Topic

B2B Commerce

Published

September 2024

Reading time

19 minutes

Usage-Based Billing

Not new, but likely never more important

Usage-Based Billing

Download ArticleResearch

Usage-based billing (UBB) isn’t new, but it likely has never been more important. We are all used to paying for the products and services provided by utilities, mobile phone companies, doctors, dentists, and ride-hailing services like Uber based on what we consume, the service provided, or the distance traveled. In fact, UBB has been around since the beginning of commerce when a value was placed on a good or service and you “paid for what you used.”

Pricing is a powerful lever, and smart strategists shifted many pricing models to bundles or flat fees to maximize revenues and profits. This was particularly prevalent in the early days of software pricing and is still used by many companies today. Asana, Atlassian and Figma, for example, price almost exclusively on a subscription basis with rates tied to the number of user seats, company size, location and functionality included. Streaming companies like Netflix, Hulu and Spotify do the same with a single access fee and unlimited use of the platforms. SaaS companies, however, have begun to change the game and Openview1 reports that 3 out of 5 now have some form of UBB2 and this number is expected to increase to 80% or more in the next few years. The $660bn global software market is forecast to continue growing at a compound annual growth rate (CAGR) of at least 5.6% for the next five years, with the $228bn SaaS market growing even quicker at a CAGR of 7.3%.3 We believe that this market development, along with the explosive growth of AI, will fundamentally change the way software and services are priced and that UBB will become an essential component of pricing plans. In fact, given that pricing is increasingly becoming a data problem and that customer experience is paramount, the platforms that win will likely be data- and customer-centric hybrid pricing solutions!

Pricing is a Growth Lever

Many of us have been schooled in the notion that “price drops to the bottom line,” and this is true for most businesses. If products have positive unit economics and fixed costs can be leveraged, a large portion of price increases do indeed flow through to the bottom line. The reality of optimizing a business, particularly a growth business, is naturally a lot more difficult. Price impacts customer acquisition and, when considered with retention, the lifetime value (LTV) of an account. The ratio of LTV to the customer acquisition cost (CAC) is the math that your entire business is based upon, and investors obsess about it. Optimizing price is an imperative and a key lever for growth.

There is no shortage of pricing models to choose from. Consider cost-plus, value-based, competitor-based, location-based, bundle pricing, and dynamic pricing, just to name a few. For many online businesses and cloud-based software solutions, the default was a subscription pricing model where users were charged a recurring fee for continued access to the product or service. The environment, however, is changing and UBB models are becoming increasingly common.

Rise of Usage-Based Billing

The rise in UBB is being driven by a few powerful forces that are likely to increase as the cumulative impact of the changes they are fueling become self-reinforcing. In the short and medium term, we see no end to the positive impact on UBB of the following.

- Increased levels of automation, driving up the number of machines consuming services rather than their human operators. Software is interacting with software, so it is very tough to comprehend, monitor or control what is happening without tools to support visibility and rules to govern the interactions. In addition to this, it goes without saying that automation typically leads to productivity improvements and the replacement of human labor so shifting from seat-based subscription models to UBB makes a lot of sense.

- Ubiquity of application programming interfaces (APIs) and the ability to seamlessly and effortlessly connect to sources of data and services to build into new products and services, often in real-time.

- Rise of AI, which is compounding the impact of automation on jobs and creating whole new use cases for data and services at all levels in the stack, from infrastructure to middleware and front-end applications. As companies add AI features, often on top of OpenAI or other models, they need to fundamentally rethink pricing to ensure that margins are maintained, and that value can be extracted from “power-users” (or machines) scaling usage disproportionately.

- Importance of tokenization and the role that it plays in AI, data security and Web3 applications.4 Tokenization is used to chunk data to facilitate easier pattern detection in AI, to obfuscate identity and limit cyber threats as part of data security efforts, or to digitize assets to make them more accessible in Web3 blockchain or digital asset applications. In all cases, processing efficiency increases and handling the smaller data packages lends itself to being valued by usage and impact. It also makes the process of managing user usage data more complex and the need for clean, reliable billing data even more important

- Shift to product-led growth (PLG), with its focus on profitable growth rather than growth at any cost, aligns interests and reduces barriers to purchase if you get paid as your customers use your product. To facilitate the frictionless upsell that characterizes many PLG initiatives, UBB and clean data is essential.

The economic environment is likely also playing a role and in higher interest rate environments there is always a premium on limiting borrowing, reducing burn, preventing churn, and encouraging growth through net revenue retention and acquisition. Usage, not users, is simply a better way to price under these conditions.

Usage-Based Billing Models

Just as there are a myriad of different pricing models, so too is there a range of different usage-based options. Some of the better-known usage-based models include:

- variable pricing, based on quantity or volume used.

- pay-as-you-go, simply paying for what you consume.

- tiered pricing, where prices are set in increments with clear thresholds.

- dynamic pricing, where prices are adjusted based on total system demand and personal consumption.

- feature pricing, based on specific tools and features used.

There is seldom a perfect solution and one size doesn’t fit all. As always, the answer is “it depends”!

One Size Doesn’t Fit All

UBB has a lot of advantages but is not always a good thing and there are a few disadvantages that must be considered alongside the advantages.

Advantages of UBB

First and foremost, UBB is customer centric. Users are only charged for what they consume and are never billed for services they don’t use. Customers don’t overpay for services they never access and can align costs with revenues as they grow their businesses. In this way, UBB supports PLG. Billing is transparent and consumption can be itemized. There should be no surprises (except for situations where you use more than you had anticipated) and, when coupled with self-monitoring tools, it is empowering for users. Multiple users can access the same account and billing is consolidated. For infrastructure providers, UBB allows them to charge for the demand put on platforms and systems by heavy users rather than having these customers subsidized by average and light users of the infrastructure.

Perhaps the most significant advantages, however, are those that can be quantified and support the growth of both your business and that of your customer. OpenView has done some terrific research on the subject and reported 9% higher net revenue retention for usage-based SaaS companies compared to the broader SaaS market.5 Many vendors, including Stripe,6BillingPlatform,7 and M3ter,8 claim that UBB reduces customer and logo churn because of the control it gives them, the alignment of objectives, and higher customer satisfaction. The estimates of reductions in churn rates vary widely (from ~10%-30%) and, while we could not independently verify any of the data, this aligns with the perspectives we gained from market experts.

Experts also reported that UBB expands total addressable markets (TAMs) by making products more accessible and lowering barriers to trial and usage. Similarly, auto-renewal of services encourages ongoing usage and expands TAMs. Many expect that net promoter scores (NPS) and customer usage will more closely align over time, allowing superior products and offers to rise to the top.

Collectively, these benefits lead to increased customer satisfaction and loyalty. Bain reported that 80% of customers surveyed for their 2022 Technology Report were satisfied with the better value they received from consumption pricing.9 The same report stated that nearly half of software companies using UBB say it helped them acquire more customers, and two-thirds said it helped them increase revenues with existing customers. This is powerful data and supports the fact that most of the fastest growing SaaS companies employ UBB.10

Disadvantages of UBB

There are naturally some disadvantages associated with UBB and it is not always the best option to pursue. It goes without saying that to use UBB one needs to be able to identify and measure usage metrics, which is not always straightforward. It sometimes takes time to find appropriate metrics to monitor and charge for, or to build a baseline. Having accurate, reliable usage data is essential and this can be an obstacle or take a while to line up. We have heard from finance teams that older systems sometimes can’t identify and reconcile usage data accurately, leading to billing errors and the associated complaints and hassles to address.11 Many of the newer UBB providers are using this “disadvantage” as the reason why teams need them!

We mentioned above that customers can sometimes lose track of their usage if there are no monitoring tools in place, which could lead to unpredictable costs. For UBB service providers, the opposite can be an issue and revenue may be less predictable as customers can throttle back usage to meet budgets or handle cash crunches. It is also easier to switch if there are no long-term contracts or subscription agreements in place.

For many customers, usage-based pricing offers a compelling map of price to value. But if you've ever been on the other side of a 10,000-page AWS bill you know that understanding the value is difficult. To build trust in usage-based pricing you need to give your customers continuous access to their usage and spend data. To support this, your billing system needs to be a data system that users can query, not a black box.”

Scott Woody, Co-founder & CEO, Metronome

We believe that these disadvantages are relatively minor when compared to the significant benefits that UBB offers and, in most cases, they can be managed. One way to manage pricing plans is not to stick religiously with one model or another but instead to use a hybrid pricing model.

Hybrid Pricing

SaaS companies are increasingly turning to hybrid pricing models. Openview’s 2022 Financial & Operating SaaS Benchmarks Survey highlighted that 41% of SaaS companies surveyed either offer usage-based subscription plans or were testing UBB alongside traditional subscriptions.12 Only 15% of companies largely used UBB, while 61% used some form of UBB. Like others, we believe that hybrid pricing models are the future of SaaS.

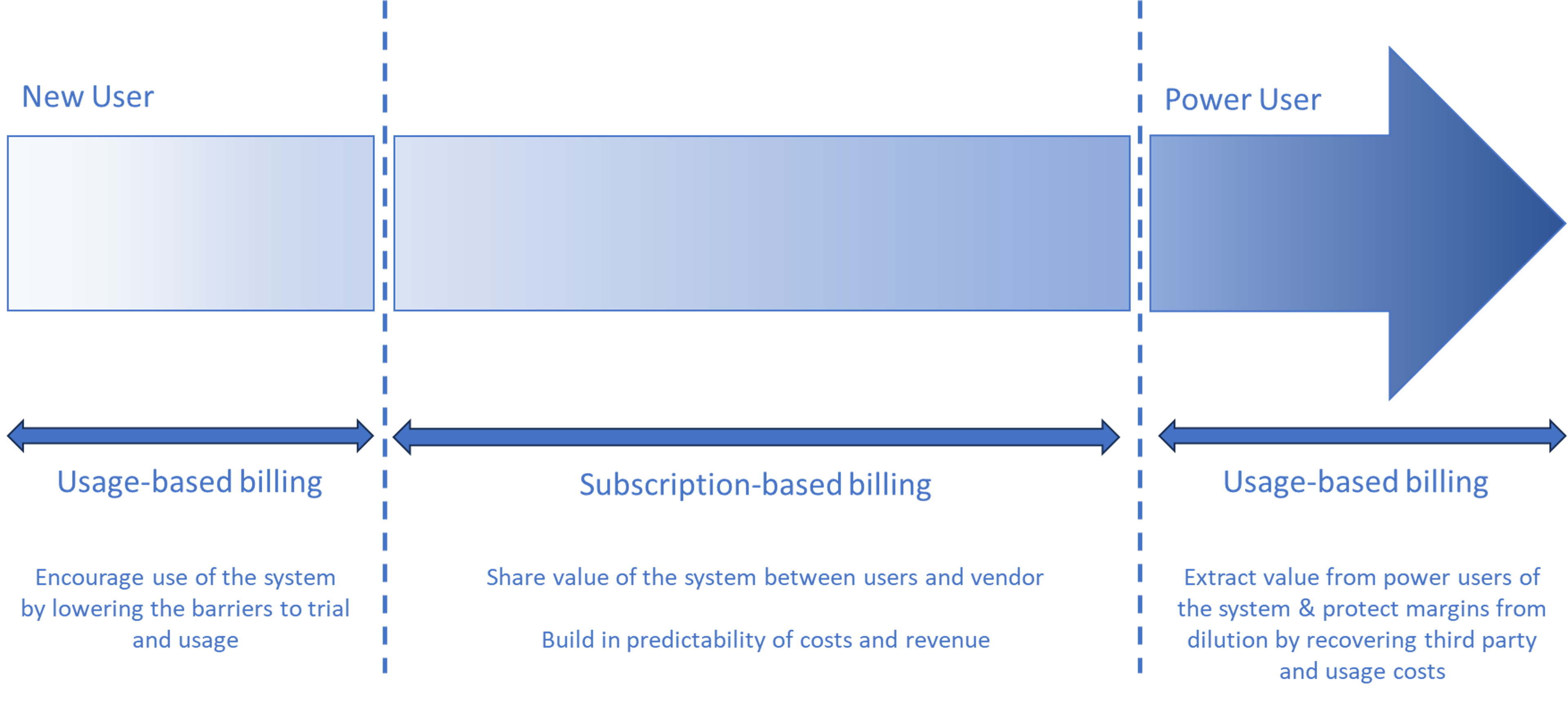

One of the reasons we believe that hybrid pricing models are the future of SaaS is the change in needs and usage along the customer journey. Customers often need incentives to try new products and vendors should do everything in their power to lower the barriers to trial and usage. At this stage it makes sense to offer UBB terms over per-seat subscription fees as the value typically accrues to new users. Once customers are comfortable with the product and see the value, it is easier to have the conversation around subscription contracts, which provide cost certainty for the users and revenue predictability for the vendors. These contracts are, on average, fair to both parties but the equation breaks down as the ratio of power users increases. This is particularly true if the vendor must absorb usage-based costs such as compute or third-party fees and royalties for embedded software or models. In these instances, UBB again makes more sense to recover some costs from power users (or machines) and protect margins. Hybrid pricing models address this challenge and align the interests of both parties along the customer journey.

Research

Suitability of Pricing Along the Customer Journey

As pricing gets more complex, we are seeing the rise of the modern pricing tech stack and ecosystem of solutions.

Almost every company with usage-based pricing has a need to better automate their tech stack and move away from brittle home-built solutions to this challenge. However, needs differ. Earlier stage AI and data companies will typically need fast computation of high volumes of events for relatively simple pricing challenges. Later stage companies will need accurate calculation for complex multi-product pricing models, often with a lower volume or frequency of events. I believe we’ll see solutions become more specialized around each of these challenges over time.”

James Wood, Head of Product, m3ter

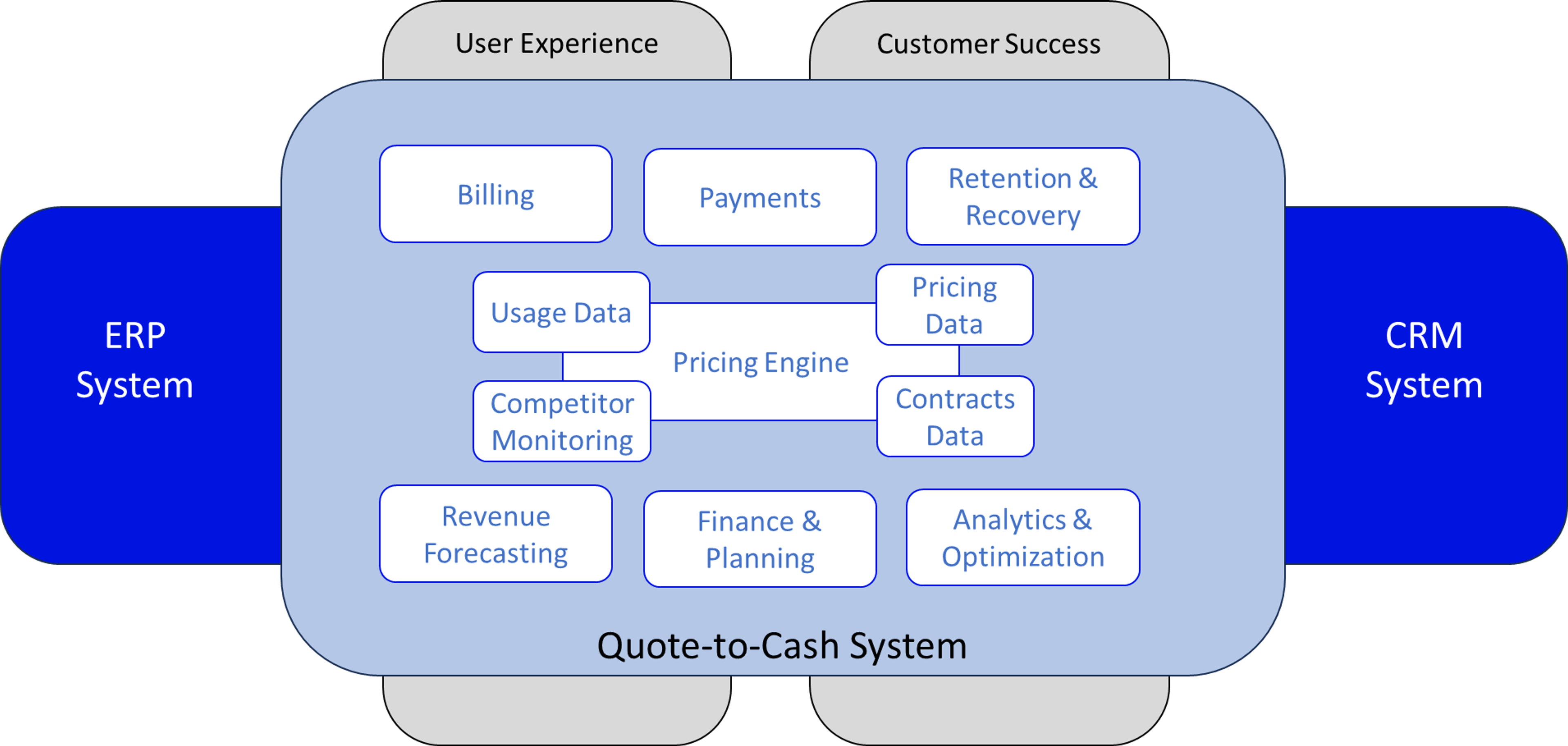

The Rise of the Modern Pricing Systems Ecosystem

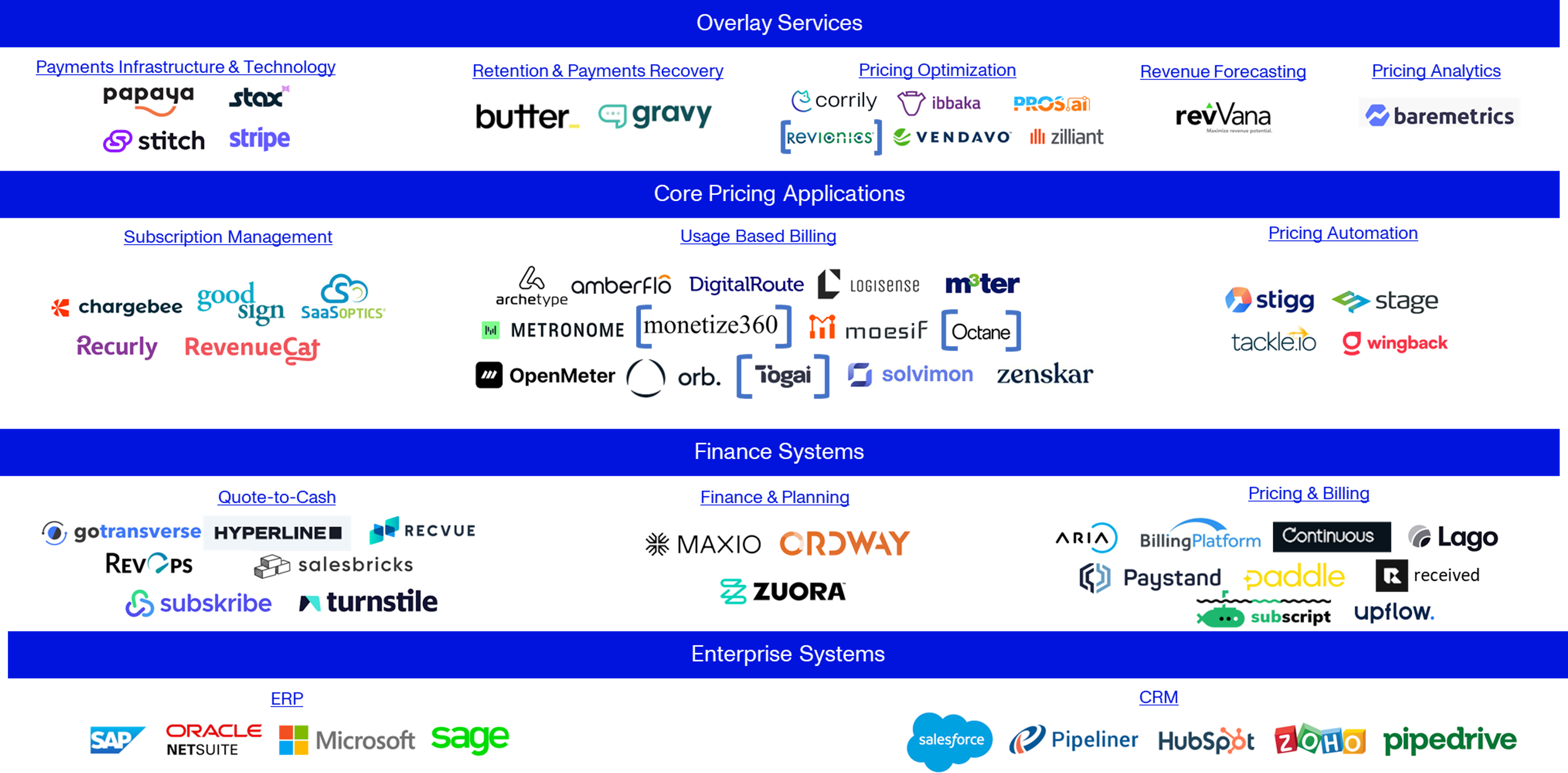

Rather than describing the various elements of the modern pricing tech stack — from data warehouses or lakes to the data cleaning and pre-processing tools required, data enrichment applications, analytics and modeling tools, enterprise platforms, execution engines, security solutions, and audit and control systems — we found it more helpful to think about the systems ecosystem that the specific pricing applications need to operate in. Most companies have the tech stack needed to implement UBB and other related pricing applications, but these solutions need to exist and operate within the broader context of the enterprise. Our Activant view on the modern pricing systems ecosystem, depicted in the diagram below, is somewhat stylistic but we think it includes all the critical elements.

Research

Our View on Modern Pricing Systems Ecosystem

Large enterprise solutions — like ERP systems, CRM applications, and core finance systems — are the central nervous system of any organization and UBB and other related applications require bi-lateral integration to draw from and update these systems. Some organizations have “quote-to-cash” (QTC) solutions that they use, while others leverage pricing operations platforms to capture usage data, process it against pricing and contracts data, and send it out to billing and payments systems. While there are a handful of exceptional point solutions in the market, most solutions that we looked at have functionality and modules addressing several core tasks. Pricing engines, for example, are likely to include some form of configure-price-quote (CPQ) functionality along with subscription and UBB modules. Analytics and optimization functionality is often contained within larger enterprise, finance or pricing platforms but there are also a few very good stand-alone solutions that integrate seamlessly into the enterprise suite.

We believe that the most successful modern pricing systems embrace the notion that pricing is fundamentally a data problem, and that customer experience is paramount. The drivers of the rise in UBB are all fundamental shifts and in each case, they imply a significant increase in the amount of data that needs to be processed. Data infrastructure and architecture plays a role, and the fidelity of data is key. Some players choose to aggregate data while others have decided to pre-aggregate. This naturally impacts some elements of performance and should be considered when choosing the solution and provider best suited to particular needs. The systems are becoming so complex that users can no longer intuitively understand where they are, and they need dashboards and tools to understand usage and the associated risks and benefits to the business. The platforms that will win are likely to be both data- and customer-centric.

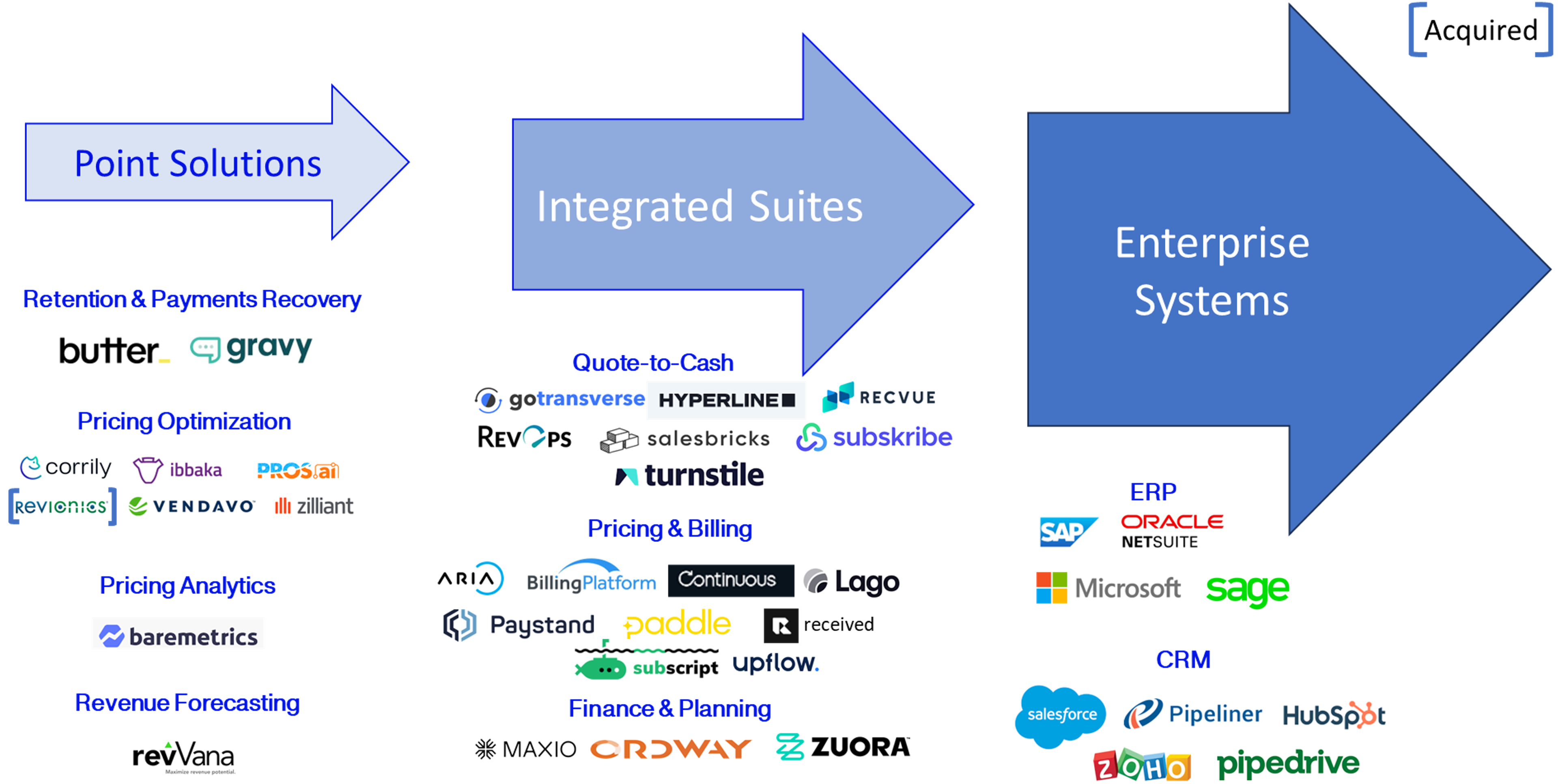

Range of Pricing Solutions

The point solutions that we like in the market are very good at the core task that they were designed for, and they typically integrate easily and seamlessly into other systems. Dunning providers like Butter, for example, address failed subscription payments and integrate directly with a company’s payment processor and subscription management platform. They work with commercial tech stacks like Stripe, or your homegrown platform. Similarly, Baremetrics offers excellent subscription analytics and integrates with many of the best-known payments platforms and providers, including Chargebee, Recurly, Stripe, Braintree and Paddle.

A characteristic of the market over the past few years has been the acquisition of point solutions by larger platform players or those looking to build integrated suites. Stripe, for example, acquired UBB platform Octane. Zuora, a cloud-based finance platform that provides services to launch and manage subscription businesses, acquired Togai to integrate its UBB capabilities. Monetize360, a no-code platform that simplifies and accelerates pricing and billing automation (including usage-based), was acquired by Ericsson. Price Intelligently was acquired by Paddle.

The integrated suites all partner with the leading ERP, CRM and other enterprise solutions to offer simple integration. Gotransverse, an enterprise billing and revenue management platform, highlights its partnerships with Workday, Salesforce, Oracle Netsuite, Stripe, Adyen, Braintree and ThomsonReuters’ Onesource, amongst others. These integrated suites can replace the functionality of core enterprise system modules or complement them selectively as the large vendors all have modules addressing core pricing functionality, including UBB.

Research

Range of Pricing Solutions

Collectively these solutions make up the pricing market landscape.

Pricing Market Landscape

We think of the pricing market landscape as a series of layers that build upon one another as required. At the base there are the core enterprise systems that often have much of the pricing functionality required, and above this are the core finance systems that organizations may use. This will include (QTC systems, finance and planning tools, as well as pricing and billing applications. Beyond this, we consider core pricing applications — subscription management systems, UBB applications, and pricing automation solutions — and finally, the overlay services that add incremental value.

Research

Pricing Market Landscape

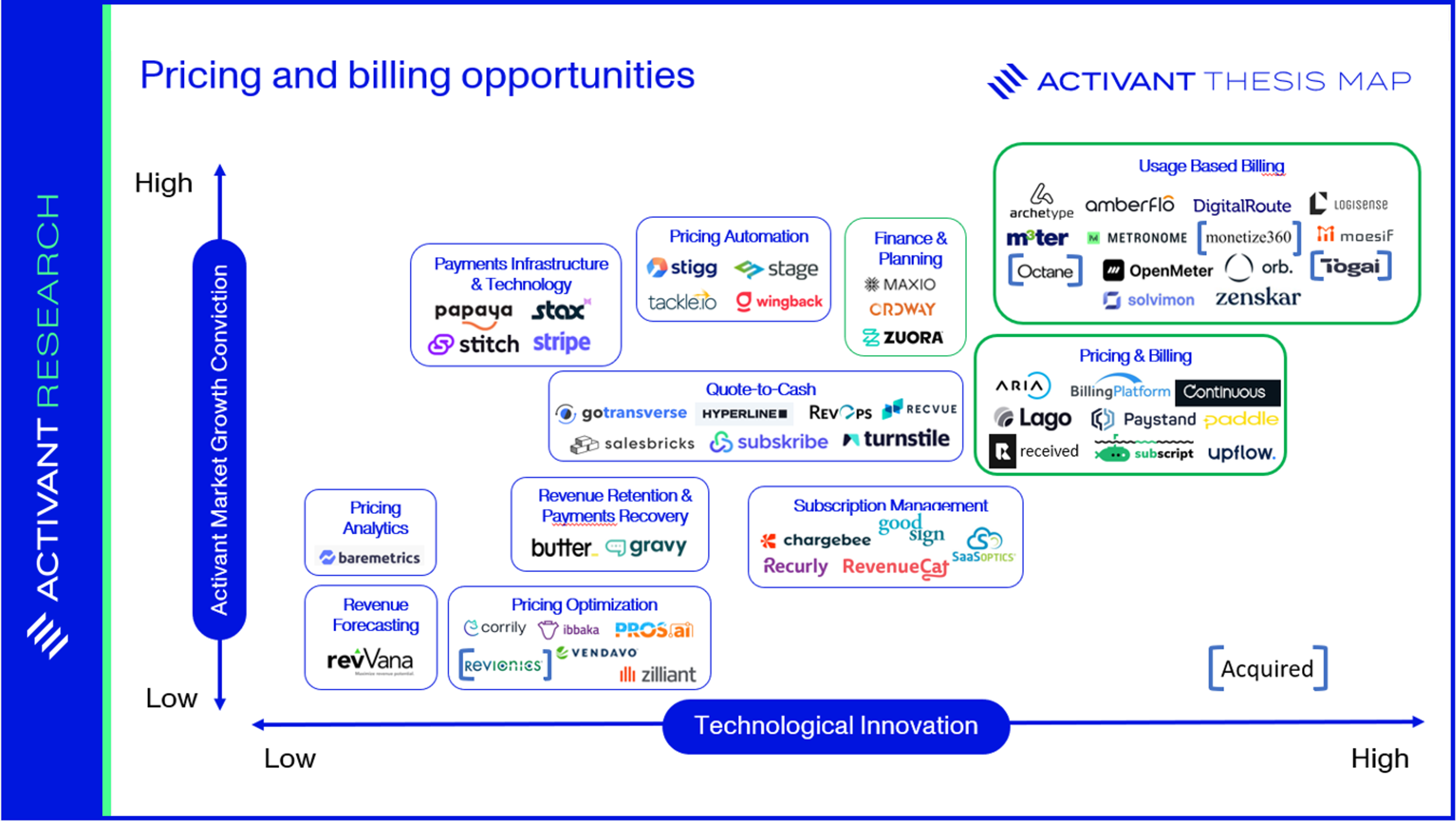

Our core belief that UBB, while not new, likely has never been more important than it currently is naturally shaped our work. The logos presented on the exhibit above are representative and not an exhaustive mapping of all players. We have focused on the players specifically offering UBB functionality.

As alluded to above, the segments that we defined, and the players shown within each, are not “mutually exclusive and collectively exhaustive” (MECE). We attempted to place companies in segments aligned with their core functionality and what they are best known for, but we readily admit the limitations of our approach and categorization. BillingPlatform, for example, is an enterprise billing platform that has excellent CPQ functionality that one could argue belongs in the QTC segment. A similar argument could be made that gotransverse, which describes itself as an enterprise billing and revenue management platform, is so much more than a QTC system that it should be considered as part of the billing platform segment. Both solutions have UBB functionality. A concept that is very important and related to UBB is revenue recognition. Most of the UBB players offer some form of revenue recognition functionality along with their core metering and billing modules, reinforcing the fact that each UBB player is so much more than the point solution that our mapping may suggest.

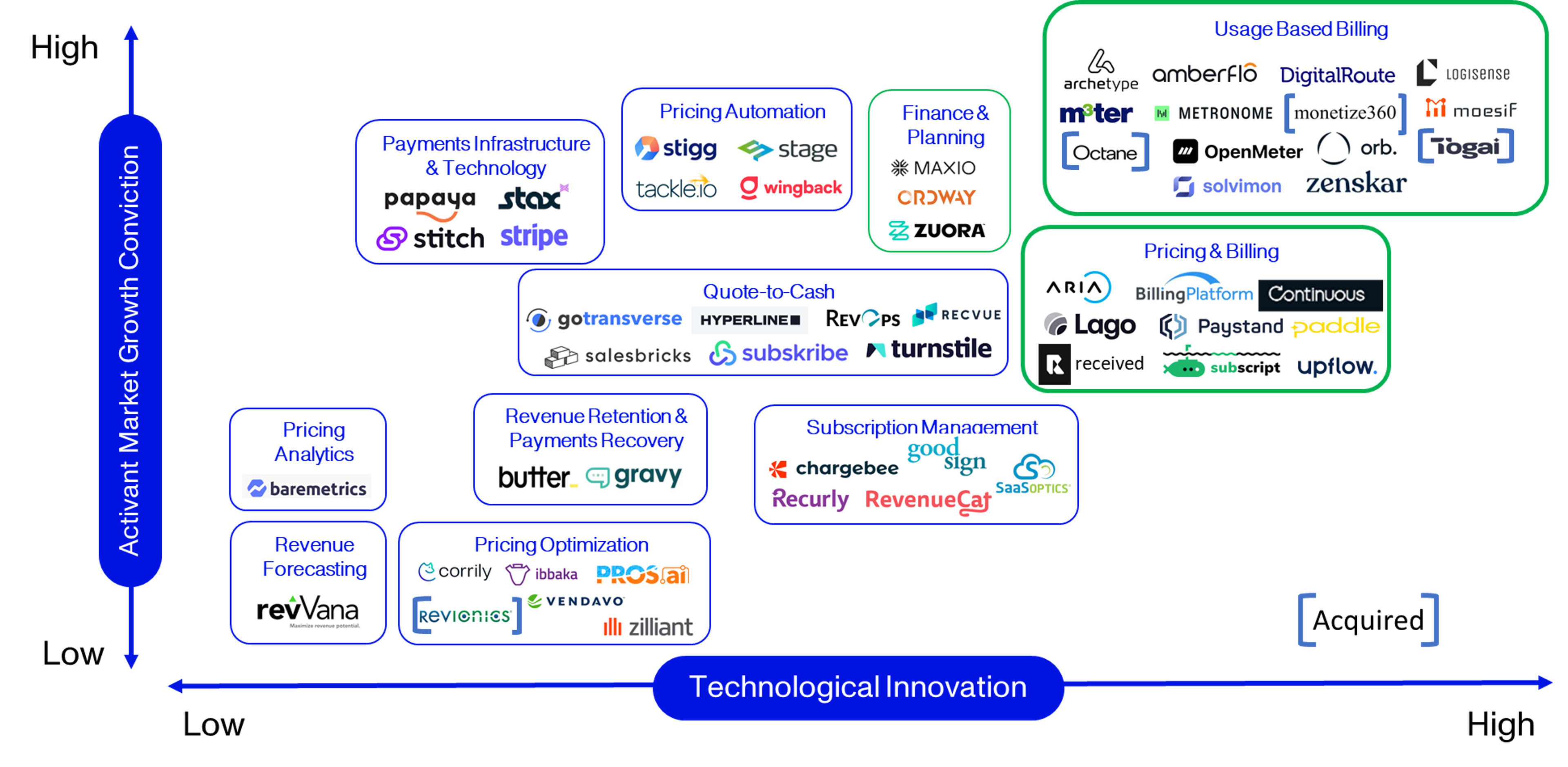

Our Activant thesis map, shown below, summarizes our market growth conviction and assessment of the degree of technological innovation for each of the distinct clusters of companies. We are most excited about the growth prospects of the UBB, Pricing & Billing, and Finance & Planning segments as these have the greatest exposure to core UBB functionality and application.

Thesis Map

Pricing and Billing Opportunities

Interesting Opportunities

While there is much to like about each of the companies that we have displayed on our thesis map, we are particularly excited about the growth prospects of those players in the segments most exposed to UBB and the growth we expect.

- Usage-based billing: Vendors often begin by focusing on narrow use cases and expanding their scope over time. UBB is no different. LogiSense has firm roots in communications, a sector that has long used UBB, and counts Vonage, Motorola, Siera Wireless and Cisco amongst its customers. Others, like Archetype and OpenMeter, have a strong developer focus. Amberflo offers solid cloud metering and billing with a recent focus on monetizing GenAI models. Orb, another relatively new entrant in the UBB market, has robust usage tracking, reporting and invoicing capabilities. Metronome, one of our favorite players in the space, offers a very solid UBB platform with a strong AI billing offer. We also like the offers from London-based M3ter and recent challengers Zenskar and Solvimon. Many of these solutions may well end up being acquired by larger players building out their suites, just as Togai, Monetize360, and Octane were by acquired Zuora, Ericsson and Stripe respectively.

- Pricing & Billing: The pricing and billing segment contains a few well-established players with long track records. Aria Systems, Paddle, and Paystand have all been in the market for 10+ years and offer solid products. CloudRatings13 recognized Paddle as a “leader” while Forrester14 considered Aria Systems to be a “contender” in their review of SaaS Recurring Billing Solutions. We are impressed with the development of BillingPlatform’s enterprise-grade platform, and so too is Forrester which designated the company a “leader” in its well-known “Wave” review.15 We think that Lago has a compelling offer focused on metering and UBB. Upflow is another emerging player that we really like (although it is important to point out that the company is associated with Activant portfolio company Sardine). Upflow’s primary focus was to drive cash collections, but the company is extending into payments and broadening its offer. Similarly, Received, a B2B billing and revenue management platform, is combining advanced billing automation with seamless accounts payable integration.

- Finance & Planning: Maxio, a financial operations platform, acquired Chargify to strengthen its subscription management capabilities and SaasOptics for its expertise in B2B SaaS financial operations. The moves complemented an already solid platform and CloudRatings celebrated the company for its High Market Adoption and High Customer Ratings.16 Publicly listed Zuora (NYS:ZUO) was recognized for its broad customer adoption while Ordway was recognized for high customer ratings. All three offer comprehensive suites of finance and planning solutions. Zuora and Ordway likely have stronger UBB capabilities than Maxio and one could imagine Maxio acquiring one of the smaller UBB players with a strong product, much as they did with Chargify, to effectively address the hybrid pricing models that we expect to become the norm in SaaS.

Conclusion

We believe that UBB, while not new, likely has never been more important. This is thanks to increasing levels of automation, the ubiquity of APIs, the rise of AI, the importance of tokenization, and a broad-based shift to PLG. These trends are likely to prevail for the next few years and we see no end to the positive impact on UBB. Pricing will never be a one-size-fits-all world and hybrid pricing models are likely the future of SaaS. We are excited about many of the players identified in the UBB segment on our Activant thesis map, as well as those in both the Pricing & Billing and Finance & Planning segments that draw on core UBB functionality and modules.

We would like to hear from you if our work resonates or you have a different perspective.

Endnotes

[1] Openview Partners, The State of Usage-Based Pricing, January 2023

[2] Note that the terms usage-based billing (UBB) and usage-based pricing (UBP) are used interchangeably. We have used UBB but others, like Openview, use UBP.

[3] Statista Market Insights, Software-Worldwide, December 2023

[4] McKinsey & Company, What is tokenization?, March 2024

[5] OpenView, The State of Usage-Based Pricing, 2nd edition, January 2023

[6] Stripe, Usage-based billing explained, May 2024

[7] Billing Platform, A Comprehensive Guide to Usage-Based Billing Software, March 2024

[8] M3ter, The Ultimate Guide to Usage-Based Pricing, 2021-2024

[9] Bain & Company, Is consumption-based pricing right for your software?, Technology Report 2022

[10] ibid

[11] Activant Capital research and interviews as part of work on the CFO Tech Stack, 3rd Generation FP&A Tools, Nov2023

[12] OpenView, The State of Usage-Based Pricing, 2nd edition, January 2023

[13] ibid

[14] Forrester, The Forrester Wave – SaaS Recurring Billing Solutions, Q1 2023

[15] Ibid

[16] CloudRatings, Subscription Management Software – Cloud Ratings Category Report 2023

The information contained herein is provided for informational purposes only and should not be construed as investment advice. The opinions, views, forecasts, performance, estimates, etc. expressed herein are subject to change without notice. Certain statements contained herein reflect the subjective views and opinions of Activant. Past performance is not indicative of future results. No representation is made that any investment will or is likely to achieve its objectives. All investments involve risk and may result in loss. This newsletter does not constitute an offer to sell or a solicitation of an offer to buy any security. Activant does not provide tax or legal advice and you are encouraged to seek the advice of a tax or legal professional regarding your individual circumstances.

This content may not under any circumstances be relied upon when making a decision to invest in any fund or investment, including those managed by Activant. Certain information contained in here has been obtained from third-party sources, including from portfolio companies of funds managed by Activant. While taken from sources believed to be reliable, Activant has not independently verified such information and makes no representations about the current or enduring accuracy of the information or its appropriateness for a given situation.

Activant does not solicit or make its services available to the public. The content provided herein may include information regarding past and/or present portfolio companies or investments managed by Activant, its affiliates and/or personnel. References to specific companies are for illustrative purposes only and do not necessarily reflect Activant investments. It should not be assumed that investments made in the future will have similar characteristics. Please see “full list of investments” at https://activantcapital.com/companies/ for a full list of investments. Any portfolio companies discussed herein should not be assumed to have been profitable. Certain information herein constitutes “forward-looking statements.” All forward-looking statements represent only the intent and belief of Activant as of the date such statements were made. None of Activant or any of its affiliates (i) assumes any responsibility for the accuracy and completeness of any forward-looking statements or (ii) undertakes any obligation to disseminate any updates or revisions to any forward-looking statement contained herein to reflect any change in their expectation with regard thereto or any change in events, conditions or circumstances on which any such statement is based. Due to various risks and uncertainties, actual events or results may differ materially from those reflected or contemplated in such forward-looking statements.