Cloud is a Global Market - Apart from China, 2024

[11] Canalys, Worldwide cloud service spending to grow by 19% in 2025, 2025

[12] Reuters, OpenAI hits $12 billion in annualized revenue, 2025

[13] The Information, Anthropic Revenue Pace nears $5 Billion, 2025

[14] Venture beat, Anthropic revenue tied to two customers, 2025

[15] PitchBook, Q2 2025 Global VC First Look, 2025

[16] PitchBook, Q4 2024 PitchBook-NVCA Venture Monitor, 2024

[17] Reuters, Google hires Windsurf execs in $2.4bn deal to advance AI coding, 2025

[18] Observer, Google Hires Top Talent From Windsurf in Silicon Valley’s Latest “Acquire-Hire” deal, 2025

[19] TechCrunch, After raising $1.3B, Inflection is eaten alive by is biggest investor, 2024

[20] Business Insider, Shopify acquihired 6 startups for their Talent, 2025

The information contained herein is provided for informational purposes only and should not be construed as investment advice. The opinions, views, forecasts, performance, estimates, etc. expressed herein are subject to change without notice. Certain statements contained herein reflect the subjective views and opinions of Activant. Past performance is not indicative of future results. No representation is made that any investment will or is likely to achieve its objectives. All investments involve risk and may result in loss. This newsletter does not constitute an offer to sell or a solicitation of an offer to buy any security. Activant does not provide tax or legal advice and you are encouraged to seek the advice of a tax or legal professional regarding your individual circumstances.

This content may not under any circumstances be relied upon when making a decision to invest in any fund or investment, including those managed by Activant. Certain information contained in here has been obtained from third-party sources, including from portfolio companies of funds managed by Activant. While taken from sources believed to be reliable, Activant has not independently verified such information and makes no representations about the current or enduring accuracy of the information or its appropriateness for a given situation.

Activant does not solicit or make its services available to the public. The content provided herein may include information regarding past and/or present portfolio companies or investments managed by Activant, its affiliates and/or personnel. References to specific companies are for illustrative purposes only and do not necessarily reflect Activant investments. It should not be assumed that investments made in the future will have similar characteristics. Please see “full list of investments” at https://activantcapital.com/companies/ for a full list of investments. Any portfolio companies discussed herein should not be assumed to have been profitable. Certain information herein constitutes “forward-looking statements.” All forward-looking statements represent only the intent and belief of Activant as of the date such statements were made. None of Activant or any of its affiliates (i) assumes any responsibility for the accuracy and completeness of any forward-looking statements or (ii) undertakes any obligation to disseminate any updates or revisions to any forward-looking statement contained herein to reflect any change in their expectation with regard thereto or any change in events, conditions or circumstances on which any such statement is based. Due to various risks and uncertainties, actual events or results may differ materially from those reflected or contemplated in such forward-looking statements.