Topic

B2B Commerce

Published

February 2024

Reading time

6 minutes

Unified APIs

Download ArticleResearch

Application Programming Interfaces (APIs), the digital conduits that allow different software systems to “talk” to one another, are the unsung heroes of digital commerce in a world where the number of connections between entities is increasing exponentially. Businesses today use nine times more individual software tools than they did five years ago,1 and complexity is only increasing. Maintaining these myriad integrations and the constant upgrades to each is a major challenge, particularly if engineering teams need to deal with each connection individually. Differences in time formats, currencies, accounting or reporting nomenclature, and a host of other nuances can make managing APIs at scale a headache.

There are solutions to this, and markets thrive when aggregators enable simple connections, much like Plaid did with its universal API for fintech companies to connect to user bank.2

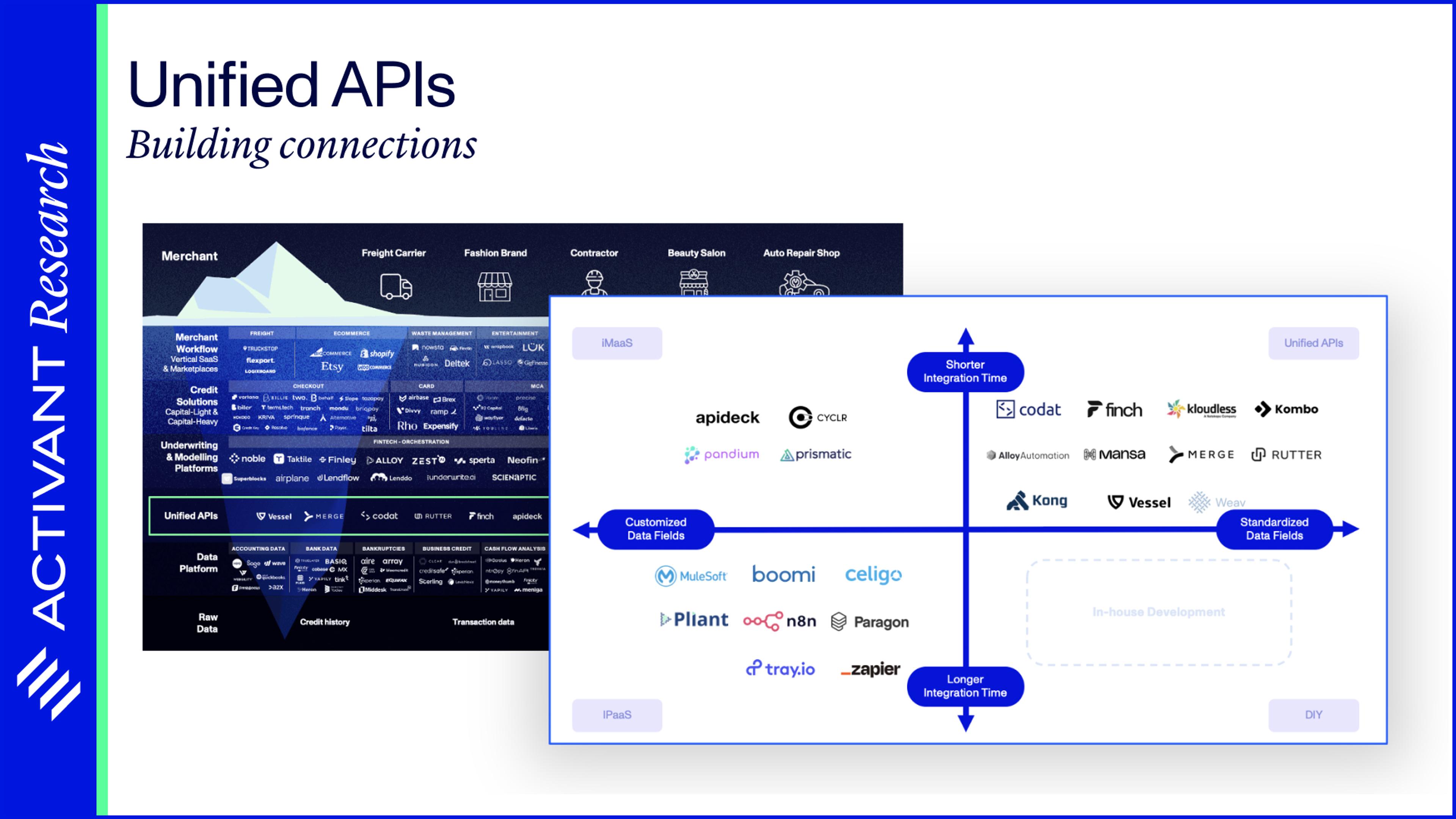

A “Unified API” is an abstraction layer that handles communication with many different APIs and backend data models. Companies only need to build one integration – to the unified API provider — and it then manages the complexities of multiple API connections. Exhibit 1 illustrates the simple difference that a unified API offers for developers.

Unified APIs offer several benefits:

- Streamlined operations: changes to APIs can lead to downtime if the individual connections are not aligned, resulting in breakages

- Cost savings: fixing these breakages is often an inefficient process consuming expensive developer capacity

- Accessing new integrations and data points: access is possible to all the API integrations a Unified API solution has built

- Faster Go-to-Market: Unified APIs offer significant time and resource savings, allowing more rapid prototyping and new product launches.

The case for Unified APIs is compelling and we expect the market to expand over time as API-first businesses proliferate.

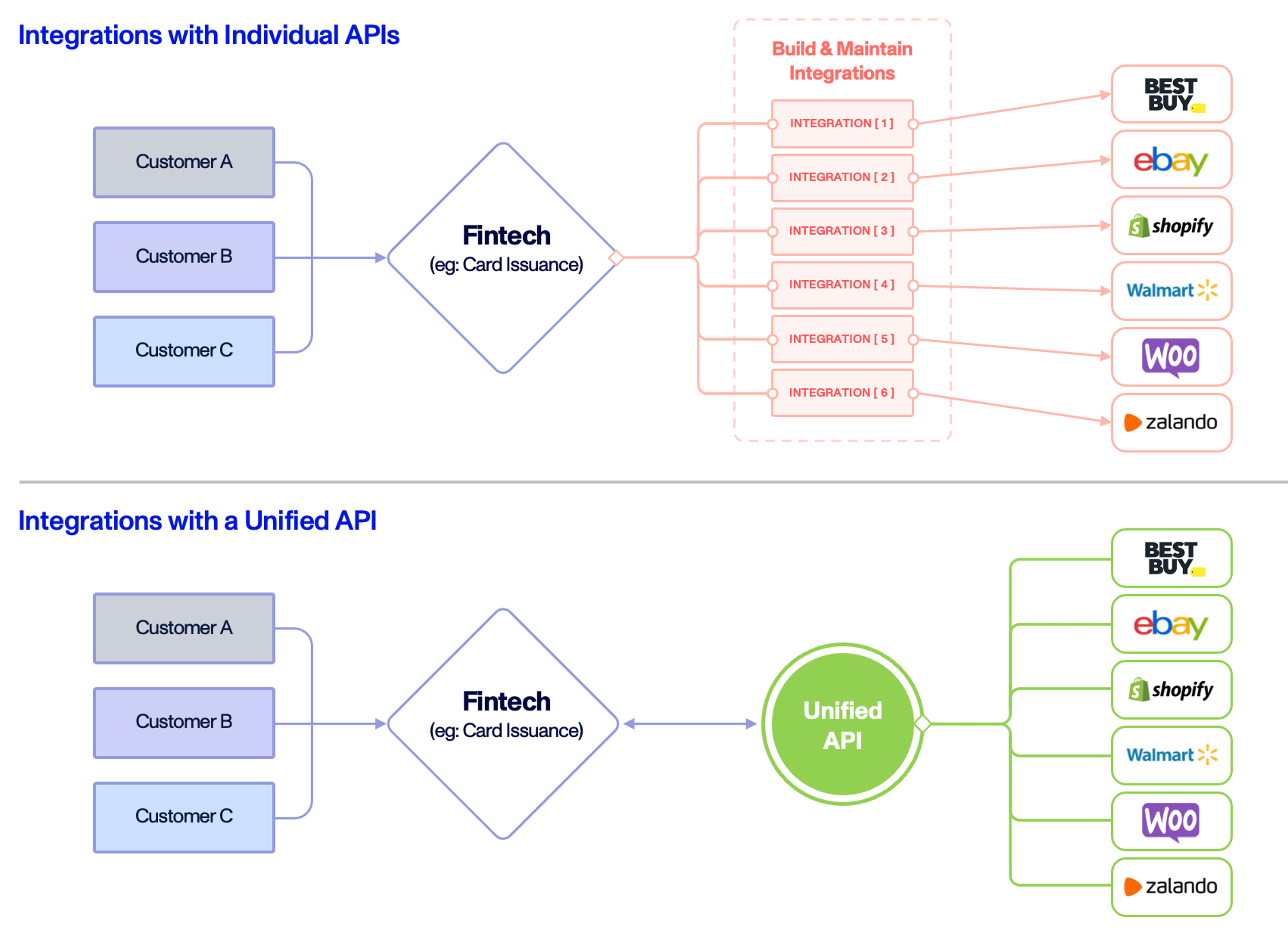

A large, growing market

We estimate that companies spend more than $50 billion annually in the U.S. alone on maintaining external-facing APIs. Our estimates include (1) the number of companies that use external API integrations, (2) the number of API integrations per company, and (3) the average annual maintenance spend per API. Based on our interactions with industry experts and practitioners, we conservatively estimate that companies have an average of four external API integrations, and that maintaining these costs approximately $620 per API per annum. Exhibit 2 summarizes the results of our market sizing analysis.

The challenge of building and maintaining API integrations isn't unique to a single market- wherever you find API connectivity, you'll likely encounter this challenge. At Mansa, we're crafting middleware to streamline commerce tools, a single integration enabling innovative B2B fintech products for millions of African SME's."

Victory Matibiri, CEO and Co-Founder, Mansa

Market Sizing

Estimated Unified APIs Market Size

Activant Market Map

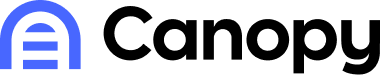

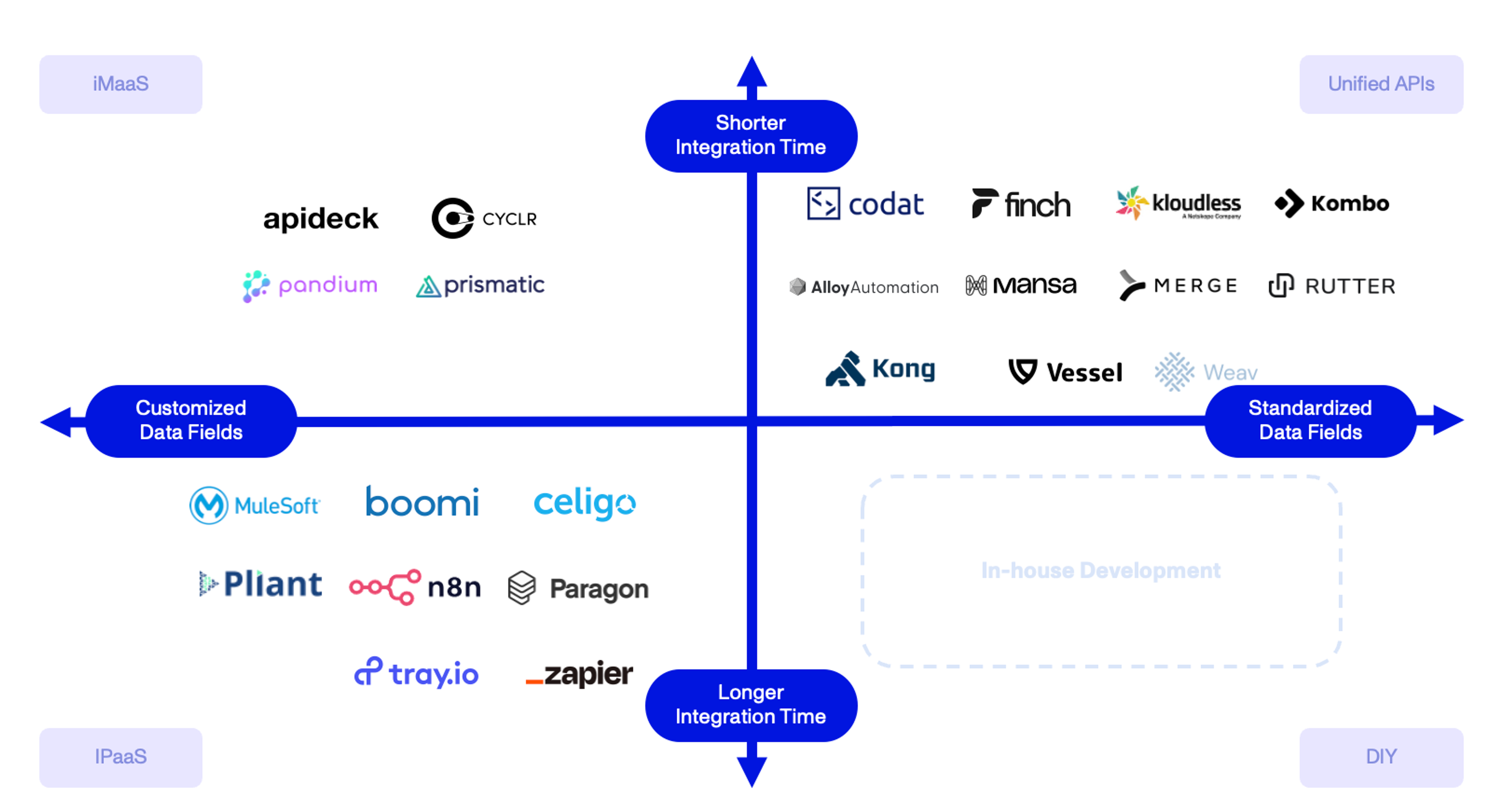

In our market study, we differentiated the players based on the time it took to integrate their solutions and the degree of customization of data fields possible. The Activant Market Map is shown below.

Market Map

One of the benefits of the segmentation approach used is the alignment with the broader market of solutions addressing the pain points of building, maintaining and orchestrating APIs. Each quadrant in the market map represents a unique approach to API integration.

Unified APIs do what the name suggests: they unify APIs. These tools are generally faster to integrate as they only need to process a single set of API documentation. Unified APIs apply a data normalization technique that standardizes API fields across software vendors. The more coverage a business has across vendors, the more participation it can expect.

Integration Platforms as a Service(iPaaS) solutions help internal development teams build individual API connections in a low-code fashion. Relative to Unified APIs, these tools generally require more engineering hours to build but are ideal for scenarios where a high degree of customization in the data being pulled is required. These tools do not apply a data normalization technique.

Integration Marketplaces as a Service (iMaaS) solutions focus on the distribution of integrations and enable SaaS companies to provide APIs to their customers in the form of a marketplace. In the same way, a traditional marketplace helps organize and showcase products a business can sell, an integration marketplace is an effective platform to showcase all the apps an SaaS can integrate with.

In-house development (“DIY”) uses company resources to build and maintain APIs. The resources required ultimately depend on the complexity of the integration, which includes factors such as the number of end-points to connect, the amount of data being pulled, and security requirements. Costs can vary from $10-$100K+ per integration.

Even at the beginning of a company's lifecycle, they're getting bombarded by customer integration requests. Using a unified API is often the quickest way to get coverage across an entire category of apps. But, as startups grow, their customers may have more complex needs for integration configuration, and embedded iPaaS becomes more suitable for leveling up past unified APIs. Alloy serves customers through their entire lifecycle, given we provide both Embedded IPaaS and Unified APIs to develop with."

Sara Du, Founder & CEO, Alloy Automation

Importantly, many of the companies that we have located on the market map offer iPaaS, iMaaS, and Unified API solutions. It is not a one-size-fits-all world and customers have the luxury of choosing a combination of the solutions depending on their specific needs. Simple solutions will win. Less friction is likely to result in more commerce.

Emerging winners

It’s still early days, despite the clear need for a ‘middleware’ layer to help manage the complexities of multiple API integrations. We believe that tomorrow’s winners will be those that offer solutions with broad coverage across software categories as well as deep integrations to allow teams to pull customized data listings. Additionally, we think the use of Large Language Models (LLMs) to automate the construction of API integrations into their common data layers will become table stakes. This may decrease the cost per integration and has the potential to expand industry margins – which is likely to increase industry competition. Whatever the future holds, there’s definitely change coming to the status quo.

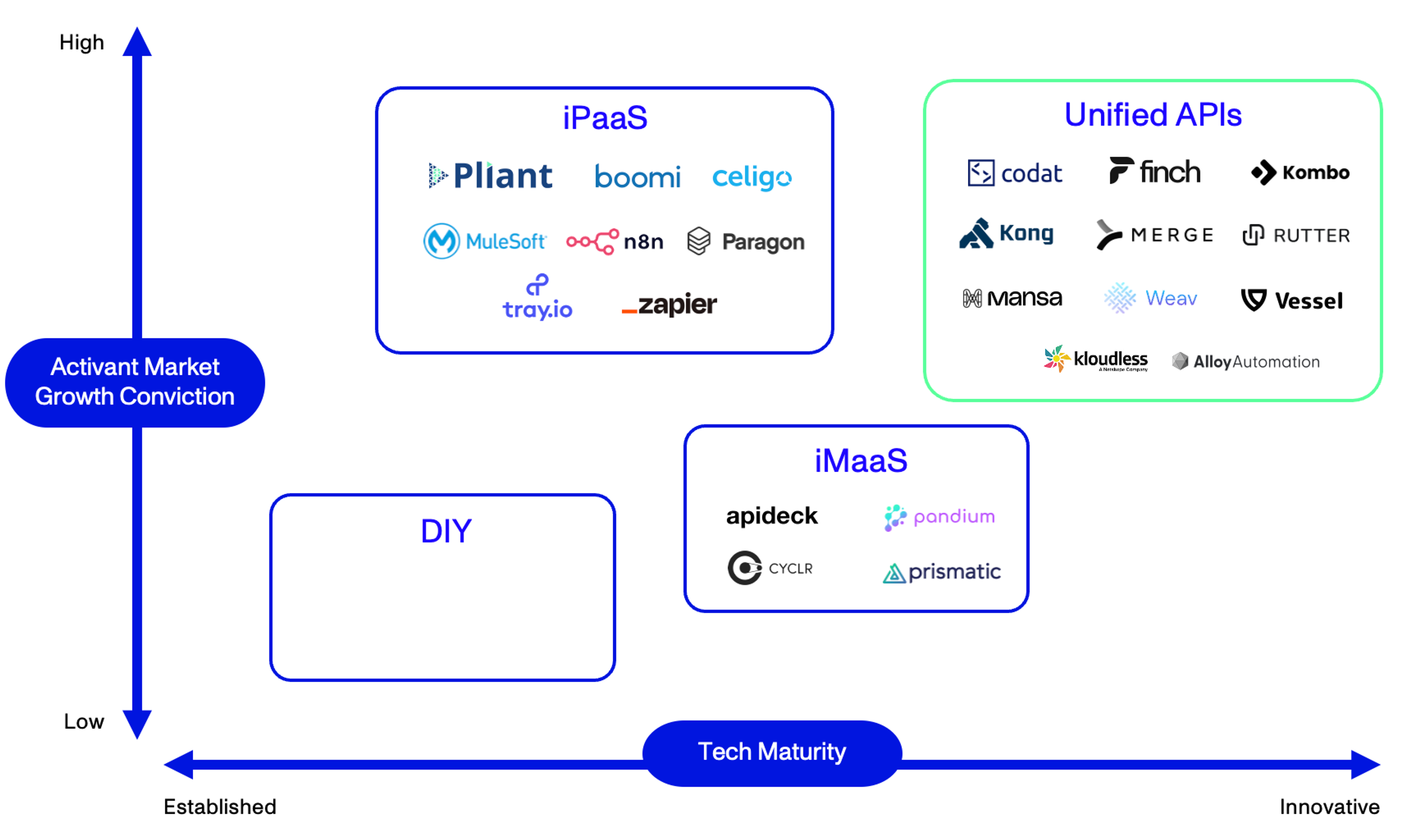

Activant’s conviction in the bright future for unified API solutions is summarized in our thesis map below.

Thesis Map

We like the solutions offered by:

- Merge, a first mover in the use of LLMs. The company recently unveiled Blueprint3 to provide LLM-built API integrations to customers.

- Codat, a solution powering the credit decision engines of top tier banks and FinTech companies that integrates with 19 accounting solutions and 16 commerce platforms. Lenders can quickly assess, for example, the size and quality of incoming payments to their customers by comparing contract details against invoices in accounting platforms.

- Finch, a market leader offering integration with 200+ Human Resource Information Systems (HRIS). Providers of 401(k) plans, HR technology, and fintech solutions can integrate with an employer’s HRIS system to streamline employee onboarding, track payrolls, update benefit deductions, and manage other core HR and compliance functions

- Alloy Automation, which offers its customers broad and deep solutions across disparate use cases in CRM, accounting, logistics, and the like, allowing them the option to build fast, then deep. A unified API allows customers to instantly set up real-time read-and-write integrations, and when it’s time to build more complex processes, customers can leverage Alloy’s Embedded iPaaS.

- Mansa, a first mover in building the category across Africa, which allows fintech firms to read and write across 17+ African commerce, banking, accounting, and payments platforms.

At Activant, we’re excited to watch this market evolve. If you’re building in the space, have a different perspective, or enjoyed the piece, please get in touch.

Endnotes

[1] Statista, Average Number of SaaS apps yearly, 2022

[2] TechCrunch, Plaid launches Plaid Exchange to help banks manage their API, 2020

[3] PRNewswire, Merge launches Blueprint, 2023

Disclaimer: The information contained herein is provided for informational purposes only and should not be construed as investment advice. The opinions, views, forecasts, performance, estimates, etc. expressed herein are subject to change without notice. Certain statements contained herein reflect the subjective views and opinions of Activant. Past performance is not indicative of future results. No representation is made that any investment will or is likely to achieve its objectives. All investments involve risk and may result in loss. This newsletter does not constitute an offer to sell or a solicitation of an offer to buy any security. Activant does not provide tax or legal advice and you are encouraged to seek the advice of a tax or legal professional regarding your individual circumstances.

This content may not under any circumstances be relied upon when making a decision to invest in any fund or investment, including those managed by Activant. Certain information contained in here has been obtained from third-party sources, including from portfolio companies of funds managed by Activant. While taken from sources believed to be reliable, Activant has not independently verified such information and makes no representations about the current or enduring accuracy of the information or its appropriateness for a given situation.

Activant does not solicit or make its services available to the public. The content provided herein may include information regarding past and/or present portfolio companies or investments managed by Activant, its affiliates and/or personnel. References to specific companies are for illustrative purposes only and do not necessarily reflect Activant investments. It should not be assumed that investments made in the future will have similar characteristics. Please see “full list of investments” at https://activantcapital.com/companies/ for a full list of investments. Any portfolio companies discussed herein should not be assumed to have been profitable. Certain information herein constitutes “forward-looking statements.” All forward-looking statements represent only the intent and belief of Activant as of the date such statements were made. None of Activant or any of its affiliates (i) assumes any responsibility for the accuracy and completeness of any forward-looking statements or (ii) undertakes any obligation to disseminate any updates or revisions to any forward-looking statement contained herein to reflect any change in their expectation with regard thereto or any change in events, conditions or circumstances on which any such statement is based. Due to various risks and uncertainties, actual events or results may differ materially from those reflected or contemplated in such forward-looking statements.