Topic

Automation

Published

February 2026

Reading time

19 minutes

Selling AI-Native Service, Now.

The Playbook for Selling Autonomous IT to Enterprise Buyers

Selling AI-Native Service, Now.

Download ArticleResearch

If you’ve been following our work, you’ll know that we believe we are entering a new economic era where intelligent systems are poised to 5X software’s share of GDP, transforming both how enterprises operate and where value accrues.1 The next wave of IT charted the industry’s steady progression from outsourced IT labor to increasingly autonomous, agent-driven operations.

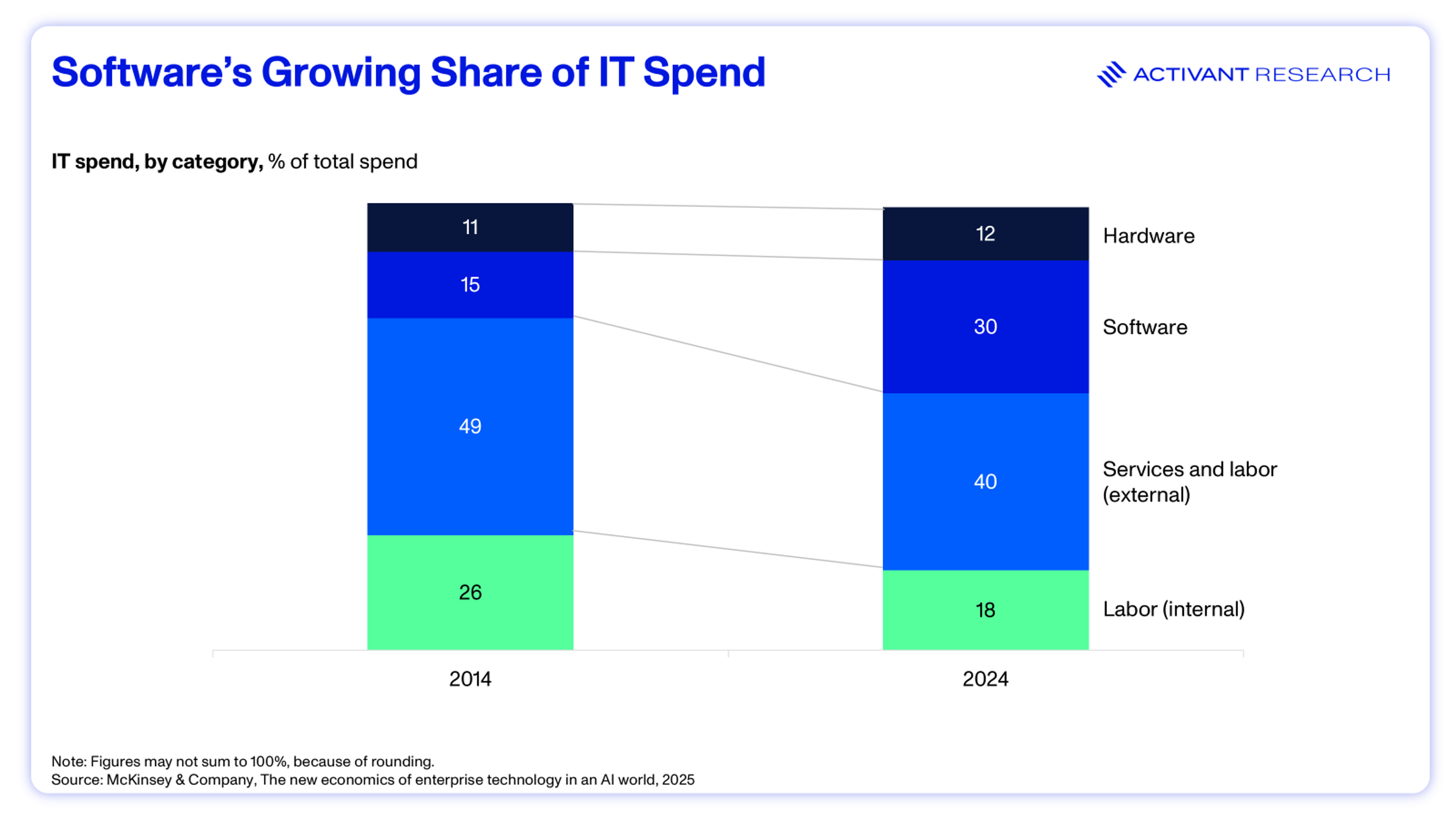

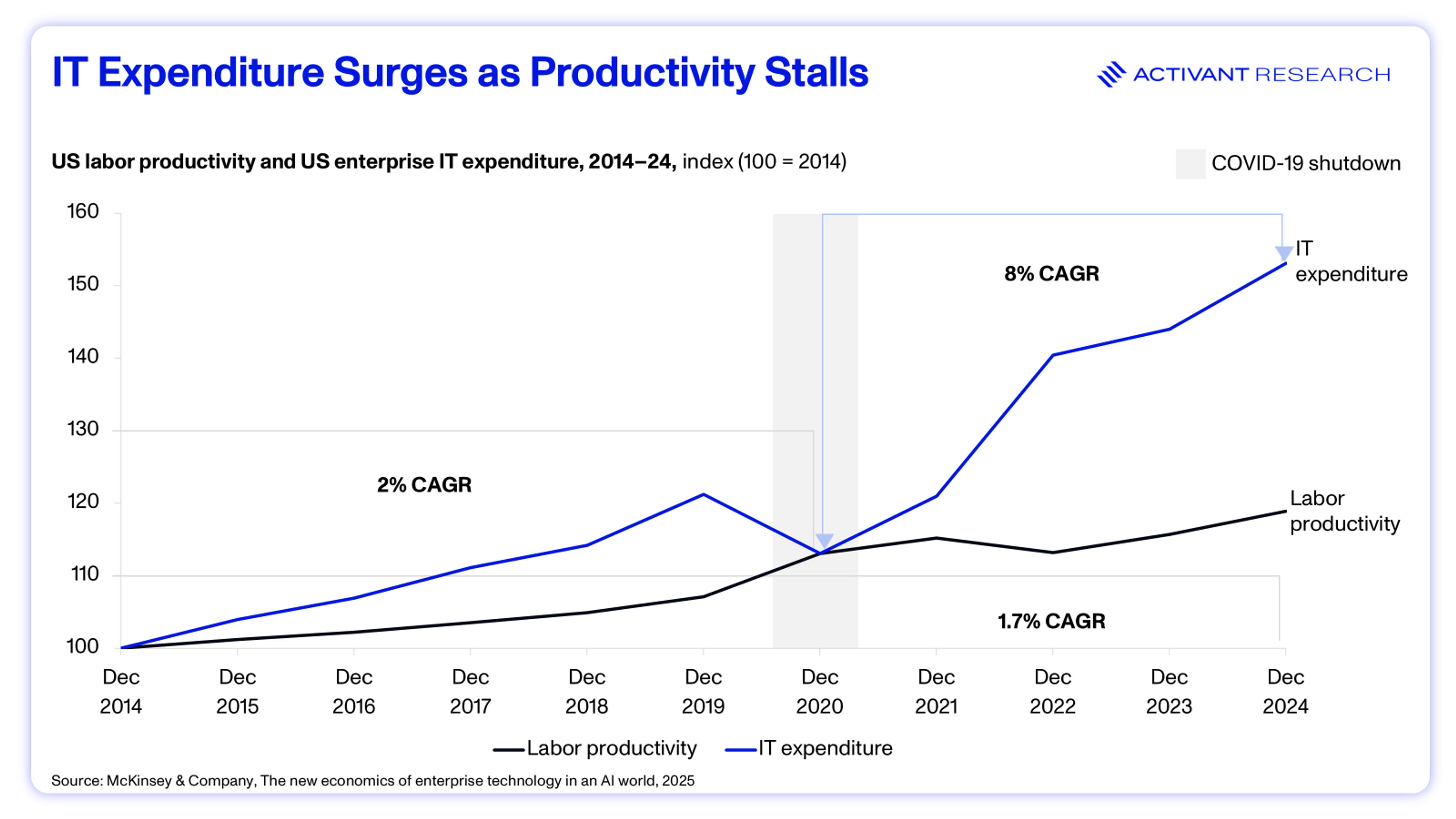

High-performing IT departments already show up to 35% higher revenue growth and 10% higher profit margins than their peers, according to McKinsey.2 Over the past decade, software has steadily absorbed work once done by people, taking a growing share of enterprise IT budgets.2

Nowhere is this transformation to Systems of Intelligence (SoIs) more visible or the potential ROI more immediate than in enterprise software asset management (SAM). Software is often the largest discretionary IT spend category for enterprises, with a global spend of more than $1.2 trillion annually.3 Unused licenses, redundant tools, and misaligned entitlements make up 30% of that investment, representing over $360 billion in lost value each year.4 AI-driven SAM promises a breakthrough by automating discovery, optimization, and compliance, a problem that traditional Systems of Record (SoRs) have failed to solve, transforming a reactive compliance function into the intelligence layer powering autonomous IT.

$360 billion

Global software spend wasted every year

But, this transition to SoIs that we are all so excited for, is bumping up against the entrenched nature of legacy SoRs. Decades of trust and entrenched market share keep these SoRs firmly embedded inside enterprises. Despite the promise of adaptive intelligence, most organizations remain stuck in a state of enterprise inertia, settling for bolt-on AI from incumbents rather than structural change. Under this status quo, we’re likely to see a continuation of the last decade’s trend – a significant increase in IT expenditure without the expected productivity benefit.2

History shows that breakthrough innovations rarely yield instant productivity results. The full economic impact of steam power on British output didn’t materialize until the late 19th century, nearly a century after James Watt’s patent.5 The same dynamic is unfolding with AI. We believe we are experiencing what economists call the productivity paradox, or J-curve: the tendency for performance to dip after adopting new technologies before rebounding with outsized gains in output, revenue, and employment.6

The reality is that SoRs have been the backbone of software for the past 20 years for a reason. In this report, we examine why SoRs remain so sticky and lay out the playbook for AI-native challengers to succeed with them.

Service is the Software, Now.

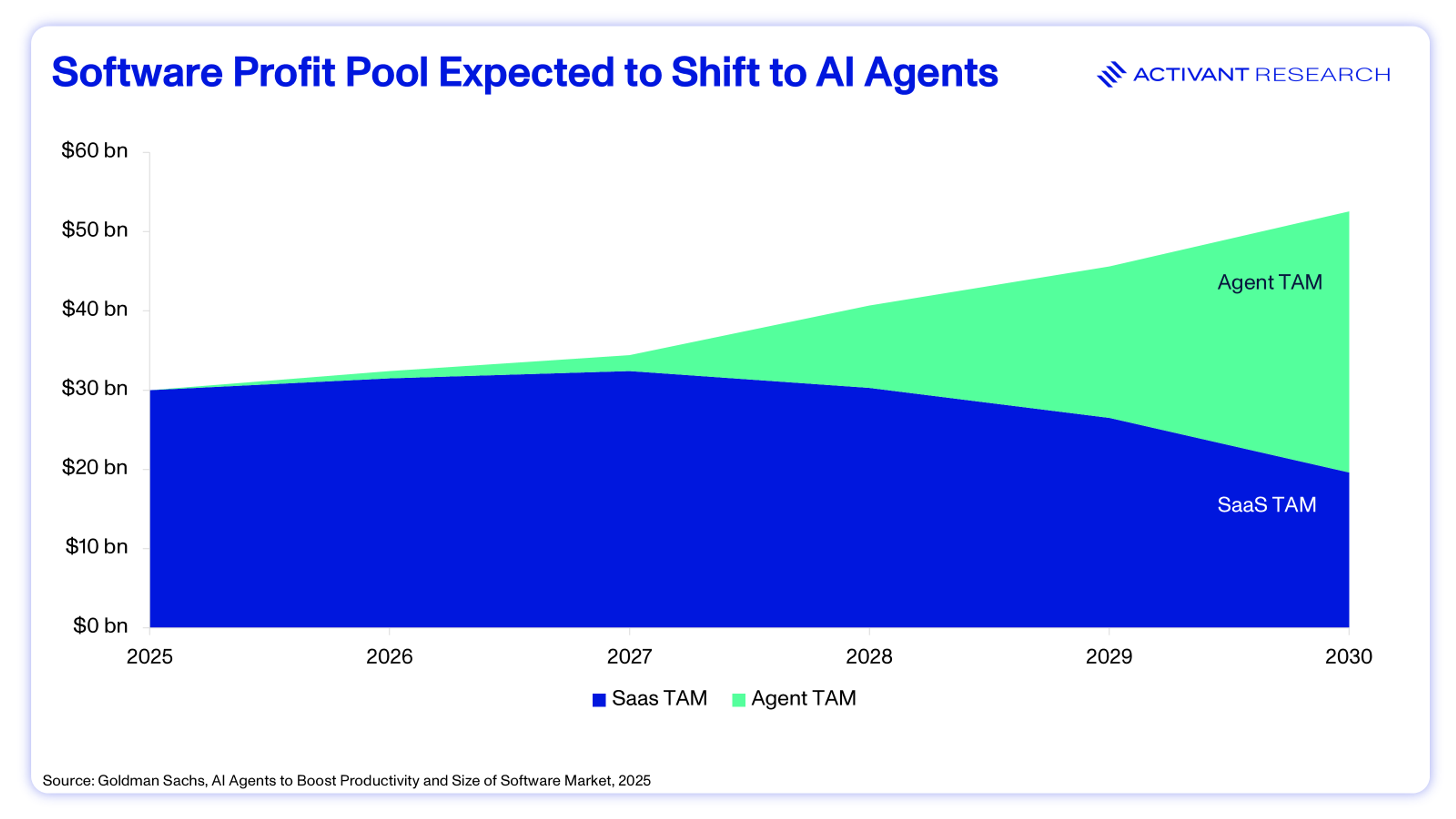

SoIs mark a clean break from the human middleware era, absorbing unstructured context to uncover insights, reason through complex scenarios, and autonomously execute tasks. By 2030, AI agents could account for more than 60% of the software market.7 This signals a decisive shift in value away from software as a service and toward service as a software, where autonomous systems deliver measurable outcomes.

Take IT Service Management (ITSM) as an example: A single large enterprise (100K+ employees with global IT operations) applying AI to core ITSM operations could realize ~$34M in annual business value, primarily through workflow automation, faster ticket resolution, and improved end-user support.8 Perplexity automated more than half of its support tickets with Serval, saving roughly ten hours per employee per week, while simultaneously tripling headcount.9 Scale AI quadrupled its ticket-automation rate after moving to Console and now supports its organization with a ratio of one IT hire per 300 employees versus the industry average of one per 23.10,11

As AI-driven systems move from automating repetitive IT tasks to orchestrating intelligent, cross-platform actions, SAM stands out for both its financial and operational impact. SAM sits at the convergence of licensing, SaaS operations and cloud consumption. With the shift to SaaS and multi-cloud accelerating, traditional siloed SAM tools are failing to bridge the widening visibility gap. SaaS spending surpassed on-premise software in 2022, and top vendors are phasing out perpetual licenses, driving costs up by an estimated 35%.12 According to Flexera’s State of IT Asset Management report, 45% of organizations surveyed incurred audit expenses exceeding $1 million, and 23% paid over $5 million in the last three years.4

Key challenges with current SAM include the complexity of software vendor use rights, the amount of time and money spent responding to audits, and the lack of resources on SAM teams.4 Activant portfolio company XOPS alleviates that pressure by eliminating the human middleware layer and automating the full software lifecycle management – mapping purchases, entitlements, assignments, devices, and actual usage. It provides organizations enterprise-wide visibility by ingesting existing telemetry and unifying data across employee access, procurement, and vendor entitlement into a confidence-ranked knowledge graph. With asset and entitlement truth in place, XOPS can autonomously execute actions such as license reclamation, right-sizing, and provisioning or deprovisioning to reduce waste and maintain compliance. The result is higher license utilization, always-on compliance monitoring, and materially fewer manual licensing tasks.

The SAM market is projected to more than double to $7.3 billion by 2029, with Gartner projecting that 60% of global enterprises will adopt AI-driven SAM and Financial Operations (FinOps), unlocking fivefold ROI through cost and efficiency gains.14,15 Buyer intent is closely tied to audit exposure, cloud sprawl, and AI era governance. By embedding intelligence directly into how software is allocated, monitored, and optimized, businesses can reduce waste, enable more precise provisioning, improve compliance, and lay the foundation for fully autonomous IT.

Within the SAM market, as is the case across broader IT and the enterprise, AI Agents have the potential to reallocate human capital from routine maintenance to strategic value, driving a permanent step-change in productivity.

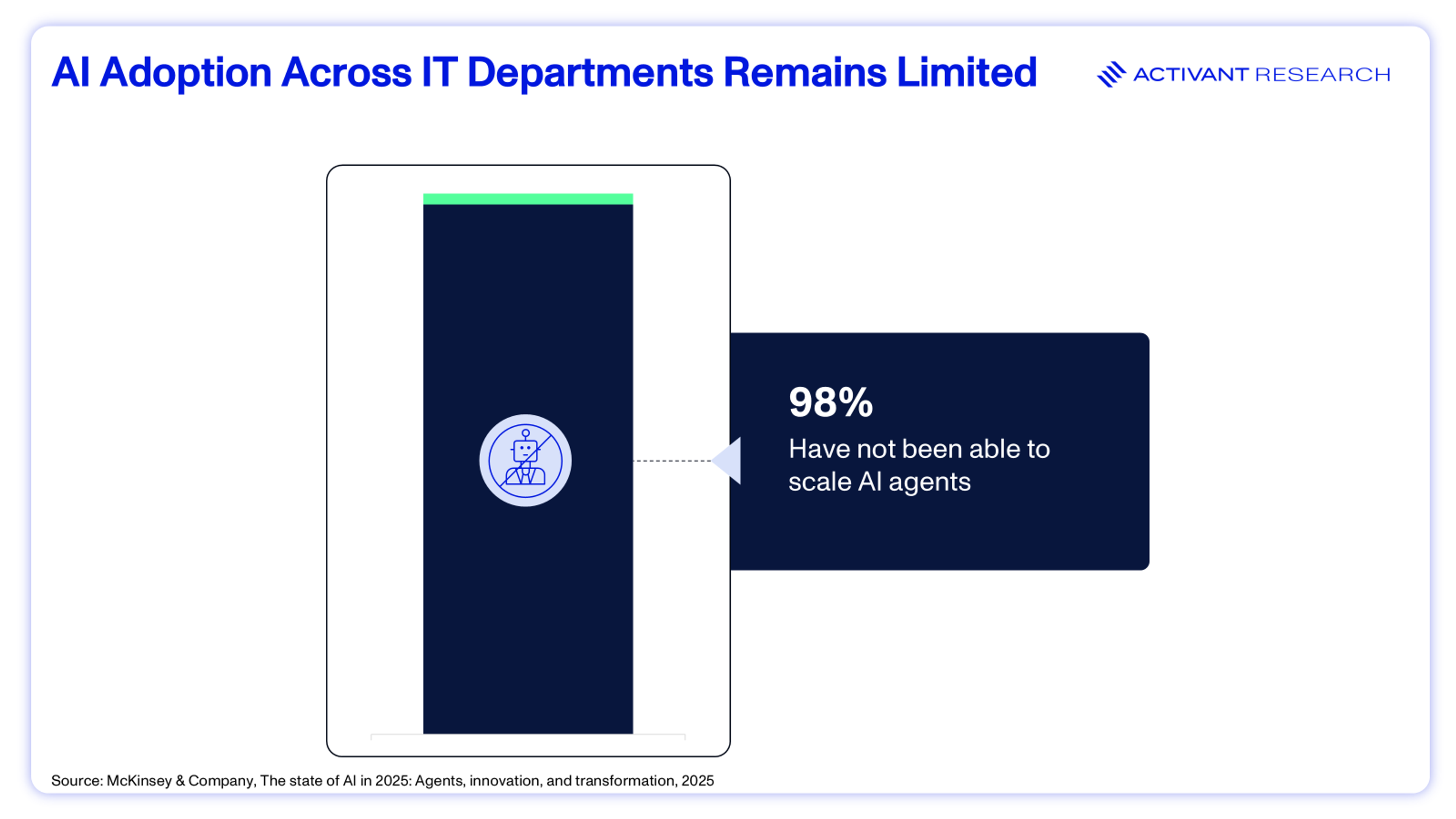

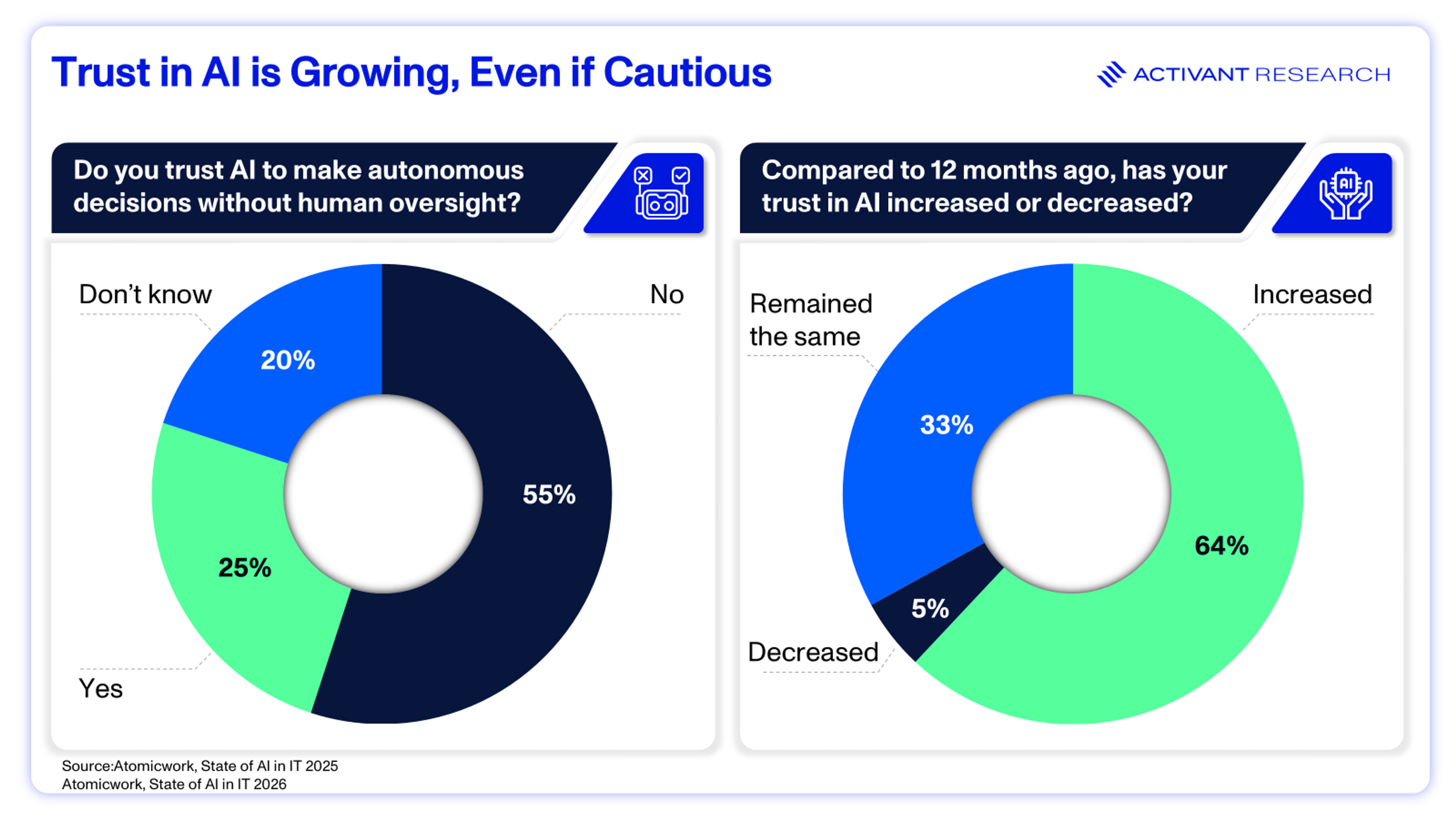

Despite the scale of this opportunity, less than 2% of IT departments have fully scaled AI agents, and 69% have yet to deploy them at all.16 This gap between promise and adoption raises an important question: What is holding enterprises back?

The Weight of Legacy

The appetite for AI is growing, yet overall adoption remains low. With headlines like “Why 95% of Enterprises Are Getting Zero Return on AI Investment,” it’s little wonder that many leaders are proceeding with caution.

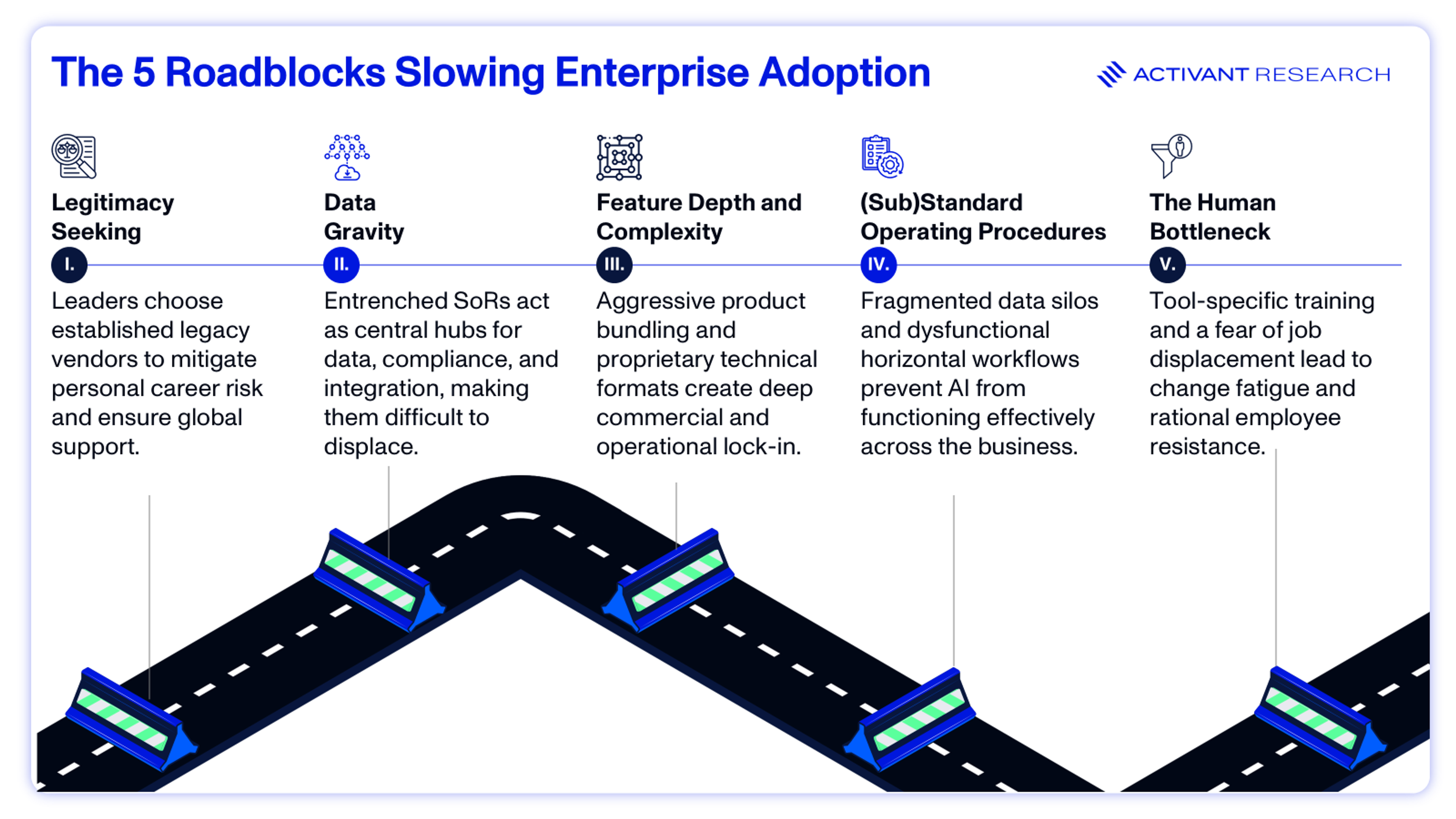

The critical complication is that this is not a simple AI-versus-non-AI battle. Incumbents are racing to bolt AI onto aging tech stacks, using their scale and distribution to dominate the narrative. This tension between agility and legacy sits at the heart of enterprise AI adoption. Even when the will to modernize exists, decades of technical debt and deeply embedded systems make transformation far harder in practice than in principle. Beneath the hype, most organizations remain stuck in enterprise inertia, opting for the path of least resistance by purchasing tools without dismantling established hierarchies.17 In most cases, the barrier to adoption is not the technology itself, but the structural and cultural hurdles that keep legacy systems anchored at the center of the enterprise tech stack.

I. Legitimacy Seeking: The Magic Quadrant Safety Net

With 70% of CEOs believing an AI crisis could cost them their job, executive strategy has moved from innovation to self-preservation.18 Leaders increasingly bypass innovative solutions in favor of the Gartner Magic Quadrant safety net. This behavior is known as legitimacy seeking: if a project fails with a legacy vendor, it is viewed as a market error; if it fails with a startup, it is a judgment error. As the saying goes, nobody ever got fired for buying IBM.

The global market reputation of legacy SoRs like ServiceNow function as a risk mitigator during procurement. ServiceNow has significant global reach, operating worldwide through a network of international offices, data centers and a large partner ecosystem, serving 85% of the Fortune 500 companies.19 For multinational enterprises, these incumbents offer necessary scale and support while functioning as default integration hubs, as third-party vendors prioritize building connectors to the most established platforms. Their reliability provides powerful social proof, positioning them as the obvious choice for enterprises operating across multiple regions.

II. Data Gravity

ServiceNow acts as a centralized data hub through its Service Graph Connectors, which provide a continuously growing library of certified, out-of-the-box integrations designed to quickly and easily load large volumes of third-party data into the ServiceNow Configuration Management Database (CMDB).20 This extensive connectivity wires the SoR into every downstream data flow and establishes it as the organization's single source of truth. Legacy SoRs further secure this position by providing the auditable provenance and lineage necessary for automated compliance with frameworks like GDPR and HIPAA. With historical data inextricably entangled in these governance processes, the SoR becomes critical for accurate reporting and meeting audit dependencies.

III. Feature Depth and Complexity

Driven by a mandate for efficiency, 87% of IT decision-makers are actively consolidating point solutions in favor of streamlined platforms in 2026.21 ServiceNow meets this demand by offering a single ecosystem that spans IT service, operations and asset management. It’s a "good enough" standard that simplifies budgeting, renewals, and vendor risk reviews.

This multiproduct strategy is visibly working. In 2024, 99% of net new ACV came from multiproduct deals, with 86% involving five or more modules.19 Through aggressive bundling and multi-year contracts, enterprises are effectively locked into paying for a Rolls Royce ecosystem to meet Prius-level needs. This dependency deepens as customers must purchase expensive discovery tools just to access basic functionality, while limited export tools make migration prohibitively difficult. Multi-year cloud commitments and proprietary data formats render platform shifts financially unviable. Consequently, the operational risk of untangling these complex integrations and the threat of downtime keeps most enterprises in place.

IV. (Sub)Standard Operating Procedures

Many companies remain trapped in pilot purgatory by layering AI onto dysfunctional processes instead of fixing the underlying structure.22 AI requires data to flow horizontally across the business to be effective (e.g., HR data informing ITAM teams), directly tying success to the readiness of an enterprise’s data estate. Yet most enterprises remain vertically siloed, fragmented by regionalized workflows (such as HR procedures differing between locations) that require costly customization.23

Siloed systems fracture visibility, reinforcing the axiom that you cannot automate what you cannot see. This opacity acts as the primary blockade to AI adoption, with 52% of professionals citing data quality as their leading barrier.24

The operational risk of bridging these integration gaps fuels a paralyzing fear of failure, causing 37% of companies to delay AI initiatives.18 The pressure for immediate ROI compounds this problem, pushing 70% of AI budgets toward easy-to-measure sales and marketing wins while leaving high-value back-office opportunities underfunded.25 The result is a cycle of "AI washing," where CEOs admit 35% of initiatives are merely performative optics.18

V. The Human Bottleneck

Legacy SoRs have conditioned the workforce to prioritize system mechanics, creating a talent pipeline anchored in vendor-specific credentials. Training is largely tool-specific, teaching employees how a system behaves rather than the underlying business logic. Adoption hinges on ease of use: if a tool feels difficult to master or disrupts workflow, employees experience it as an obstacle, not an enhancer.

In environments where employees context-switch more than 100 times a day and 80% report a lack of capacity, the introduction of new tools often triggers acute change fatigue.26,27 Even Workday had to launch an internal “Everyday AI” program to drive adoption of its own AI products.28 When tools are mandated top-down without consultation or adequate training, employees feel fear and frustration rather than empowerment. Less than a quarter (22%) of employees say their organization has communicated a clear strategy for how AI will change their specific roles, leaving them to navigate the transition alone.29

New York is officially tracking AI layoffs, Anthropic’s CEO predicts a 20% unemployment spike, and giants like Klarna and Salesforce are openly swapping headcount for algorithms.30,31,32 The fear of status loss can outweigh fear of job loss. Harvard Business Review observed a pattern of engineers concealing their AI use to avoid being seen as lazy, incompetent or dishonest.17 When the friction of learning meets the fear of replacement, resistance stops being about stubbornness and becomes a form of rational self-preservation.

On the surface, incumbents appear advantaged by scale, distribution, and enterprise entrenchment. In practice, they are no more advanced than the enterprises they serve.

Smoke and Mirrors

Legacy incumbents are no further ahead in the AI adoption race than new entrants. Despite management’s optimistic commentary, equity research reveals ServiceNow’s AI products require heavy customization and rely on aggressive discounting rather than delivering immediate out-of-the-box value.34 Partners report that polished demos often mask real-world complexity, leading to low consumption rates and ROI concerns.

Workday sees only single-digit percentage adoption across its primary AI SKUs.35 And less than 4% of Salesforce’s customer base is paying for Agentforce, with win-rates increasingly pressured by AI-native startups like Sierra and Decagon.36,37 These consistently low adoption figures confirm that incumbent scale does not guarantee AI success.

The AI potential is real – we can finally deliver the transformation enterprises have been promised for a decade. But getting there requires courage: will you leapfrog legacy architecture or incrementally improve? Either way, a healthy reckoning is coming. Customers are asking 'did we get 2x, 5x ,10x value for this investment?' Companies delivering genuine outcomes will win. The ones coasting on brand and lock-in will need to prove their worth – in results and in pricing."

Parisa Naseralavi, COO, XOPS; Former SVP, ServiceNow.

Adoption may feel slow as enterprises cling to legacy systems, entrenched operating models, and an understandable fear of change. But incumbents are visibly fumbling their transition to true AI-driven architectures. This creates a clear opening for challengers. By executing the SoI playbook, AI-native challengers can capitalize on this moment and capture a market that is wide open.

The Activant Playbook: Winning the Enterprise Buyer

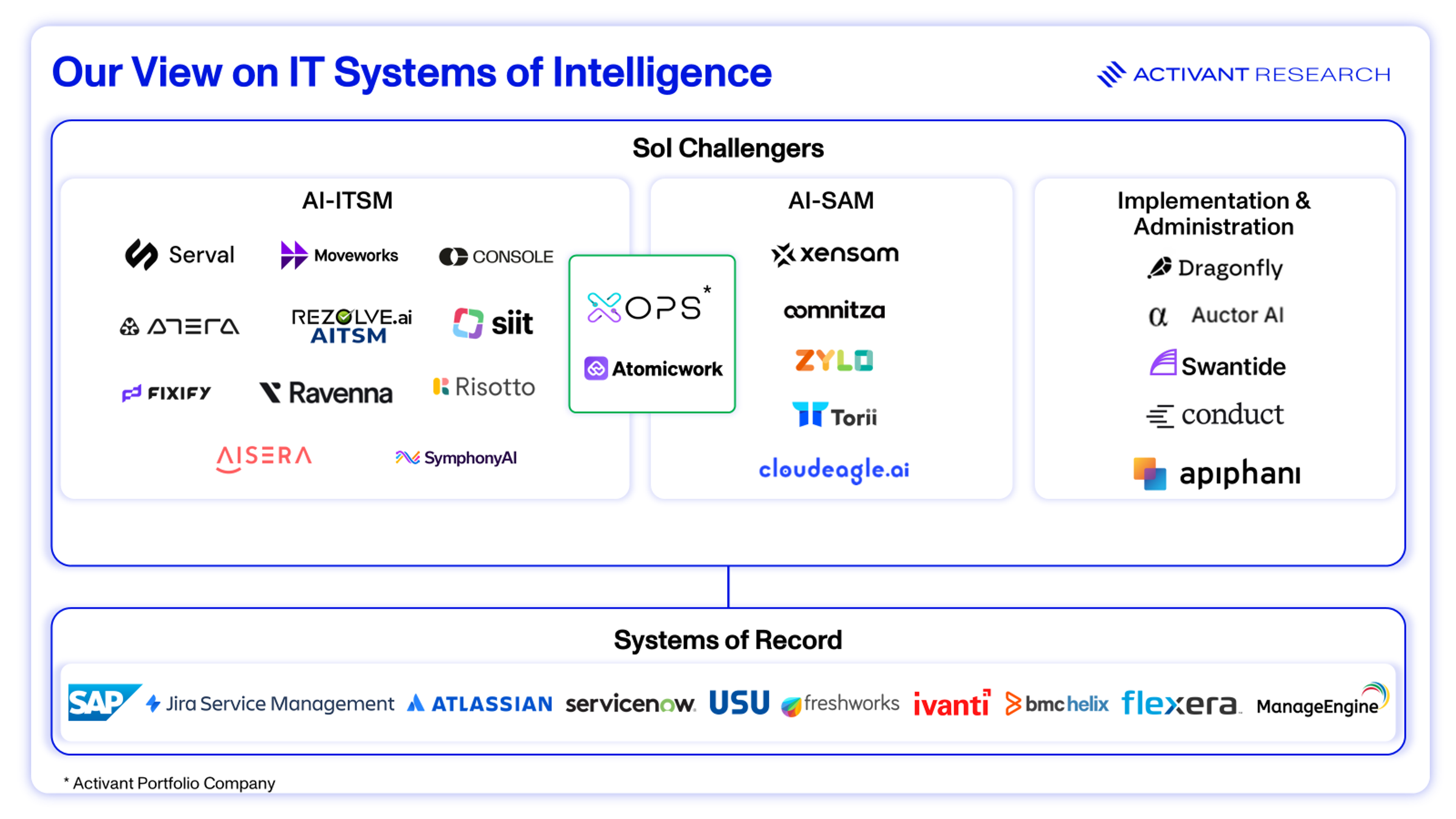

AI-native challengers such as Serval, Moveworks, and XOPS are moving beyond pilots and gaining meaningful enterprise adoption. Drawing on these early success stories and precedents set by adjacent leaders, we identify six core steps required to scale SoIs into the enterprise stack.

1. Respect your elders

SoRs are deeply entrenched. Pitching "rip and replace" is a failed strategy. Instead, successful challengers meet customers where they are by designing for architectural coexistence. This means prioritizing seamless integration and embedding within existing workflows, rather than forcing data duplication or platform migration.

Most enterprises incorrectly conflate a System of Intelligence with a traditional data lake, assuming they must duplicate data into a central repository to enable automation. Modern architectures, like Activant portfolio company XOPS, leave data within the SoR and employ an agentless, metadata-driven approach to construct a unifying knowledge graph. This integration provides real-time access to live data across disparate SoRs like HR, CRM and IT, supplying the context necessary for accurate execution.

This strategy relies on native connectors for plug-and-play implementation and bidirectional syncing to layer automation atop the existing stack with minimal friction. Serval and Risotto, for example, integrate via two-way syncs with existing ITSM platforms like Jira, ServiceNow, and Freshservice, ensuring that actions taken in the intelligence layer are instantly reflected in the record layer. Over time, this lays the foundation for gradual migration. Moveworks validates the financial viability of this "front door" strategy. By acting as an interface rather than a replacement, it scaled to five million users and over $100 million in ARR with roughly 250 joint customers before being acquired by ServiceNow for $2.85 billion.38

To maximize adoption, these systems must inhabit the workflows where employees already operate, reducing "swivel chair" friction while capitalizing on the distribution power of major platforms. Rezolve.ai demonstrates this by deploying directly in Microsoft Teams to capture Microsoft-centric organizations, while Serval and Console integrate deeply with Slack to tap into the Salesforce ecosystem. That said, building atop these dominant platforms introduces risk. Glean’s experience illustrates this clearly: after Salesforce revoked its Slack access, Glean was forced to pivot from extracting data out of Slack to pushing utility into Slack, ultimately securing its survival by becoming indispensable to users within the chat window itself.

2. Target strategic beachheads

Avoid moving upmarket too early. The strongest initial customers are those already aligned with AI-native architecture, often your AI-native peers. These companies have minimal legacy infrastructure and are willing to build alongside new platforms. Serval’s customers include Perplexity, Mercor, Together AI, and Abridge. Console works with Ramp and Scale AI.

From there, the mid-market offers the ideal next entry point, large enough to provide credible references yet agile enough to adopt new technology. Pepper Money’s switch from ServiceNow to Atomicwork is one such example.

Every enterprise eventually outgrows spreadsheets, slack channels and shared inboxes for IT, but very few are ready for the complexity and cost of ServiceNow. That's not just a gap but a massive, underserved market. We deliberately target companies at this inflection point because they're building their technology operational backbone for the first time, with no legacy workflows to untangle. When you're the system they grow up on, you don't just win a deal - you become new infrastructure."

Vijay Rayapati , Co-Founder and CEO, Atomicwork

Disruptive innovation begins with understanding your competitor’s behavior. Legacy incumbents behave rationally, optimizing for their biggest customers, highest margins, existing workflows, and quarterly expectations. In doing so, they overserve some segments while neglecting others. The opportunity lies with their most dissatisfied customers, particularly price-sensitive buyers trapped in bloated bundles and opaque AI add-ons.

The Activant expert network consistently cites pricing and packaging as the most acute sources of friction, with aggressive discounting reserved for net-new deals, while renewals face far tighter ceilings. As vendors like ServiceNow and Flexera continue to push pricing higher, customers are increasingly open to more economical solutions.

3. Evangelize your product

Customers using incumbents consistently report the same pain points:

- Steep learning curves: Unfriendly UIs and complex configurations require expensive, scarce expertise.

- Predatory pricing: Opaque licensing, 15-20% annual hikes, and implementation fees often exceeding 1.5x license cost.

- Slow time-to-value: Multi-month deployments and implementation bottlenecked by heavy reliance on third-party partners.

- Data inaccuracy: Poor visibility and unreliable CMDBs that undermine AI outcomes.

- Rigid lock-in: Forced feature bundling and long contract terms that prevent modular adoption or downsizing.

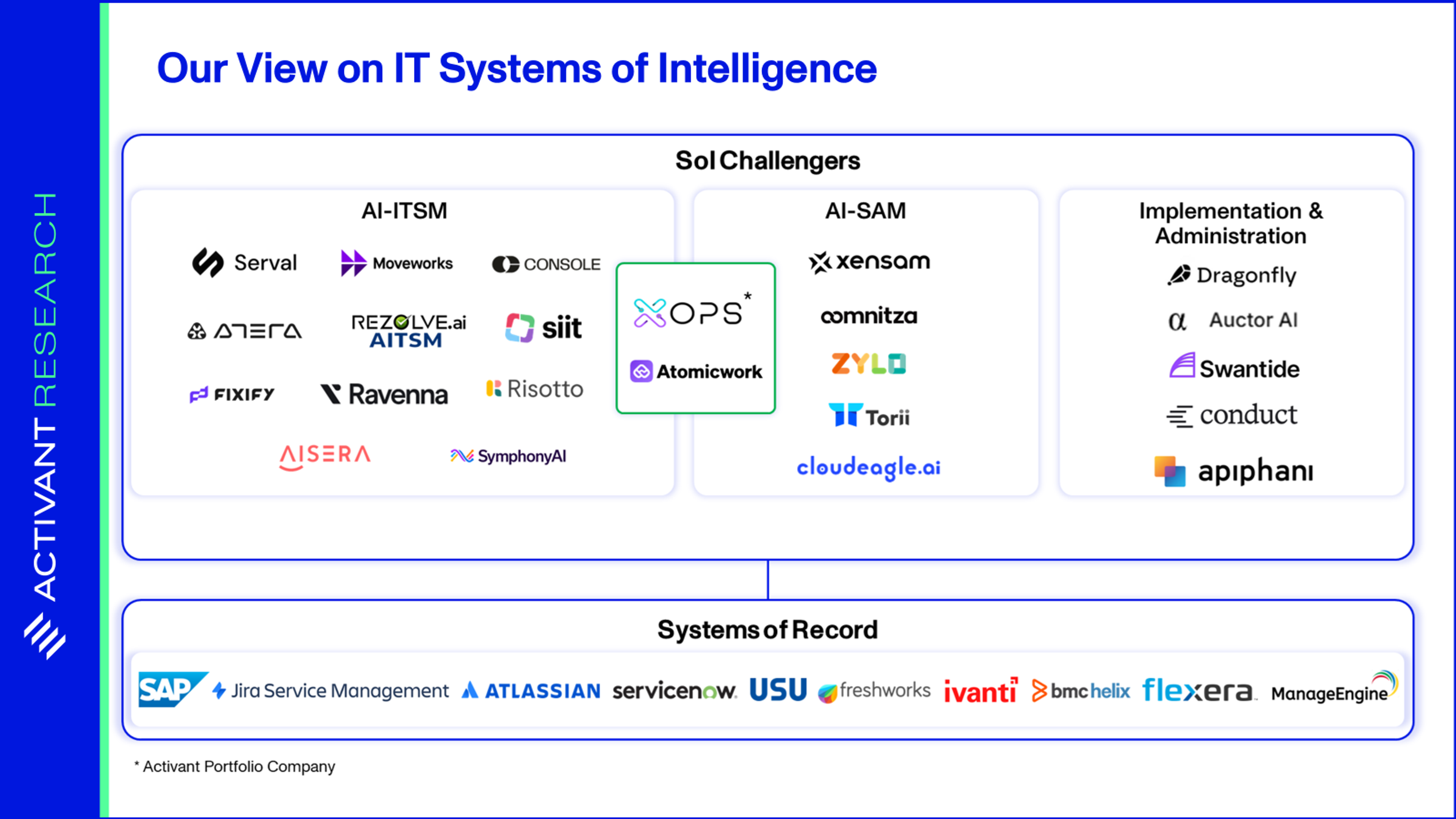

Market Map

Challengers should use these frustrations as a checklist for product evangelism. Winning means selling directly to the failures of the incumbent model.

a) Solve the data deficit with unified observability. With complete visibility into IT assets dropping year-over-year to just 43%, enterprises are effectively flying blind.4 Installing additional discovery agents increases performance drag and operational overhead. AI-native solutions like Activant portfolio company XOPS address this by connecting disparate data sources and metadata through agentless discovery, creating a single pane of glass and bypassing the need for manual CMDB remediation.

b) Dismantle the package wall with transparent modularity. Incumbents force buyers into opaque bundles, gating basic capabilities behind "Pro" tiers. Challengers must differentiate through clarity, offering focused, modular architectures backed by simple, transparent pricing. Even amid consolidation trends, a recent BCG survey found IT leaders are more satisfied with focused vendors than with broad, multipurpose providers.39 Allowing enterprises to adopt specific use cases without the bloat validates buyer demand for flexibility and predictable pricing.

c) Clearly define success. In a climate where leaders cut projects that cannot prove immediate value, the 23-month ROI timeline of platforms like Ivanti ITSM is a liability.40 The focus must be on intuitive usability and immediate time-to-value, shifting the metric from long term theoretical savings to immediate work completion. Intuitive UX combined with quick wins, closes the adoption gap by removing friction between the user and the software.

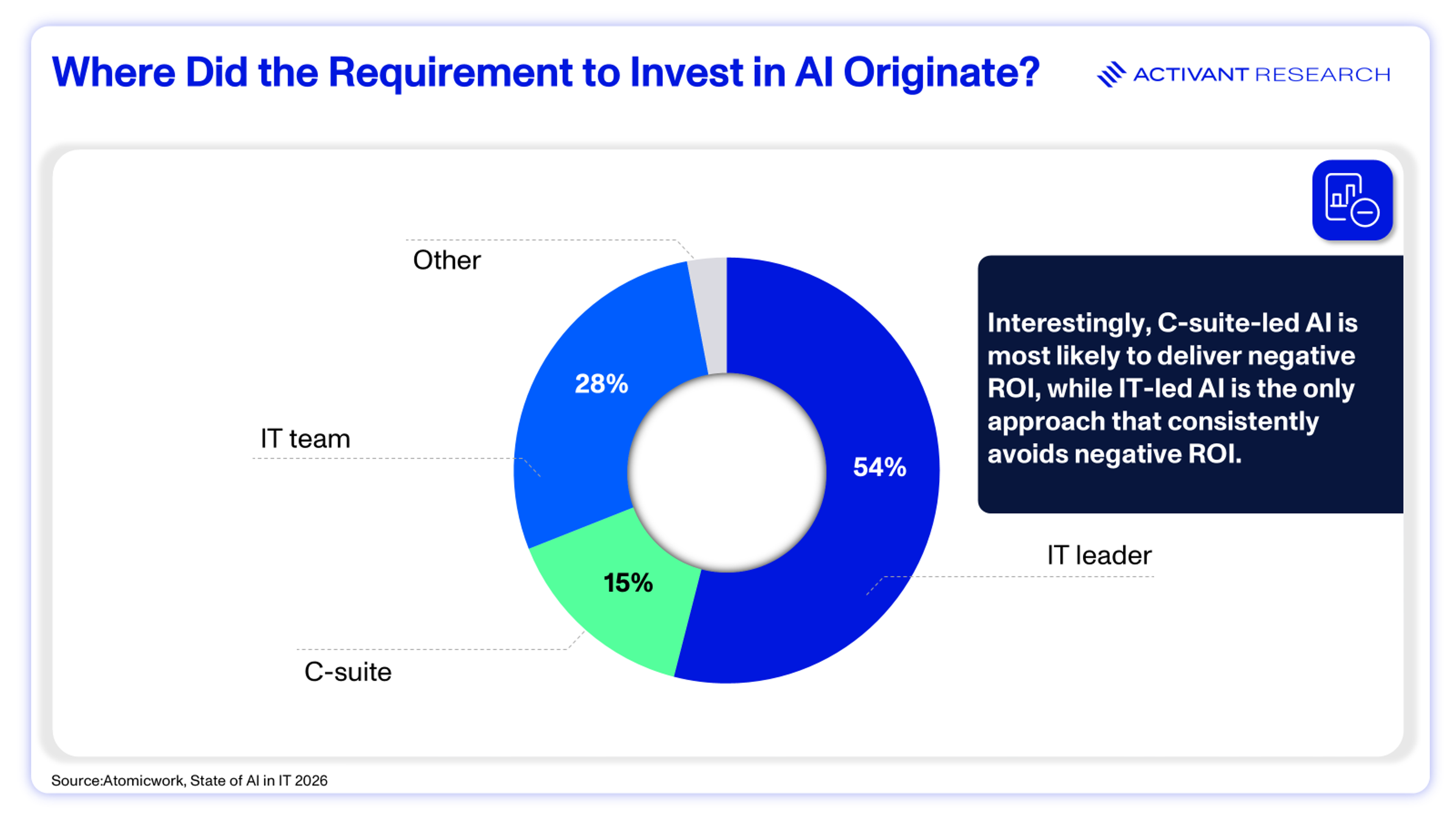

4. Create internal champions

Disruption rarely starts at the top. Data confirms that executive-led AI initiatives are the least likely to generate positive ROI and significantly more likely to destroy value. In contrast, AI investments originating within IT teams consistently avoid negative ROI.41 With roughly 70% of applications purchased outside of IT’s direct oversight, founders should lean into the shadow AI economy.21 Offer a superior, sanctioned alternative that users fight to keep. Products that make employees visibly more effective will gain momentum organically.

This loyalty is reinforced by positioning AI as a vehicle for upskilling, rather than a headcount-reduction tool. With 85% of employers prioritizing workforce development, the most compelling tools are those that move employees from repetitive, manual work into higher-value, architectural roles.42 Scale AI’s adoption of Console illustrates this dynamic: users will "go down fighting" for tools that level up their careers, cementing a retention moat that top-down mandates can never replicate.10

5. Build trust through scaffolding

Earning enterprise trust is a multi-year architectural commitment starting with non-negotiable security stakes like SOC 2 and GDPR. From there, trust must be scaffolded. Successful platforms offer a phased path to autonomy, starting with low-risk, human-in-the-loop assistance before graduating to fully autonomous agents. Atera exemplifies this by using its "Copilot" to build technician confidence, earning the right to deploy "Autopilot" for independent resolution. This incremental approach proves reliability on high-volume, low-stakes tasks without triggering the enterprise immune system.

Strict guardrails and total traceability are essential. Every AI action must be inspectable, reversible, and attributable. Serval builds this trust by translating natural language prompts into audit-ready scripts, while Atomicwork constrains action through identity-authenticated skills. Third-party validation further compounds this credibility. As Aisera (acquired by Automation Anywhere) demonstrated, Gartner recognition paired with concrete ROI data remains essential in risk-averse enterprises.

6. Capture context, not just data

In our view, the real value unlock of a SoI is its ability to provide a durable contextual layer. SoRs excel at capturing usage, spend, and activity but rarely capture intent. They do not explain why a license was deprovisioned, why a tool was purchased, which alternatives were considered, who owned the decision, or what outcome was expected. That context lives outside the system, scattered across Slack threads, emails, documents, and human memory. As with any new employee, SOPs provide the baseline, but real understanding comes from seeing how work actually gets done.

This demand for enterprise context is fueling a new wave of AI-native startups, from enterprise search platforms like Glean and Guru to workflow intelligence companies such as Scribe, Worktrace AI and Activant portfolio company, Celonis. By connecting internal data sources and mapping how work flows across tools, these platforms enable AI agents that can execute and automate workflows end to end. Dragonfly operates upstream as a discovery and decision-intelligence layer. It helps businesses shape their future operating models based on their existing tech stack, constraints, governance requirements, AI-readiness, and strategic priorities, all while preserving the context behind those decisions for future use. The future enterprise will move beyond systems that simply record what happened toward systems that understand why it happened and use that insight to shape what comes next.

The real opportunity with AI isn’t just better tools, it’s a chance to rethink how every enterprise operates. No human can hold the full context of a modern enterprise tooling stack in their head, but AI can help us reason across that complexity. The next generation of companies will be built on discovery and decision intelligence, not just automation layered on top of yesterday’s thinking."

Sean King, Co-Founder, Dragonfly

Together, these steps convert early traction into enterprise scale by earning the trust of the cautious enterprise buyer and laying the foundation for migration to an AI-native architecture with systems that are truly intelligent.

Earning the Right to Reason

For all the excitement around AI-native systems, the reality is more evolutionary than revolutionary. SoRs remain anchored by data gravity, governance requirements, procurement inertia, and human habit. SoIs represent a structural reallocation of value from static software to autonomous service. But that shift will not be delivered through bolt-on features or cosmetic AI overlays. Enterprises that take the path of least resistance today, choosing incumbent AI add-ons over architectural change, are effectively compounding future cost, complexity, and AI debt. What appears safer in the short term ultimately makes the long-term transition to autonomy harder, slower, and more expensive.

For now, SoRs are here to stay. Successful AI-native challengers acknowledge the stickiness of the current stack and design around it. The playbook is clear: integrate rather than replace; target beachheads where pain is acute; sell directly against incumbent failures; empower users as champions; scaffold trust toward autonomy; and capture context so intelligence compounds over time.

Endnotes

[1] Activant Capital, Systems of Intelligence: The Replatforming of Enterprise Software, 2025

[2] McKinsey & Company, The new economics of enterprise technology in an AI world, 2025

[3] Gartner, Gartner Forecasts Worldwide IT Spending to Grow 7.9% in 2025, 2025

[4] Flexera, State of IT Asset Management Report 2025, 2025

[5] Oxford Economic Papers, Slow real wage growth during the Industrial Revolution: productivity paradox or pro-rich growth?, 2021

[6] Center for Economic Studies (CES), The Rise of Industrial AI in America: Microfoundations of the Productivity J-curve(s), 2025

[7] Goldman Sachs, AI Agents to Boost Productivity and Size of Software Market, 2025

[8] Symphony AI, AI-powered gains in service, resolution, and efficiency, 2025

[9] Serval, Perplexity Transforms IT Ops with Serval, 2025

[10] Console, How Scale AI 4x’d their Ticket Automation Rate By Switching to Console, 2025

[11] Indeed, What Is the Ideal Ratio of IT Staff to Employees?, 2025

[12] Zylo, Defining Software License Management in the Age of SaaS, 2025

[13] Flexera, State of IT Asset Management Report 2025, 2025

[14] Markets and Markets, Software Asset Management Market Size, Share, Industry Analysis, 2024

[15] Gartner, Magic Quadrant for Software Asset Management Managed Services, 2025

[16] McKinsey & Company, The state of AI in 2025: Agents, innovation, and transformation, 2025

[17] Harvard Business Review, Overcoming the Organizational Barriers to AI Adoption, 2025

[18] DATAIKU/HARRIS POLL SURVEY, Global AI Confessions Report: CEO Edition, 2025

[19] ServiceNow, ServiceNow ranks on Fortune 500® list for third year in a row, 2025

[20] ServiceNow, Integrate third-party data efficiently, 2025

[21] Flexera, 2026 IT Priorities Report, 2025

[22] Asana Work Innovation Lab, State of AI at Work, 2025

[23] Activant ecosystem interviews

[24] AI Data & Analytics Network, Data quality & availability top list of AI adoption barriers, 2025

[25] MIT, The GenAI Divide STATE OF AI IN BUSINESS 2025, 2025

[26] Microsoft, Work Trend Index Report 2025: The year the Frontier Firm is born, 2025

[27] Lokalise, Too Many Tools, Too Little Time: How Context Switching Is Killing Team Flow, 2025

[28] Yahoo Finance, How software giant Workday got 79% of its employees to embrace AI, 2025

[29] GALLUP, AI Use at Work Has Nearly Doubled in Two Years, 2025

[30] Bloomberg, New York State Updates WARN Notices to Identify Layoffs Tied to AI, 2025

[31] AXIOS, Behind the Curtain: A white-collar bloodbath, 2025

[32] CNBC, AI-washing and the massive layoffs hitting the economy, 2025

[33] Harvard Business Review, Overcoming the Organizational Barriers to AI Adoption, 2025

[34] Guggenheim Securities, LLC, NOW 3Q25 Preview: Limited Upside, All Eyes On Fed, 2025

[35] Jefferies Research, Workday, Inc: 35-Page Survey Points to In-Line Q, Steady Execution, 2025

[36] Northland Capital Markets, Salesforce (CRM) Downgrading to MP as ARPU Growth from AgentForce Fails to Materialize, 2025

[37] Jefferies Research, Salesforce.com: F3Q Preview: Neutral Checks Point to In-Line Q, 2025

[38] Investor’s Business Daily, ServiceNow Acquires AI Startup Moveworks In $2.85 Billion Deal, 2025

[39] BCG, IT Spending Pulse: With Rising Optimism, CIOs Pursue Targeted Investments in AI and Security Priorities, 2025

[40] G2 Reviews, Ivanti Neurons for ITSM, 2025

[41] Atomicwork, State of AI in IT 2025, 2025

[42] World Economic Forum, Future of Jobs Report 2025, 2025

[43] Console, How Scale AI 4x’d their Ticket Automation Rate By Switching to Console, 2025

Disclaimer: The information contained herein is provided for informational purposes only and should not be construed as investment advice. The opinions, views, forecasts, performance, estimates, etc. expressed herein are subject to change without notice. Certain statements contained herein reflect the subjective views and opinions of Activant. Past performance is not indicative of future results. No representation is made that any investment will or is likely to achieve its objectives. All investments involve risk and may result in loss. This newsletter does not constitute an offer to sell or a solicitation of an offer to buy any security. Activant does not provide tax or legal advice and you are encouraged to seek the advice of a tax or legal professional regarding your individual circumstances.

This content may not under any circumstances be relied upon when making a decision to invest in any fund or investment, including those managed by Activant. Certain information contained in here has been obtained from third-party sources, including from portfolio companies of funds managed by Activant. While taken from sources believed to be reliable, Activant has not independently verified such information and makes no representations about the current or enduring accuracy of the information or its appropriateness for a given situation.

Activant does not solicit or make its services available to the public. The content provided herein may include information regarding past and/or present portfolio companies or investments managed by Activant, its affiliates and/or personnel. References to specific companies are for illustrative purposes only and do not necessarily reflect Activant investments. It should not be assumed that investments made in the future will have similar characteristics. Please see “full list of investments” at https://activantcapital.com/companies/ for a full list of investments. Any portfolio companies discussed herein should not be assumed to have been profitable. Certain information herein constitutes “forward-looking statements.” All forward-looking statements represent only the intent and belief of Activant as of the date such statements were made. None of Activant or any of its affiliates (i) assumes any responsibility for the accuracy and completeness of any forward-looking statements or (ii) undertakes any obligation to disseminate any updates or revisions to any forward-looking statement contained herein to reflect any change in their expectation with regard thereto or any change in events, conditions or circumstances on which any such statement is based. Due to various risks and uncertainties, actual events or results may differ materially from those reflected or contemplated in such forward-looking statements.