Topic

B2B Commerce

Published

November 2022

Reading time

11 minutes

The Dominoes are Starting to Fall

Why B2B Commerce is the $100 Trillion Market Technology Hasn’t been Able to Crack – Until Now

Authors

The Dominoes are Starting to Fall

Download ArticleResearch

We often say that businesses will want what consumers already have. After all, business users are consumers at home. It’s not a radical notion, but a strong rule of thumb that helps us think about markets and what’s coming next.

Over the last twenty years, consumer payments have undergone incredible innovation, across peer-to-peer (PayPal, Venmo, Cash App) and consumer-to-business (Square, Stripe, Bolt). Today, consumers now have too many methods to choose from.

Research

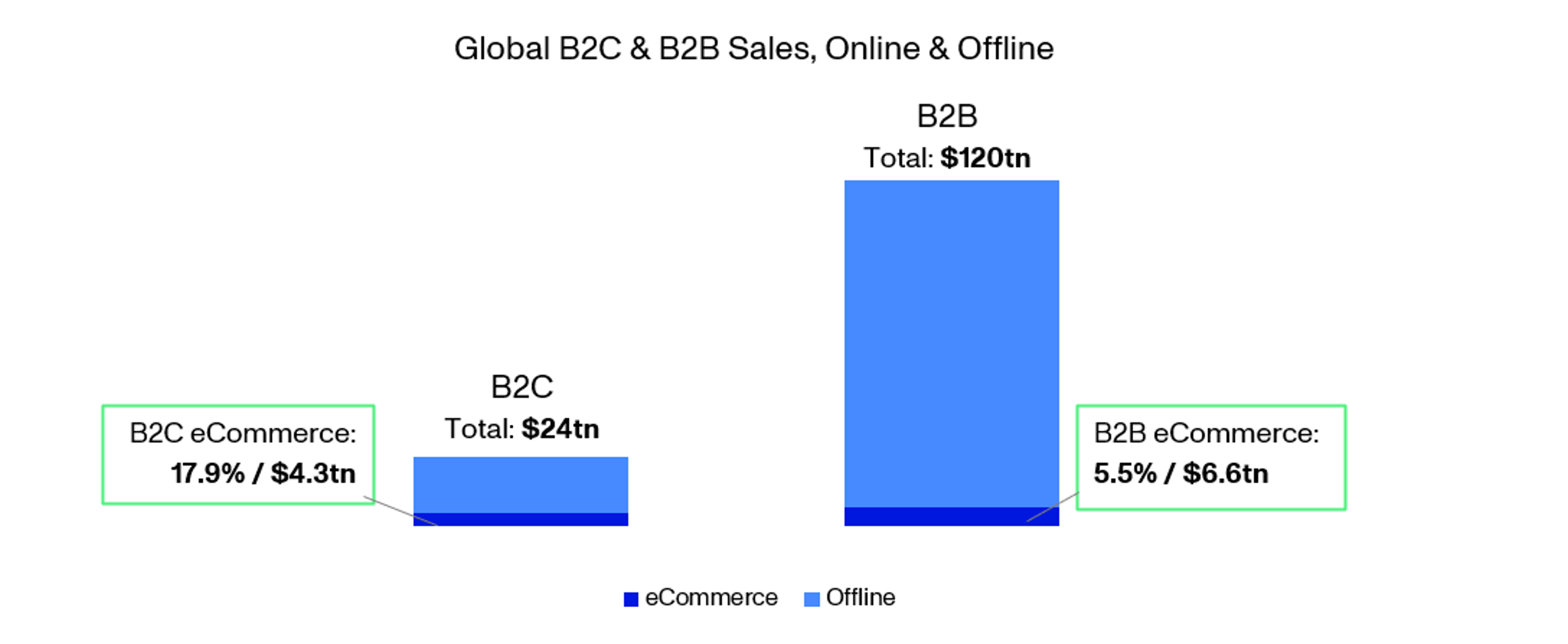

If you’ve ever tried to procure a product or service for your business or one you work for, the right side of this image is likely a familiar sight – and not a welcome one. A business transaction isn’t just clicking a button – it’s a complex, hairy, and manual workflow with many decision makers. Procurement, pricing, payment, and fulfillment are highly bespoke. It’s no wonder, then, that when we look at the data, we find that B2B ecommerce adoption is so low – only 5.5% globally – compared to B2C at nearly 18%:

Research

Global B2C and B2B sales, Online and Offline

Source: Statista - B2B e-Commerce - In-depth Market Insights & Data Analysis

17.9%

B2C ecommerce adoption

5.5%

B2B ecommerce adoption

But the upshot is made clear by the towering bar on the right – the B2B market is 5x the size of B2C. With our earlier adage in mind, it’s clear that B2B commerce and payments are next to digitize, with enormous spoils awaiting those that unlock the transition. But if it were easy, it would have already been done.

5x

Market size B2B compared to B2C

For that remaining 94% of B2B spend to come online (or at least have the option to) there are many intertwined problems to solve, from making sense of vast quantities of unstructured data, to modernizing international payment rails. Fundamentally, legacy markets only truly change when two distinct shifts occur simultaneously:

Behavioral Shifts

Mega-trends like demographic change and COVID-19 mean that doing business digitally is no longer just a nice-to-have, but a need-to-have. But while today’s B2B leaders are ready to digitize, old habits die hard. To get widespread option, digital products need to break what we call “relationship inertia,” and unlock a 5-10x better experience to convince users to adopt the digital equivalent of their existing offline workflows.

Technological Shifts

If you tried to build a B2B commerce platform 10 years ago, it was nearly impossible. Today, there’s an entirely new quiver of powerful tools to allow software business and their end customers to chip away at the offline chunk of B2B trade, from credit underwriting databases to marketplace infrastructure software. This explosion of companies and teams solving problems isn’t an accident – they’re all chasing a piece of that $100 trillion pie. We’ll walk you through the major sectors at a high level in this article, and in detail in subsequent research.

It’s clear that these two shifts are converging unlike ever before. At Activant, we have fierce conviction that the digitization of B2B commerce across procurement, payment, and fulfillment is the most powerful trend in all of commerce. And we believe that the dominoes are now starting to fall.

Why now?

1However clumsy the word, omnichannel is the key to an elegant future

When we throw around terms like “digital,” and “online,” it can be easy to get them mixed up. Just because an interaction is online doesn’t mean humans are out of the loop. We know for certain that the future of B2B trade isn’t going to consist of business buyers doing all their purchasing via self-serve ecommerce sites. Just as consumer retail is not 100% online or 100% in-person, but a dynamic mix.

At the end of the day, we’re human, and especially for big purchases, we need some human interaction (in-person or remote) to build trust, the foundation of all commerce.

The last three years – from a dramatic swing towards self-serve ecommerce channels back to a hybrid in-person world – have shown that we don’t know what’s coming. This is precisely why business trade needs digital and adaptable underpinnings to tie together interactions, whatever form they take: this is what it truly means to be omnichannel.

2Millennials are taking the reins of unsexy businesses and demand better

Whether by inheritance, acquisition, or disruption, we are undergoing a generational transfer of business control from retiring Baby Boomers to digitally native Millennials and soon, Gen-Z business leaders. From the perspective of technology investors, it’s easy to forget that unsexy businesses underpin the American economy and generate most of the wealth. An economic study found that within the top 0.1% of earners (making more than $1.6 million per year), most own “regional business[es]…such as an auto dealer, beverage distributor, or large law firm.” With half of the 5.2 million privately held businesses in America majority-owned by a Baby Boomer, and 10,000 Americans turning 65 per day, this shift is well underway.

3The figurative API sandbox is now full of toys

As mentioned, hard work by thousands of companies – much of it to unlock consumer innovations initially – has yielded a rich ecosystem of API-first products and platforms. This tech accelerates data visibility and automation to ultimately create a better customer experience. Incumbents that would traditionally prefer to read a fax rather than implement an API are now changing their tune. Tech-native business simply won’t work with anything else.

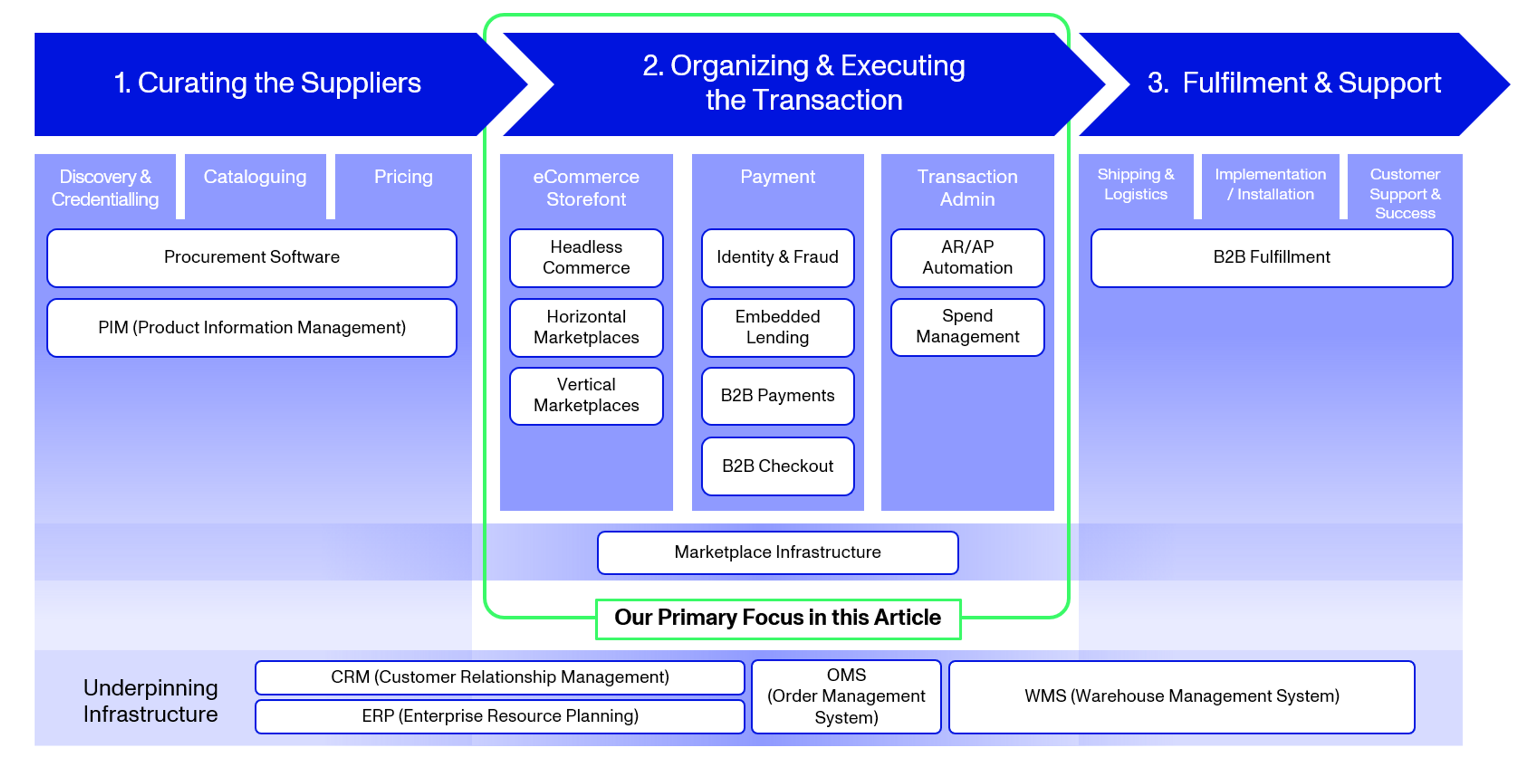

The B2B Commerce Value Chain

We find it helpful to think about markets with a value chain: a framework that breaks down a sector into the major activities, as well as the underpinning infrastructure required to connect and enable it.

While B2B commerce is complex, it has three primary components. These in turn have subcomponents, which are interdependent and related. For the interests of this article, we will focus primarily the transaction component, and will explore more areas in the future.

Value Chain

B2B Commerce

Note that this framework is a work-in-progress. Our understanding, along with the market itself, is rapidly evolving. If you have a differing view, please reach out!

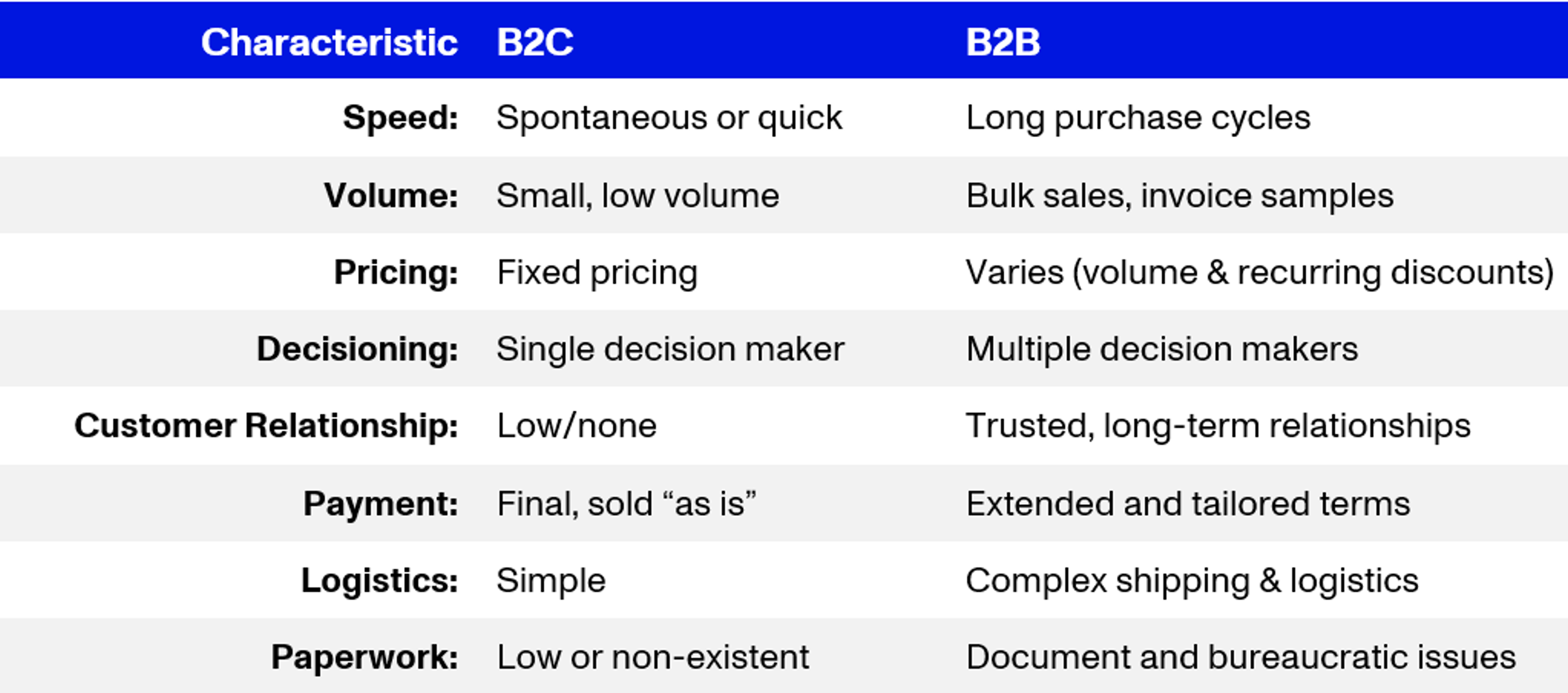

It’s also helpful to consider the distinct differences between B2C and B2B transactions:

What Markets Matter Most Today?

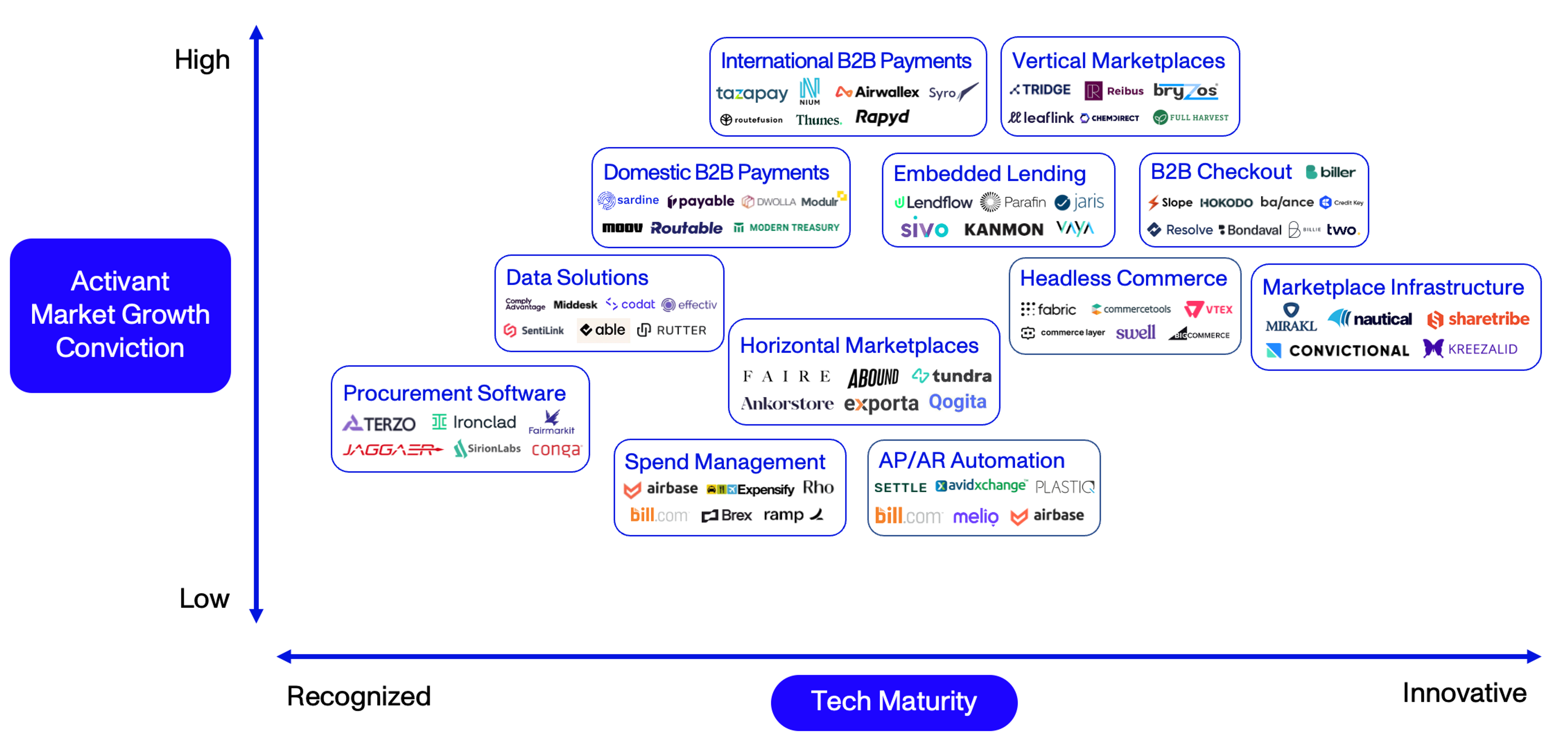

Let’s cut this market a different way. Do to so, we’re proud to introduce the Activant Thesis Map – a map not just of companies, but of markets themselves. This map highlights Activant’s conviction in the fastest growing and most innovative areas in B2B Commerce:

Thesis Map

B2B Commerce

Figure Caption

Note that the grayed-out spaces, while important, won’t be covered just yet. If you disagree with our perspective, we want to hear it. Let’s walk through those that are highlighted:

1. B2B Checkout

Until recently, “B2B Checkout” didn’t really exist. Even software purchasing – what you might expect to be the most digital – still ends often with a long email thread, a DocuSign, and an ACH transfer. Building a truly digital checkout experience that mirrors the one we’re used to as consumers has only recently become possible, by connecting into modern KYB (know your business) data, credit underwriting, and insurance platforms. This category is quickly emerging, with players like Balance, Slope, and Hokodo chasing the powerful network effects that are up for grabs. We’re excited to cover the segment checkout in detail in our next article.

2. International B2B Payments

1/5th (or $24 trillion) of all B2B payment flow is cross-border, 95% of which are moved via international wire transfer. When we peel back the curtain, we find that “wires” are really a network of what are known as correspondent banks using the 50-year-old SWIFT messaging technology. These banks take a high fee for the complexity and risk associated with that transfer – adding up to $1 trillion in revenue annually. This network is shrinking, too – by 20% in the last decade. This is a clear case of “there has to be a better way,” and the time is now. Companies like Tazapay, Nium, and Airwallex are using tech to move money across borders faster, with lower fees, and less risk for B2B customers.

$24tn

of B2B payment flow is cross-border

3. Embedded Lending

Credit greases the wheels of commerce. B2B workflows, especially those at scale, almost universally include credit in some form, so these workflows can’t come online without it. Take Shopify Capital, their lending product – which has advanced over $1 billion so far this year alone to merchants. Applying for that line of credit is seamless for the merchant, because it happens all inside of the Shopify platform, which is arguably the best suited to underwrite the customer as the core hub for their online business. Embedded lending platforms like Kanmon, Lendflow, and Parafin allow software platforms and marketplaces of any size to place credit products at the optimal point for the B2B customer and seamlessly unlock access to capital.

$1bn

loaned by Shopify Capital from Q1 to Q3 2023

4. Horizontal B2B Marketplaces

Horizontal consumer-facing marketplaces have been a staple of the digital consumer experience – beginning with eBay and Craigslist, which persist today. Much of B2B is still in the realm of the printed catalog and price sheet, let alone a digital place to browse products and transact. Platforms like Faire, Abound, and Tundra are building horizontal marketplaces that feature a range of categories of products & services.

5. Vertical B2B Marketplaces

When a market is both large and complex enough, it can support a vertical solution that caters to its unique characteristics and participants. Just as vertical SaaS emerged to solve the problems for the pharmaceutical, restaurant, and construction industries that horizontal SaaS could not, Activant believes the same will be true for marketplaces. Platforms like Tridge, Indigo (both Activant portfolio companies) Reibus, and Full Harvest are building end-to-end marketplace solutions in specific sectors to unlock some of the traditionally toughest B2B markets.

6. Marketplace Infrastructure

Building a marketplace itself – whether vertical or horizontal, consumer or B2B – is difficult. To do so has traditionally required a from-scratch build, costing years and millions at the top end, or been achieved by hacking on top of an existing 1-party ecommerce platform like Shopify or Magento, which is inelegant and unscalable. Players like Nautical, Mirakl, and Convictional are building the infrastructure to make opening a marketplace as easy as Shopify has made it to build an online 1-P store.

7. Data Solutions

You can’t onboard and verify customers, underwrite a loan, connect apps, or really do much of anything in the digital commerce world without trusted, instant data sources and piping. Accurate and immediate data ultimately builds trust, the backbone of all trade. In the offline B2B universe, this involves enormous quests like digitizing the unstructured data in a thousand filing cabinets across a thousand municipal government offices. Companies like Middesk, Rutter, and Sentilink are doing the tough but critical work of exhuming, digitizing and connecting data and applications to increase access, reduce inaccuracies, and stop fraud.

In Conclusion

We’ve covered a lot of ground, but this is just the beginning – for B2B commerce, and for Activant Research. Next up, we’ll be covering B2B checkout in detail, with more to come.

Disclaimer: The information contained herein is provided for informational purposes only and should not be construed as investment advice. The opinions, views, forecasts, performance, estimates, etc. expressed herein are subject to change without notice. Certain statements contained herein reflect the subjective views and opinions of Activant. Past performance is not indicative of future results. No representation is made that any investment will or is likely to achieve its objectives. All investments involve risk and may result in loss. This newsletter does not constitute an offer to sell or a solicitation of an offer to buy any security. Activant does not provide tax or legal advice and you are encouraged to seek the advice of a tax or legal professional regarding your individual circumstances.

This content may not under any circumstances be relied upon when making a decision to invest in any fund or investment, including those managed by Activant. Certain information contained in here has been obtained from third-party sources, including from portfolio companies of funds managed by Activant. While taken from sources believed to be reliable, Activant has not independently verified such information and makes no representations about the current or enduring accuracy of the information or its appropriateness for a given situation.

Activant does not solicit or make its services available to the public. The content provided herein may include information regarding past and/or present portfolio companies or investments managed by Activant, its affiliates and/or personnel. References to specific companies are for illustrative purposes only and do not necessarily reflect Activant investments. It should not be assumed that investments made in the future will have similar characteristics. Please see “full list of investments” at https://activantcapital.com/companies/ for a full list of investments. Any portfolio companies discussed herein should not be assumed to have been profitable. Certain information herein constitutes “forward-looking statements.” All forward-looking statements represent only the intent and belief of Activant as of the date such statements were made. None of Activant or any of its affiliates (i) assumes any responsibility for the accuracy and completeness of any forward-looking statements or (ii) undertakes any obligation to disseminate any updates or revisions to any forward-looking statement contained herein to reflect any change in their expectation with regard thereto or any change in events, conditions or circumstances on which any such statement is based. Due to various risks and uncertainties, actual events or results may differ materially from those reflected or contemplated in such forward-looking statements.