Topic

Supply Chain & Logistics

Published

April 2024

Reading time

11 minutes

Pain at the Pump

Opportunities to innovate with fuel cards

Authors

Julius Stener

Investment Team

Pain at the Pump

Download ArticleResearch

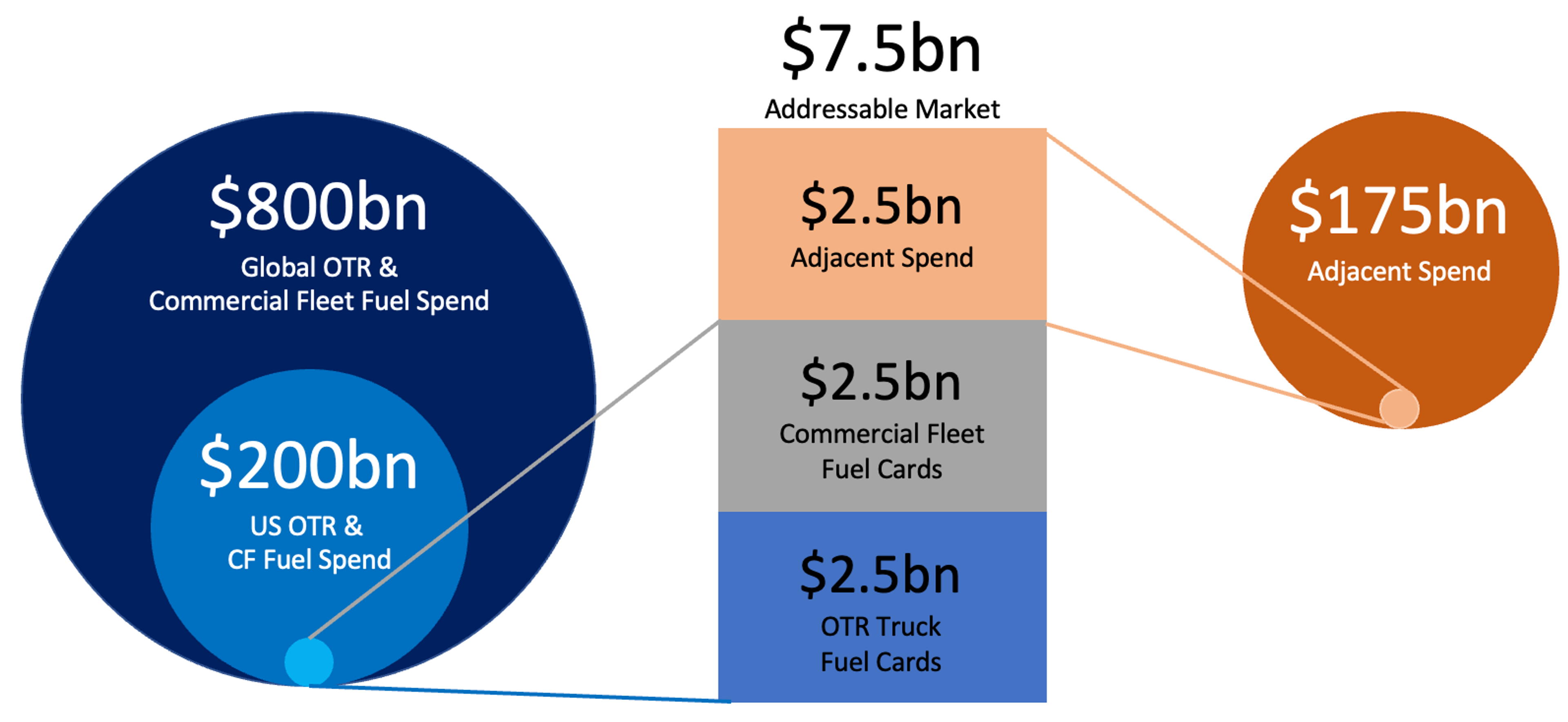

Trucking is a vital cog in the U.S. economy and a way of life for more than a million over-the-road (OTR) truckers and three million commercial fleet drivers.1 Together these groups spend a combined $200+ billion on diesel and gasoline every year, and another $150+ billion annually on tolls, maintenance, lumpers, taxes, and a host of ancillary charges.2 For the privilege and convenience of using a fuel card, the issuers take a cut of 1%-2%. Sound like a good deal? Yes, for the card issuer, but not for the trucker.

Once the rubber hits the road, truckers quickly find that the great “in-network” deal they were sold on doesn’t hold up to the pump price across the street. They’re told about extensive fuel card networks, then have to drive an extra half hour to find an in-network station, paying the fuel cost of going out of their way as well as the lost-time cost. Finally at the pump, drivers find themselves waiting in long lines, wasting even more time while the clock continues to tick.

That’s just the on-the-road experience. Add in a host of account maintenance, transaction, and card replacement charges, and all-in fees are more than likely 50% higher than what truck drivers thought they signed up for.3 And because Fleetcor and Wex – the two dominant fuel card companies – control nearly 70% of the $375 billion gross spending OTR card market, they have little incentive to innovate or improve their technologies and product offering. The closed-loop systems they operate present a litany of unforeseen expenses.

However, there are some innovative start-ups targeting this $7.5 billion market that is ripe for disruption.4

Research

TAM Analysis

Activant estimate based on bottom-up analysis

The Convenience and Curse of Fuel Cards

Fuel cards emerged in the 1980s to solve the cash flow and tracking challenges that truckers and trucking companies endured. Early leaders like Comdata and EFS were ultimately surpassed by Wex and Fleetcor, which began acquiring and aggregating more than 150 companies to largely consolidate the market. Today, 99% of all truck stops offer payments through either Fleetcor or Wex, and most fuel card agreements in OTR flow through their cards.

Drivers using a plastic charge card issued by Fleetcor or Wex must go through a series of prompts while inputting multiple codes, allowing the card to attribute the transaction to the driver and the specific trip. Importantly, after the transaction is completed, the fleet pays Fleetcor and Wex (i.e. the card issuer) for the fuel, and then Fleetcor and Wex pay the truck stop, acting as the merchant acquirer. This creates a closed-loop system, in which Fleetcor and Wex act as the card issuer, the transaction processor and the merchant acquirer.

For the truck driver, this has a few notable benefits. First, because the drivers pay Fleetcor and Wex directly for the cost of the fuel, and the card-issuers then pay the truck stops, the card issuers can afford to give drivers cash prices while providing the flexibility and convenience of a plastic charge card. That represents 2-3% in savings per fill-up. When the average fill-up for OTR trucks is 120 gallons, or about $500 to $600, the savings can be $10-$20 per fill at today’s prices.5 Secondly, because Fleetcor and Wex capture both sides of the transaction, they have near-perfect data visibility, which can help to combat fraud. Closed-loop systems can see what type of fuel a driver purchased, how much they paid, and what trip they’re on. If the driver happens to be in Cedar Rapids, Iowa, and a fraudster has used the same card details to buy $1,000 of fuel near Cedar Springs, Texas, they can easily dispute that charge using transaction metadata contained within the system. These are proven positives of closed-loop systems.

Recent innovations in credit card technologies and metadata tracking have, however, made it easier and cheaper to automate expense tracking and fraud protection, making one of the major benefits of fuel cards redundant. Closed-loop systems also have significant downsides for truck-drivers and for the truck stops in their networks.

Pain Points to Address

To understand the drag fuel cards place on the industry, it’s helpful to look at the end-to-end process and highlight the many inefficiencies and unnecessary costs of filling up a vehicle.

1The Cost of Going “In-Network”

Before a driver can fill their vehicle, they need to use the Fleetcor or Wex app to figure out which truck stops are in their fuel card network. Conversations with industry leaders suggest that drivers often need to travel up to 30 minutes off their path to fill up at an “in-network” fuel station. This costs them twice: first, in the extra gallons spent driving to the truck stop and, secondly, in the time eaten out of their 11-hour daily limit.

2“In-Network” Prices

Truckers often find that the price posted at a “Big 3” stop (Love’s, TA, Pilot Flying J) is meaningfully higher than at small, regional chains. For large fleets, which negotiate directly with the truck stops and operate on a cost-plus model, this isn’t really an issue. But for the smaller fleets and owner-operators, who get price-minus costing, this means a higher “discounted” price for in-network fuel than they could get across the street at a regional chain.

3Lost Earnings at the Pump

Besides potential waiting time at the truck stop island, the average driver takes between five and 15 minutes to enter the long list of numbers and selections required to identify their trip: mobile app codes, reward card details, unit numbers, trip numbers, fuel types, DEF selections, and more. And while the actual pumping of fuel takes less than four minutes, if the driver gets any number wrong, they will have to restart the whole process.

All of this time is on the clock, adding to the driver’s 11-hour maximum behind the wheel. When drivers are paid by the mile, this translates directly to lost earnings.

4Hidden Fees

Away from the pump, a driver might be hit with a late fee, a card recharge fee, a toll fee or even an unused money code fee. On average, we found that smaller carriers and owner-operators pay up to 50% more in fees than they expected. In any given month, this can add up to thousands away from a small carrier’s bottom line.

5Fraud Protection

Card theft or skimming is always a risk. Fraudulent charges are common and drivers reporting unusual transactions may have their cards frozen for up to 60 days as Fleetcor and Wex investigate before sending a new card, leaving the driver back at square one using cash. Also, because Fleetcor and Wex are struggling to push chip cards, most drivers are stuck with old technology magstripe cards, years after their personal credit cards got the more secure chip.

Many of these pain points are a feature — not a bug — endemic to the current fuel card duopoly. In addressing these challenges, Activant research highlights the opportunity for open-loop alternatives.

Emerging Solutions

New solutions are emerging to address the pain points drivers face.

1Open-Loop Data

Over the past few years, both Visa and Mastercard have rolled out better data requirements for fuel merchants wanting to accept their cards. Now, 98% of truck stops offer Level 3 data to Visa and Mastercard, meaning the price per gallon, the gallons pumped, the DEF and refrigerant selections can all be logged in one open-loop transaction.6 The result is that the long-time expense management benefits of having a closed-loop network are disappearing, as open-loop cards can offer the same visibility without the network lock-in.

2ELD Integration

Electronic Logging Devices (ELDs) come standard in all new OTR trucks (by law) and in most commercial vehicles used in fleets. These devices can be connected to a cellular signal and can provide real-time data about the GPS location, mileage, fuel level and MPG of the vehicle remotely. The natural next step is to integrate this data into the fuel payment workflow, which can immediately eliminate buddy fraud by allowing only the necessary gallons and stop theft-driven fraud by verifying where the truck is filling up.

3Modern Fueling Workflow

Newer fuel cards can provide a modern workflow that eliminates the long codes a driver currently punches into the keypad when they fill. The industry has already seen some early versions of this, with apps that let drivers make selections with a tablet instead of the keypad, but this has further potential. Imagine a world in which your integrated ELD system already knows how much fuel a truck needs, what load it’s carrying, and whether the driver needs to fill up DEF. This future is being built today by some of the players mentioned below.

4Cardless Systems

As data visibility increases, Activant anticipates a cardless world in which RFID tagging and GPS geo-locating identifies the vehicle at the pump, knows the number of gallons to pump from the ELD system, and accepts ACH direct-debit (cash-priced) payments from a known account without the need to swipe a card. To realize this vision, core infrastructure at truck stops and gas stations will need to be reworked to accommodate the technology, but it will ultimately have to happen.

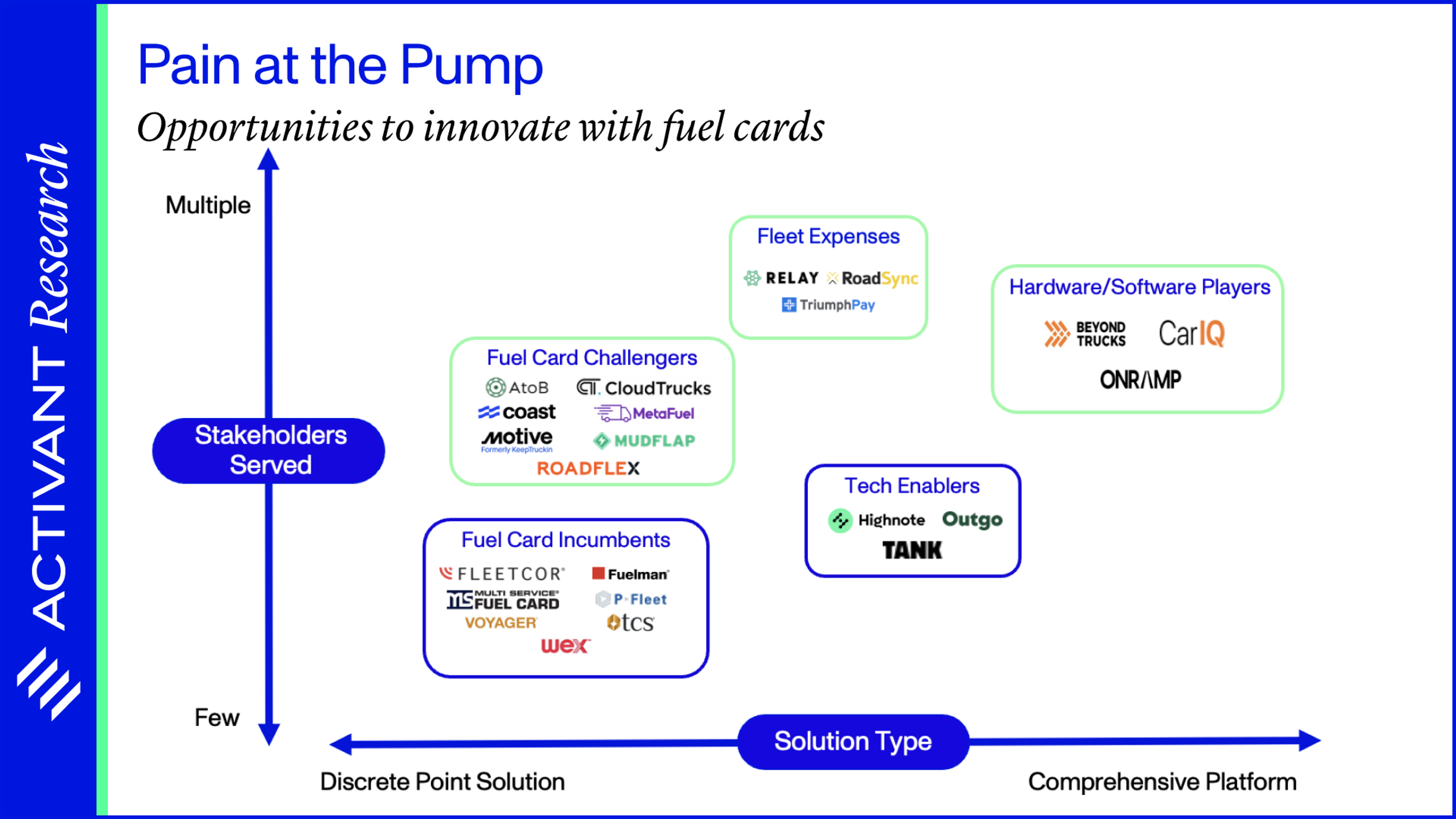

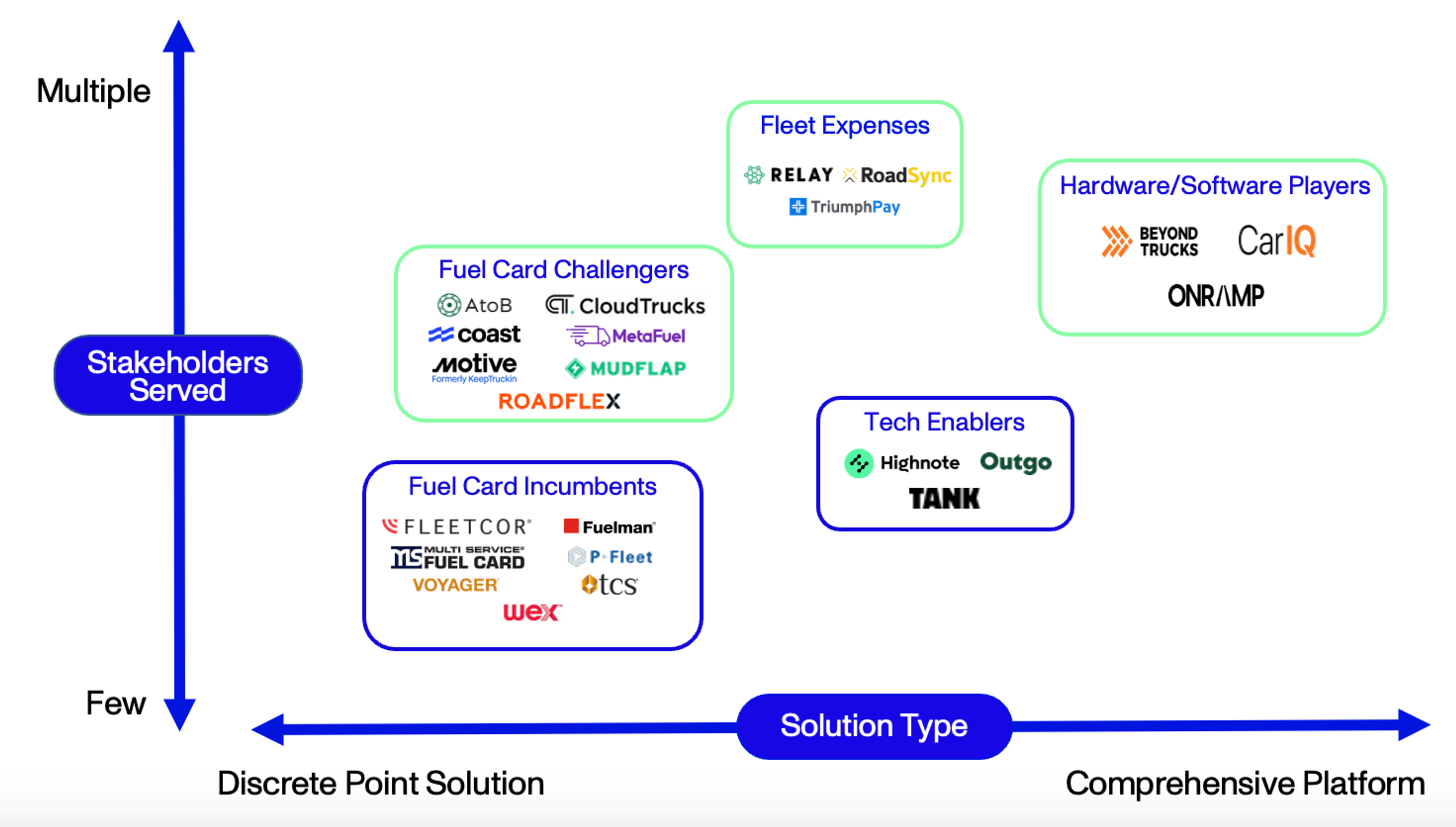

Activant Market Map

When we studied the market, we chose to segment the players based on the stakeholders served and where on the spectrum from a point solution to a full platform offer the product fit.

Market Map

Trucking Payments

Three categories of start-ups emerged, each tackling the pain points in unique ways.

Emerging Winners

Fuel card challengers:

These are open-loop cards, targeting owner-operators and small-to-midsize fleets (~1-100 vehicles). They offer universal acceptance, modest discounts, lower fees, and better product user interface and flexibility. We believe they offer a differentiated value proposition, both from a product and a cost perspective, and they have seen solid traction (to the tune of tens of thousands of cardholders). It’s worth noting that most of these challengers are powered by Visa, which is committed to growing their fuel card payments network, to catch not just Fleetcor and Wex, but also to compete with similar efforts from Mastercard.

Companies in this first wave include AtoB, which is mainly focused on mid-market OTR carriers, Coast, which targets non-trucking commercial fleets, and Roadflex, which aims to serve all fleet types.

Logistics Tech Providers

Another category of challengers are logistics tech companies that are starting to offer fuel cards. Usually, these companies already have an existing adjacent solution targeted at carriers and are looking to expand their value proposition.

Emerging winners in this segment include companies like Relay and Roadsync, which started out handling lumper, warehouse, repair and accessorial payments, all of which are much simpler than fuel. Relay just launched its own fuel card and Roadsync could follow suit. Other companies, such as CloudTrucks and TrueNorth, which offer a broader trucker workflow solution (often including load boards), as well as discount fuel networks such as Mudflap, are also offering fuel cards. Brokerages like Uber Freight and ExoFreight have launched fuel solutions with existing partners like AtoB. Even Motive, one of the ELD leaders, has started offering their own cards. New fintech issuer processors such as Highnote have led the way on powering logistics payment solutions.

Platform Players

There are challengers looking to fundamentally reinvent the experience, offering a platform solution comprised of various combinations of hardware and software. OnRamp has built its own fuel payment network and is actively signing on carriers and truck stops in a very cost-effective manner. Similarly, CarIQ links commercial and personal cars to its own digital payment method, allowing drivers to pay for fuel without the need for a card.

Conclusion

If you’re an owner-operator or part of a fleet, you should seriously consider switching your card. You’re paying too much in hidden fees, higher prices, lost time, extra miles, and unnecessary fraud exposure.

We’re excited about the future of fuel cards and what it means for the industry. There hasn’t been enough innovation in the last 30 years, but things are changing – one card at a time – and we have no doubt that open-loop winners will emerge in the near-term to challenge the entrenched (and very profitable) duopoly. If you're building in this space, please reach out!

Endnotes

[1] Truckstop, Over-The-Road [OTR] Trucking: What It Is & Job Requirements, 2023

[2] Activant Analysis - based on Tegus Expert Calls

[3] Ibid

[4] ibid.

[5] Freightwaves, How many gallons does it take to fill up a big rig?, 2020

[6] P Fleet, A Comprehensive Guide to the Best Fuel Card Programs, 2024

The information contained herein is provided for informational purposes only and should not be construed as investment advice. The opinions, views, forecasts, performance, estimates, etc. expressed herein are subject to change without notice. Certain statements contained herein reflect the subjective views and opinions of Activant. Past performance is not indicative of future results. No representation is made that any investment will or is likely to achieve its objectives. All investments involve risk and may result in loss. This newsletter does not constitute an offer to sell or a solicitation of an offer to buy any security. Activant does not provide tax or legal advice and you are encouraged to seek the advice of a tax or legal professional regarding your individual circumstances.