Topic

Supply Chain & Logistics

Published

November 2025

Reading time

9 minutes

Ideology vs. Infrastructure Reality

The Fleet Electrification Experiment Playing Out in Real Time

Ideology vs. Infrastructure Reality

Download ArticleResearch

Fleet electrification was supposed to be inevitable. Governments across the world set aggressive targets to decarbonize freight, starting with trucks. California’s Advanced Clean Fleets rule mandates that every new truck sold after 2036 be zero-emission.1 The European Union went even further, 100% CO₂ reduction for new vans by 2035 and 90% for heavy-duty trucks by 2040.2,3

Both efforts were built on the logic that climate urgency requires intervention because markets move too slowly. Transportation makes up 29% of U.S. emissions, and freight trucks are the fastest-growing slice.4 In the EU, trucks and buses make up just 2% of total vehicles on the roads, yet they account for 25% of all transport-related emissions.5 But where Europe doubled down on state-led mandates, the U.S. has moved back toward a market-led experiment.

President Trump’s new administration has already revoked California’s waiver authority, ending its ability to enforce stricter standards than the federal baseline, and frozen unspent EV infrastructure funds. Environmental Protection Agency (EPA) rules requiring roughly 25% of new truck sales to be electric by 2032 are being “reconsidered”.6

At first glance, this is a simple political reversal, but the reality is that electrification was never just a regulatory problem - it’s an infrastructure problem. No matter who’s in office, that can’t be legislated away. To achieve their electrification goals, governments should focus more on reducing the actual barriers to fleet electrification, such as infrastructure challenges and high upfront costs. Without this reprioritization, large scale fleet electrification will remain out of reach for most countries.

But it’s not all doom and gloom. Developments in renewable energy infrastructure have made it not only cheaper to deploy than fossil fuel alternatives but also faster to scale. When paired with battery energy storage systems (BESS), renewables can smooth the “duck curve” - stabilizing supply and enabling continuous, cost-efficient power delivery. Applied to battery electric vehicle (BEV) fleets, especially in last-mile logistics where range is no longer a constraint, this integration could radically reshape delivery economics. We see a significant opportunity for investors willing to underwrite the infrastructure deals to enable broad-based fleet electrification.

Europe’s Mandates vs. America’s Markets

Europe’s approach is pure industrial policy; set the direction, force the market, and backfill the costs with subsidies and carbon penalties. The EU’s aggressive mandates work because the bloc treats decarbonization as a collective obligation, even if it means higher short-term costs or uneven national readiness. The U.S., by contrast, is letting markets decide. The argument is that if electrification makes operational sense - on cost, uptime, and total cost of ownership - fleets will transition voluntarily.

So far, Europe’s model has delivered clearer direction but limited scale. Five out of seven EU truck makers are largely on track to meet the 2025 CO₂ target of a 15% reduction from 2019 levels, and the bloc’s new Clean Transport Corridor initiative is knitting together cross-border charging infrastructure.7 Yet, in the first half of 2025, just 3.6% of new truck sales in Europe were electric, an order of magnitude below the 38% target set for 2030.8

In the U.S., adoption is more fragmented. Federal incentives under the Inflation Reduction Act pushed battery trucks closer to cost parity in several classes. The law allowed commercial EVs to receive a tax credit for up to 30% of the sales price, up to $7,500 for vehicles under 14,000 pounds and up to $40,000 for all other vehicles.9 By 2024, U.S. electric truck sales surpassed 1,700 units, exceeding the total sold between 2015 and 2022.10 More than 15,000 medium- and heavy-duty EVs were deployed in 2024.11 With the passing of the One Big Beautiful Bill Act (OBBBA) in July 2025, many of the incentives of the Inflation Reduction Act were curtailed. Without stable regulation, national uptake remains inconsistent.

The stakes of these approaches are not just climate outcomes, but cross-border trade competitiveness, innovation pathways and political durability. The elephant in the room is that both strategies are being met with the same set of constraints, the physics of energy, mass, and infrastructure. Without solving for these, fleet electrification will never fully evolve.

The Bottlenecks No One Wants To Talk About

Full fleet electrification remains a heavy lift, constrained by capital costs, inadequate infrastructure, and change-management hurdles that are slowing down fleet electrification.

1. Inadequate charging infrastructure - The availability of public charging infrastructure is still developing in many regions, making long-distance travel and convenient charging a challenge in some areas. In Europe, for example, McKinsey estimates that, by 2030, more than 300,000 public and private charge points will be required across the continent for medium- and heavy-duty trucks, up from roughly 10,000 in 2024.12 The progress towards achieving these goals is bleak. Building out robust networks of chargers will require approximately €40 billion of capital investment until 2040. Of this, €7 billion of investments are needed until 2030, less than a quarter of which has been publicly committed today.13 Analysis by Atlas Public Policy suggests that the U.S. will need to commit between $100 and $166 billion in charging infrastructure investments this decade to support an acceleration in electric truck adoption.14

2. Grid Capacity - Charging electric vehicles requires large amounts of power. To charge more than one heavy-duty truck at a time, and get them all back on the road quickly, a charging station may need to pump out 20MW of power or more. This is the equivalent of powering 6,000 homes for a day.15 For Europe to create the required charging infrastructure to achieve its goals, it would consume 20 terawatt-hours (TWh) of electricity annually by 2030, roughly 0.5 percent of Europe’s total electricity demand.16 Gaining access to all this energy will often mean securing additional capacity on an already congested grid. Global annual investment in power transmission alone will need to more than double, from about $140 billion in 2023 to as high as $300 billion in the mid-2030s, if the world is to meet rising demand for power and emissions reduction targets.17

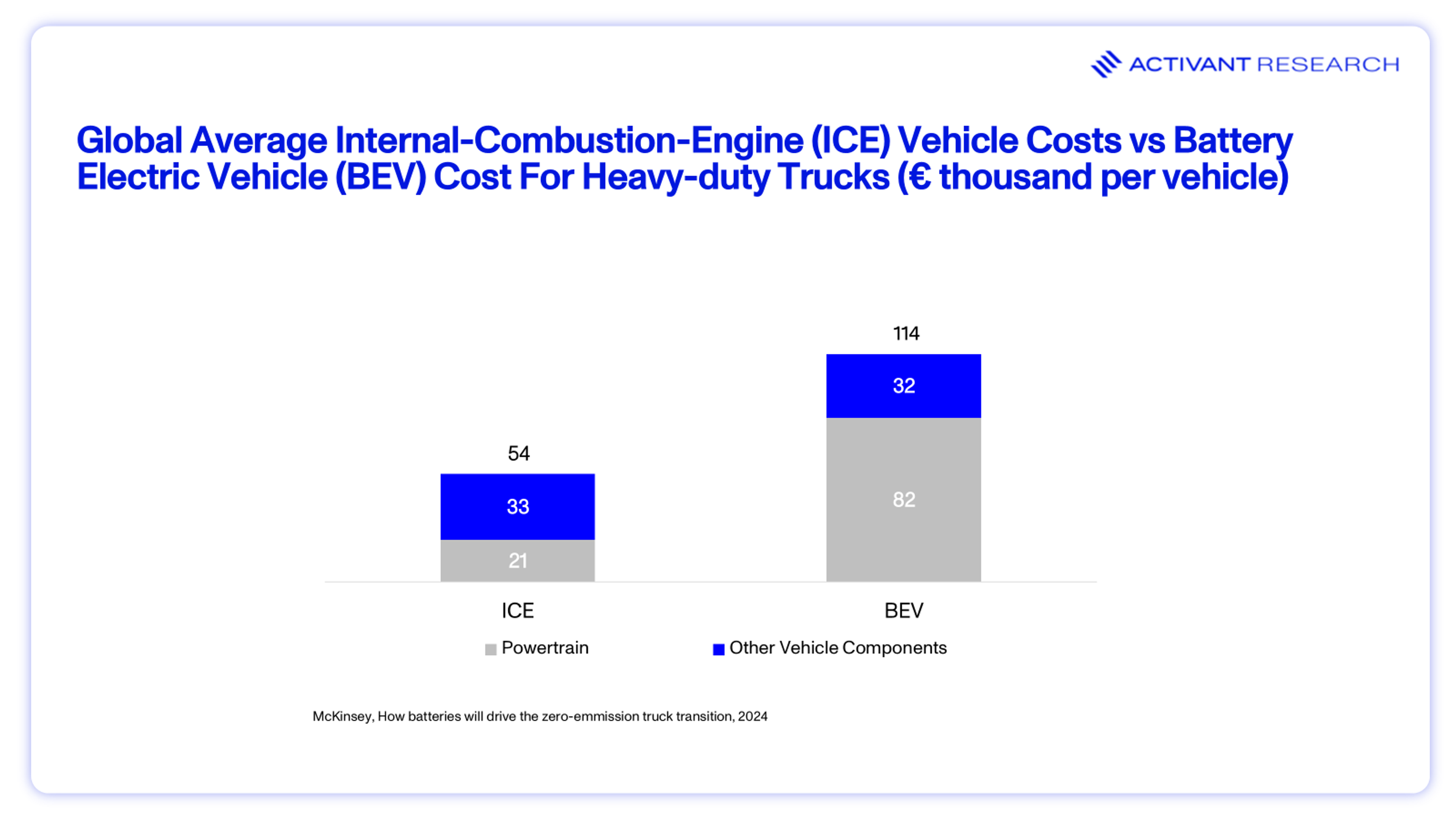

3. High upfront costs - For electric trucks to reach mass adoption, the total cost of owning an electric truck must be able to compete with the cost of owning a traditional diesel truck. In Europe, the cost of battery electric vehicle (BEV) heavy-duty trucks are more than two times that of Internal-combustion-engine (ICE) heavy-duty trucks.18 The main expense for a BEV truck is the battery, which accounts for 84% of powertrain costs.19 This price discrepancy is highlighted by the exhibit below.

Having said this, battery costs are continually coming down. From 2010, when the Nissan Leaf was first released, to 2023, battery pack costs fell by 87%.20 Should this trend continue, price parity may not be too far off. Chinese fleet operators now report that their electric freight trucks cost 10% to 26% less to operate than diesel models.21 Theres a real uptick in adoption, 22% of heavy-duty trucks in China are electric.22 BEVs in the U.S. and Europe are double the cost of those in China.23 Further complicating things, are the 25% tariffs on imported automobiles and auto parts that were introduced by the Trump administration in April 2025.24 This could jeopardize whether large-scale fleet electrification even happens in the U.S. at all, at least for the short-term.

4. Range anxiety and use case limitations -Uncertainty over range, reliability, and workload keeps many operators on the sidelines. Long-haul BEVs typically have a limited driving range and require recharging, which can take longer than refueling an ICE vehicle. For example, Volvo recently announced the launch of its battery-electric long-haul truck with a 600km range, compared with more than 1000km for a conventional diesel truck with standard fuel tanks.25 This has created the stigma that ICE vehicles may be better suited for long-haul functions until BEV technology is improved. Currently the strongest use case for BEVs is in last-mile delivery operations. That’s because most light commercial delivery vehicles, specifically those in Classes 2B and 3, rarely drive more than 200 miles in a single day. A vehicle with this range can cover between 72% and 97% of all the miles these trucks typically travel, meaning it can handle nearly every delivery route without needing mid-day charging or a larger, more expensive battery.26

The gap between current commitments and long-term requirements underscores the importance of continued investment and coordination. With accelerated rollout of infrastructure and enabling technologies, government efforts to electrify fleets can align more closely with policy ambitions and deliver faster, more efficient outcomes. Solving for the required infrastructure rollout will need participation from private investors. This is an attractive opportunity for private infrastructure funds, who see fleet electrification not just as profitable, but also as a compliant, reportable, and marketable ESG investment. It offers investors stable return potential while meeting sustainability goals.

Building the Next Freight Economy

Fleet electrification will happen, but not on the timelines that governments have set into motion.

Europe's mandate-driven model has created policy certainty while failing to deliver adoption at scale. This was the result of imposing strict adoption targets without first ensuring the supporting ecosystem, such as charging infrastructure, grid capacity, and cost-competitive EV availability, was ready. The U.S. is taking the opposite bet, letting markets lead, but that's producing fragmented progress without the infrastructure coordination needed to make electrification work beyond niche use cases. We are more bullish on fleet electrification in Europe, given that tariffs will likely dramatically slow BEV adoption in the U.S.

Despite today’s bottlenecks, there remains a compelling opportunity for investors in the next phase of fleet electrification. These private investors could be the long-term winners, as early investors can secure strong returns through long-term contracts, demand growth, and first-mover advantages in a market with high barriers to entry and government support. We believe securing financing for these large-scale infrastructure projects will define the next decade of climate investment.

Endnotes

[1] California Air Resources Board, California approves groundbreaking regulation that accelerates the deployment of heavy-duty ZEVs to protect public health, 2023

[2] Icct2O, An amendment to the CO2 standards for new passenger cars and vans in the European Union, 2025

[3] Icct2O, The revised CO2 standards for heavy-duty vehicles in the European Union, 2024

[4] MAWEB, US carbon emissions contribution explained, 2025

[5] The Driven, The Unequivocal path forward: EU adopts strong pollution laws for trucks and buses, 2024

[6] Forbes, Planned EPA Rules Could Make 67% of New US Cars Electric by 2032, 2023

[7] T&E, Nearly all truck makers on track to meet 2025 CO2 target – ICCT finds, 2025

[8] EVBoosters, From 3.6% to 38% in 2030, the industry blueprint to close Europe’s electric truck gap and not fall behind China, 2025

[9] Electrification Coalition, Inflation Reduction Act & EVS, 2025

[10] Iea, Trends in heavy-duty electric vehicles, 2024

[11] NREL, The Dawn of Electric Trucking Calls for High-Power Charging, 2025

[12] McKinsey, Building Europe’s electric-truck charging infrastructure, 2024

[13] McKinsey, How batteries will drive the zero-emission truck transition, 2024

[14] Atlas Public Policy, U.S. Medium -and Heavy-Duty Truck Electrification Infrastructure Assessment, 2021

[15] PKNERGY, What is Megawatt (MW) and how many homes can it power?, 2025

[16] McKinsey, How batteries will drive the zero-emission truck transition, 2024

[17] Financial Times, China poised to benefit as blackout risk rises from Iberia to Siberia, 2025

[18] Ibid.

[19] Ibid.

[20] The Driven, EV costs will keep dropping as battery prices fall, and price parity is not far away, 2025

[21] Rest of world, China won the electric car race. Up next: freight trucks, 2025

[22] Ibid.

[23] Automotive World, JATO: BEV prices fall in Europe and USA, but remain double the cost of those in China, 2025

[24] Promwad, Impact of New Tariffs on the US Electric Vehicle Market, 2025

[25] Business Day, Volvo set to launch electric truck with 600km range, 2025

[26] Kearney, Electric vehicles for last-mile delivery: start scaling now to capture early profits, 2022

The information contained herein is provided for informational purposes only and should not be construed as investment advice. The opinions, views, forecasts, performance, estimates, etc. expressed herein are subject to change without notice. Certain statements contained herein reflect the subjective views and opinions of Activant. Past performance is not indicative of future results. No representation is made that any investment will or is likely to achieve its objectives. All investments involve risk and may result in loss. This newsletter does not constitute an offer to sell or a solicitation of an offer to buy any security. Activant does not provide tax or legal advice and you are encouraged to seek the advice of a tax or legal professional regarding your individual circumstances.

This content may not under any circumstances be relied upon when making a decision to invest in any fund or investment, including those managed by Activant. Certain information contained in here has been obtained from third-party sources, including from portfolio companies of funds managed by Activant. While taken from sources believed to be reliable, Activant has not independently verified such information and makes no representations about the current or enduring accuracy of the information or its appropriateness for a given situation.

Activant does not solicit or make its services available to the public. The content provided herein may include information regarding past and/or present portfolio companies or investments managed by Activant, its affiliates and/or personnel. References to specific companies are for illustrative purposes only and do not necessarily reflect Activant investments. It should not be assumed that investments made in the future will have similar characteristics. Please see “full list of investments” at https://activantcapital.com/companies/ for a full list of investments. Any portfolio companies discussed herein should not be assumed to have been profitable. Certain information herein constitutes “forward-looking statements.” All forward-looking statements represent only the intent and belief of Activant as of the date such statements were made. None of Activant or any of its affiliates (i) assumes any responsibility for the accuracy and completeness of any forward-looking statements or (ii) undertakes any obligation to disseminate any updates or revisions to any forward-looking statement contained herein to reflect any change in their expectation with regard thereto or any change in events, conditions or circumstances on which any such statement is based. Due to various risks and uncertainties, actual events or results may differ materially from those reflected or contemplated in such forward-looking statements.