Topic

Automotive

Published

July 2025

Reading time

27 minutes

Click. Buy. Drive.

Navigating the Next Era of Vehicle Commerce

Click. Buy. Drive.

Download ArticleResearch

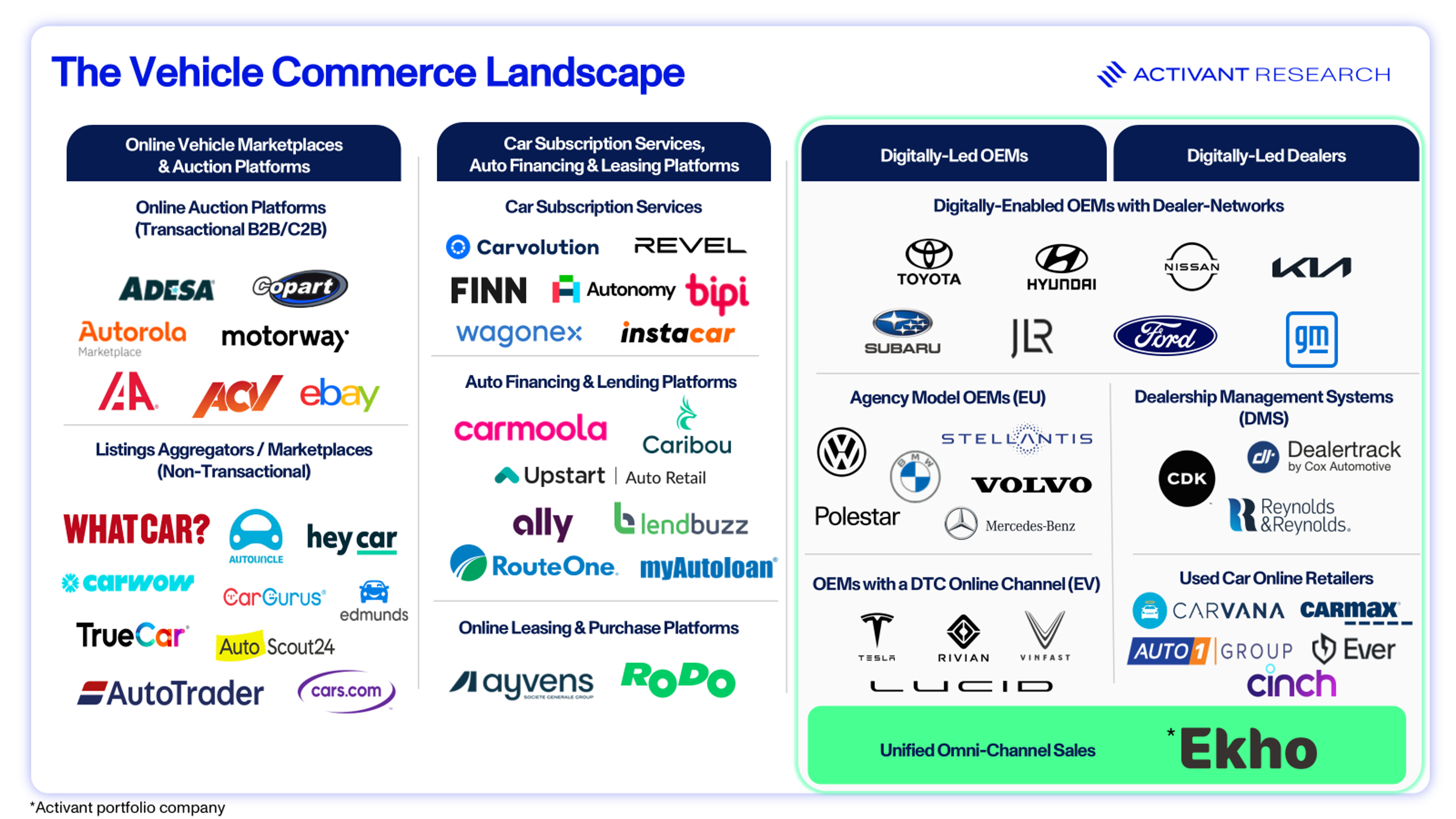

The automotive industry is a pillar of the global economy, accounting for 4.8% of U.S. GDP and moving nearly 75 million new vehicles globally in 2024–not including millions more motorcycles, RVs, golf carts, and off-road ATVs.1,2 Yet for all its economic might, the industry is built on a fundamental flaw: after spending billions to build brand equity, Original Equipment Manufacturers (OEMs) surrender their customer at the dealership door, precisely when that equity is most vulnerable. For a century, this hand-off was an accepted cost of doing business. Today, it is no longer inevitable. A new technology stack is finally enabling a seamless “Click. Buy. Drive.” journey, sparking the industry’s most radical reinvention since the Model T rolled off the line.

The deeply ingrained traditions of vehicle purchasing–the familiar cadence of showroom visits, the often-tense ballet of protracted negotiations, the daunting mountains of ensuing paperwork–are steadily ceding ground to a digitally native, consumer-first paradigm. This "Click. Buy. Drive." is far more than a mere iteration or a superficial gloss of technology on an old model; it represents a fundamental re-architecting of automotive commerce–a ground-up rethinking of how vehicles move from factory to driveway. This transformation promises shared benefits to all key stakeholders: end consumers seeking value and convenience; OEMs striving for efficiency and brand control; and, crucially, dealerships eager to expand margins, reduce or eliminate inventory burden, and prepared to embrace this digital-first future.

The Old Showroom Blues: A System Failing Everyone

For generations, automotive commerce has been defined by the physical dealership, a model entrenched by century-old state franchise laws. Originally designed to ensure service availability, this framework now creates a cascade of friction that leaves every key stakeholder–the consumer, the manufacturer (OEM), and the dealer–in a worse position. This misalignment of incentives has rendered the entire system untenable.

1. The Consumer's Burden: A Lottery of Frustration

For the buyer, the process is notoriously broken. Car buying consistently ranks among the least enjoyable retail experiences, with most millennials preferring to clean their homes over negotiating with a salesperson.3 The pain is well-documented:

- A Vortex of Wasted Time: The journey is bogged down by lengthy research, multiple dealership visits, and hours of paperwork.

- Adversarial by Design: Haggling over price and high-pressure add-on sales foster deep consumer stress and distrust.

- The Illusion of Choice: The quality of service, professionalism, and even the final price, vary drastically from one dealer to the next. This inconsistency turns the buying journey into an unpredictable lottery.

This "showroom lottery" has a direct, corrosive effect on brand value. A 2023 Cox Automotive study found a single Toyota Camry listed at 14 different prices within a 50-mile radius, a spread that dragged Toyota’s Net Promoter Score down eight points. When the same badge signals wildly different value from lot to lot, it’s the brand that ultimately pays the price.

Call-out: Women are rewriting the buyer profile:Women now influence 62% of U.S. vehicle purchases and are 50% more likely than men to abandon a dealership after a poor in-store interaction. 4 The current process is already broken for most shoppers; for women it’s often intolerable.

2. The OEM’s Paradox: Power Without Control

For the OEMs who design, build, and market the vehicles, the franchise model creates a fundamental paradox: they own the brand but have almost no control over the most critical moment in its lifecycle–the customer transaction.

- Brand Surrender: After spending billions building brand equity, OEMs are forced to surrender the customer relationship at the dealership door, precisely when brand loyalty is most vulnerable. The carefully crafted brand promise of a "Ford" or "Hyundai" experience is lost to the fragmented reality of thousands of independent dealer practices.

- Data Blackout: OEMs are disconnected from their end-users. Lacking a direct line to customer data and feedback, they operate on lagging, filtered information, hampering their ability to innovate, tailor marketing, and build lasting relationships.

- Misaligned Incentives: The system forces OEMs to focus on pushing wholesale inventory onto dealer lots, often leading to costly incentives and production schedules that are disconnected from real-time consumer demand. This erodes profitability and brand integrity.

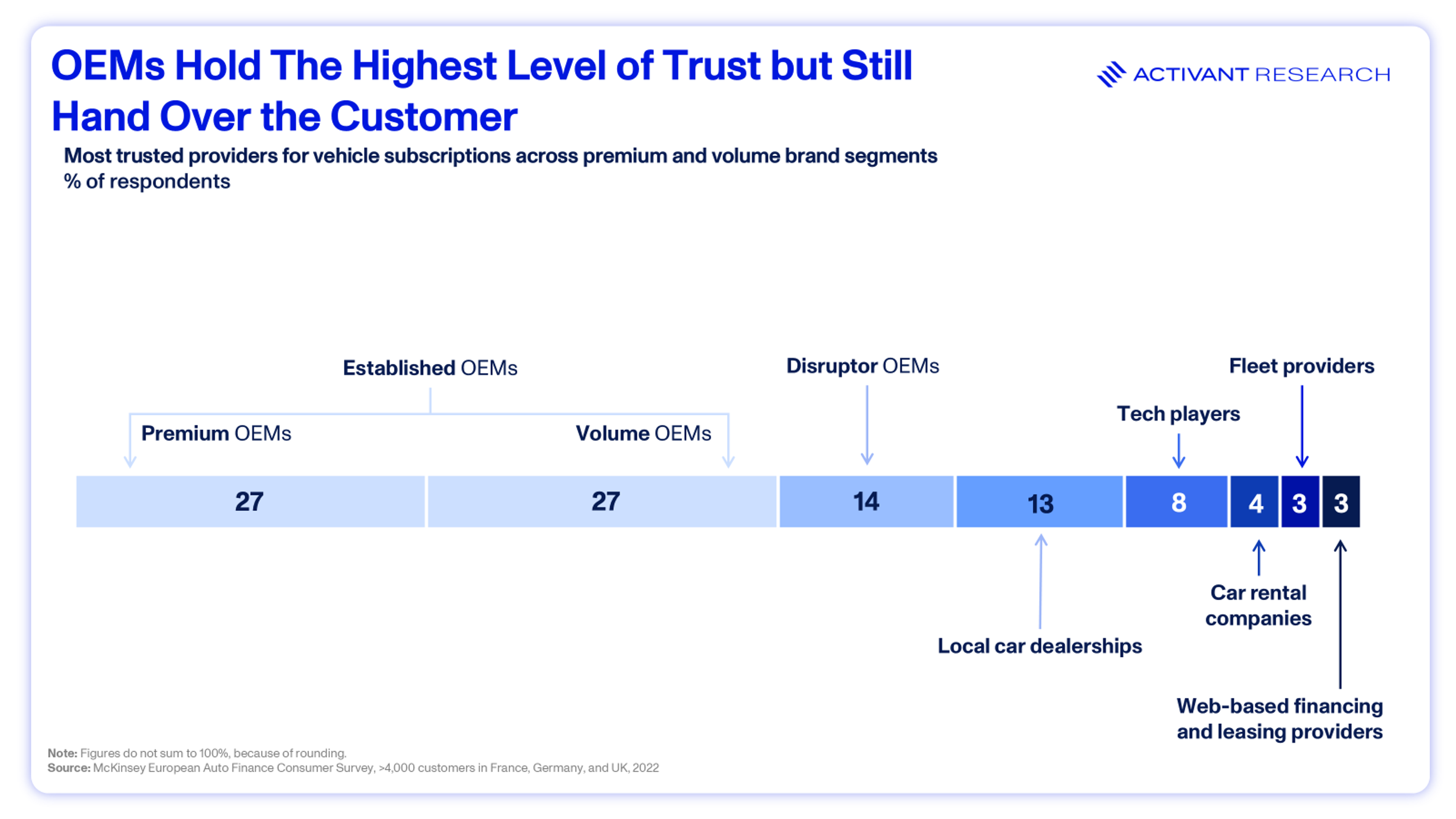

This disconnect isn't just theoretical; it's a quantified reality. Data on consumer trust in a direct vehicle relationship reveals the paradox in stark terms.

As research from McKinsey shows, consumers already place the lion's share of their trust directly with the brand, with established OEMs commanding more than four times the trust of local dealerships (54% vs. 13%).5 This is the core inefficiency of the franchise model: the entity that has earned the most trust is legally barred from the final transaction and forced to hand over its most valuable asset–the customer relationship–at the most critical moment.

3. The Dealer's Squeeze: Profitless Volume and Self-Defeating Competition

Contrary to popular belief, the conventional model imposes severe economic burdens on dealers themselves.

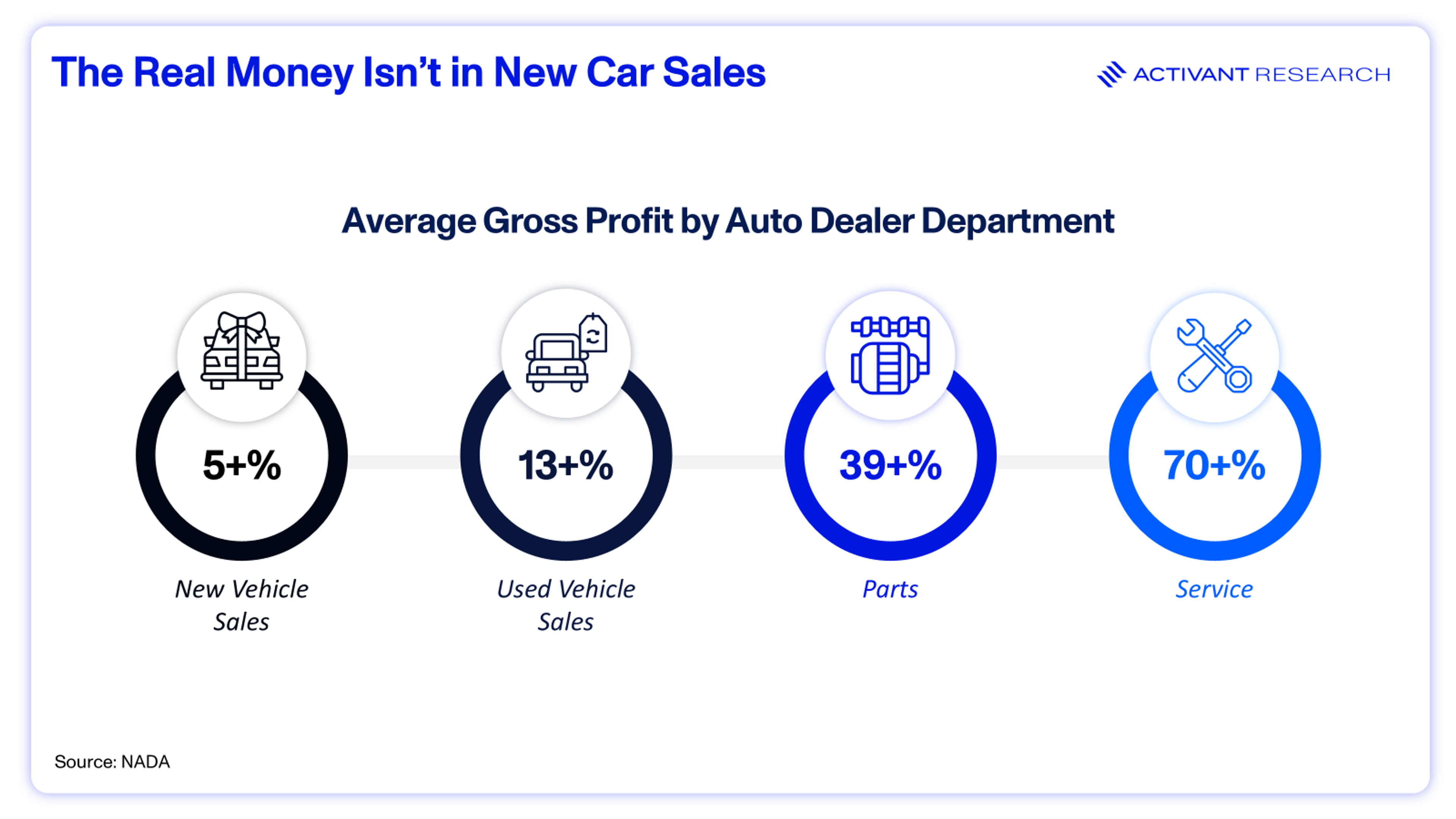

- Razor-Thin Margins: The average gross profit on a new car sale is a mere 4%–5%, often relegating new vehicles to a loss-leader strategy designed simply to drive traffic to the more lucrative service bay.

- Crippling Costs: Escalating operational costs, chief among them inventory financing (floorplan), have become severe burdens. With recent interest rate hikes, total floorplan interest costs for public dealer groups surged from approximately $126 million in 2021 to over $363 million in just the first nine months of 2023.6 Through the first nine months of 2024, the average dealership posted a net floorplan interest expense of nearly $109,000, a significant shift from a gain of approximately $24,000 during the same period in 2023.7

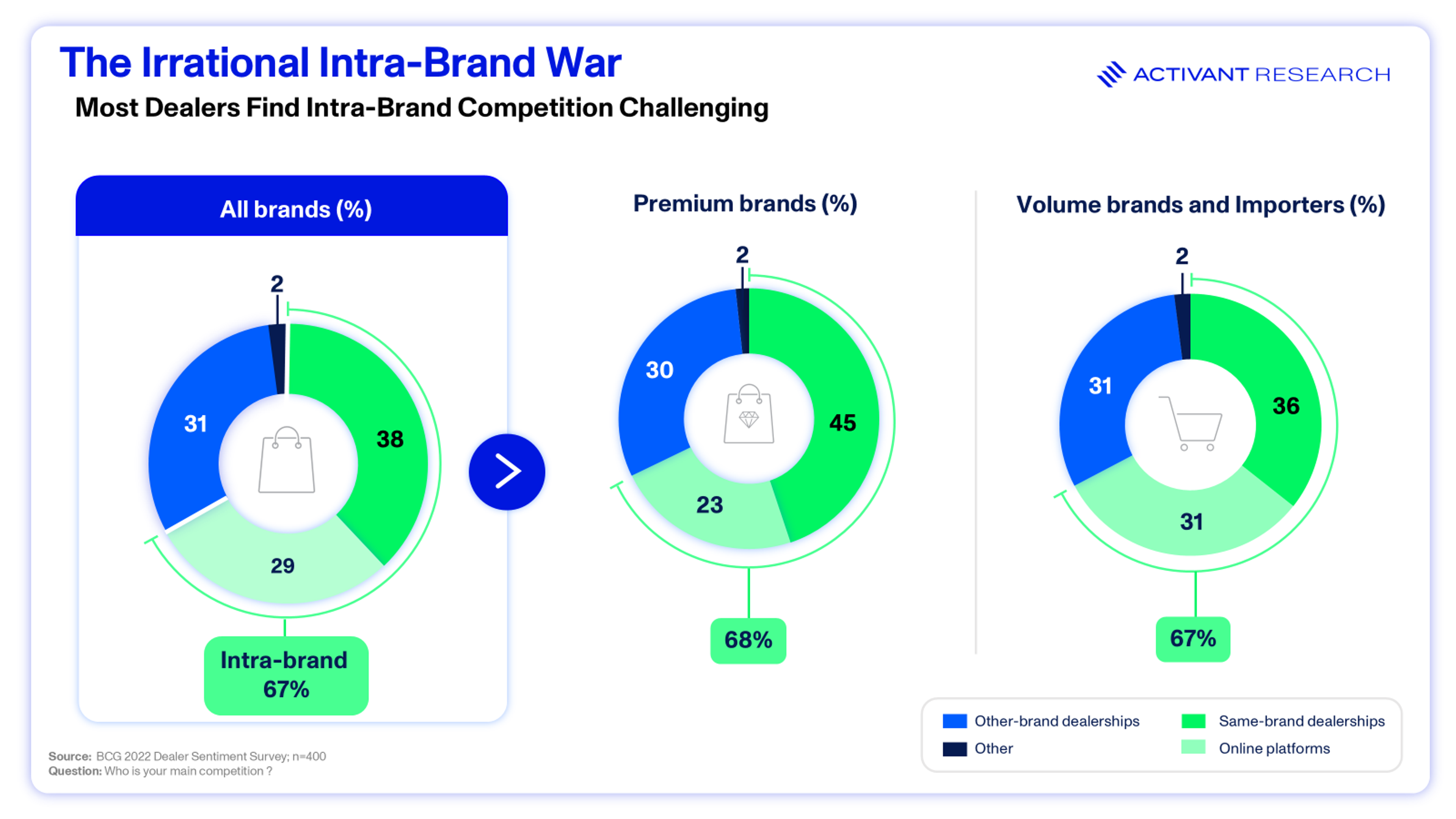

- Irrational Intra-Brand War: Perhaps most self-defeating is the pervasive intra-brand competition. A BCG study found that two-thirds of dealers view other same-brand dealerships as their fiercest rivals.8 This triggers intense, localized price wars that destroy profit margins as dealers aggressively discount to capture customers who are already loyal to the brand.

This convergence of profound consumer dissatisfaction, OEM brand erosion, and acute dealer economic pressure renders the traditional automotive franchise model fundamentally unsustainable. The appetite for change is no longer just a preference; it is a systemic necessity.

Roadblocks to Reinvention: The "Four Horsemen" of Automotive Inertia

Despite clear consumer demand and pioneering successes, widespread adoption of end-to-end online vehicle sales by incumbent OEMs, traditional retailers and dealerships has been sluggish. This inertia largely stems from four entrenched, often prohibitive, challenges:

- Regulatory Hurdles: Century-old state franchise laws across most of the U.S. bar OEMs with existing dealer networks from direct consumer sales, mandating transactions through local dealers. Navigating this complex, fiercely defended legal landscape is a monumental, often litigious, challenge. That legal minefield also forces OEMs to lean on dealers for compliance, outsourcing the very customer touchpoints where brand perception can soar – or crater.

- Technological Complexity: A fully compliant, 50-state online vehicle sale is a Herculean task, requiring far more than standard e-commerce solutions. It necessitates a bespoke suite of integrated tools for financing, titling/registration, insurance verification, state-specific signatures, jurisdictional documentation, and complex tax/fee remittance. Developing and maintaining this infrastructure is a significant technological and financial commitment.

- Operational Cost Scaling: Historically, a compliant 50-state online sales channel implied replicating extensive dealership back-office functions (titling, F&I, support). Without substantial automation and workflow redesign, these operational costs risk scaling linearly with volume, becoming prohibitive given thin new car margins.

- Dealer Network Alignment: For OEMs with established dealer networks, introducing D2C online sales is perilous. Dealers are vital B2B customers and service/warranty partners. Any move perceived as disintermediation or unfair competition risks damaging these crucial relationships. Integrating dealers economically and operationally into new online channels is a critical, complex strategic challenge.

While these barriers have long constrained progress, consumer expectations and a new generation of players are exposing just how outdated the traditional model has become. What once seemed impossible–buying a vehicle entirely online–is now not only feasible, but increasingly preferred.

The Digital Dawn: Why “Click-to-Drive” is Finally Here

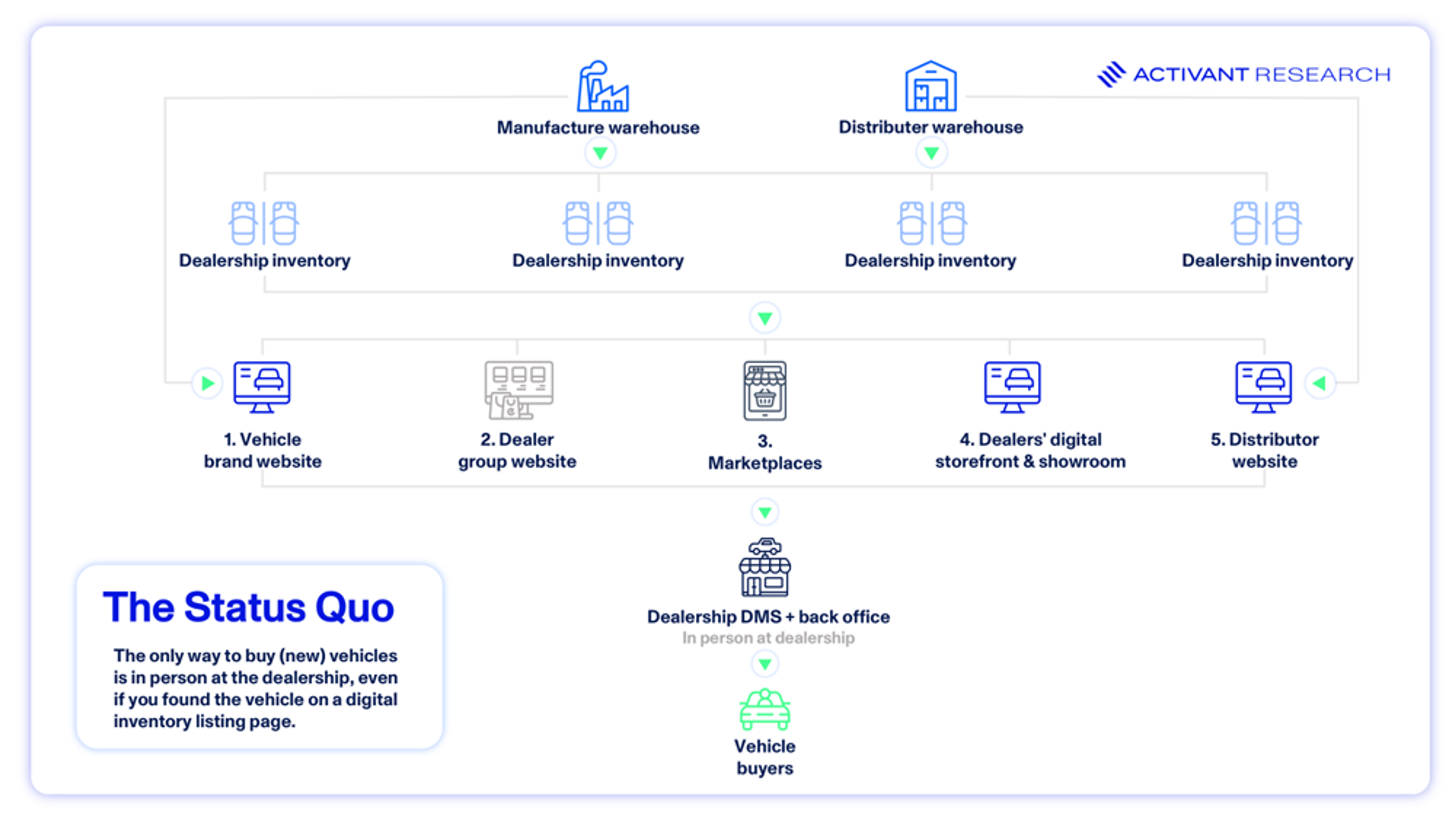

For decades, the promise of digital auto retail has been a facade. Sleek online configurators and marketing funnels inevitably led to the same dead end: a physical desk at a dealership. This wasn't a failure of imagination but a hard-coded technological and regulatory limitation. The industry was a landscape of siloed innovations, digital payments, online financing, and reservation tools, all bolted onto a fundamentally analog transaction.

Research

The stalemate is now breaking, not from a single invention, but from the convergence of a mature tech stack and the power of AI. The “why now?” is clear:

The final, and most formidable, barrier was never the shopping cart; it was the “deal jacket,” the chaotic, state-specific web of titling, registration, tax calculations, and compliance paperwork. This is a problem too complex and variable for traditional software to solve. It requires AI – and a dedicated team, deeply focused and determined to solve this uniquely fragmented problem.

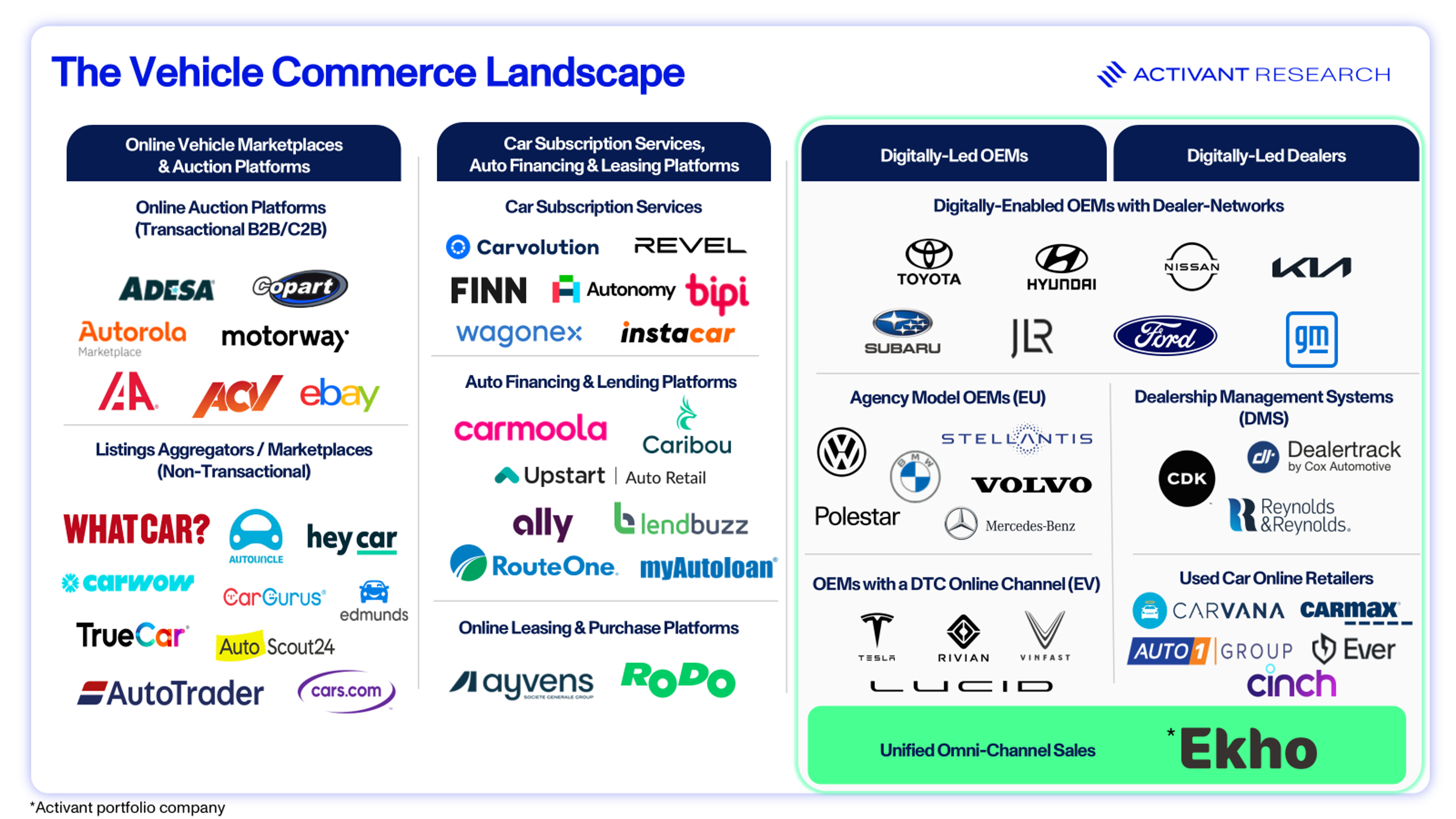

Transaction orchestration platforms like Ekho, an Activant portfolio company, are streamlining the complex back-office workflows behind vehicle sales. By pairing targeted AI with their proprietary rules engine, Ekho is able to manage the variability of each transaction. The result is a faster, more reliable path to a complete, e-signable deal jacket.

A key advantage of this approach is that it aligns incentives across the ecosystem. By enabling dealers to move inventory through a digital sales channel embedded directly on the OEM’s site, Ekho helps manufacturers and retailers work in sync – delivering a more seamless experience for the customer while preserving dealer participation. It’s the missing orchestration layer that connects the new generation of APIs for identity (Alloy), payments (FedNow), and insurance (Boost) into a single, seamless workflow.

We’re solving one of the most complex problems in commerce – and building a world-class team to do it – in a way that ensures OEMs, dealers, and shoppers all win”

Chris Howard, Co-Founder, Ekho

This new reality stands in sharp contrast to the pioneers who exposed the system's flaws but couldn't fix them. Carvana and CarMax proved the direct-to-consumer model but had to become asset-heavy digital dealers. Subscription services like FINN cleverly sidestepped franchise laws by reframing the transaction as a lease, though the company has since exited the U.S. market. Meanwhile, incumbents like Ford and General Motors, have invested heavily in digital front-ends, yet remain legally tethered to the dealer for the final, paper-based handshake.

So, if the technology is finally here, who is leading the charge? The answer lies with the disruptors who had no legacy to protect. Unburdened by the century-old franchise laws and dealer networks that constrain incumbents, EV makers were free to build a new retail playbook from the ground up. They became the natural first adopters and the ultimate case study for what this new technology stack makes possible.

EVs as Catalysts in the D2C Evolution

Nowhere is the future of auto retail more visible than in the electric vehicle (EV) segment. Unburdened by legacy dealer networks, EV makers were free to experiment, and the very nature of their product demanded a closer customer relationship. With battery warranties, over-the-air software updates, and complex recycling loops to manage, owning the lifetime customer journey is not just an option; it's the strategic imperative.

No company has weaponized this advantage more effectively than Tesla. The company's first act was to wage a decade-long war against protectionist franchise laws, winning precedent-setting victories in states like New York (2013), Michigan (2020), and Louisiana (2024).9,10,11,12 These legal battles, which continue to this day, were not just for show; they were fought to enable a complete redesign of the car-buying experience. By controlling the transaction, Tesla could offer transparent, no-haggle pricing and move the entire purchase process online. By 2018, 78% of Model 3 sales were already happening digitally and physical showrooms were transformed from high-pressure closing rooms into educational "experience centers." The result? A Net Promoter Score of 97, a figure that is unheard of in an industry where scores above 50 are considered excellent.13,14

Tesla’s model created a powerful blueprint. The COVID-19 pandemic then acted as a potent accelerant, driving a 50% increase in consumer appetite for online purchasing. This, combined with the market entry of D2C-native brands like Rivian and Lucid (who directly benefited from Tesla's legal groundwork), cemented the direct-to-consumer experience as the new benchmark for vehicle commerce.15

Lessons from Other Retail Revolutions

After everything you've read about rising consumer demand for convenience, dealership friction, and EV brands thriving with D2C models, you might still be thinking:

"Cars are different. People will always want to touch, feel, and drive before they buy."

And sure, that instinct isn’t entirely wrong. But it’s also not new. That same belief once held back transformation in other industries now thriving online. Just look at how other “can’t-sell-online” categories evolved:

- Eyewear: Warby Parker demystified online prescription glasses sales via at-home try-ons and transparent D2C pricing, proving an expensive, medicalized purchase could be accessible online.

- Mattresses: Casper has demonstrated that "touch-and-feel" products like mattresses can be successfully sold online. In 2024, Casper generated $343m in online sales, underscoring the strength of its direct-to-consumer model.16 With the U.S. mattress market projected to reach $19.21 billion by 2025, brands such as Casper, Saatva, and Purple Innovations are capturing meaningful share in a category once dominated by in-store retail.17

- Real Estate: While agent roles persist, initial search is now almost exclusively online (100% of buyers used the internet to search for homes in 2023, with 52% purchasing a home they found online), with platforms like Zillow empowering consumers and shifting agents to advisory roles.18

- Travel Agencies: Online booking transformed simple transactions, but savvy agents evolved, focusing on complex itineraries and personalized service where human expertise provides undeniable value.

The consistent lesson is that industries prioritizing consumer-centric innovation and adapting to evolving expectations thrive. The common thread: winners didn’t just add new channels; they linked every interaction to a single customer identity, so in-store staff already knew what shoppers configured online. Auto retail must deliver the same omnichannel continuity.

A Trillion-Dollar Arena

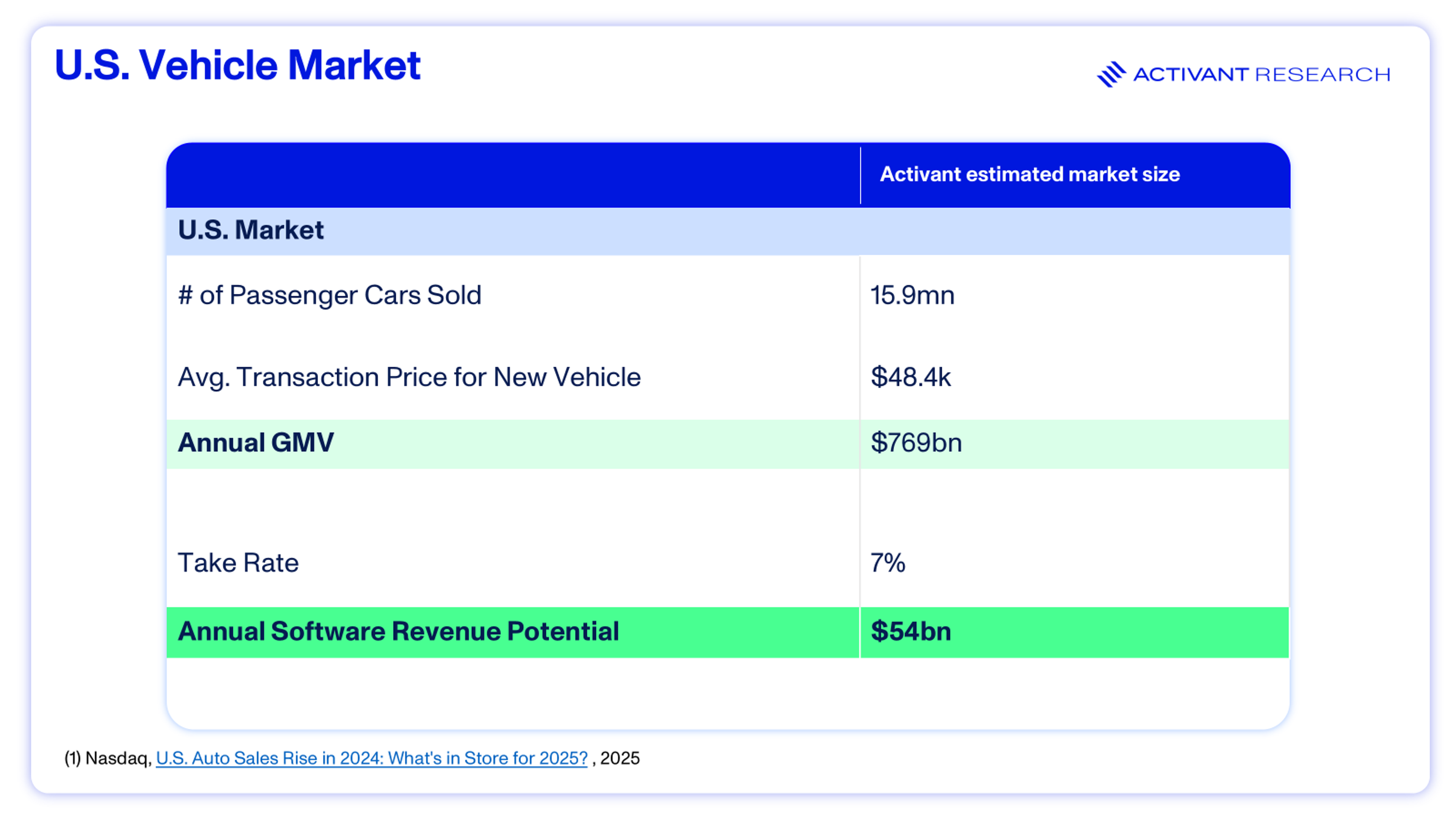

In 2024, the U.S. automotive market recorded approximately 15.9m new passenger car sales, with an average transaction price of $48,400.19 This translates to an annual Gross Merchandise Value (GMV) of roughly $769bn for new vehicles alone.20

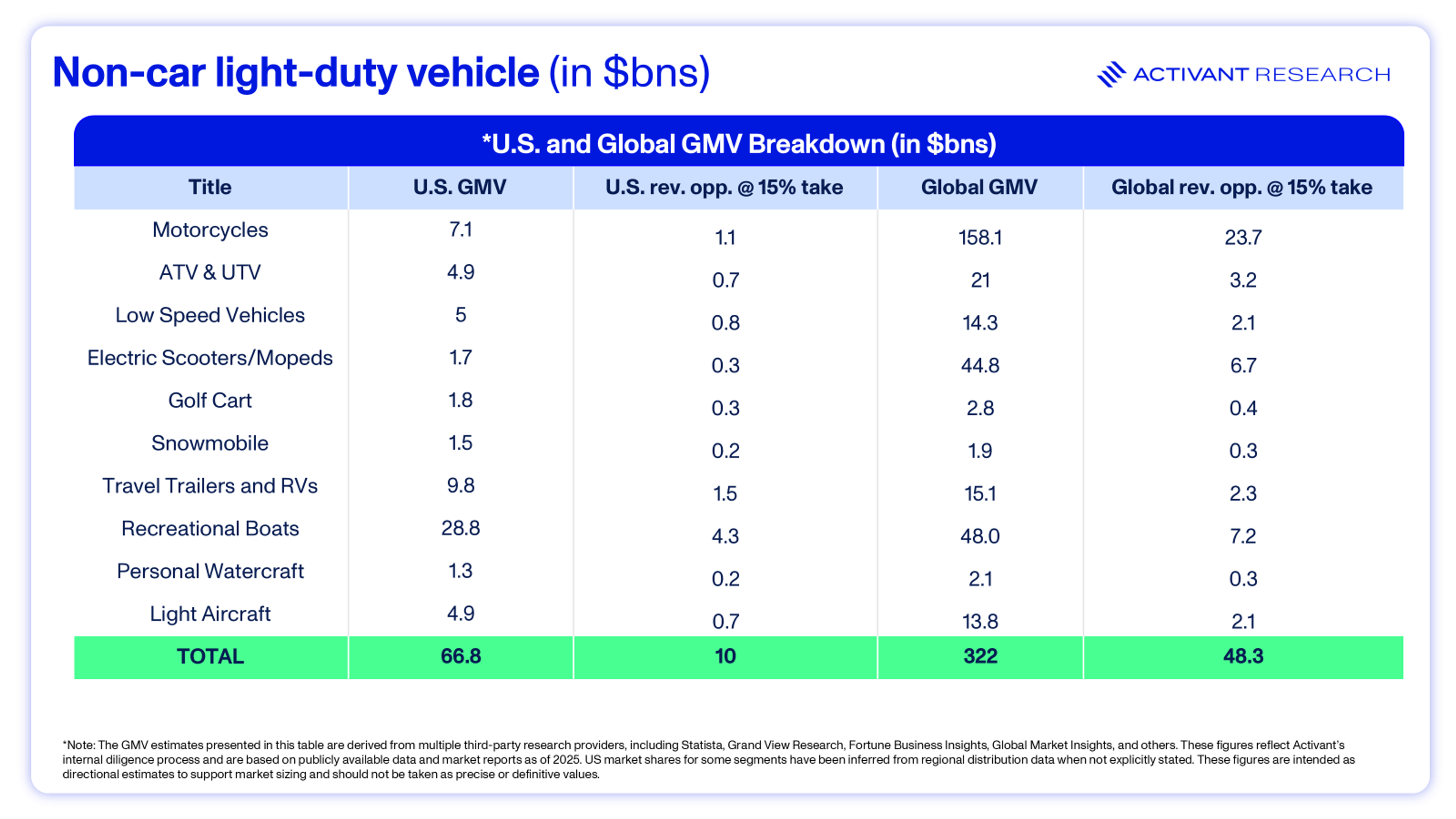

Complementing this is the "non-car light-duty vehicle" segment, covering motorcycles, ATVs, golf carts, travel trailers, RVs, recreational boats, etc, which contributes an estimated $75 billion in GMV. Combined, the total U.S. vehicle-related commerce exceeds $1 trillion annually, making it one of the largest retail markets globally.

Activant Research estimates that the digitization of this ecosystem represents a $50 billion annual software revenue opportunity in car sales (based on a 7% take rate), with an additional $10 billion opportunity in non-car segments (assuming a 15% take rate) in the U.S. alone.

As this trillion-dollar industry shifts online, new retail models are gaining traction. We believe one of the most transformative among them is the agency model, redefining the role of dealers in the digital era.

The Agency Model: An Emerging Path for Modernized Auto Retail

Mechanics of the Model

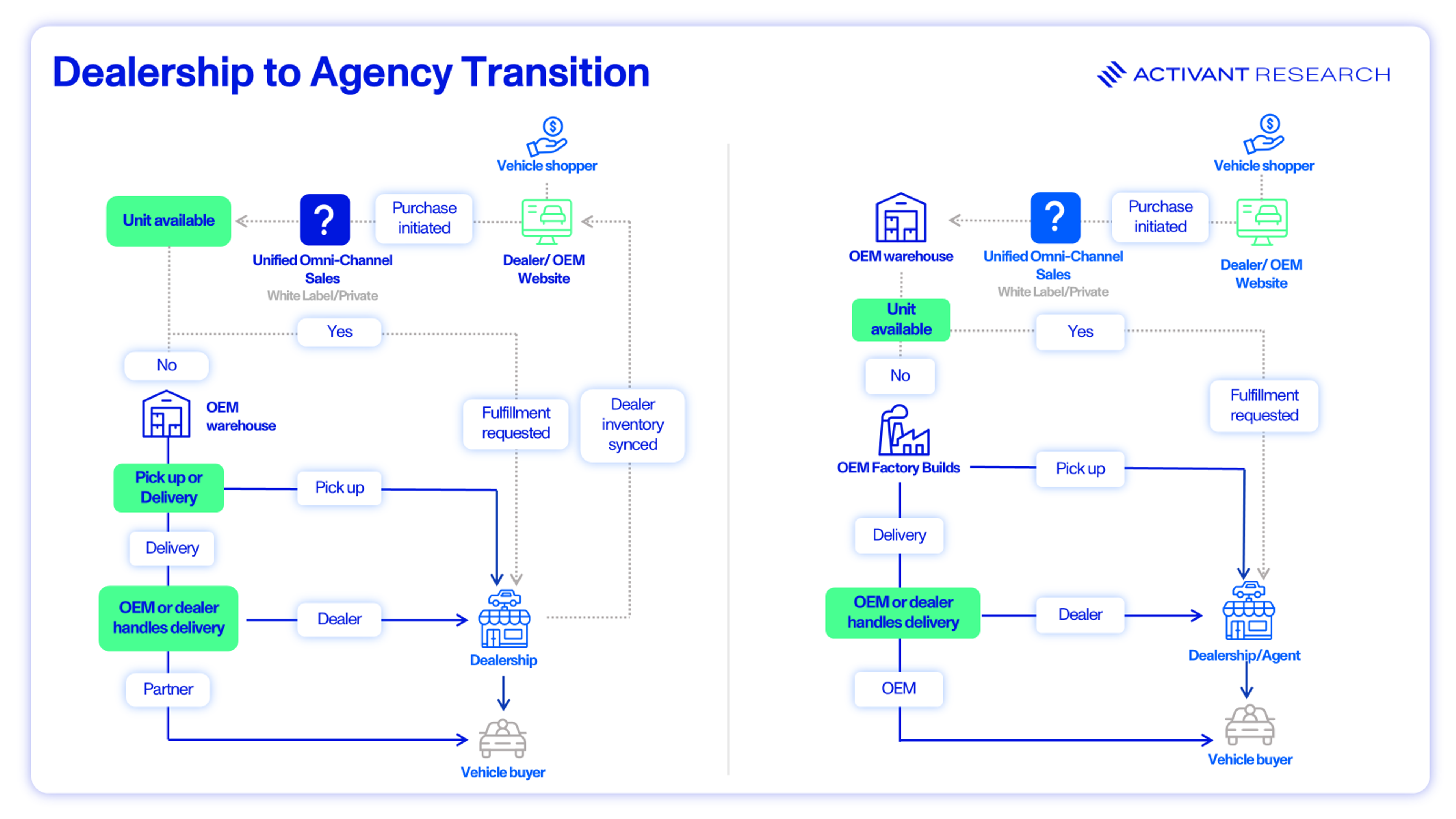

As automakers race to modernize, the "agency model" is emerging as a viable alternative to traditional dealership structures, particularly for OEMs managing entrenched franchise networks. Under this model, dealers no longer buy and resell inventory. Instead, they act as agents on behalf of the OEM, facilitating customer engagement, vehicle delivery, and after-sales service, while the OEM retains ownership and centrally controls pricing.

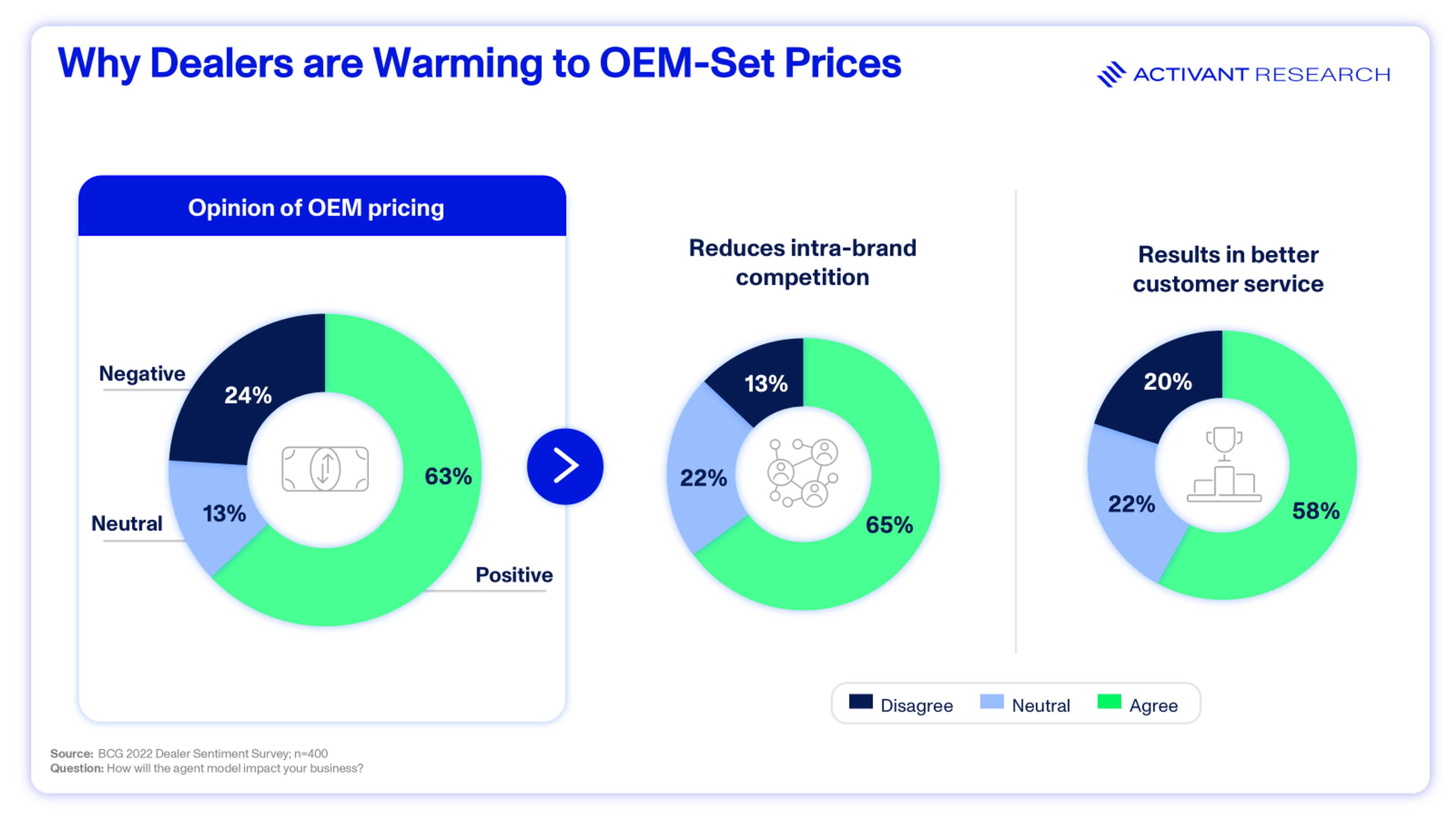

Crucially, the agency model standardizes pricing across all channels. Customers see a consistent, non-negotiable price whether they’re online or in-store. This eliminates the margin-eroding price competition between same-brand dealers, reduces customer distrust, and creates a level playing field focused on experience rather than discounts. For their role, dealers earn a commission on each transaction, either a fixed fee or tiered according to volume or satisfaction scores (CSI).

In the U.S., however, this kind of price consistency isn’t currently feasible under existing franchise laws. OEMs are legally prohibited from setting the retail price at which dealers sell vehicles, meaning true price standardization would require changes to state legislation.

By removing inventory carrying costs and pricing pressure, the model aligns economic incentives and allows dealers to focus on what they do best: building local trust and managing the human side of the transaction. In many ways, it repositions them from resellers to high-touch fulfillment and service providers.

Dealer Response & Strategic Outlook

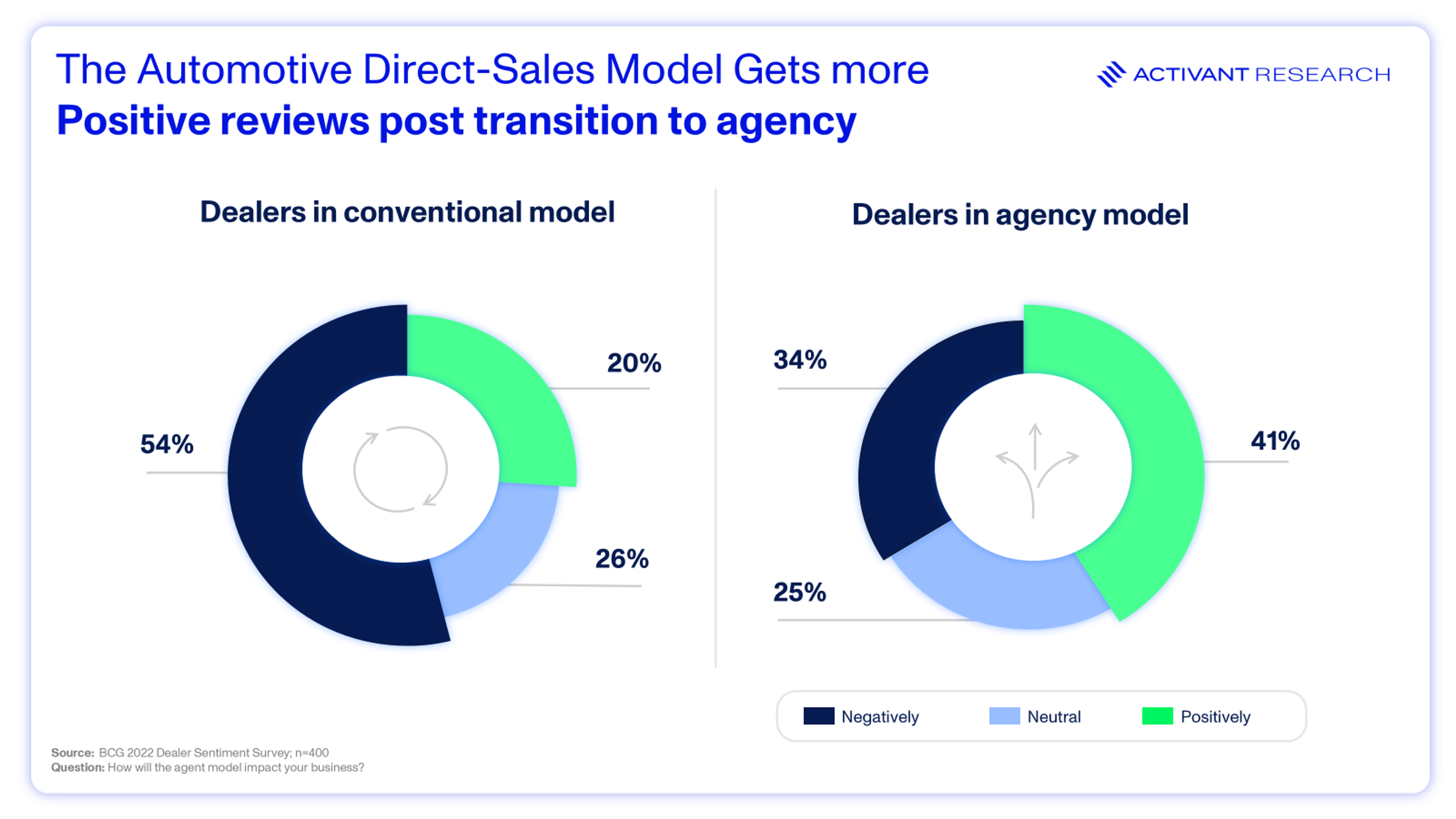

Naturally, this model has drawn skepticism, especially in the U.S., where franchise laws and legacy expectations are deeply rooted. Dealers voice concerns over loss of pricing control, lack of detail on commission structures, and doubts about OEMs’ ability to effectively localize pricing. In a 2023 BCG survey, 80% of conventional dealers feared that switching to an agency model would harm their business.21 But this early resistance tends to soften with real-world exposure.

As the data clearly shows, apprehension is replaced by operational reality. Positive sentiment among dealers’ doubles–from 20% to 41%–after moving to an agency model, while negative sentiment is more than halved. This shift occurs as theoretical concerns fade and the tangible benefits outlined later in this report, such as reduced working capital requirements and simplified pricing conversations, begin to materialize.

The Global Outlook

Globally, the shift is well underway. Europe, Australia, and parts of Asia have seen accelerating adoption. In the UK and across much of Europe, Polestar contracts directly with customers while relying on dealers only for test drives, servicing and warranty support, and vehicle handover – an agency model by design. In the U.S., legal constraints force Polestar to work through licensed Volvo-affiliated dealers, but the digital front-end mirrors its global vision.

This hybrid approach may preview how the U.S. market could evolve: a legally compliant framework where dealers remain essential to customer experience, but without owning inventory or setting prices. With digital retail tooling now mature and consumer expectations reshaped by Tesla, CarMax, and others, the trajectory is clear. The agency model is coming. The real question is not whether, but how, dealers choose to adapt and lead within it.

A Shared Destination: The Compelling Win-Win-Win of Modernized Auto Retail

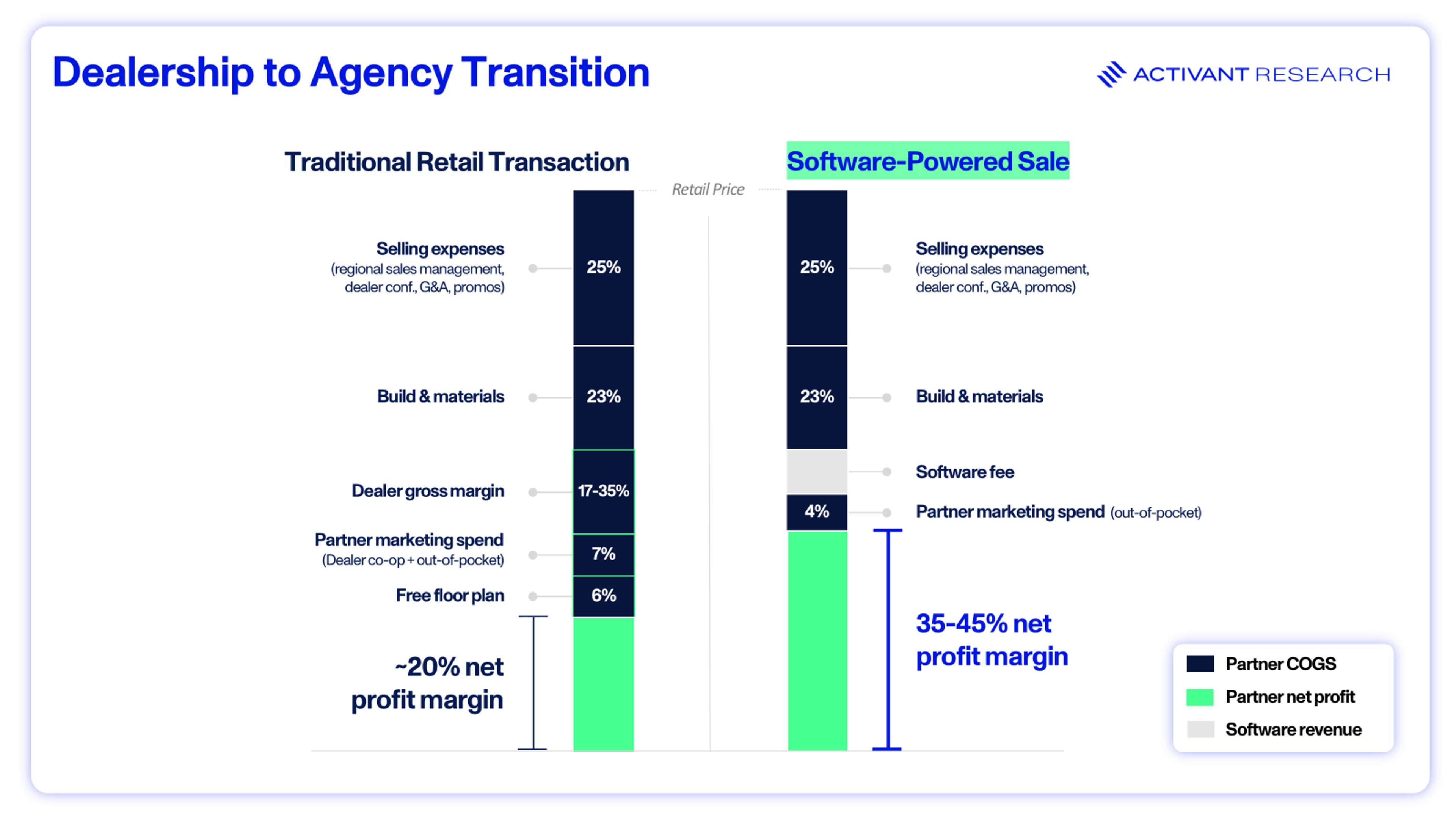

The move to digital D2C, particularly via a thoughtfully implemented agency model, promises a rare "win-win-win" scenario, offering distinct advantages for all key vehicle stakeholders. This financial transformation is best understood visually:

This model fundamentally re-architects the transaction's economics:

- For the Dealer (Partner): The volatile, often-thin "dealer gross margin" is replaced by a predictable and significantly larger net profit margin (35-45%). This is achieved by eliminating major dealer costs like inventory floorplan, sales processing overhead and most marketing spend, which are now absorbed by the OEM and the efficient sales processing software platform.

- For the OEM (and Software Provider): A small, efficient software fee captures a fraction of the value it creates. This fee funds the technology that eliminates onerous traditional costs, drives down marketing spend, and provides the data and control the OEM previously lacked.

The result is a more profitable, stable, and collaborative ecosystem. The dealer makes more money per unit, and the OEM gains efficiency and brand control – a true win-win powered by technology. But this modernized model doesn't just reallocate profits; it fundamentally resolves the long-standing frustrations of the most important stakeholder: the consumer.

In just a year, our platform has helped OEMs and their dealers generate tens of millions in online revenue, while delivering shopper CSAT scores well above traditional buying – proving that the demand is real and the opportunity is massive”

Rowan Mockler, Co-Founder, Ekho

1. Consumers: Empowerment, Transparency, and Convenience

The emerging paradigm directly addresses long-standing frustrations in car buying.

Amplifying this demand for a new paradigm is the single most powerful consumer segment in automotive retail: women. Influencing over 85% of car-buying and accounting for over 62% of all U.S. vehicle purchases, this demographic is also the most acutely dissatisfied with the traditional model.22 Despite their dominance as buyers, only 24.6% of all car sales representatives in the U.S. are women, highlighting a stark disconnect between who is buying and who is selling.23

The imbalance has tangible consequences. Female buyers are significantly more likely than men to walk away from a dealership after a poor interaction and consistently cite speed and paperwork simplicity as their chief frustrations – the exact pain points of the legacy showroom model. The legacy process is not just inconvenient for this group; it is often intolerable. As a result, they are not just a target market; they are a primary catalyst, actively seeking and rewarding the transparency, efficiency, and respect that a digital-first journey provides.

This new consumer-centric model delivers on those demands by offering:

- Supreme Convenience: Research, configure, finance and order online from anywhere at any time, with the flexibility to transition seamlessly to dealerships for physical interactions like test drives.

- Transparent & Equitable Pricing: No-haggle, OEM-set prices eliminate negotiation stress and foster fairness and trust. Estimates of consumer cost savings from D2C vehicle sales have varied significantly over time. Earlier studies suggested average savings of approximately $2,225 per vehicle, primarily driven by reduced distribution inefficiencies.24 In contrast, a more recent study conducted by consulting firm Oliver Wyman and commissioned by the National Automobile Dealers Association (NADA)–an organization with a vested interest in preserving the traditional dealership model–pegged the savings at just $200 per vehicle.25

- Unparalleled Choice: Digital platforms offer broader inventory access, including regional stock or build-to-order options, catering to individual preferences.

- Pleasant Experience: Removing adversarial haggling shifts interactions towards positive, knowledge-focused assistance, aligning with dealer desires (58% of the BCG survey believe fixed prices allow focus on customer needs, not price).21

2. OEMs: Direct Insights, Enhanced Brand Control, and Margin Expansion

This shift offers OEMs opportunities to modernize distribution, strengthen brands, and improve financial performance:

- Enhanced Profitability: According to PwC, adopting a (D2C) full agency model can yield cost efficiencies of approximately 10%, translating into a 1.5%-3% uplift in overall profitability. 27Complementing this, Accenture estimates that transitioning to an agency model can reduce retail-related costs by as much as 4%, a shift that could unlock over $1 billion in annual savings for a well-established OEM operating in a mid-sized region.28

- Direct Customer Connection & Data: Owning or overseeing sales provides invaluable first-party customer data for innovation, tailored marketing, and ongoing engagement.

- Brand Consistency & Control: Centralized pricing and curated digital journeys ensure consistent brand messaging and experience, preventing erosion from inconsistent retail practices and protecting residuals.

- Optimized Inventory Management: Direct inventory oversight allows better production-to-demand matching, reducing costly incentives and overproduction burdens.

Brands wanting NPS ≥ 70 by 2028 – a hard KPI possible only when OEMs control the entire funnel.

3. Dealers: Evolving to Resilient, Higher-Margin, Customer-Centric Hubs

Contrary to obsolescence fears, a well-structured agency model empowers dealers to reinvent and fortify their businesses by focusing on strengths and shedding legacy burdens. And Dealers themselves are already warming up to this new paradigm: nearly two-thirds believe that if OEMs enforced consistent pricing, same-brand competition would ease, reducing the need to sacrifice margin to retain already-loyal customers. Many also see the operational upside: eliminating negotiation could reclaim up to 25% of their sales time, allowing them to focus more on service, experience, and customer retention.29

This shift unlocks significant operational cost reductions:

- Liberation from Inventory Burden: With vehicles on OEM balance sheets, crippling floorplan interest payments (>$200M annually for U.S. public groups recently) and inventory insurance costs (1%-3% of vehicle price) shrink near zero, freeing capital and improving cash flow.30

- Predictable New Car Margins: Fixed commissions replace volatile, often loss-making new car sales, creating stable, reliable income per unit as intra-brand price wars cease.

- Leaner Operations & Lower Overhead: Simplified administration, reduced need for vast lots and extensive inventory management staff, and OEM handling of tasks like ordering can significantly cut operating expenses.

- Reduced Sales/Marketing Costs: Transparent pricing diminishes negotiation-focused sales staff needs (freeing ~25% of salesperson time) and allows for more efficient, performance-based marketing over broad-stroke traditional spend.21

- Streamlined Back Office: Digital platforms and LLMs can automate administrative tasks. LLM-powered deal-jacket assembly (minutes, not hours), AI finance bots that pre-approve 70% of buyers before they walk in, and NLP service chat that deflects routine queries, freeing advisors for high-value work

- Amplified Focus on High-Margin Profit Centers: Highly profitable service/parts departments (60%-75% of net profits) become even more crucial, as all vehicles require ongoing service.32 Freed from price battles, dealers can focus on these core revenue streams.

- New Revenue as Value-Added Fulfillment Partners: Dealers earn fees for critical last-mile services: test drives, product experiences, PDIs, premium handovers, and local customer support/education.

- Stronger Customer Relationships & Loyalty: Without adversarial negotiations, staff can build genuine, long-term relationships through expert advice and superior service, fostering loyalty in areas where consumers already trust dealers.

Navigating the Transition: Lessons from the Global Road & A Proactive Stance for U.S. Dealers

The transition to agency or similar direct-sales models faces challenges, but early international experiences offer U.S. stakeholders invaluable lessons.

Australia served as a key early testbed. Honda and Mercedes-Benz's 2021-2022 agency model adoptions were controversial and far from smooth. Mercedes faced a significant $650M dealer lawsuit alleging business harm and unfair profit seizure. However, the court ultimately upheld the agency model's viability in late 2022, signaling that outright resistance to change is likely futile and that pragmatic negotiation for better terms is a more constructive path.33 Mercedes' rationale, revealed in court, was that aggressive dealer discounting (averaging over 5% off MSRP pre-COVID) was systematically eroding its premium brand's equity and profitability. Coupled with 90% of customers starting their purchase journey online, modernization was deemed imperative to avoid a downward spiral.34 Honda Australia's experience, despite initial sales volume drops (halving from 2020-2022), showed dealers becoming more profitable per sale and less exposed to market volatility as Honda (OEM) absorbed inventory costs and financial risks. By early 2024, Honda dealers had reportedly embraced the model's stability, with sales recovering–highlighting that dealer financial health and adaptability, rather than short-term volume alone, are the true indicators of success.35

In Europe, the agency trend is accelerating. Mercedes-Benz aims for 80% of its European sales via agency by 2025 and has successfully struck agreements with dealer associations, demonstrating that collaborative implementation is indeed possible.36 Volkswagen Group, on the other hand, while temporarily pausing its EV agency rollout in some markets due to complexities of parallel systems and slower EV uptake, firmly reaffirmed that "Direct to Customer with a Full Agency remains our guiding star in the long-term”. This underscores that meticulous, phased execution, jointly planned by OEMs and dealers, is critical for successful, sustainable transitions, even if the goal remains fixed.

Learnings for U.S. Dealers from Global Experiences:

Evolving overseas agency model rollouts offer diverse, actionable insights for American dealers:

1. Engage Early & Constructively: Dealers who proactively collaborated with OEMs in Europe and Australia generally secured better outcomes in shaping critical elements like commission rates, demo policies, and data protocols, compared to those who primarily resisted the change.

2. Anticipate Short-Term Disruption: The transition won't be seamless; expect potential legal hurdles (requiring franchise law adjustments) and initial recalibrations in sales or profitability. These are typically transitional, not permanent, and consumers often adapt quickly, appreciating the transparency and haggle-free pricing.

3. Prioritize Communication & Comprehensive Training: Early overseas challenges often stemmed from unclear information for dealers, sales staff, and customers. Mitigate this with clear compensation plans, robust staff training for new roles and mindsets, and comprehensive consumer education on the new buying process.

4. Learn from Others & Insist on Collaboration: A recurring critique was insufficient OEM consultation before major shifts. U.S. dealers should insist on integral involvement in planning, forming working groups, piloting concepts, iterating based on feedback, and then planning wider rollouts. Negotiate transitions now to shape a model that works locally, clarifying specifics like used-car handling, facility upgrade costs, and fair lead distribution.

Proactive Dealer Imperatives for a Successful Transition:

Dealers choosing a proactive stance should focus on several key strategic imperatives:

- Engage OEMs & Shape the Transition: Actively participate in dealer councils and OEM working groups to negotiate fair, sustainable agency contracts. Focus on commission structures adequate to replace lost margins, clear expense handling (demos, facilities), and equitable lead/data sharing. As BCG notes, these negotiations critically impact future profitability, demanding thorough preparation and unified representation. Advocate for transitional support or new incentives rewarding customer satisfaction and local marketing efforts.

- Invest Heavily in Customer Experience – The New Competitive Front: Shift the entire store culture from "sales-at-any-cost" to "service-at-every-opportunity." Retrain sales staff as product experts and customer advocates–not just negotiators, emphasizing soft skills and agency model fluency. Adjust pay plans to reward customer satisfaction (NPS), delivery quality, and retention. Upgrading dealership environments is key to delivering a superior experience that justifies set pricing through modern lounges, efficient processes, "genius bar" specialists, and seamless online-to-showroom journeys. If prices are equal, the best experience wins.

- Double-Down on Service, Parts, & Lifetime Value – The Enduring Profit Engine: Recognize that service and parts departments (often 60%-75% of net profits) become even more critical. Audit and enhance service capacity, efficiency, and technician training (especially for EVs). Boost marketing and focus on customer retention through maintenance plans and loyalty programs. With fixed new-car margins, increasing customer lifetime value via your service ecosystem is paramount.

- Modernize Operations & Aggressively Leverage Digital Tools: Embrace technology as integral to the agency model. Implement robust digital retailing platforms, such as Ekho (Activant Portfolio Company), CDK Roadster or AutoFi, to deliver seamless online customer journeys, with your dealership as the trusted local fulfillment point. Utilize CRM and data analytics for personalized communications and lead follow-up. Reinvest savings from reduced inventory management into tech and processes that enhance the customer experience and operational efficiency, positioning your dealership as a valued, forward-looking OEM partner.

- Cultivate a Change-Ready Team and a Resilient Culture: Proactively communicate the agency model's vision to staff, allowing freedom to focus on the customer and remove old frustrations. Involve managers and frontline staff in planning process adaptations. Re-evaluate staffing roles, potentially shifting from "closers" to "vehicle coaches" or experience specialists. Critically, realign internal incentives across all departments towards customer happiness, service retention, and efficient throughput under the new model. Foster a culture where employees thrive by delighting customers in this new paradigm.

In summary, dealers who proactively lean into these preparations, leveraging global insights and available time, can transform the agency model from a perceived threat into a powerful launchpad for a new era of stability and prosperity.

The Checkered Flag: A Unified, Prosperous, and Customer-First Automotive Future

The "Click. Buy. Drive." metamorphosis, accelerated by new retail models like agency, is a strategic imperative, not just a technological shift. It promises a superior experience by aligning the success of consumers (gaining streamlined, transparent journeys), OEMs (achieving efficiency, direct customer intimacy, and brand control), and forward-thinking dealers (evolving into highly valued, profitable, resilient partners leveraging local strengths).

At Activant Capital, we see technology as the key to unlocking these transformative, mutually beneficial outcomes. The automotive retail landscape is irrevocably changing. This isn't a disruption to fear, but a shared opportunity for a more efficient, customer-centric, and prosperous future.

Clinging to the past is likely to invite imposed, detrimental outcomes. Adaptation and proactive leadership, however, allow stakeholders to shape this new paradigm to their advantage. For auto dealers, this is a rare chance to reinvent, shedding old constraints and embracing a modern approach that amplifies their inherent strengths in community engagement and service excellence. Global evidence confirms this direction: dealers transitioning to new models are often finding greater stability and profitability by focusing on customer care and high-margin services.

U.S. dealers, historically resilient and adaptive, now face their next evolution. The status quo is untenable. Proactive engagement with new retail models is not just about survival; it's about securing relevance and prosperity by selling cars smarter, leveraging unique assets within a 21st-century framework. The road ahead has three lanes: brand ownership, AI-enabled efficiency, and omni-channel trust. Companies that fire on all three cylinders will win the next era of automotive retail. The choice is clear: drive change and thrive, or risk being left behind. The future of auto retail has arrived!

Endnotes

[1] The USA Auto industry report, 2024

[2] Acea, Economic Report: Global and EU auto industry, 2024

[3] Prnewswire.com, study-Americans-feel-taken-advantage-of-at-the-car-dealership, 2016

[4] CJ Pony Parts, Men Vs. Women: The Gender Divide of Car Buying, 2024

[5] McKinsey & Company, Online sales and subscriptions will shape tomorrow’s car financing journey, 2023

[6] Yahoo, one-car-dealers-most-closely-watched-cost-metrics-is-skyrocketing, 2023

[7] Presidio Group, Average-dealership-performance-benchmark, 2024

[8] BCG, Shifting to an Automotive Direct-Sales Model, 2023

[9] MOTORTREND, Tesla Wins Direct Sales Case in New York State, 2013

[10] CNN Business, Tesla finally wins the right to sell cars in Michigan, 2020

[11] Reuters, Tesla can challenge Louisiana direct sales ban, US appeals court rules, 2024

[12] Seyfarth, Court Rules that Rivian and Lucid May Sell Vehicles Direct to Consumers in Illinois, 2023

[13] CutomerGauge, Tesla’s NPS Score: What’s Driving Tesla’s Customer Loyalty?, 2025

[14] CleanTechnica, 78% Of Tesla’s 2018 Model 3 Sales Were Online — Musk Email Sheds Light On New Sales Strategy, 2019

[15] Businesswire, New Independent Study Finds Majority of Car Shoppers Open to Purchasing Online , 2021

[16] ECDB, Casper Company & Revenue, 2024

[17] Mordor Intelligence, US Mattress Market Size & Share Analysis - Growth Trends & Forecasts (2025 - 2030), 2025

[18] iPropertyManagement, Zillow Statistics, 2024

[19] CARSCOOPS, Average New Car Transaction Prices Drop To $48k, Incentives On The Rise, 2024

[20] Nasdaq, U.S. Auto Sales Rise in 2024: What's in Store for 2025? , 2025

[21] BCG, shifting-to-automotive-direct-sales-model, 2023

[22] Forbes, Its true women really do shop more for cars, 2019

[23] Zippia, Car Sales Representative demographics and statistics in the US, 2021

[24] Mercatus, state-franchise-law-carjacks-auto-buyers?, 2015

[25] Dealershipguy.com, study-shows-franchised-dealerships-rival-direct-sales-in-cost-efficiency, 2024

[26] BCG, shifting to automotive direct sales model, 2023

[27] PWC, the-agency-distribution-model, 2022

[28] Accenture, accenture-study-the-future-of-automotive-sales.pdf, 2023

[29] BCG, Shifting to an Automotive Direct-Sales Model, 2023

[30] Acvauctions.com, car-dealership-floor-plan, 2025

[31] BCG, shifting to automotive direct sales model, 2023

[32] NADA, accelerating-success-for-the-automotive-retail-industry, 2024

[33] ABC News, Mercedes-Benz's legal win over car dealers could transform the way new cars are sold in Australia, 2023

[34] Whichcar.com.au, Why did Mercedes-Benz Australia introduce the agency model?2023

[35] CarExpert.com, Honda Australia stands by agency model despite sales slide 2024

[36] CarDealer Magazine, Mercedes-Benz to cut ten per cent of dealerships as part of switch to agency sales model, 2022

Disclaimer: The information contained herein is provided for informational purposes only and should not be construed as investment advice. The opinions, views, forecasts, performance, estimates, etc. expressed herein are subject to change without notice. Certain statements contained herein reflect the subjective views and opinions of Activant. Past performance is not indicative of future results. No representation is made that any investment will or is likely to achieve its objectives. All investments involve risk and may result in loss. This newsletter does not constitute an offer to sell or a solicitation of an offer to buy any security. Activant does not provide tax or legal advice and you are encouraged to seek the advice of a tax or legal professional regarding your individual circumstances.

This content may not under any circumstances be relied upon when making a decision to invest in any fund or investment, including those managed by Activant. Certain information contained in here has been obtained from third-party sources, including from portfolio companies of funds managed by Activant. While taken from sources believed to be reliable, Activant has not independently verified such information and makes no representations about the current or enduring accuracy of the information or its appropriateness for a given situation.

Activant does not solicit or make its services available to the public. The content provided herein may include information regarding past and/or present portfolio companies or investments managed by Activant, its affiliates and/or personnel. References to specific companies are for illustrative purposes only and do not necessarily reflect Activant investments. It should not be assumed that investments made in the future will have similar characteristics. Please see “full list of investments” at https://activantcapital.com/companies/ for a full list of investments. Any portfolio companies discussed herein should not be assumed to have been profitable. Certain information herein constitutes “forward-looking statements.” All forward-looking statements represent only the intent and belief of Activant as of the date such statements were made. None of Activant or any of its affiliates (i) assumes any responsibility for the accuracy and completeness of any forward-looking statements or (ii) undertakes any obligation to disseminate any updates or revisions to any forward-looking statement contained herein to reflect any change in their expectation with regard thereto or any change in events, conditions or circumstances on which any such statement is based. Due to various risks and uncertainties, actual events or results may differ materially from those reflected or contemplated in such forward-looking statements.