Topic

Automation

Published

February 2024

Reading time

8 minutes

Conversational AI and the Future of Customer Service

A shift in the customer support landscape

Conversational AI and the Future of Customer Service

Download ArticleResearch

“Sorry, I didn’t understand. Please select option 1 to ...” We have all suffered the frustration of self-service automation systems used by large banks, telcos, airlines, and hotels. Caught in a loop of misunderstandings and inflexible options, it can feel like the service provider has never encountered the issue we want to resolve. Why do we have to type “one’’ for English or “dos” for Spanish when voice recognition technology is effective and freely available? It simply makes no sense and indicates an opportunity for change. Conversational AI is likely the solution.

Introduction to enterprise conversational AI Platforms

An enterprise conversational AI platform allows users to design enterprise-to-customer communications across voice and digital channels. This would allow human customer service agents to be augmented or entirely replaced, a potentially significant cost saving that means business owners are willing to explore and invest in conversational AI solutions. For example, the procurement manager at a large Swiss wholesaler suggested that the company planned to reduce its customer service headcount by 40% because PolyAI both freed up agent time by triaging inbound customer requests and improved overall productivity through its ability to quickly resolve client queries like a “super-agent.” We estimate that conversational AI platforms have the potential to automate as much as 50% of all customer service calls, generating value up to $40 billion in the US and $100 billion globally.

Given this potential to leverage technology and create value, the market is unsurprisingly competitive and well-funded. Established incumbents such as Zendesk are developing in-house AI tools targeted at customer service, and investors have lined up behind myriad start-ups: India-based Uniphore has raised more than $600 million, and US-based Sierra, Cresta, Replicant have each raised more than $100 million in funding. Lesser funded but equally notable players include Replicant, PolyAI, Parloa, Observe, Forethought, Hiver, Freshdesk, Tidio, Balto, Kustomer, and Invoca. There is no shortage of competitors in the market.

Impetus for sustained growth

Our research highlighted three factors providing the impetus for growth that we believe will be sustained for years to come:

- Increasing Customer Service Workloads: The demands on customer service agents increased meaningfully with the onset of Covid-19 as both call complexity and frequency increased.1 Recent research highlights that consumers are unlikely to change these new behaviors.2

- Normalization of Conversational AI: Machine-led conversational AI interactions are the quickest and most effective route for institutions to drive customer engagement, and widespread implementation has led to normalization.3 Business leaders recognize the potential for increased upsell and cross-sell because of faster issue resolution and higher customer satisfaction. 4Also, generative AI models have introduced the ability to engage in more complex “multi-turn” conversations and provide human-like logic which broadens the scope for understanding user intent.

- Increasing Labor Costs in Customer Service: Customer service professionals resigned en masse during and after the pandemic. The following period of coordinated stimulative monetary and fiscal policy has driven a significant increase in labor costs, limiting returns and incentivizing further automation.5

Degrees of software orchestration

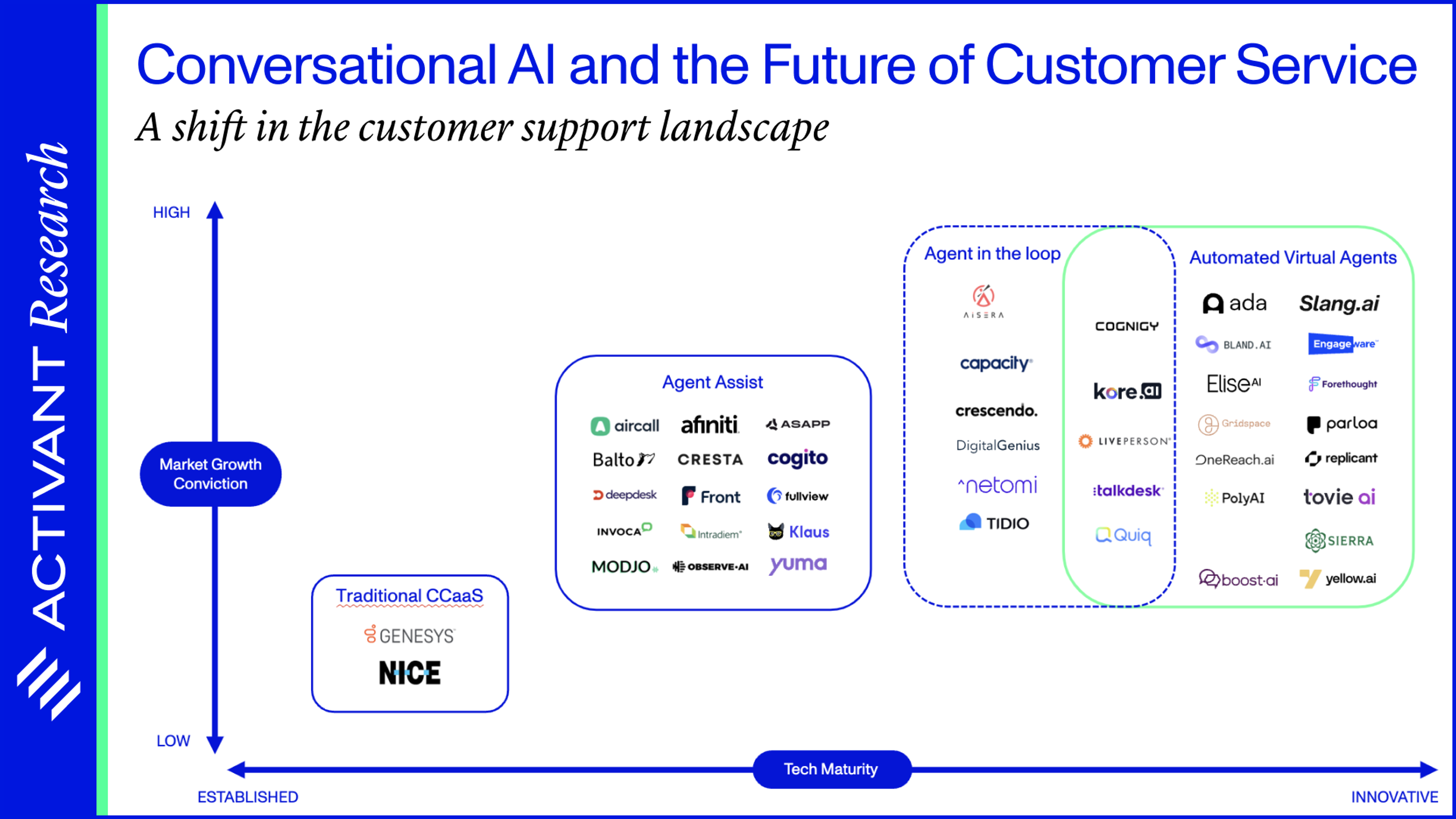

When we studied the market, it became clear that the solutions offered differentiated themselves on the degree of software orchestration (from simply understanding the issue to independent tech-enabled resolutions) and whether a human or software agent resolves the issue. Our Activant Market Map segments the market on this basis.

Market Map

Conversational AI

Winning in a crowded landscape is never easy but we think that vertically focused players offering voice solutions that leverage naturalistic speech and understanding will differentiate themselves.

Likely differentiators

Most customer service still takes place via voice/telephone and the share of voice-related service increased during Covid-19, indicating a strong user preference for the medium.6 Experts confirm that voice will remain the primary channel of customer service and that legacy voice automation solutions (Intelligent Voice Recognition (IVR) and self-service automation) frustrate customers, who largely express a preference for human interaction.

Natural-sounding voices are a major selling point when enterprises consider purchasing an automation solution, and naturalistic dialogue (where the AI dynamically responds to naturally phrased human input as opposed to presenting an ordered list of viable options) is valued by customers and end-users.7 Future automation solutions should, therefore, be highly naturalistic.

Vertical specialization increases model accuracy and results in the creation of data moats wherein domain-specific user intents can be learned and modeled by the software agent, thus increasing the number of context-specific tasks a solution would be able to solve (which a generalized solution would not be able to). Cognigy, for example, focuses on the manufacturing and financial services sectors and this gives them an advantage in acquiring new business as they increasingly develop domain-specific intents. User engagement can also be improved by using proprietary models in conjunction with open-source models to improve response accuracy, extract more intent from human input, and empower software agents to complete tasks in business systems of record. For example, Sierra uses a mix of models to ensure accuracy and reduce response latency, Boost.ai leverages OpenAI’s GPT3.5 alongside their in-house NLU model, and PolyAI makes use of third-party tools to enhance the naturalistic aspect of their voice models.

The importance of these differentiators will increase over time as we believe that switching costs will decrease. One enterprise customer described how it took six weeks to switch their solution, with the biggest inhibitors being the need to build integrations into ERP and CRM systems as well as training human agents in the system. However, they were open to switching again in the future if a better product became available. We believe that switching costs will decrease over time as companies develop better pre-trained models (likely limited by vertical) and can more quickly achieve higher containment rates.

The solutions that we find the most attractive are “Automated Virtual Agents” (software solutions which are capable of independently understanding an issue, deducing a path to its resolution, and solving the issue without the intervention of a human agent) as shown in the Activant Thesis Map. There does, however, exist some overlap between firms that address the customer service end-market by augmenting the abilities of human agents while automating some portion of the agent’s work (Agent in the Loop) and Automated Virtual Agents.

Thesis Map

Conversational AI

A few (early) interesting contenders

We have identified a few interesting players based on the work we have done in the space:

PolyAI has an enterprise-grade product that performs well in terms of naturalistic language, issue resolution and routing accuracy. A customer interviewed cited 50% containment rates using PolyAI – an 8x increase over the containment rates that they previously achieved with another leading product. They believed that the product could replace as many as 40% of the current human agents as it can handle complex use cases and multi-turn conversations with a long context window.

Sierra has recently emerged from stealth and is a surprisingly compelling example of an enterprise-ready product. Sierra’s agents are quick to deploy and integrate deeply into a business’ systems of record which allows them to act on customer issues such as updating customer information or updating a subscription. Sierra has overcome its lack of vertical specialization by orchestrating across several knowledge sources and AI models (both open-source and proprietary) to address different elements of the overall issue resolution workflow without losing context.

Boost.ai appears to have strong traction within its focused industry verticals of financial institutions, municipalities (Nordics) and utilities (UK). The company considers itself to be “middleware AI” and is confident enough in its product that it guarantees containment rates with a money-back guarantee if targets are missed.

Forethought offers a platform that learns from conversational data and knowledge-base articles, allowing it to deliver a more naturalistic solution. It also integrates into existing customer service processes, increasing efficiency without disrupting workflows. Forethought provides data schema and shares models directly with customers for observability. Customers claim a superior customer experience.

Parloa, LivePerson and Kore.ai all offer enterprise-grade platforms that effectively manage the orchestration of AI agents, integration with ERP & CRM suites, as well as providing “easy-to-use, out-of-the-box” functionality for business users.

… But it is a rapidly changing market

There is no doubt that this is an interesting market worthy of serious consideration for investment. The rate of AI research and product developments is impacting this market, and competition is intense –so intense that industry experts suggest that as many as half of the players could disappear over the next 12 months. Picking winners is always difficult, and in a rapidly changing world, it sometimes feels impossible! If our work resonates or you have a different perspective, please reach out!

Endnotes

[1] Hubspot, State of Service in 2022, 2022

[2] Forrester, How to make sense of consumer behavior after the pandemic, 2021

[3] McKinsey& & Company, The next frontier of customer engagement, 2023

[4] McKinsey& & Company, The next frontier of customer engagement, 2023

[5] McKinsey & Company, The state of customer care in 2022, 2022

[6] Forbes, 15 Stats about post-COVID customer service, 2022

[7] PR NewsWire Nearly 90% of People Prefer Speaking to a Live Customer Service Agent on the Phone, 2019

The information contained herein is provided for informational purposes only and should not be construed as investment advice. The opinions, views, forecasts, performance, estimates, etc. expressed herein are subject to change without notice. Certain statements contained herein reflect the subjective views and opinions of Activant. Past performance is not indicative of future results. No representation is made that any investment will or is likely to achieve its objectives. All investments involve risk and may result in loss. This newsletter does not constitute an offer to sell or a solicitation of an offer to buy any security. Activant does not provide tax or legal advice and you are encouraged to seek the advice of a tax or legal professional regarding your individual circumstances.

This content may not under any circumstances be relied upon when making a decision to invest in any fund or investment, including those managed by Activant. Certain information contained in here has been obtained from third-party sources, including from portfolio companies of funds managed by Activant. While taken from sources believed to be reliable, Activant has not independently verified such information and makes no representations about the current or enduring accuracy of the information or its appropriateness for a given situation.

Activant does not solicit or make its services available to the public. The content provided herein may include information regarding past and/or present portfolio companies or investments managed by Activant, its affiliates and/or personnel. References to specific companies are for illustrative purposes only and do not necessarily reflect Activant investments. It should not be assumed that investments made in the future will have similar characteristics. Please see “full list of investments” at https://activantcapital.com/companies/ for a full list of investments. Any portfolio companies discussed herein should not be assumed to have been profitable. Certain information herein constitutes “forward-looking statements.” All forward-looking statements represent only the intent and belief of Activant as of the date such statements were made. None of Activant or any of its affiliates (i) assumes any responsibility for the accuracy and completeness of any forward-looking statements or (ii) undertakes any obligation to disseminate any updates or revisions to any forward-looking statement contained herein to reflect any change in their expectation with regard thereto or any change in events, conditions or circumstances on which any such statement is based. Due to various risks and uncertainties, actual events or results may differ materially from those reflected or contemplated in such forward-looking statements.