Topic

Supply Chain & Logistics

Published

October 2024

Reading time

8 minutes

Supplier Intelligence

Cost efficiency and resiliency through insights

Supplier Intelligence

Download ArticleResearch

The past few years have been tumultuous to say the least. Global businesses have had to operate through a pandemic, two wars, and economic uncertainty that has seen supply chain risk multiply and annual losses from supply chain disruptions increase to $2.5 trillion.1 Disruptions lasting a month or longer now happen every 3.7 years on average,2 and a single long-term disruption to production could cost companies as much as 30-50% of annual EBIDTA.3 It’s no wonder that supply chain overhauls are now a CEO-level problem, with resilience and sustainability a top priority for executives around the world.

Supply chains have traditionally been designed for cost efficiency, not resilience. As a result, organizations have had opaque relationships with suppliers – often relying on manual data collection and analysis. With the help of supplier intelligence tools, this is changing.

Supplier Intelligence

Supplier intelligence platforms enable a holistic view of opportunity and risk by analyzing existing and potential suppliers across multiple key financial, operational, environmental, social and governance (ESG), labor, and security risk domains. This allows companies to monitor their entire supply chain and equip users with the ability to execute preventive and corrective measures, thereby minimizing risk and enhancing individual supplier performance.

Supply chain specialists have long had access to large platforms like Oracle and SAP, but these platforms lack additional intelligence on where supply chains could potentially break. These weak links in the supply chain could be anything from factories that violate child labor laws to shifts in government trade policies that are not observed. Much of the data that is provided by legacy players is static. Few of these players can offer the predictive risk features that newer entrants to the market have built.

One of the most significant challenges today is uncovering Environmental, Social and Governance (ESG) controversies, especially within small and medium-sized private companies. Advanced supplier intelligence tools are essential to bridge this information gap, providing timely and actionable insights to help businesses navigate these hidden risks.”

Sylvain Forte, Co-founder & CEO, SESAMm

McKinsey estimates that it takes an average of three months to complete a single supplier search and more than 40 hours of work.4 With customer preferences constantly in a state of flux, the ability to quickly identify, qualify, and onboard new suppliers has become table stakes for businesses that want to survive. Through newer supplier intelligence solutions, supplier discovery is no longer the time-consuming and manual process that it once was.

Supply Chain Visibility is an Imperative

Businesses have begun to realize that supply chain disruptions expose them to significant brand, operational and financial risks. In their Annual Global Supply Chain Report conducted in spring of 2021, Interos reported that organizations surveyed, on average, lose $184 million annually due to global supply chain disruptions.5 McKinsey estimates that the situation could get even worse with supply chain disruptions costing companies 45% of annual profits within ten years.6

Enterprises also experience severe problems resulting from misinformation and outdated supplier records. A Tealbook survey found that 67% of surveyed procurement organizations reported financial loss attributed to bad supplier data.7 In addition, shortages of products and materials brought about by disruption result in delayed and stalled revenue-building business activity. With 90% of organizations lacking awareness of sub-tier supplier disruptions for up to 48 hours, the need for supplier intelligence solutions is real.8

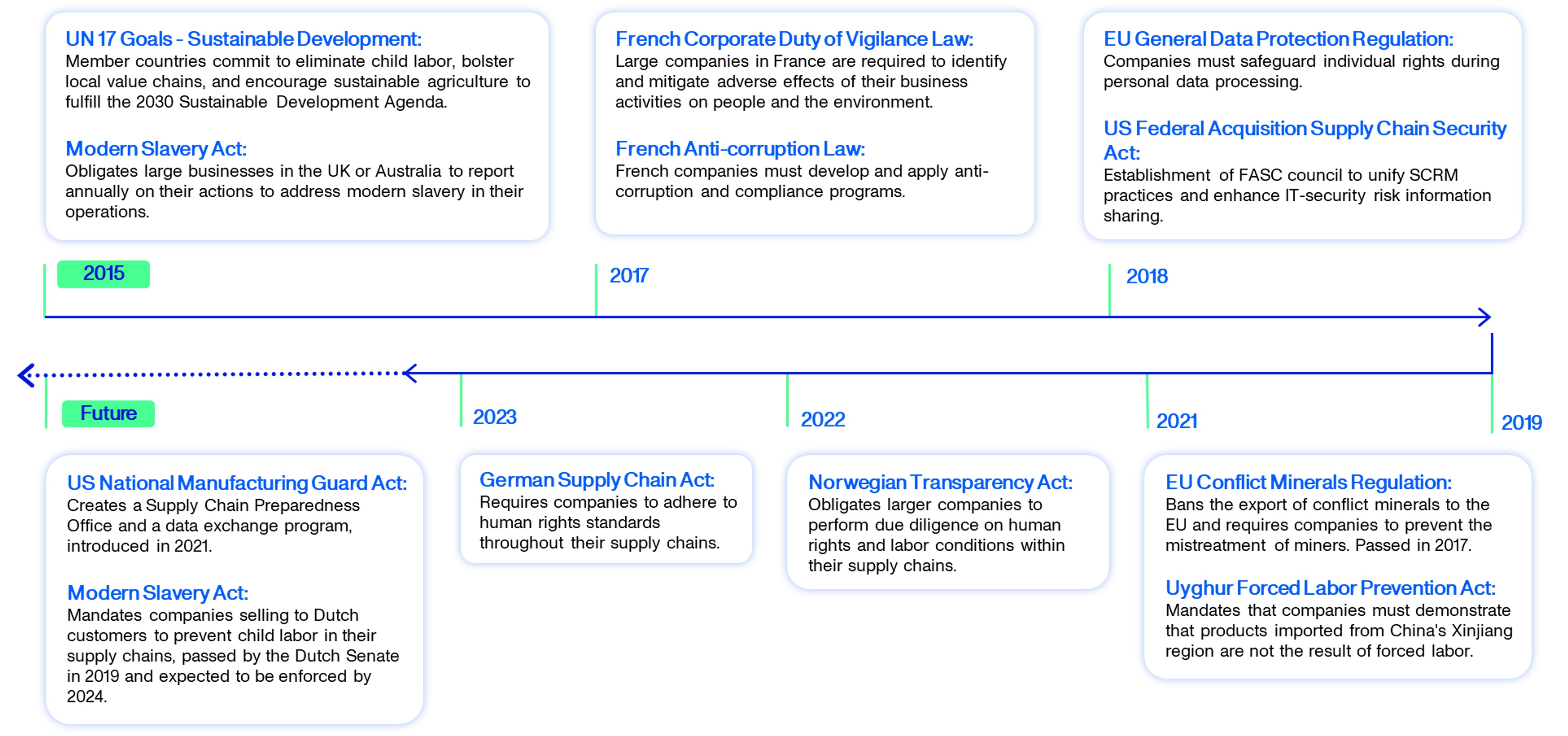

There are several tailwinds supporting supplier intelligence solutions, but regulation has been a particularly strong driving force of adoption. Europe leads with regards to regulatory pressure. The German Supply Chain Act requires large companies to track both human rights violations and environmental risks through their supply chains. Those that do not comply will be fined 2% of their annual global turnover, depending on their size.9 In addition, in March 2024, the Corporate Sustainability Due Diligence Directive (CS3D) was endorsed by the EU council. This is expected to impact around 5,000 companies in the EU that have at least €450 million net worldwide turnover. The new rules are centred around mandatory sustainability due diligence, requiring companies to identify — and to prevent, end or mitigate — adverse impacts on human rights or the environment because of their activities across their global “chain of activities”, with consequences including pecuniary penalties and civil liability for non-compliance.

The U.S. Inflation Reduction Act (IRA) requires automakers to demonstrate the percentage of minerals within their batteries that are extracted and processed in the U.S. (or a country with which the U.S. has a free trade agreement) to meet the threshold criteria for vehicles to qualify for tax credits. This means that a company needs to be able to accurately and responsibly trace its supply chain all the way back to the raw materials.

The fashion and textile industry is known to have significant social and environmental risks hidden deep in their complex supply chains, but without having evidence of what is happening, companies cannot proactively manage and mitigate them. As global legislation increases the pressure on companies to prove responsible sourcing, companies need to map out their full supply chains, per product and shipment, and analyse them for risk.”

Shameek Ghosh, Co-founder & CEO, Trustrace

The exhibit below provides an overview of the key regulation impacting global supply chains. If the recent past is anything to go by, regulation will continue to increase, and supplier visibility will be an imperative.

Research

Timeline of Key Regulation

Supplier Intelligence as a Foundation for Procurement

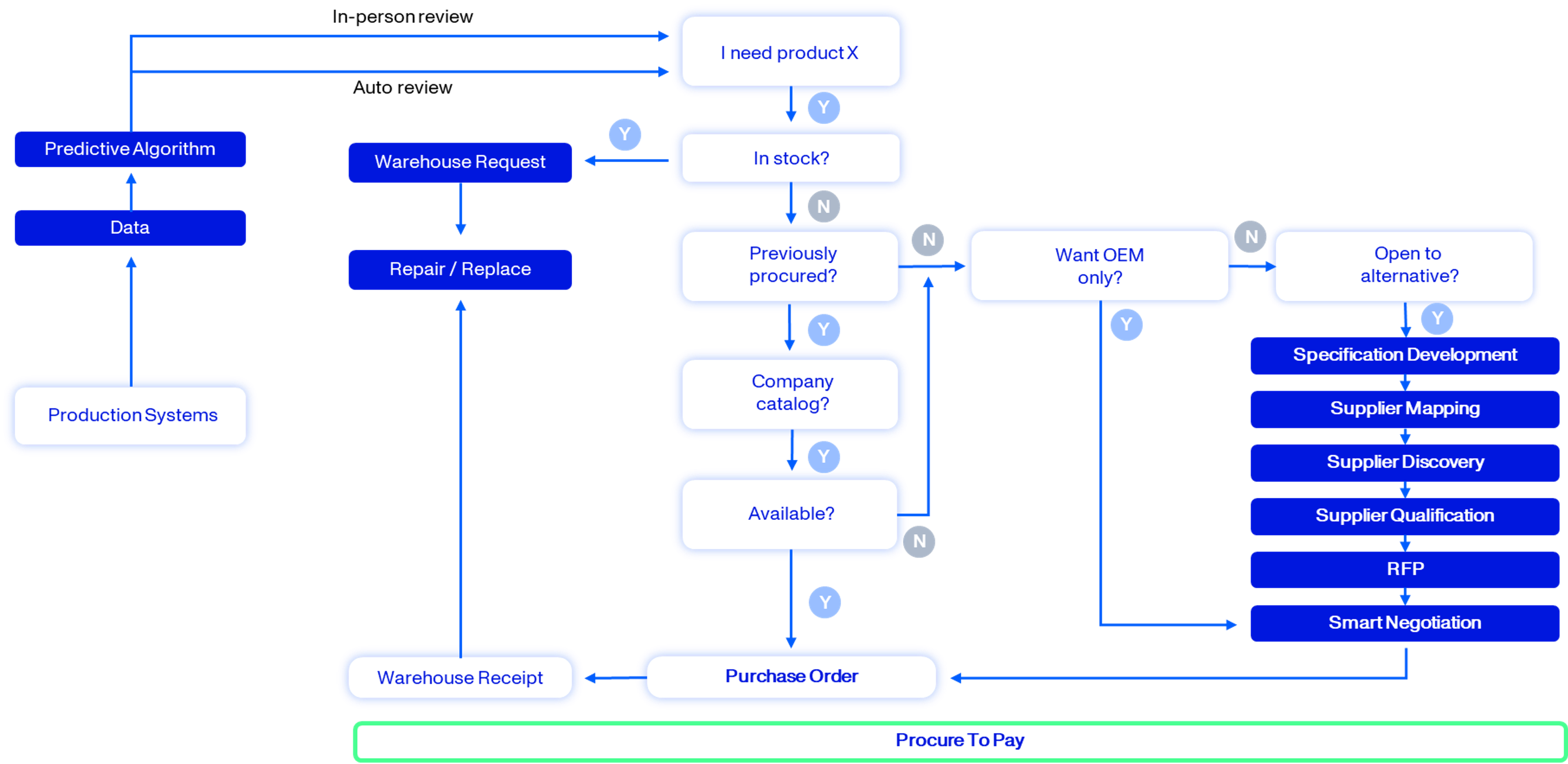

We would be remiss to not highlight the role that supplier intelligence solutions play within the procurement process. The process flow map below attempts to highlight the events that take place when a product is needed to be supplied.

Research

Our View: Procurement Process Flow

Whether or not a product has been previously procured plays a large part in which aspects of supplier intelligence come into play. More specifically, when an organization is looking to purchase an alternative from an OEM, and once clear product specifications are defined, multiple components of supplier intelligence are triggered. This includes:

1Supplier Mapping – The process of identifying, assessing, and understanding the relationships between a company and its suppliers. It involves creating a detailed overview of the entire supply chain, including the flow of raw materials to finished products.

2Supplier Discovery – Identifying potential suppliers who can meet the organization’s needs.

3Supplier Qualification – Evaluating suppliers based on criteria such as reliability, geographic location, compliance regulations, quality, etc.

Following on from the typical supplier intelligence components, is contract management. This involves managing contracts effectively by understanding terms, conditions, and compliance requirements to ensure value for money and mitigate risks.

Risk management is at play across the entire process and data can help to identify potential vulnerabilities within the supply chain such as reliance on single suppliers or geographic concentration. Supplier relationship management also relies on the data to streamline and improve interactions between an organization and its suppliers. It is through these features that procurement teams can effectively vet suppliers and focus on those that are most reliable and meet the company’s needs.

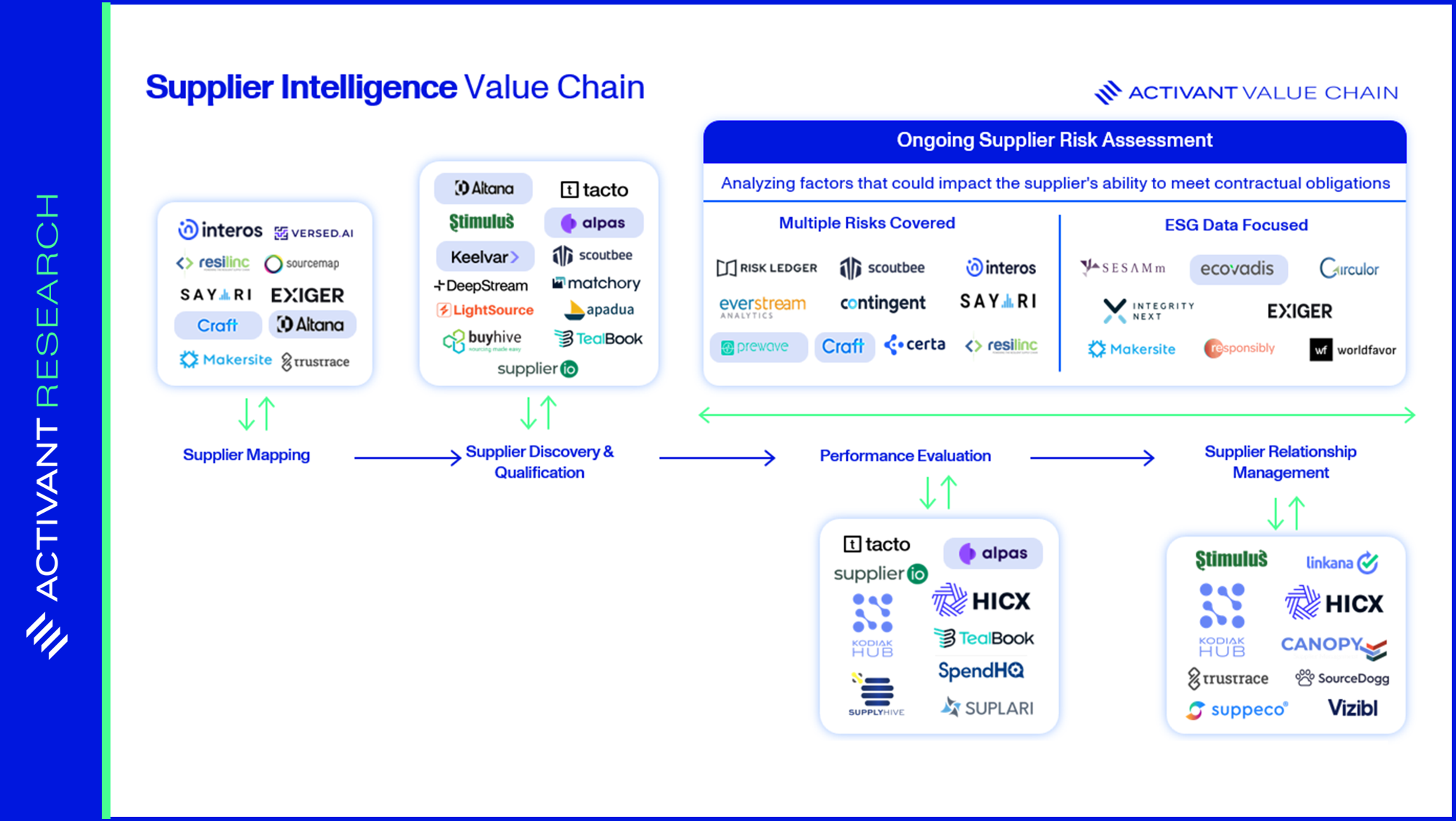

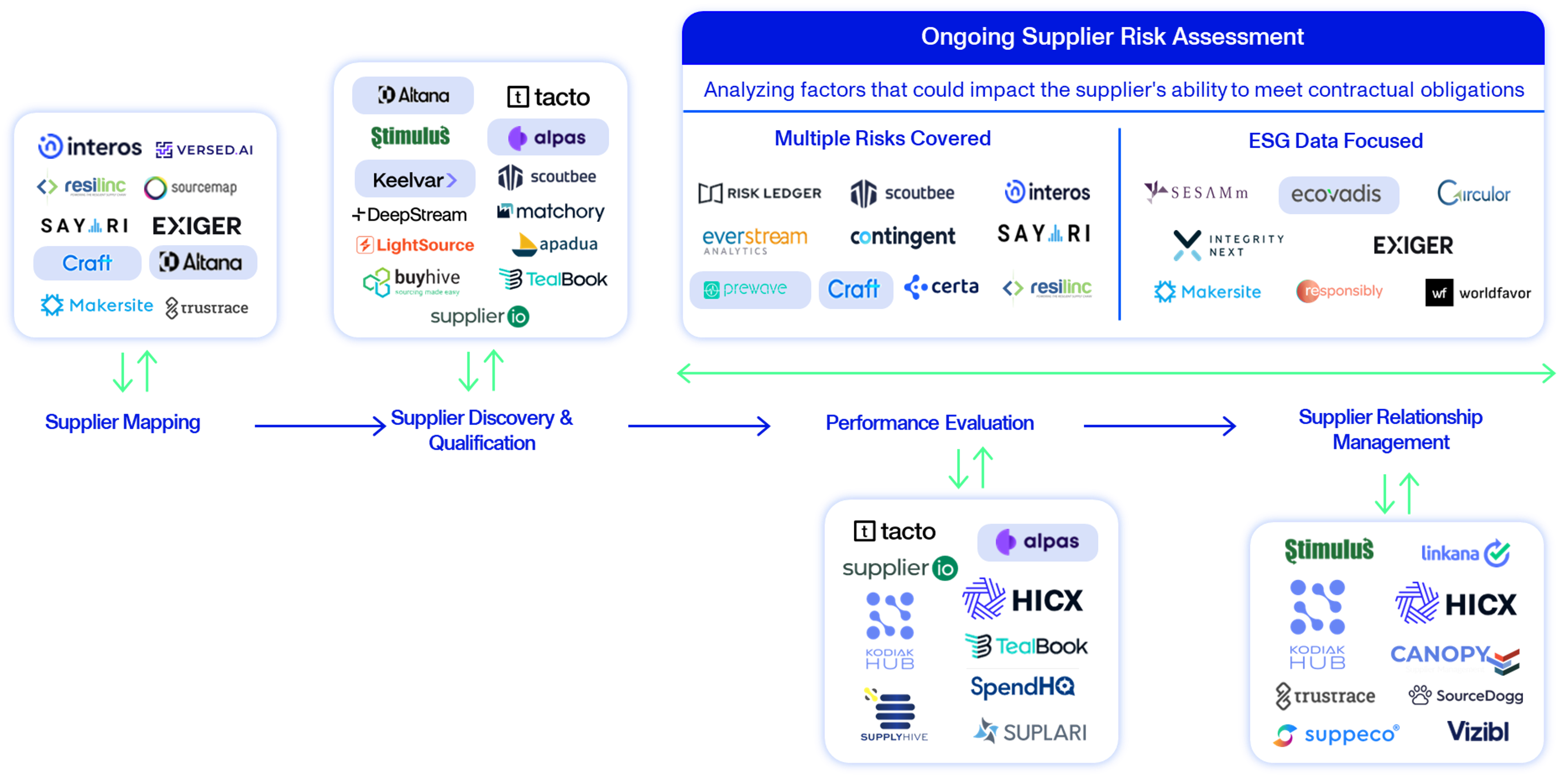

Supplier Intelligence Ecosystem

The supplier intelligence landscape can be best mapped across a value chain. There is a clear overlap between the core elements of supplier intelligence and the procurement process flow mentioned above. Supplier intelligence provides the critical data and insights that underpin effective procurement decisions. Together, the two drive strategic sourcing and supply chain optimization.

We have identified numerous startups that operate across the supplier intelligence value chain, with supplier mapping and supplier discovery players being a vital part of the first link of the chain. Supplier performance evaluation and supplier relationship management are two important elements that follow. Lastly, we see ongoing supplier risk assessment as one of the most exciting components of the value chain. Unlike traditional, static assessments, this approach recognizes that the business environment is constantly changing.

We believe that this market is not a ‘winner-takes-all’ across the different process steps of mapping, discovery and intelligence. Instead, we believe it’s more likely that each step will see individual winners, with the market consolidating across steps as it matures (which we believe is still at least three years out, if not longer). Being able to serve different verticals to an equal degree of granularity is a significant as it expands the addressable market and proves the underlying product’s capabilities.

Research

Supplier Intelligence Value Chain

Players We’re Excited About

There are multiple players offering supplier intelligence solutions. Many of the early winners are incorporating AI, automated supplier scoring and public data/incident monitoring into their solutions. We like the solutions offered by:

Prewave, a supply chain risk intelligence platform that helps enterprises to reduce the cost of supply chain disruptions, proactively prevent supply chain concentration to improve resilience, monitor regulatory changes and provide compliance certifications on regulations like the German Supply Chain Act (LkSG) and many others.

Alpas develops AI-powered software that enables procurement teams to identify suppliers 10x faster. This type of sourcing automation enables more efficient supplier discovery.

SESAMm use their AI technology to allow businesses to access ESG insights on any private and public companies. Their diverse client base includes private equity firms, asset managers, index providers and global corporations.

Altana focuses on multi-tier value chain visibility, focusing on creating a comprehensive view of a company’s extended global supply chain network. This has enabled them to be a go-to player for risk, resilience & decision support.

Craft helps supply chain and procurement professionals discover, evaluate, and monitor suppliers to create stronger supply chain resilience. The startup provides 360-degree visibility into a company’s supply base.

Trustrace offers a platform that is dedicated to product traceability and compliance. The technology developed by the company empowers global brands and suppliers to standardize the capture, digitization, and sharing of supply chain and material traceability data.

Conclusion

We are just at the beginning of truly understanding the supplier intelligence space, but we are certain that these solutions are addressing a real pain point. Those that do not know their suppliers inside and out will ultimately fall behind. If you’re building a dynamic solution within this space, reach out to us.

Endnotes

[1] Interos, Supply Chains Shouldn’t be invisible, 2024

[2] McKinsey, Risk, resilience, and rebalancing global value chains, 2020

[3] McKinsey, Building national supply chain resilience, 2021

[4] McKinsey, With artificial intelligence, find new suppliers in days not months, 2021

[5] Interos, Resilience 2022: Interos Annual Global Supply Chain Report

[6] McKinsey, Building national supply chain resilience, 2021

[7] Tealbook, Severe Business Consequences Stem from Poor Supplier Data, 2020

[8] Interos, Supply Chains Shouldn’t be Invisible, 2023

[9] Prewave, The German Supply Chain Act, 2022

The information contained herein is provided for informational purposes only and should not be construed as investment advice. The opinions, views, forecasts, performance, estimates, etc. expressed herein are subject to change without notice. Certain statements contained herein reflect the subjective views and opinions of Activant. Past performance is not indicative of future results. No representation is made that any investment will or is likely to achieve its objectives. All investments involve risk and may result in loss. This newsletter does not constitute an offer to sell or a solicitation of an offer to buy any security. Activant does not provide tax or legal advice and you are encouraged to seek the advice of a tax or legal professional regarding your individual circumstances.

This content may not under any circumstances be relied upon when making a decision to invest in any fund or investment, including those managed by Activant. Certain information contained in here has been obtained from third-party sources, including from portfolio companies of funds managed by Activant. While taken from sources believed to be reliable, Activant has not independently verified such information and makes no representations about the current or enduring accuracy of the information or its appropriateness for a given situation.

Activant does not solicit or make its services available to the public. The content provided herein may include information regarding past and/or present portfolio companies or investments managed by Activant, its affiliates and/or personnel. References to specific companies are for illustrative purposes only and do not necessarily reflect Activant investments. It should not be assumed that investments made in the future will have similar characteristics. Please see “full list of investments” at https://activantcapital.com/companies/ for a full list of investments. Any portfolio companies discussed herein should not be assumed to have been profitable. Certain information herein constitutes “forward-looking statements.” All forward-looking statements represent only the intent and belief of Activant as of the date such statements were made. None of Activant or any of its affiliates (i) assumes any responsibility for the accuracy and completeness of any forward-looking statements or (ii) undertakes any obligation to disseminate any updates or revisions to any forward-looking statement contained herein to reflect any change in their expectation with regard thereto or any change in events, conditions or circumstances on which any such statement is based. Due to various risks and uncertainties, actual events or results may differ materially from those reflected or contemplated in such forward-looking statements.