Topic

Supply Chain & Logistics

Published

January 2024

Reading time

8 minutes

The Future of Demand Forecasting Software

A balancing act between innovation and market realities

The Future of Demand Forecasting Software

Download ArticleResearch

If you’re a sneaker fan, you’ve probably wondered how Nike knows what style you want, when you want it, and where you might buy it. The answer likely has something to do with one of Activant’s former portfolio companies: Celect. Nike acquired the forward-looking inventory management platform in 2019 to bolster their direct-to-consumer strategy by harnessing Celect’s optimization of merchandising planning to match customer purchasing behaviors. Direct sales grew to 39% by the end of the 2021 fiscal year.1,2 Compare this to the 16% achieved in 2011, and you’ll agree they’re doing something right.

When Celect was acquired, it was one of the only demand-predictive tools in the market that didn’t take a full inventory cycle to adjust purchasing and allocation parameters. With Celect’s technology integrated into Nike’s mobile apps and website, the shoemaker had the ability to serve consumers more personally at scale without any data-related delays.

When Nike acquired Celect in 2019, they acquired an AI-based demand forecasting and optimization platform, which enabled them to more accurately execute on their direct-to-consumer strategy. They were able to use their own rich customer and product data, controlling the full demand planning process with their own data and analytics platform."

John Andrews, CEO, Celect

Demand Forecasting

Demand forecasting, an essential part of end-to-end supply chain management, is simply a process that predicts customers’ future demand for a product or service. This is essential for businesses to develop informed perspectives and ensure that the appropriate volume and type of stock flows to minimize the risk of understock, overstock, or obsolescence.

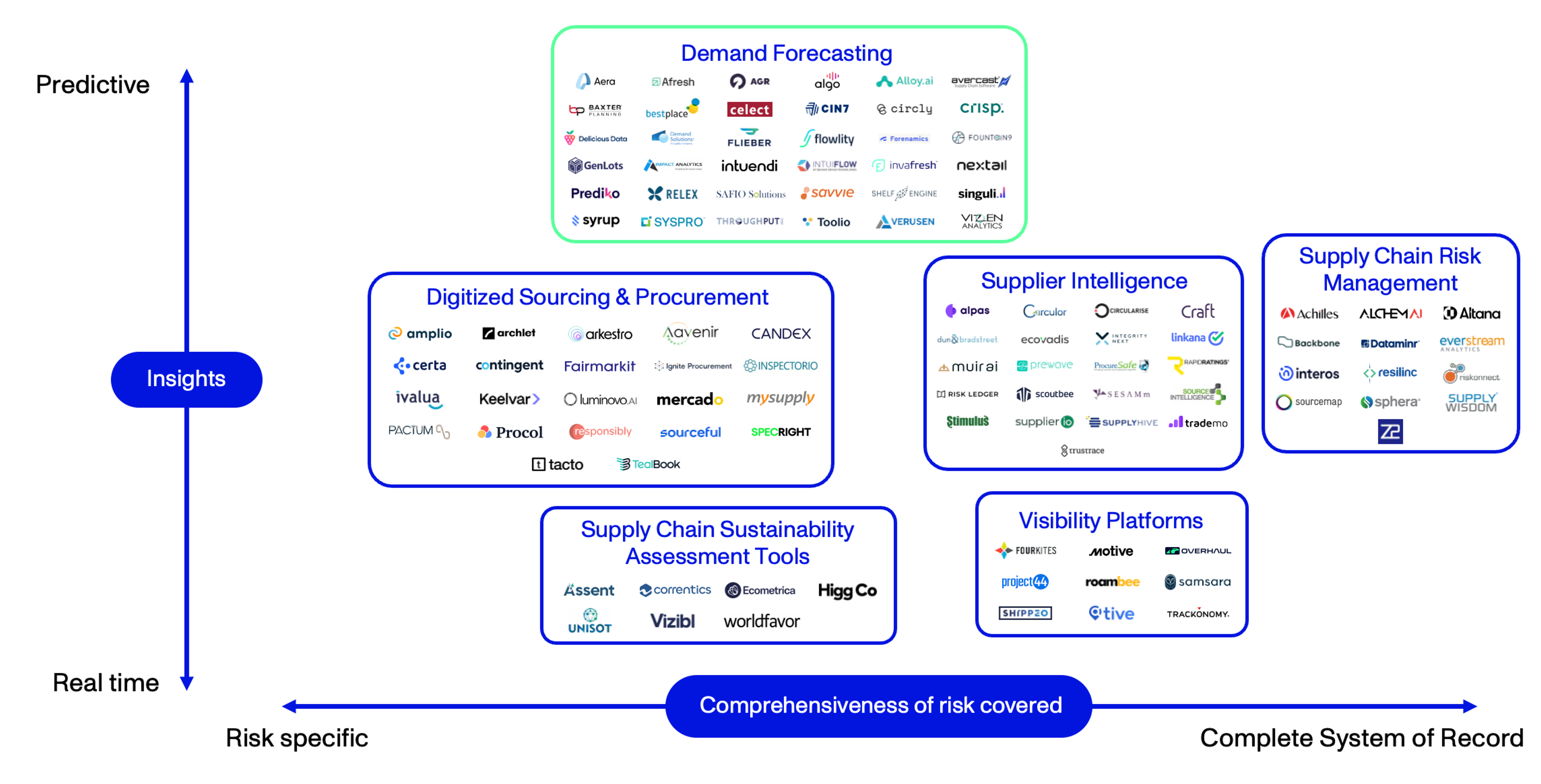

Thesis Map

Supply Chain Optimization Software

With new channels, increased demand signals, shorter product life cycles, and growing economic uncertainty, many firms are finding their current demand forecasting capabilities inadequate. This is exacerbated because supply chain leaders still cling to manual systems and antiquated software. Close to 75% of supply chain functions run operations using spreadsheets. The remainder use IT planning solutions that are part of large enterprise systems offered by incumbents like SAP, E2Open, and Blue Yonder. More than 50% of supply chain planners use SAP Advanced Planning and Optimization (APO), which was introduced in 1998 and will no longer be supported from 2027.3 The imperative for a new solution could not be clearer.

The wild demand swings of the Covid pandemic left companies more punch-drunk than ever, flailing between inventory stockouts and gluts that legacy solutions didn’t see coming and couldn’t react to in time, let alone flag, predict, and act upon in advance. When every supply chain network in the world is constrained by bottlenecks, if you’re not leveraging data and solutions to sense your true demand, match it to your actual capacity, and optimize for the greatest efficiencies between those supply chain endpoints, then you’re doomed to repeat the same costly mistakes again and again…”

Seth Page, COO, ThroughPut

A $50 billion problem in the US alone

Sellers in the traditional B2B world often struggle with poor forecasts. Even the most successful companies typically deal with 20% to 30% dead or obsolete inventory.4 This dead stock costs sellers and manufacturers as much as 11% of their revenue.5 Estimates indicate that stale inventory in the US retail industry totals $50 billion a year,6 and that a staggering 5 billion pounds of retail returns end up in US landfills annually.7 There is a growing call to address this sustainability issue.

With inefficient legacy systems lacking the capabilities required and the very significant cost of poor forecasting, the market is ripe for disruption.

Basing inventory decisions on historical averages at the category level creates massive financial risk for omnichannel brands and retailers. With AI, we now have the tools to optimize purchasing and allocations for all style/color/size combinations across all channels and locations while making real-time adjustments based on events, emergent trends, and market conditions. There is just no good reason to over-produce anymore.”

Ferdinand Stockmann, Co-Founder & COO, Syrup

What pain points do winners need to address?

As retailers grow their omnichannel presence, they’ve started to prioritize forward-looking inventory management. Demand plans must align with multiple areas across the business, such as marketing, sales, and finance as well as external third parties. This means that the planning process requires additional workflow tools to enable collaboration with internal and external partners.

The need for demand forecasting to be dynamic and resilient is evident. Many solutions, however, are little more than pure regression models (often with seasonal overlays) for predictive forecasting. In a crowded market, this is unlikely to provide the differentiation and distinctiveness required to win.

The vast majority of the solutions we identified target the SME market to avoid the challenges of integration and long sales cycles that McKinsey claims average 2.8 years from vendor selection to complete rollout in the Enterprise market.8 These solutions tend to be narrowly focused on demand planning, but those offering a wider array of supply chain workflow tools are gaining traction in the Enterprise market. With large companies reluctant to replace ERP systems, integration of point solutions or suites is essential.

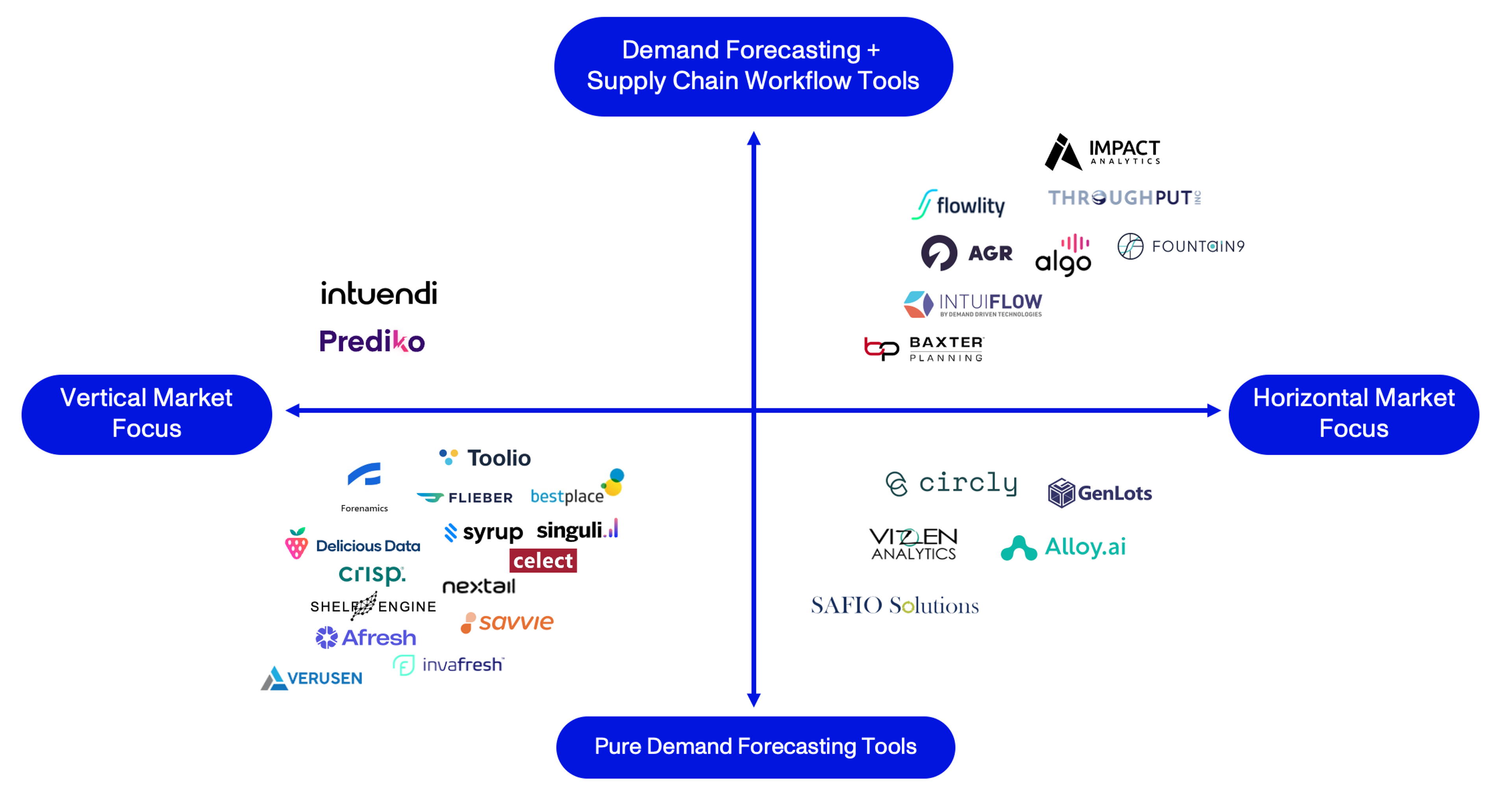

Activant Market Map

When we studied the market, it became clear that innovators differentiated themselves based on their sector focus or breadth of solutions. We also identified a range of solutions, from pure demand forecasting solutions to those with additional supply chain workflow tools. These tools include solutions that address elements such as supplier collaboration, production planning, and purchase order management.

We have, therefore, mapped the landscape using a vertical market vs. horizontal market focus on the one hand and a pure demand forecasting solution vs. a suite of demand forecasting and related workflow tools on the other hand. Most of the players mapped are system agnostic and are thus able to integrate with existing ERP or alternative sources to get historical and real-time internal data to use in their demand forecasting models and algorithms.

Market Map

Demand Forecasting Software

Emerging winners

It is early in the race, despite the clear imperative for next-generation solutions. The early winners are embracing AI, machine learning, and data analytics to speed up decision-making and lay the groundwork for autonomous planning. We like the solutions offered by:

- Syrup, with a vertical market focus and a pure demand forecasting tool that is focused on providing a plug-and-play solution to support inventory decision-making in commerce. They’re enabling brands and retailers to accurately determine thousands of color-style-size-location combinations.

- Prediko, which allows Shopify brands to take control of their inventory operations. The additional features embedded in the solution, such as purchase order management and financing, set them apart from competitors as they automate tasks that sit within adjacent supply chain workflows.

- Alloy.ai, a pure demand forecasting tool with a horizontal market focus. This solution uses AI features to predict out-of-stock and warehouse product shortages, accurately forecast consumer demand, identify sales, and deliver supply chain insights.

- ThroughPut, which leverages operational principles (such as the theory of constraints) with AI to offer an end-to-end solution. They use Demand Sensing to determine actual rather than forecast demand and then identify, manage, and automatically address potential bottlenecks. The solution delivers better operational and financial results.

Conclusion

Our analysis revealed a landscape fraught with both challenges and opportunities to shape the future of demand forecasting software. Gone are the days of a company’s historical data being the single source of truth. The need for change is clear and the opportunities are vast. We have no doubt that there are start-ups building these solutions. If you are in this camp–we want to talk.

Footnotes

[1] Nexford University, Nike’s New Business Model Focusing on DTC: What Business Students Stand to Learn, 2023

[2] IBID

[3] McKinsey & Company, To improve your supply chain, modernize your supply-chain IT, 2022

[4] Manufacturing.net, What is the real cost of dead inventory?, 2017

[5] Katana, The dead stock survival guide for manufacturers, 2024

[6] The Business of Fashion, The Cost Of Dead Inventory: Retail’s Dirty Little Secret, 2017

[7]Retail Touchpoints, How Returns Drag Down Sustainability Efforts (and what Retailers can do About it), 2021

[8] McKinsey, To improve your supply chain, modernize your supply-chain IT, 2022

Disclaimer: The information contained herein is provided for informational purposes only and should not be construed as investment advice. The opinions, views, forecasts, performance, estimates, etc. expressed herein are subject to change without notice. Certain statements contained herein reflect the subjective views and opinions of Activant. Past performance is not indicative of future results. No representation is made that any investment will or is likely to achieve its objectives. All investments involve risk and may result in loss. This newsletter does not constitute an offer to sell or a solicitation of an offer to buy any security. Activant does not provide tax or legal advice and you are encouraged to seek the advice of a tax or legal professional regarding your individual circumstances.

This content may not under any circumstances be relied upon when making a decision to invest in any fund or investment, including those managed by Activant. Certain information contained in here has been obtained from third-party sources, including from portfolio companies of funds managed by Activant. While taken from sources believed to be reliable, Activant has not independently verified such information and makes no representations about the current or enduring accuracy of the information or its appropriateness for a given situation.

Activant does not solicit or make its services available to the public. The content provided herein may include information regarding past and/or present portfolio companies or investments managed by Activant, its affiliates and/or personnel. References to specific companies are for illustrative purposes only and do not necessarily reflect Activant investments. It should not be assumed that investments made in the future will have similar characteristics. Please see “full list of investments” at https://activantcapital.com/companies/ for a full list of investments. Any portfolio companies discussed herein should not be assumed to have been profitable. Certain information herein constitutes “forward-looking statements.” All forward-looking statements represent only the intent and belief of Activant as of the date such statements were made. None of Activant or any of its affiliates (i) assumes any responsibility for the accuracy and completeness of any forward-looking statements or (ii) undertakes any obligation to disseminate any updates or revisions to any forward-looking statement contained herein to reflect any change in their expectation with regard thereto or any change in events, conditions or circumstances on which any such statement is based. Due to various risks and uncertainties, actual events or results may differ materially from those reflected or contemplated in such forward-looking statements.