Topic

AI

Published

October 2025

Reading time

6 minutes

AI bubble signals intensifying

or one company’s strategic gambit? Our view on circular transactions

AI bubble signals intensifying

Download ArticleResearch

Trillion Dollar Handshakes

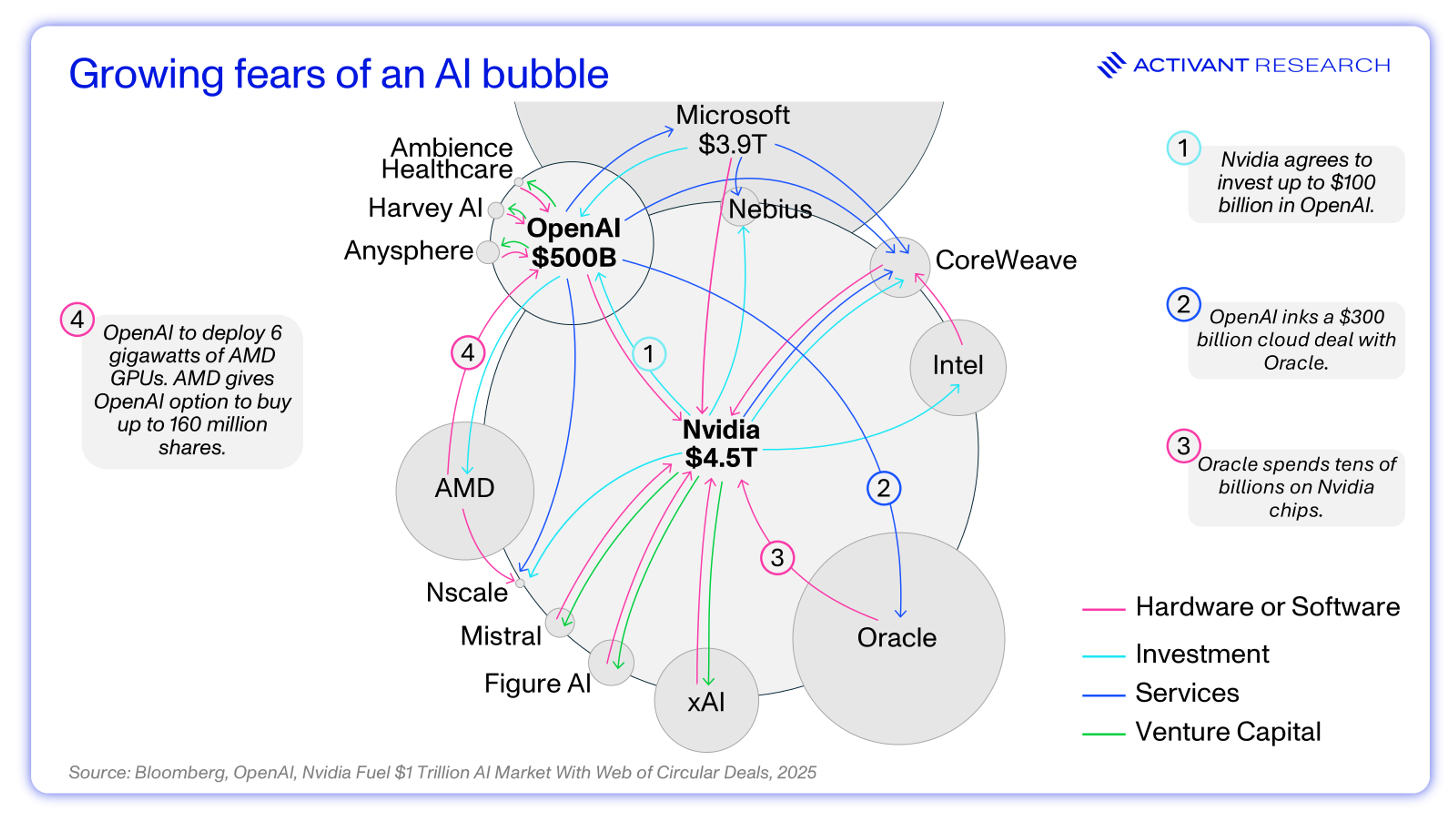

Anyone following technology is familiar with the concept of circular AI transactions. Two or more companies enter a transaction that benefits all parties, obscuring the true economic value of the transactions. The dynamic became mainstream when Microsoft invested over $13 billion into OpenAI, gaining exclusive access to OpenAI models, but also accelerating their own revenue growth as Azure became the exclusive cloud provider for OpenAI.1 $13bn seemed like a lot but OpenAI has now announced deals exceeding $1 trillion in 2025 alone.2 Those deals have increasingly made use of circular financing structures and generated ever louder voices that this is a clear signal we’re in an AI bubble, echoing the vendor financing that capped the dot-com bubble of the 90s.

But this view is incomplete – these transactions are best understood through the lens of strategy and necessity. For example, Nvidia financing players like Coreweave and Nscale is a simple play at increasing competition in the highly concentrated cloud computing market. They can’t support 70%+ gross margins if their only major customers are a few Megacap tech companies. We see these transactions as a response to the tension between integration and modularization, and the obscene economic potential of AI.

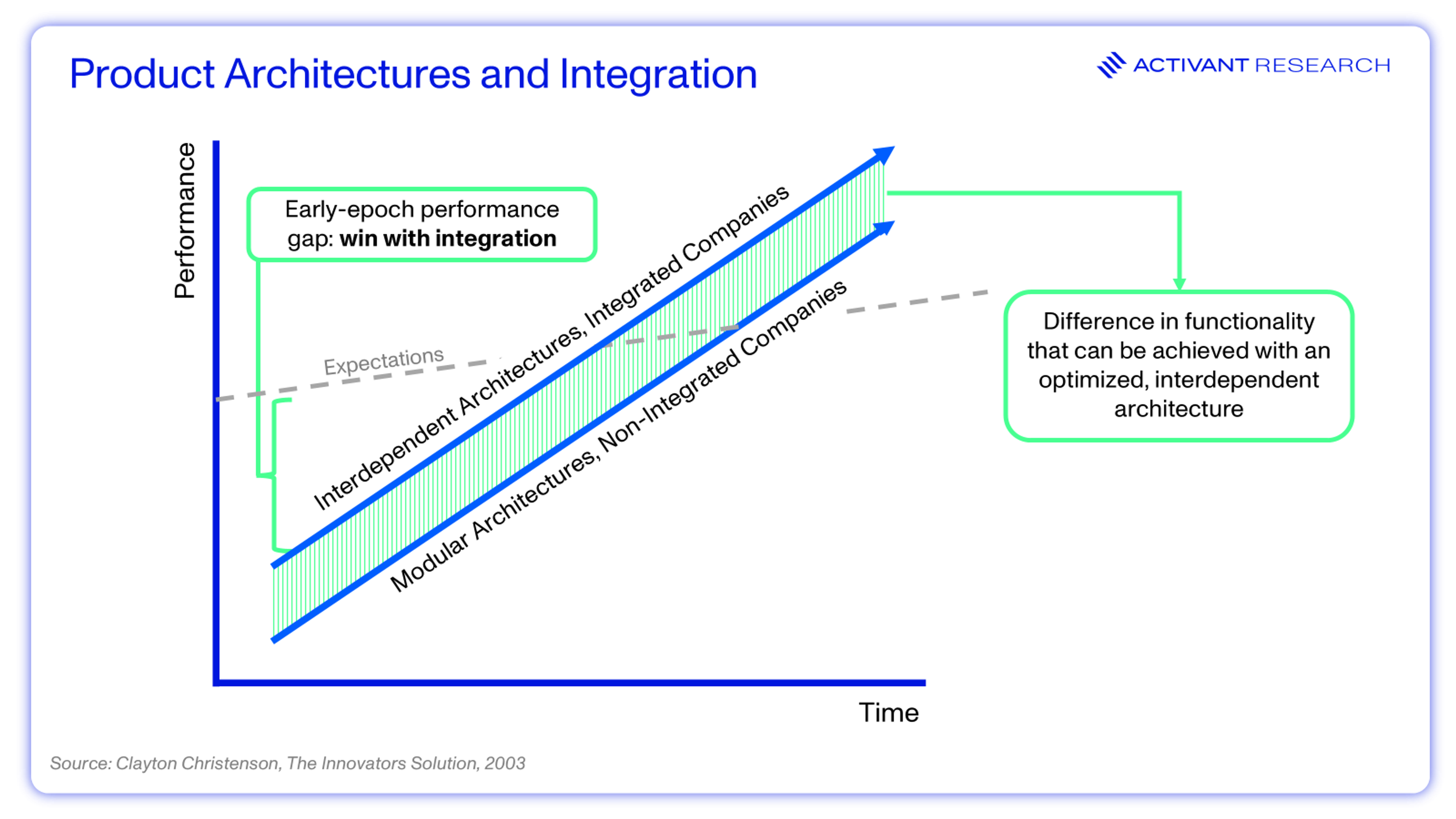

Integration or Modularization

This is a key strategic decision that companies need to make, but one that is generally not available to start-ups. You need to start by being great at one thing, gain traction, and work your way up from there. But integrated architectures can drive performance and win markets, particularly early in a tech epoch when reliability is a core challenge of the new tech. The iPhone is the obvious example.

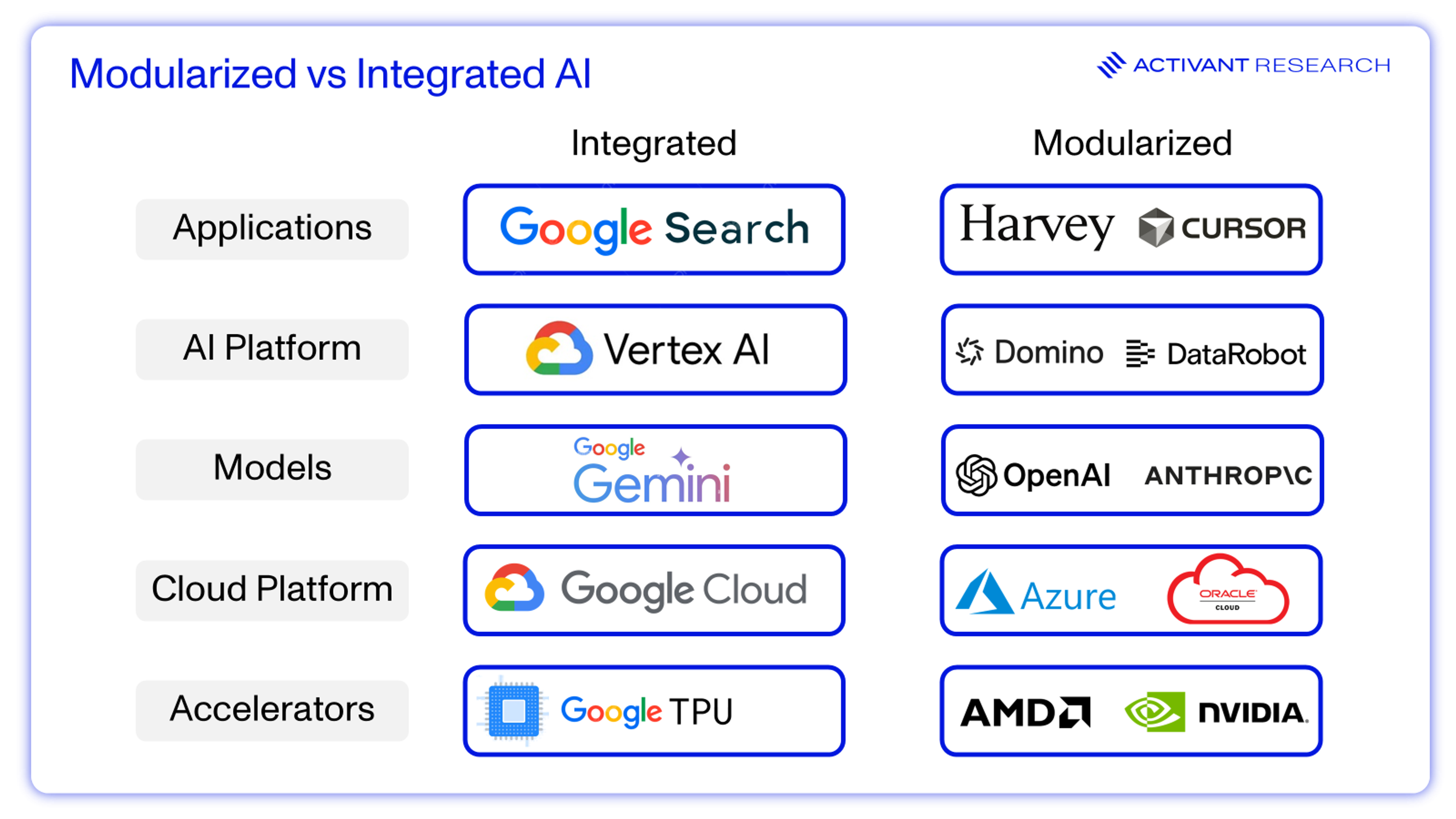

In AI, that’s Google. The company designs its own Tensor Processing Unit (TPU) chips, which are optimized for its Google Cloud Platform (GCP), which in turn hosts the Vertex AI platform used to train and serve its proprietary Gemini models. This top-to-bottom control yields significant performance gains – Gemini 2.5 Pro has a context window ~4x that of GPT5.3,4 Like Microsoft and Meta, Google is integrated upwards into the application layer. Arguably, this is the most important piece - a massive, cash-generating core business to fund its AI ambitions and an extensive global user base to deploy new AI features for an immediate return on investment.

OpenAI, in contrast, began as a modular player. While its partnership with Microsoft provided a deep integration with Azure, the company has historically lacked end-to-end control over its own infrastructure design and spending plans. Further, they lack the massive core business to fund investments, with only (relative to their massive peers) $12bn in ARR.5 A large chunk of OpenAI’s actions can be explained by their need for this deep integration and control, including a $10bn deal with Broadcom for custom chips and their own/partnered datacenters under the Stargate project. 6,7OpenAI are making the critical jump from a piece of a modularized stack to an integrated player.

All in

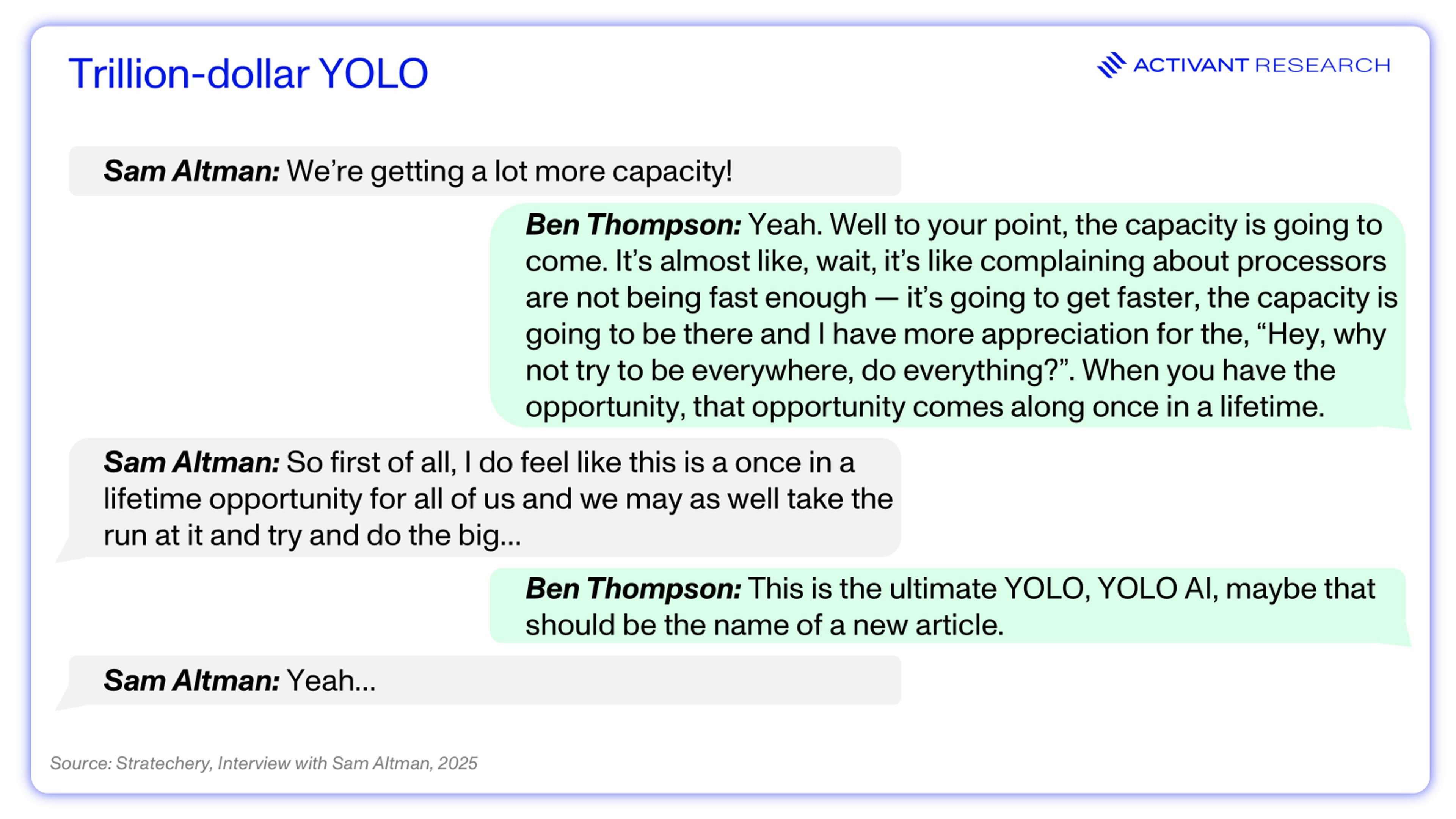

The economic potential of Generative AI is measured in the trillions, and the emergence of systems of intelligence promise to shift software from systems of record to an always-on unit of labor. This shift is going to rewrite the economics of a software industry that already represents $2 trillion+ in market cap. But it’s well known that AI is fundamentally constrained by computing power, so if your strategic goal is to capture trillions of dollars of economic value, you need trillions of dollars of infrastructure.

For OpenAI, a smaller, specialized player competing against integrated giants, this presents a monumental challenge. The response, engineered by CEO Sam Altman, has been an all-in bet, a “once in a lifetime” run at building the required scale. But financial engineering must be part of the strategy to get from $12bn to $1 trillion.

Deconstructing the Master Plan

How does a company win a game where scale and integration are decisive advantages, when its starting point is that of a relatively small, specialized player?

- Economically bind yourself to the most critical supplier in your value chain. OpenAI will buy 10GW of compute capacity, worth ~$350bn but they get a ~30% discount through Nvidia’s $100bn investment back into OpenAI. The deal is cheaper, but they also guarantee supply of the industry’s most sought after resource and give Nvidia a powerful incentive to think about OpenAI’s success in future chip design.

- Leverage your influence to secure favorable terms with weaker players. To diversify its hardware supply, OpenAI struck a deal to deploy 6 GW of AMD’s GPUs, but OpenAI’s cost is significantly reduced by the award of warrants in AMD that are worth ~$35bn at today’s prices.8 Similarly, OpenAI’s five-year, $300 billion cloud deal with Oracle catapults Oracle from a niche provider to a major Hyperscaler, but they may have given up significant economics to do so – Oracles AI cloud gross margins are indicated at 16%.9

- Commoditize your complements. By contracting with and validating specialized, AI-native cloud providers like CoreWeave, OpenAI fosters competition in the cloud infrastructure layer. This helps drive down the long-term bargaining power of the large, established cloud providers, turning what could be a dependency into a more commoditized and competitive market.

Executing this complex industrial strategy - multi-hundred-billion-dollar commitments, novel financing structures, and the careful management of partners who are also competitors requires a unique type of leader. This is where the role of Sam Altman as a political actor becomes essential. His ability to articulate a world-changing vision, build powerful coalitions, and engage in high-level global diplomacy is what makes this audacious plan possible. Its technological statecraft, marshaling capital and aligning the interests of industrial giants toward a single, ambitious goal.

So, are these circular deals a sign of an industry-wide AI bubble? Not necessarily. While the arrangements do create financial loops that can inflate revenues and valuations, they are not irrational. They are the calculated moves of a company executing an exceptionally aggressive and arguably necessary strategy to overcome its strategically weak starting position and try to capture trillions in economic value. Do these deals show that a pocket of companies are making an increasingly large directional bet on the success of OpenAI? Definitely.

Endnotes

[1] CNBC, Microsoft’s $13 billion bet on OpenAI carries huge potential along with plenty of uncertainty, 2023

[2] Financial Times, OpenAI’s computing deals top $1tn, 2025

[3] Google, Gemini 2.5: Our most intelligent AI model, 2025

[4] Wired, OpenAI Finally Launched GPT-5, 2025

[5] The Information, OpenAI Hits $12 Billion in Annualized Revenue, 2025

[6] WSJ OpenAI, Broadcom Make $10 Billion Deal for Custom AI Chips, 2025

[7] OpenAI, OpenAI, Oracle, and SoftBank expand Stargate with five new AI data center sites, 2025

[8] 160 million warrants, 1c exercise price, AMD shares worth $230/sh

[9] The Information, Internal Oracle Data Show Financial Challenge of Renting Out Nvidia Chips, 2025

Disclaimer: The information contained herein is provided for informational purposes only and should not be construed as investment advice. The opinions, views, forecasts, performance, estimates, etc. expressed herein are subject to change without notice. Certain statements contained herein reflect the subjective views and opinions of Activant. Past performance is not indicative of future results. No representation is made that any investment will or is likely to achieve its objectives. All investments involve risk and may result in loss. This newsletter does not constitute an offer to sell or a solicitation of an offer to buy any security. Activant does not provide tax or legal advice and you are encouraged to seek the advice of a tax or legal professional regarding your individual circumstances.

This content may not under any circumstances be relied upon when making a decision to invest in any fund or investment, including those managed by Activant. Certain information contained in here has been obtained from third-party sources, including from portfolio companies of funds managed by Activant. While taken from sources believed to be reliable, Activant has not independently verified such information and makes no representations about the current or enduring accuracy of the information or its appropriateness for a given situation.

Activant does not solicit or make its services available to the public. The content provided herein may include information regarding past and/or present portfolio companies or investments managed by Activant, its affiliates and/or personnel. References to specific companies are for illustrative purposes only and do not necessarily reflect Activant investments. It should not be assumed that investments made in the future will have similar characteristics. Please see “full list of investments” at https://activantcapital.com/companies/ for a full list of investments. Any portfolio companies discussed herein should not be assumed to have been profitable. Certain information herein constitutes “forward-looking statements.” All forward-looking statements represent only the intent and belief of Activant as of the date such statements were made. None of Activant or any of its affiliates (i) assumes any responsibility for the accuracy and completeness of any forward-looking statements or (ii) undertakes any obligation to disseminate any updates or revisions to any forward-looking statement contained herein to reflect any change in their expectation with regard thereto or any change in events, conditions or circumstances on which any such statement is based. Due to various risks and uncertainties, actual events or results may differ materially from those reflected or contemplated in such forward-looking statements.