Published

May 2024

Reading time

11 minutes

A Key Piece of the Renewables Puzzle

Energy Storage Solutions

A Key Piece of the Renewables Puzzle

Download ArticleResearch

A key piece of the renewables puzzle

There’s no debate that the transition to net zero is a global imperative. A study by Oxford University’s Institute for New Economic Thinking at the Oxford Martin School comes to a clear conclusion: there is an 80% chance that the net present cost of a “fast transition” away from fossil fuels by 2050 is lower than that of no transition, regardless of the discount rate used or accounting for any of the severe climate damages that would ensue. At 1.4% and 5% discount rates, the corresponding net present savings are estimated at $12 and $5 trillion globally, respectively.1

Regulators and developers are moving in the right direction, with $1.8 trillion2 invested in the energy transition globally in 2023. Of that, ~$600 billion went into renewable energy sources. Renewable power represented ~80% of the generation capacity added in 2022,3 with wind- and solar-generated power growing from almost nothing at the turn of the century to 12.1% of global generation in 2022.4

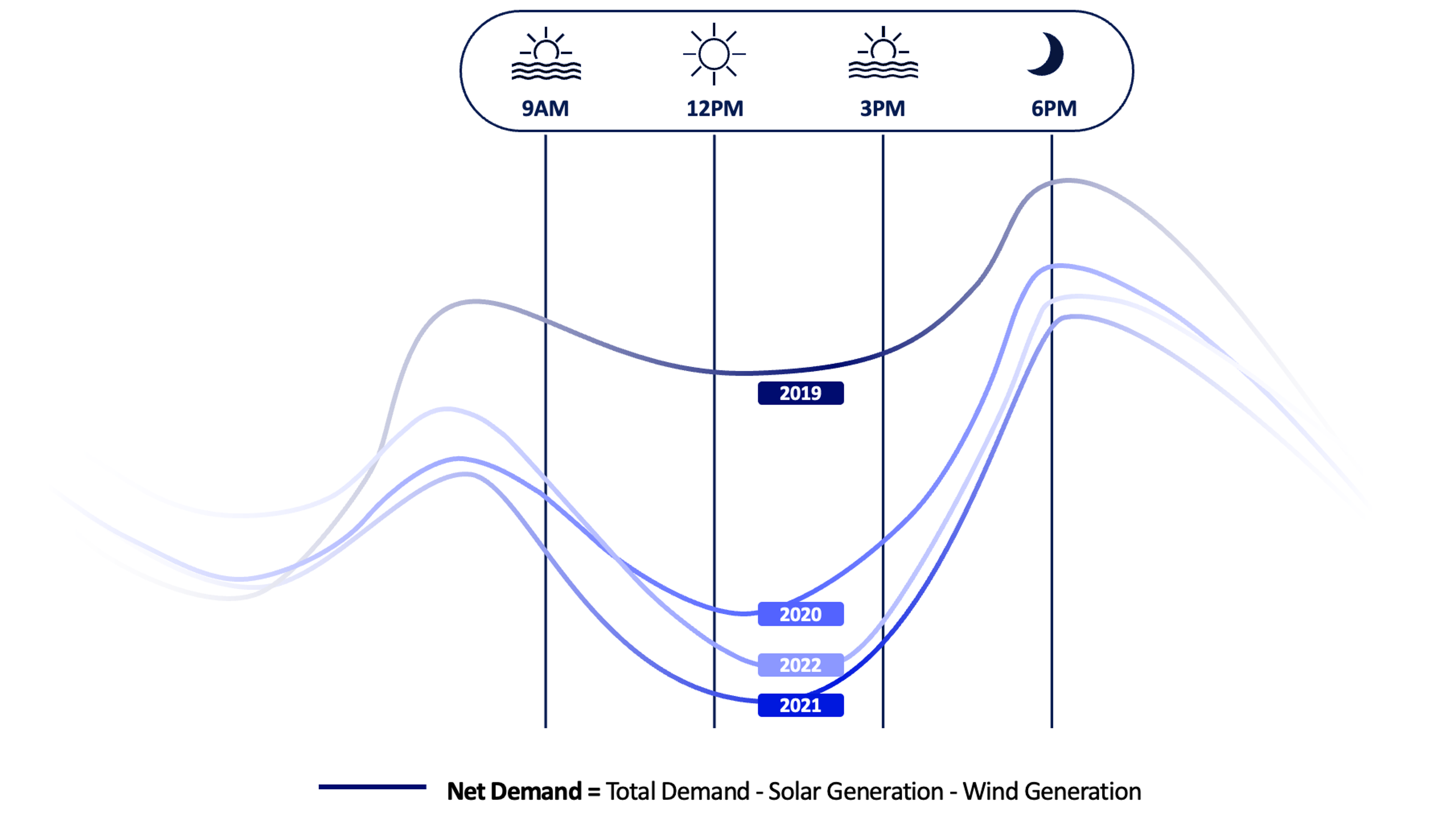

To effectively use a greater share of solar,local grids need to address the intermittency problem caused by early evening peaks in energy demand just as the sun sets and solar generation falls. The so-called “duck curve,” shown in figure 1 on the following page, highlights the issue and the challenge of managing net demand. Battery energy storage solutions (BESS) currently offer one of the most viable mitigants to the intermittency problem by:

- Enabling consistent use of renewable energy by charging when production is high (and demand is low) and discharging when these conditions reverse.

- Ensuring grid stability by providing so-called ancillary services that keep the grid continuously balanced. Importantly, technologies, like pumped hydro or molten salt (thermal energy storage), cannot provide these types of services as their discharge time at rated power is currently too slow. 5

- Reducing the need for “peaker plants” that are turned on when the base load generation cannot meet demand. Using nuclear, waste-to-energy, or biomass temporarily is not economically viable and, therefore, gas-powered “peaker plants” are commonly used even though this decreases the share of renewables.

Put simply, based on currently available technologies, BESS are a vital component in making the energy transition work. Batteries are naturally just one piece of the renewables puzzle, which includes solutions like Reverion’s solid oxide fuel cell technology that can both convert biogas to electricity and, if there is excess power in the grid, use that power to produce green hydrogen or methane through electrolysis.

To quantify the opportunity, the International Energy Agency (IEA) estimates that the global installed grid-scale (i.e. front-of-meter) battery storage capacity will have to grow from 28 GW in 2022 to 967 GW by 20306 to achieve true “net zero.” To put that into perspective, the 1.21 GW needed to send Marty McFly "Back to the Future” would power >10 million light bulbs (or one flux capacitator in a time-traveling DeLorean).

Managing the resulting integrated energy network will be a complex challenge, giving rise to a host of software, hardware and hybrid solutions that will need to operate seamlessly. Activant believes this is a strong investment opportunity.

A market primed for growth

Energy storage is not a new phenomenon. Simple copper-zinc batteries were developed in 1800, and rechargeable lead-acid batteries were powering railway carriage lights by 1859. These same batteries powered the world’s first electric car in 1888! Lithium-ion batteries emerged in the 1970s and have been the dominant commercial option since 1991.7

As energy density increased (5x since the 1980s),8 BESS prices (per kWh) decreased significantly. The National Renewable Energy Laboratory estimates the capital cost of a 4-hour lithium-ion battery system will drop from ~$490/kWh in 2022 to anywhere between $220/kWh and $400/kWh by 2035 (conservative scenario). 9

This combination of increasing battery efficiency and declining costs is unlocking explosive growth. BloombergNEF forecasts the energy storage market will grow 15x from 2021-2040, with batteries dominating this sector because of their affordability, established supply chain, and proven track record.10 Bloomberg estimates that this massive increase will require more than $262 billion in investment.

The grid is undergoing its biggest transformation since its inception, moving from a top-down, command-and-control architecture to a federated, distributed, dynamic system. This will necessitate new hardware, such as storage, as well as the software infrastructure to ensure that each node in the network is responding optimally in relation to the whole. The speed and success of this transformation will determine the progress we make on decarbonization."

Karl Bach, Co-founder & CEO, Axle Energy

We see no end to this rapid growth and believe that the market will be propelled for years to come by the following:

- Broad-based commitment to net zero goals and an energy transition. Net zero targets touch 89% of the world’s population, 92% of global GDP (PPP), and 88% of global emissions.11 Two-thirds of the Fortune 500 now have a climate commitment,12 and more than 6,000 companies have committed to science-based emissions targets.13

- Regulatory and financial incentives. Policymakers are in favor of battery storage adoption and there are widespread government-sponsored financial incentives in the form of tax rebates, grant supports and subsidized financing. This support, both direct and indirect, will continue to drive growth in this sector. Specific noteworthy regulation includes:

- Federal Energy Regulatory Commission (FERC) Order 841 and Order 2222. Order 841, issued in 2018, enables the participation of energy storage resources in wholesale markets and is intended to foster competition with traditional energy resources. Order 2222, issued in 2020, allows aggregators of distributed energy resources (DERs) to compete in regional wholesale energy markets. Most individual resources would be too small to qualify as market participants unless grouped together in aggregate.

- EU Green Deal Industrial Plan. To meet Europe’s climate targets the Commission launched a plan in December 2019 to invest €1 trillion in public and private funds over the next decade.14 The plan specifically highlights batteries and battery storage as key technologies in this transition.

- US Inflation Reduction Act (IRA). Passed in August 2022, this includes an investment tax credit for stand-alone storage. The International Energy Agency (IEA) estimates that the IRA could reduce capital costs for battery storage by almost 15%, providing a huge boost to this sector in the U.S.15

- Grid modernization. Many countries are embarking on grid modernization programs to improve efficacy and address issues caused by aging infrastructure. This often entails deploying smart technologies within established grids and integrating DERs. As a result, these grids need more flexibility to adapt and respond to fluctuations in capacity and renewables generation, which is provided by using BESS.

- Increased demand for electric vehicles (EVs). Investment in EVs has more than doubled since 2021, reaching $130 billion in 20234 and creating ever-increasing demand for charging power. EV batteries can no longer power cars once they fall to 80% capacity, but they can still be used to store and dispatch power to the grid. This has triggered interest in the second-life battery storage market as players recycle vehicle batteries to develop a sustainable circular economy. It also propels the cost decrease of lithium-ion batteries as the sheer volume of batteries means that cost economies of scale materialize quicker.

The battery energy storage value chain

By 2030 as many as 6 million EVs will be retired annually. Despite having ~80% capacity of new lithium batteries at high discharge capabilities, 95% of retired batteries are not handled sustainably. Data on different form factors, chemistries and states of health can be used to develop optimized battery management systems that extend battery life by decades. We're already seeing hundreds of MWh of EV battery supply today, with a line of sight to reach hundreds of GWh of supply over the next five years."

Edward Chiang, Co-Founder & CEO, Moment Energy

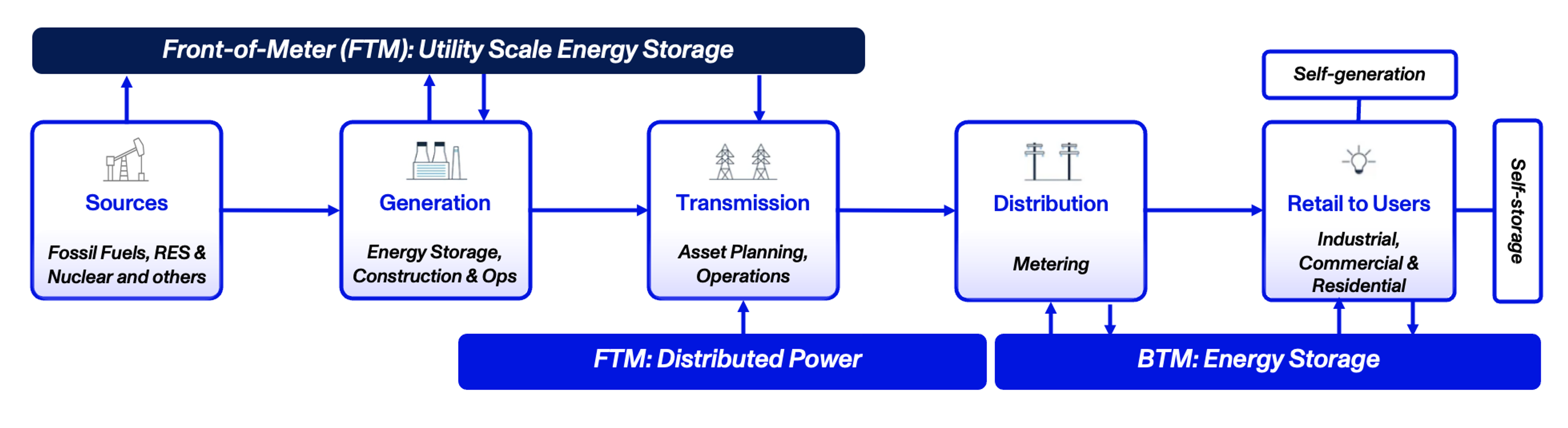

The energy storage ecosystem can be mapped across the value chain of the electricity system. This segmentation includes energy sources, power generation, transmission lines, distribution systems, and the end user. Those services and solutions provided by utilities are often described as “front-of-meter” systems (FTM), while the distribution and consumption of power by end-users is said to fall “behind-the-meter” (BTM).

Research

We believe that BESS will increasingly penetrate grids, with both commercial and consumer applications. While we understand and acknowledge that it is often necessary to consider hardware to tap into the largest profit pools along the value chain, we at Activant prefer software-enabled, proprietary business models and lack the deep technical expertise required to offer informed perspectives on the many hardware solutions emerging. We are also wary of risks associated with battery hardware, such as:

- Supply chain/3rd party risk where delays in delivery of hardware components can significantly impact assembly and installation.

- Geopolitical risk arising from dependence on lithium supply from China [34%], Argentina [16%] and Chile [11%].17

- Technology risk where major changes in battery efficiency or new battery technologies will accelerate asset depreciation.

While there are many attractive opportunities to invest in already-commercialized hardware with proven positive unit economics in mature markets, such opportunities are likely more interesting to infrastructure private equity rather than growth investors like Activant. Our analysis, therefore, does not explore the hardware-related opportunities in any detail.

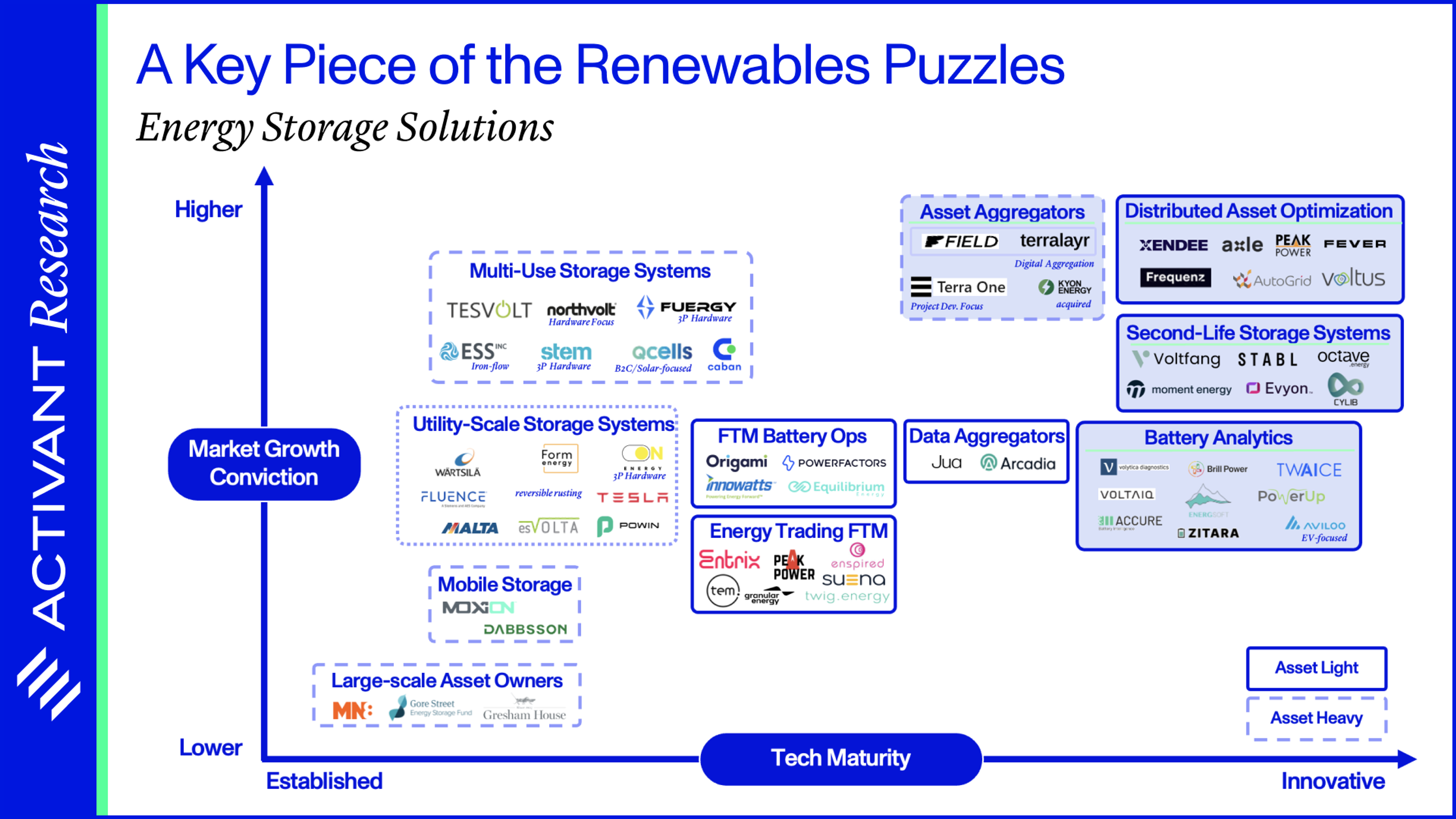

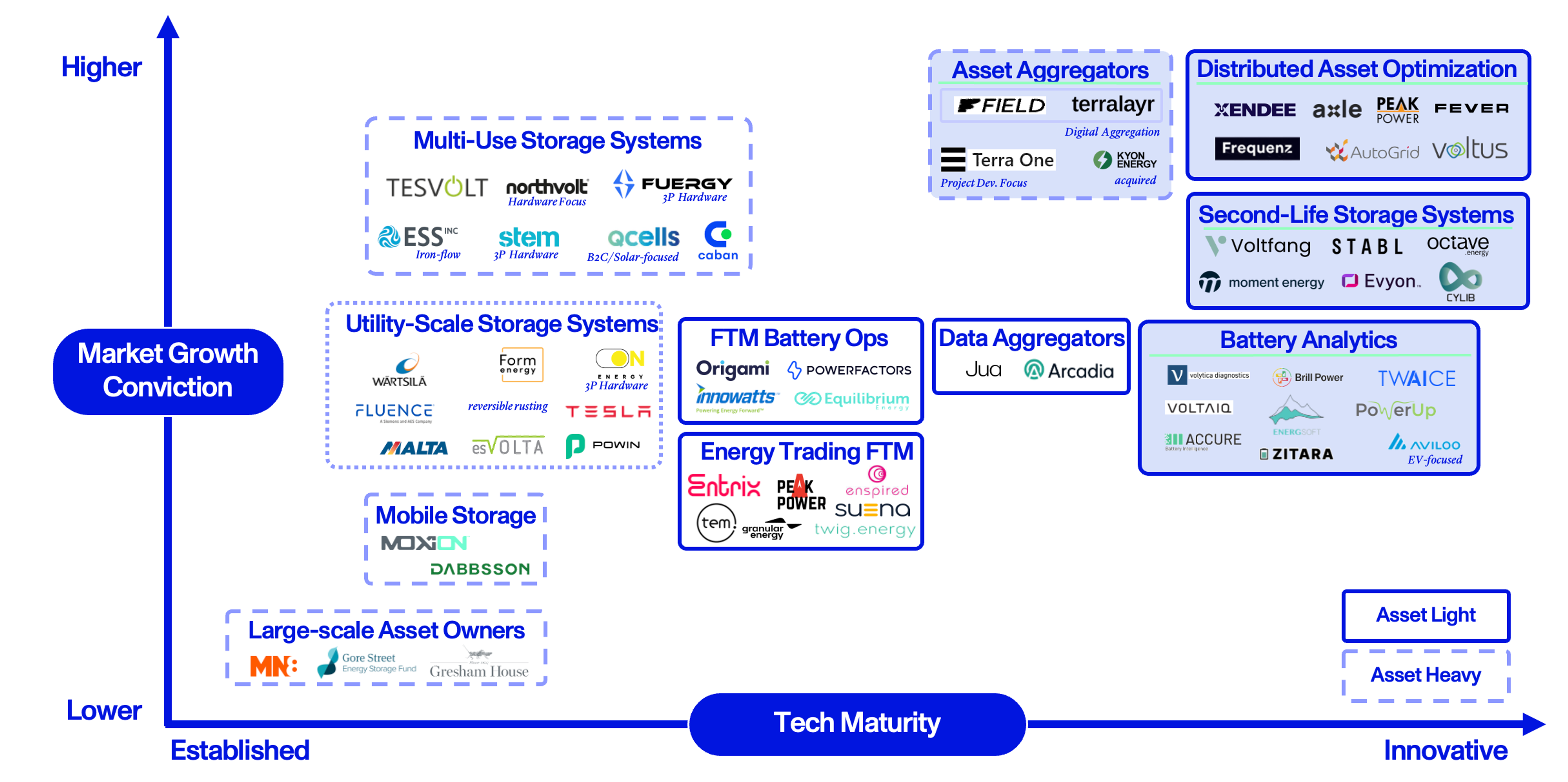

Thesis Map

Energy Storage Solutions

The Activant Thesis Map provided below considers the maturity of the technologies and our conviction in the associated market growth.

Distributed Asset Optimization involves managing a network of DERs such as solar panels, wind turbines, batteries, or EVs to maximize efficiency and reliability. Using predictive algorithms and centralized workflow software, it allows for the integrated management of various energy sources and storage technologies. We arevery excited about this space and consider it vital in transitioning towards a more decentralized, efficient, and environmentally friendly energy infrastructure.

Second-Life Storage Systems offer viable uses for the millions of EV batteries that are expected to have reached the end of their useful lives powering vehicles, but still retain the ability to effectively store and discharge energy. There are some uncertainties for second-life batteries, such as the increasing complexity of refurbishing due to ever-more complex EV battery designs or the ongoing decrease in the cost ofnew batteries. Nevertheless, we believe in the potential of this market for BESS, and we’re not alone. McKinsey, for instance, estimates that the second-lifebattery supply for stationary applications could exceed 200 GWh per year by 2030 (potentially even more than the utility-scale GWh’s in demand by then).18

There's a 10-fold difference between the projected battery capacity in electric cars and the capacity required to stabilize the grid. It implies that we just need to repurpose 10% of electric car batteries to maintain grid stability. Overall performance is limited by the weakest cell in the high-voltage battery packs, and it is therefore crucial to carefully assess and pre-test the batteries or utilize technological methods to mitigate the operational risks.

Dr. Arthur Singer, Co-Founder & CTO, STABL

Asset Aggregators combine and manage multiple BESS assets. Given Activant’s preference for software solutions, weare primarily interested in players that use software to monetize them as a “unified asset” rather than trading each asset individually (which is the status quo in the market). Asset aggregators participate in wholesale energy trading and ancillary services such as frequency response and can offer proprietary flexibility products such as imbalance load hedges. In an ideal world, they will have customers with opposing load profiles and generate “alpha” from the offsetting trade. Consider, for example, an industrial manufacturer wanting to buy power between the hours of 12-2pm (effectively discharging one of the batteries) and a solar park wanting to sell power (charging one of the batteries) at the same time. Because the two customers’ load profiles cancel each other out, the asset aggregator does not have to move any physical electrons while charging both parties for the provided service. We think this is an exciting business model but note that ithas yet to be commercialized profitably at scale.

Battery Analytics Software aims to monitor, assess, and predict a battery’s health, safety, and maintenance. It ensures early failure detection and enhanced safety measures, resulting in improved lifespan and reduced costs. BAS can come as a standalone solution or as part of a battery package. Activant estimates that the total addressable market (TAM) for EV and stationary storage battery analytics is approximately $8 billion, growing at a CAGR of 40% for the next 3-5 years. 19

Players we're excited about

Energy Storage Solutions is a relatively new market, and we expect there to be a tremendous amount of change in the coming months as the push for renewable energy and achievement of the 2030 “net zero” targets increases. It is always difficult to predict winners, and this is even more difficult in fast-changing environments. While it is still early days, we like the solutions offered by:

- Fever: A Stockholm-based startup that aggregates distributed energy storage assets and optimizes power production and consumption. Utility companies, EV manufacturers, data centers and power producers use Fever’s platform to operate their own virtual power plants, by integrating multiple types of energy assets.

- Axle: A startup providing solutions that enable grid flexibility. This company connects EVs, batteries, heat pumps and solar panels to electricity markets, aiming to remove fossil fuels from the grid.

- Frequenz: A platform that provides enterprise developers with innovative tools to orchestrate DERs efficiently. Through their use of machine learning models, Frequenz can harmonize local energy assets with markets in real-time.

- STABL: This second-life storage player is an experienced provider of battery storage solutions in the DACH region, enabling companies to embark on a greener future. STABL’s commercial battery storage systems emphasize reliability, safety and efficiency.

- Moment Energy: A Canada-based startup that operates in the second-life storage space. Their modular BESS has been built for commercial applications and has signed enterprise customers such as Mercedes and Nissan.

- Terralayr: A Zug-based company operating in the asset aggregator space. Terralayr is a co-developer, owner and operator of short-duration BESS. The company’s business model is based on aggregating both owned and 3rd party front-of-meter, utility-scale storage assets, which are in turn virtualized into a central, cloud-like system.

Conclusion

The BESS market is clearly in an explosive stage of development and growth, with tailwinds that will ensure that this continues for years to come. With the significant financial and societal value at stake and investments being made in the sector, this will be a highly competitive market with rapid innovation.

We would love to hear from you if our work resonates and, if you have a different perspective, we are always eager to learn. Please reach out if you operate in an adjacent space as we will continue to expand our insights in the broader energy market.

Endnotes

[1] Rupert Way, Matthew Ives, Penny Mealy and J. Doyne Farmer, Empirically grounded technology forecasts and the energy transition, September 2021

[2] Renewable Energy World, Energy transition investments hit record $1.8 trillion in 2023, 2024

[3] NatBullard, Decarbonization: Stocks and flows, abundance and scarcity, net zero, 2024

[4] Ibid

[5] Fraunhofer ISE, Energy Storage in Germany, 2020

[6] International Energy Agency, Global installed grid-scale battery storage capacity in the Net Zero Scenario, 2023

[7] Power and Beyond, Battery energy storage systems: Past, present, and future, 2020

[8] NatBullard, Decarbonization: Stocks and flows, abundance and scarcity, net zero, 2024

[9] National Renewable Energy Laboratory, Cost Projections for Utility-Scale Battery Storage: 2023 Update, 2023

[10] BloombergNEF, Global Energy Storage Market to Grow 15-fold by 2030, 2022

[11] NatBullard, Decarbonization: Stocks and flows, abundance and scarcity, net zero, 2024

[12] Climate Impact Partners, Markers of Real Climate Action in the Fortune Global 500, 2023

[13] Bain and Company, Operations and Supply Chain Decarbonization: Lower Emissions, Higher Performance, 2023

[14] European Commission, Finance and the Green Deal

[15] IEA, World Energy Investment Report, 2023

[16] Ibid

[17] European Commission, Battery Supply Chain Challenges, 2023

[18] McKinsey, Second-life EV batteries, 2019

[19] Activant Analysis