Topic

Automation

Office of the CFO

Published

November 2023

Reading time

15 minutes

3rd Generation FP&A Tools

A new wave of tools revolutionizing a dated CFO tech stack

Authors

Robert Lamprecht

Research Director

3rd Generation FP&A Tools

Download ArticleResearch

Introduction

Forged in the fire of late nights with no tolerance for mistakes, finance professionals build numerous skills – namely a wicked eye for detail and the ability to operate Excel at incredible speed. However, this revered Excel skill - the ability to speed up crushing loads of manual work - is a symptom of the problem rather than cause for celebration.

The problem begins in the “CFO’s tech stack” – the software tools that a finance department uses to get their job done. This tech stack revolves around Excel, making workflows highly manual and error-prone. Further, the pressing need for accuracy and ever-looming reporting deadlines have held back innovation for years.

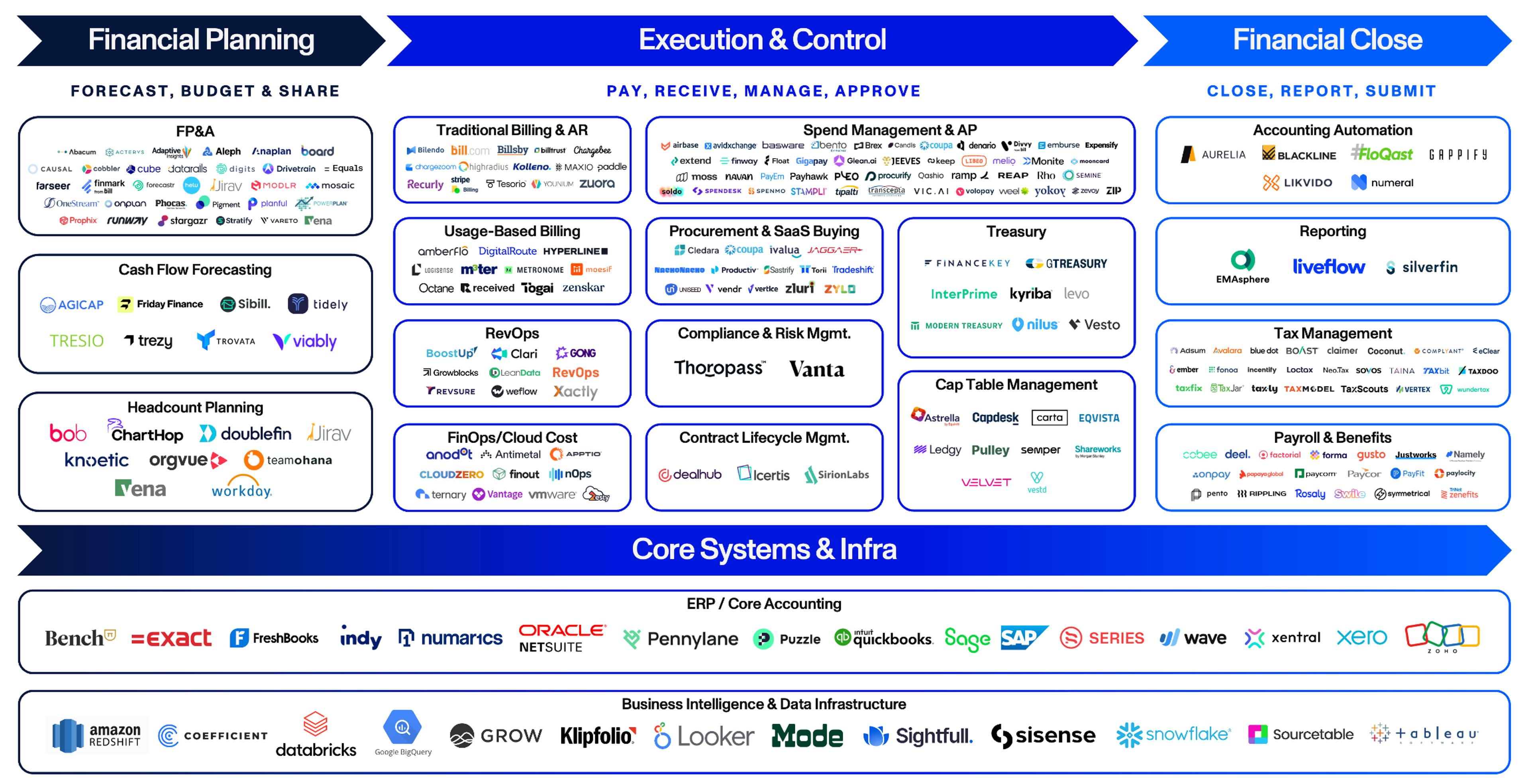

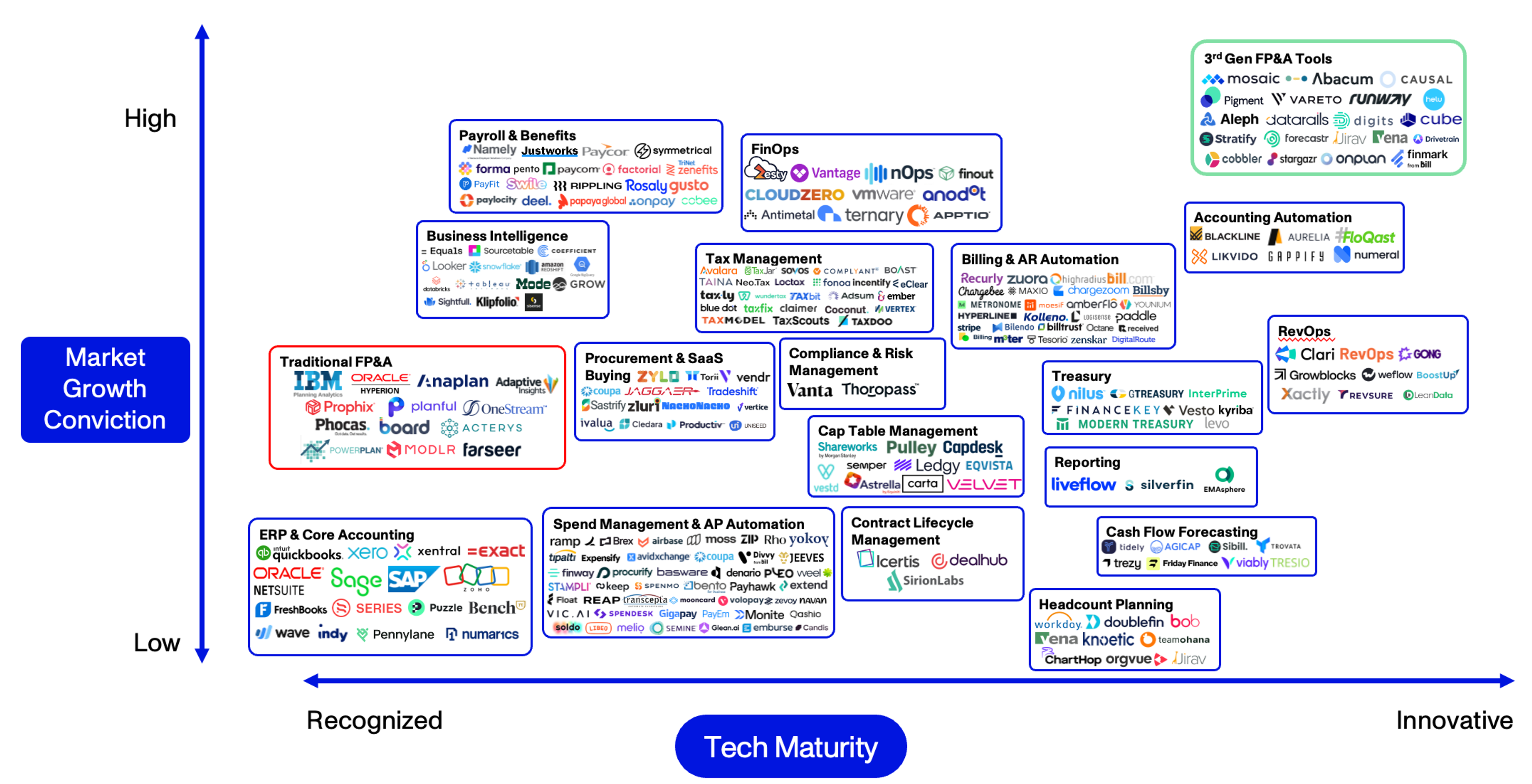

The CFO’s tech stack is ripe for disruption, and at Activant, we believe a new generation of tools is emerging to capitalize. The 3rd generation of FP&A tools is set to tie the whole finance stack together, provide unparalleled visibility into real-time data, eliminate manual work, and usher in the generation of strategic finance – where finance staff spend less time crunching numbers and more time propelling the organization forward.

In this report, we explore the problems inherent in the CFO’s tech stack, how previous generations of FP&A tools failed to solve them, particularly for a broad user base, and finally, how the 3rd generation will provide solutions.

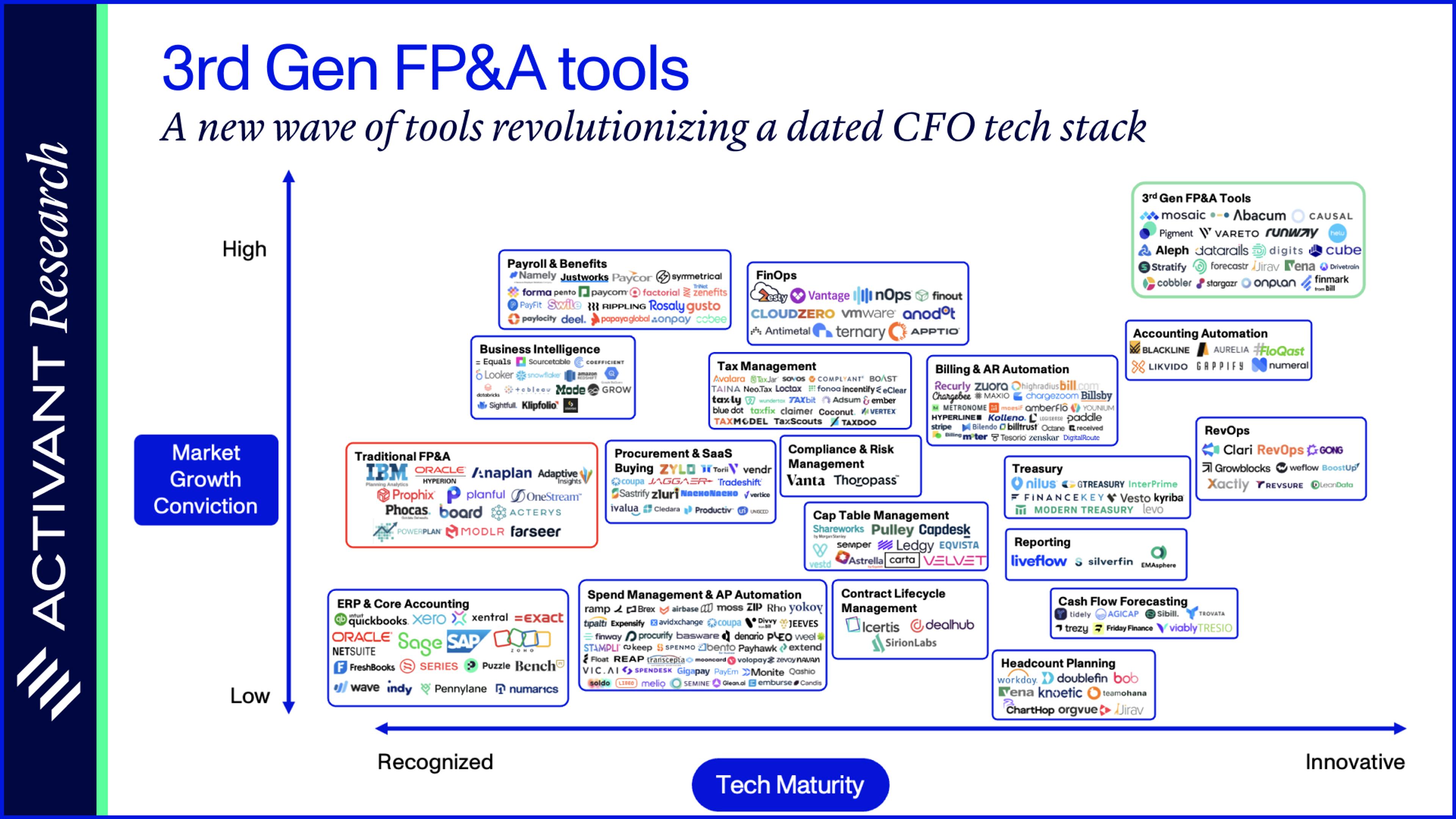

The CFO’s tech stack – siloed, excel-centric and manual

The CFO needs to contend with data that lives in numerous siloes. Why? Because CFOs oversee functions that are managed on a day-to-day basis by domain experts (finance, accounting, sales, supply chain, and more). When it comes to software, each domain expert uses their own source of truth, and those functions evolve into data siloes.

And that’s a natural evolution – purpose-built software provides numerous user advantages. But the result is that CFOs and their finance departments have to work across a tech stack that looks like this:

Value Chain

Our View on The CFO Tech Stack

There are several problems with this:

1The finance team needs all their data in one place.

For example, a billing reconciliation may require data from the billing system and the CRM. Those systems might happen to have a native integration, but it's more likely that the IT team will need to get involved to build one (and fix it every time something breaks). Scale this across the number of systems a typical finance department needs to interact with, and integration complexity rises exponentially.

Teams could build out a highly customized ERP implementation to solve this problem, but few can stomach the resources required – dollars, time, and management teams focused on the ERP, not business execution. However, such ERP implementations just leave the company with an expensive, static system that is likely clunky and complex. Ultimately, it’s extremely difficult to create one single source of truth for business data, so CFOs are left without one.

As a result, everything ends up in Excel. The practical solution is to extract CSV reports from these disparate systems when the data is needed and complete the analysis in Excel. 86% of finance staff predominantly use Excel irrespective of other tools available.1 Unfortunately, Excel-centric workflows have many downsides.

CFOs need a single source of truth but also need a solution that is affordable, scalable, and easy to use. Unfortunately, traditional ERP implementations and custom-built solutions often fail to meet these criteria, leaving CFOs to rely on Excel spreadsheets, which are prone to errors and inefficiencies.”

Nikola Obradovic, VP of Finance, Truework

2Excel lacks key features.

Collaboration is limited, auditability and change-logging are non-existent, security features like user-level access controls are missing, finding issues becomes difficult as spreadsheets become more complex, and performance limits are reached quickly. i.e. If you try to jam that 56th tab into your operational model, your laptop starts to sound like an F50 fighter jet, and you meet the spinning pinwheel of death.

3Excel-centric workflows are completely manual.

Once those system reports are in CSV, the finance team's skills (and nightmares) come to the fore - joining datasets, manipulating data formats, and relentlessly checking and reconciling totals. These tasks make up a considerable time investment just to be able to begin the work that matters. These workflows aren’t just manual, they’re repetitive too –most finance tasks recur weekly, monthly, quarterly, and annually. Repetitive, manual workflows are a breeding ground for errors.

4A real-time view of any aggregated dataset is completely out of the question.

Teams must wait until reports have been through the financial close cycle, so they are always looking backward at the previous period, potentially by a few weeks. Without a real-time view of the business, being responsive to critical events, changes, and trends becomes incredibly difficult.

As these issues compound, finance staff are disempowered from acting strategically. Being caught up with getting the right data prevents teams from asking, let alone answering the vital questions: “Should we continue running this division?”, or “What are the top ways to increase profitability next year?”

Simply, CFOs need a tool that can tap into the whole finance stack, be the glue to tie it all together, and unlock real-time data views without requiring an SQL expert. CFOs need a finance tool to pull workflows out of hacky Excel books and into collaborative software tools that can leverage well-defined workflows and drive automation.

We think that 3rd generation FP&A tools are the solution.

Thesis Map

CFO Tech Stack

The FP&A Opportunity

Understanding the FP&A department

The FP&A department is responsible for reporting, analysis, planning and forecasting. This could include preparing management reports, organizational budgets, long-range planning models, or ad-hoc analyses for the C-suite. This work is challenging to templatize and requires a powerful calculation engine – so the FP&A department has standardized on Excel. In fact, no financial use case relies on Excel more than forecasting and budgeting.2

However, the FP&A department also leverages data from other departments more than any other. That’s why the pain points in the CFO’s tech stack are magnified in the FP&A department: Four of the top ten finance tasks, measured by time-saving potential, fall under the FP&A umbrella; and FP&A staff spend three-quarters of their time just gathering and managing data.3,4

Ironically, this department is the most bogged down in manual work yet expected to be one of the key strategic drivers in the organization. FP&A needs to determine long-range plans that incorporate multiple departments – tying the broader organization together through the lens of finance. FP&A is supposed to be the glue, but all they have is a semi-functional stapler.

It's no wonder that FP&A tech ranks number one on the list of where finance executives are increasing spending.5 However, if FP&A workflows are so manual and just run on Excel, where is that spending going? Largely to outdated, legacy tech.

Historical generations of FP&A tech

FP&A started with TM1 (now known as IBM planning analytics, four acquisitions later). Released in 1983, it was ground-breaking for its time – multi-dimensional with in-memory computation in a spreadsheet-like interface.6

Together with competitors like SAP, and Oracle Hyperion, these tools became known as the 1st generation of FP&A software. They ran on-premises and were extremely expensive and time-consuming to implement (potential $1mn+, 6-month implementation cycles). This leaves the 1st generation out of reach for all but the largest, most static organizations.

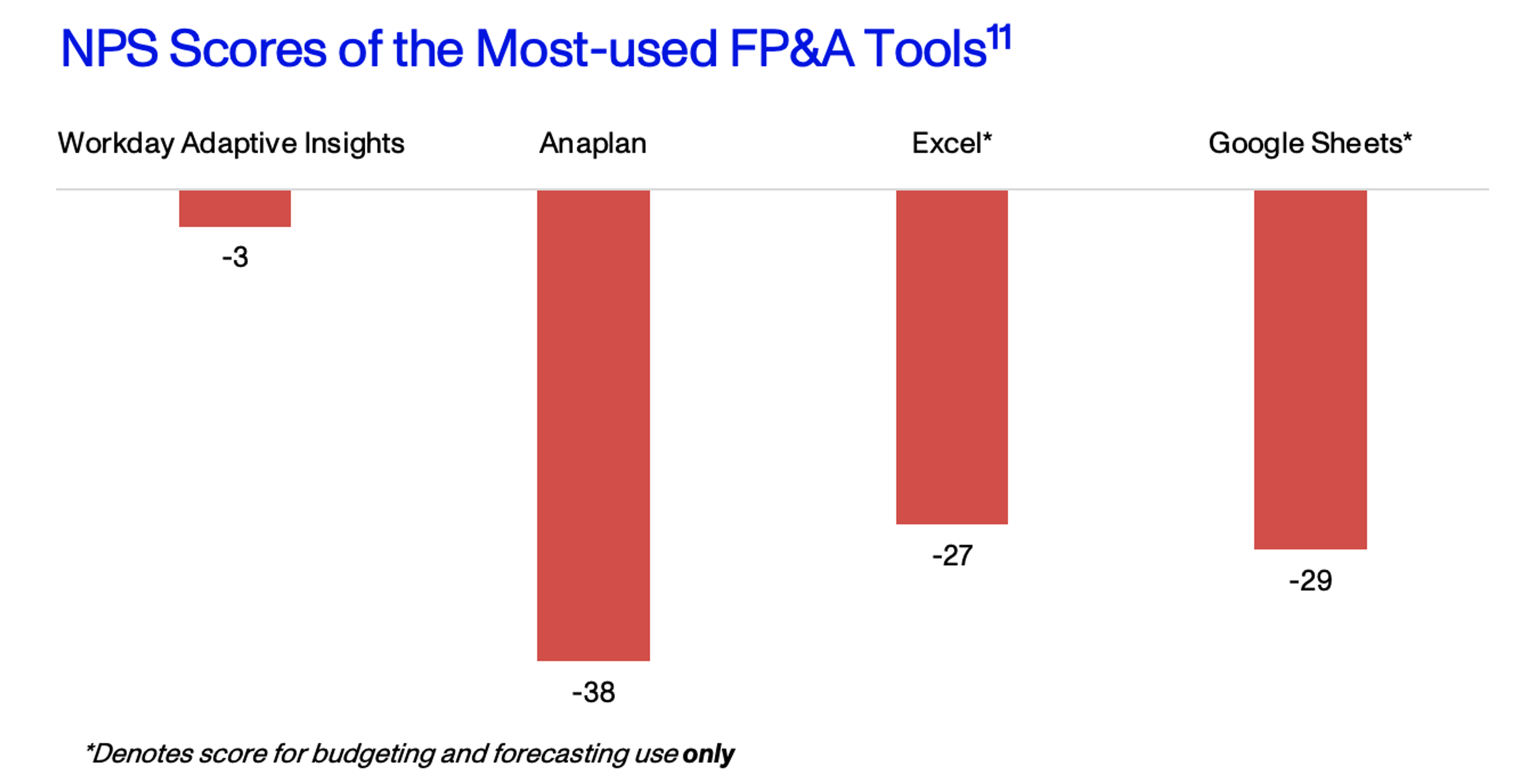

Of course, a new generation was born to solve these problems. Accessible via the cloud, the 2nd generation promised to improve access to sophisticated planning tools massively. With lower costs and faster implementation cycles, they did – Anaplan reached just under 2,000 customers before its $10.4bn take-private.7,8 Adaptive Insights had over 3,700 customers in 2018, before becoming a part of Workday for $1.6bn.9,10

However, Gen 2 became synonymous with complexity. Anaplan used a new syntax unfamiliar to Excel users, and some tools required calling out an engineer for every major model change. Pricing also increased over time, now out of reach for all but deep-pocketed enterprise clients. To put it more bluntly, the prevailing FP&A tools have been described to us by users as “hated.”

Finally, the 1st and 2nd generations deeply focus on their planning and modeling use cases. Boasting powerful, in-memory calculation engines, they’ve neglected the data silo problem, leaving the FP&A team still largely disempowered.

In sum, today’s FP&A market is dominated by legacy technology (some built on mainframes!), which locks out a substantial portion of the market with excessive price tags, heavy implementations, and difficult-to-use products. That’s why 64% of forecasting and budgeting still takes place in Excel.12 There is a massive opportunity for 3rd generation FP&A tools to disrupt the status quo.

Finance teams are stuck in siloes, and spend a lot of time cleaning data- which prevents them from being more involved in operations. That’s why an FP&A tool needs to connect with numerous systems and provide the finance team with real-time operational KPIs, unlocking their ability to act more strategically. You need a native modeling solution. Excel-based solutions will always break as companies scale."

Julio Martinez, Co-founder and CEO, Abacum

Tools truly designed for their users

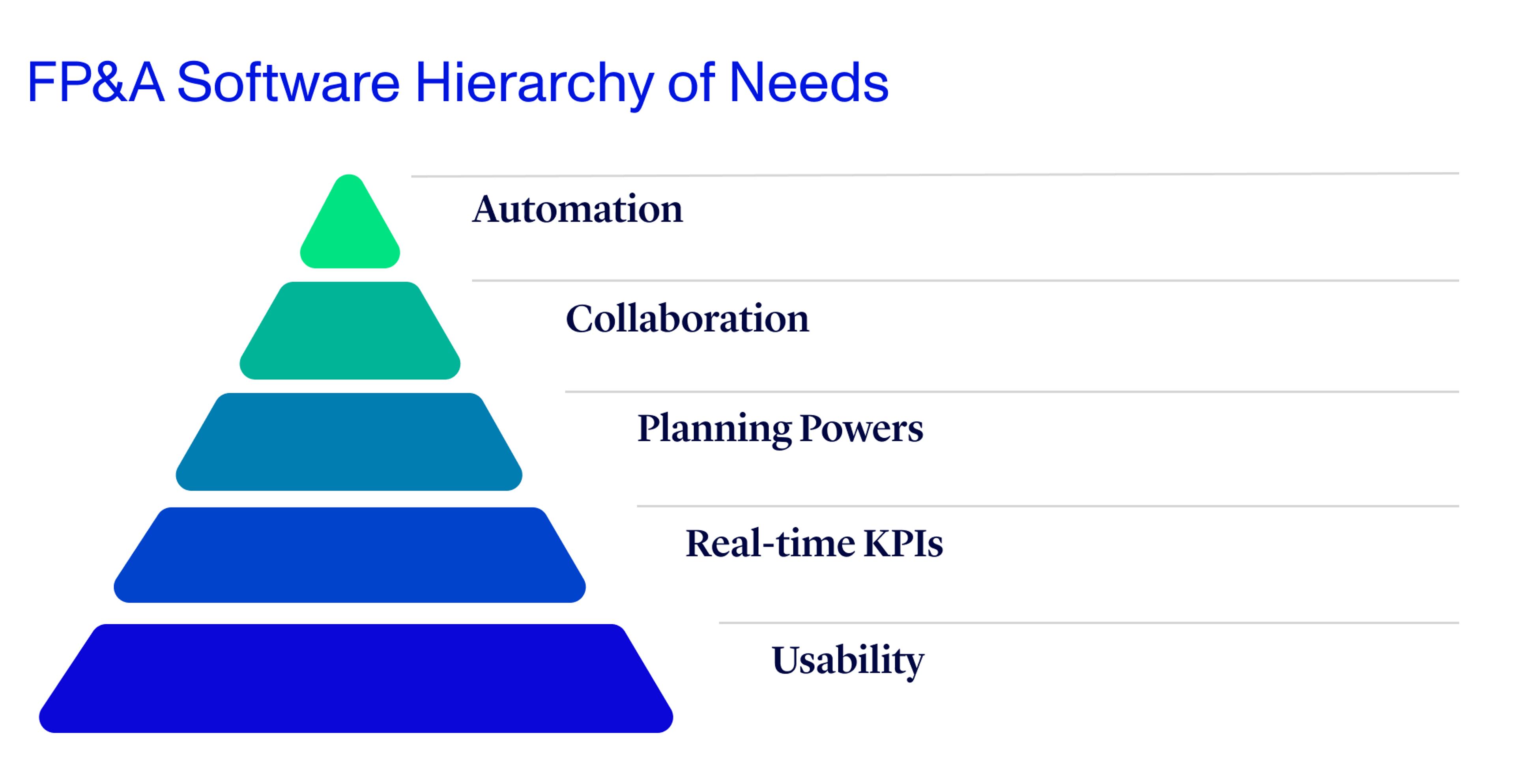

3rd generation FP&A tools picked apart all the areas where prior generations failed and redesigned the solution from the ground up. These companies have built products that FP&A truly needs, not just a big, expensive modeling tool. Furthermore, they’ve opened the door to users locked out by prior generations. We look at the five most pressing needs for FP&A staff and how 3rd generation tools are innovating to deliver.

1Usability:

By leveraging modern, intuitive UIs, and comprehensive training and documentation, Gen 3 users see rapid time to value. Stripping out complexity saves users from running up massive professional services bills, which were par for the course in prior generations.

2Merging accounting and business intelligence:

Pre-configured integrations make it ridiculously easy to create a single source of truth with customizable dashboards and reports. Tracking key metrics is boosted by features like Abacum’s no-code data transformation and Mosaic’s 150+ pre-configured metrics. By integrating with the ERP at the source transaction list, click-down analysis from a dashboard all the way to the transaction level is possible.

3Faster planning:

Models can be ready in minutes, enabled by model templates, and improved by specialized modules, like Jirav’s solution for workforce planning. Scenario analysis can be automated in one click from within the core model. The best part? Integrated real-time data can roll forward into actuals without the risk of turning a model into one big #REF error. Leveraging the insights from data to drive model assumptions becomes simpler from within one platform, and players like Datarails are leveraging that advantage with predictive budgeting. Most importantly, many tools like Abacum provide unlimited dimensions, so modeling has incredible flexibility.

4Real-time collaboration:

Multi-player models and reports become the status quo. No more bouncing around Excel documents in email, unclear on whether we are on v13 or v14. Causal and Helu enable version control and individual permissions, while Jirav powers tracking and approval flows.

5Automation:

Preparing regular reports and analyses, like comparing budget vs. actuals are done with just a few clicks. AI takes this to the next level. Cobbler leverages GenAI to prepare board decks, complete with explanations of major variances derived from company data. AI tools from Pigment, Vareto, and Runway allow users to generate summaries of complex financial reports to share with non-financial departments. Critically, AI tools let finance staff ask questions of their data using natural language.

An impactful finance leader requires a robust reporting and planning tool to enable insightful, real-time decision-making. The next generation of FP&A tools must deliver on this expectation with intuitive interfaces, seamless integrations, and unparalleled flexibility.”

Joel Abdinoor, CFO, NewStore

With these advancements, a real-time view of organization-wide data with deep analytics capabilities is within reach. No system extractions, no data prep, no SQL. Just like that, the manual tasks that FP&A staff waste much of their time on are eliminated. The companies building the 3rd generation are ushering in the age of strategic finance. Freed from fighting for accurate data, finance teams can ask the right strategic questions to level up their companies. With these tools in their hands, the FP&A department becomes a competitive advantage.

So, how does the 3rd generation break into the market?

The mid-market opportunity

The mid-market is the most natural point of entry for the next generation - companies just large enough that their planning department is outgrowing Excel, too small to afford the price tags (and consulting fees for every change!) of incumbent tools, and moving too quickly to freeze their operations for multi-month implementations. It's not about eating someone else’s lunch, it’s about fostering access, which includes cutting pricing from over $100k ACVs to $20k – $40k and speeding up implementations to a few weeks.13 Further still, newer entrants like Aleph promise that customers can be up and running in just a few hours.

However, the opportunity doesn’t stop at the mid-market.

Expert-level users of 1st and 2nd generation tools might argue that these tools are only fit for simpler/smaller planning departments, but that’s classic disruption theory. 3rd generation tools will naturally improve through product updates over time and start to break into the enterprise. Examples like Pigment and Causal have already done so, with traction at PVH, Klarna, Deliveroo, and Kitopi.

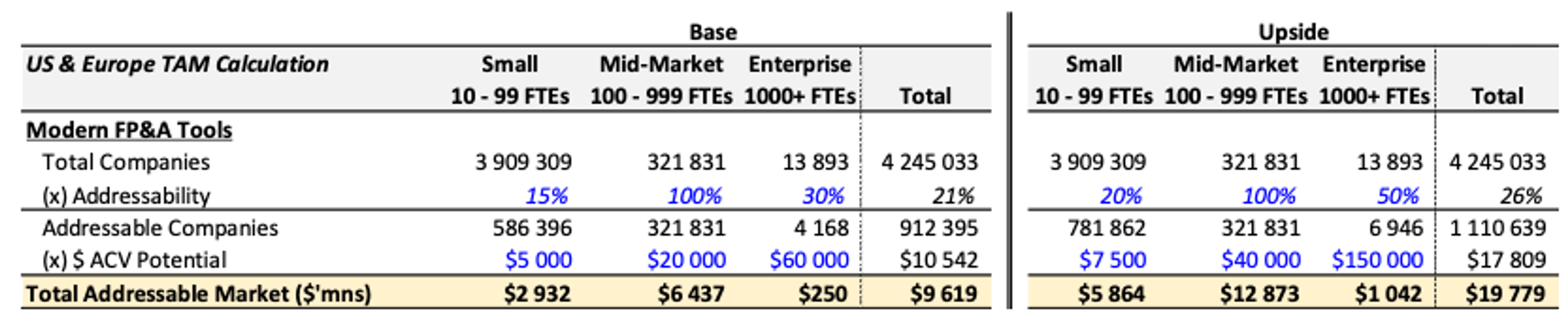

With a focus on the mid-market and enterprise traction, we see an addressable market for these tools of $9.6bn in the US and Europe, with an upside to $20bn. That upside can be achieved through new modules that capture use cases like AR and AP automation. Tools that closely resemble Analytics / BI could also capture some of those budgets and seat expansion can drive up ACVs - if these planning tools become the glue for the whole organization, they can find users across sales, supply chain management, HR, and more.

We derive our TAM based on the number of registered companies by size classification, adjusting for the proportion of those companies likely to use a 3rd generation FP&A tool, and multiplying out by observed pricing ($ACV).14,15,16

What it takes to win

We see three key vectors for success in the 3rd generation FP&A market: 1) Scalability and Flexibility, 2) Ease of Use, and 3) Excel-friendliness.

1Scalability and Flexibility:

To serve customers across industries, product types, geographies, currency exposures, and group structures, FP&A tools must be flexible. Remember, the users of these tools are Excel pros, so they’ll default back to Excel at the very moment they reach the limits of another tool. That’s one reason why churn can be high in this market. Product requirements are not static as high-growth mid-market customers can outgrow a tool quickly. Success will rest on engineering muscle and high-velocity product release cadence. Companies like Causal follow this playbook with a product update page that reflects weekly updates.

2Ease of Use:

Often scalability and flexibility can come at the expense of ease of use, but what’s special about this trade-off, is that it doesn’t need to be one-for-one. Balancing the flexibility-ease of use tightrope is a skill, and we’re all familiar with tools that do both well, like Notion. If FP&A tools want to be successful over the long term, they need to nail this skill. Runway is leveraging the popular Notion-style UI, using flexible, point-and-click workflows to build a financial model. This provides incredible ease of use improvements, helping to take the power of a sophisticated planning tool outside the finance department.

3Excel-friendliness:

The best FP&A tools make Excel their friend – with tight integrations to Excel and Google Sheets. In fact, players like Cube and Datarails work within Excel, so FP&A staff never need to leave the tool they’ve come to know and love. This approach makes getting started easier but might reduce chances of long-term success because such Excel-native approaches still suffer from limited dimensionality, performance issues, and limited collaboration. Web-native approaches can maintain attractiveness to Excel power users with Excel-like syntax and features. For example, Pigment’s sheet view appends familiar Excel experience to the core product.

The scope of Excel use in the finance department presents a massive opportunity for companies trying to build a better experience. But Excel is a fierce competitor – a tool whose Lindy-ness measures close to 50 years. This new class of FP&A tools will need to focus relentlessly on their usage metrics, course correcting at the very moment that they notice that their users are logging in less, or worse, doing their work elsewhere.

Conclusion

At Activant, we believe that 3rd generation FP&A tools are the key to unlocking the strategic potential of finance departments. By breaking down data silos, automating mundane tasks, and fostering collaboration, these companies are driving FP&A professionals and their firms into a new era of financial excellence. In the new era, it's not about crunching the numbers. It's about connecting the dots, solving complex problems, and charting the course for success. Welcome to the future of finance.

An important note – we could never have built this research project without the help of numerous experts across our portfolio and ecosystem. Special thanks to our Activant portfolio CFOs, the founders that we spoke to at Abacum, Causal, Runway, Stratify, Aleph, Forecastr, Mosaic, and Cobbler, as well as Paul Barnhurst, aka The FP&A guy.

When researching the CFO tech stack, we became incredibly excited by the changes occurring in the FP&A space. However, we look forward to continuing our research across the broader CFO tech stack and meeting the incredible founders building here.

If you’re building in the CFO’s tech stack– we’d love to chat.

Footnotes

[1] Vena Solutions, The State of Strategic Finance, 2022

[2] Maxio, Annual Tech Stack Survey, 2023

[3] PWC, Finance Benchmarking Report, 2019

[4] Association for Finance Professionals, Five Practices of Highly Effective FP&A Teams, 2019

[5] Netsuite, CFOs on Profits, Payroll and Peer Expectations, 2022

[6] Cubewise, The Official History of TM1 according to Manny Perez, the inventor of TM1, 2023

[7] Anaplan, Fourth Quarter 2022 Results Announcement, 2022

[8] Thoma Bravo, Thoma Bravo Completes Acquisition of Anaplan, 2022

[9] SEC, Adaptive Insights Inc. Form S-1, 2018

[10] Workday, Workday to Acquire Adaptive Insights, 2018

[11] Battery Ventures, FP&A Survey, 2021

[12] Maxio, Annual Tech Stack Survey, 2023

[13] Average pricing is ascertained from discussions with product users

[14] House of Commons, Business Statistics, 2022

[15] Eurostat, Enterprise statistics by size class and NACE Rev.2 activity (from 2021 onwards), 2023

[16] Bureau of Labour Statistics, Number of business establishments by size of establishment in selected private industries, 2023

Disclaimer: The information contained herein is provided for informational purposes only and should not be construed as investment advice. The opinions, views, forecasts, performance, estimates, etc. expressed herein are subject to change without notice. Certain statements contained herein reflect the subjective views and opinions of Activant. Past performance is not indicative of future results. No representation is made that any investment will or is likely to achieve its objectives. All investments involve risk and may result in loss. This newsletter does not constitute an offer to sell or a solicitation of an offer to buy any security. Activant does not provide tax or legal advice and you are encouraged to seek the advice of a tax or legal professional regarding your individual circumstances.

This content may not under any circumstances be relied upon when making a decision to invest in any fund or investment, including those managed by Activant. Certain information contained in here has been obtained from third-party sources, including from portfolio companies of funds managed by Activant. While taken from sources believed to be reliable, Activant has not independently verified such information and makes no representations about the current or enduring accuracy of the information or its appropriateness for a given situation.

Activant does not solicit or make its services available to the public. The content provided herein may include information regarding past and/or present portfolio companies or investments managed by Activant, its affiliates and/or personnel. References to specific companies are for illustrative purposes only and do not necessarily reflect Activant investments. It should not be assumed that investments made in the future will have similar characteristics. Please see “full list of investments” at https://activantcapital.com/companies/ for a full list of investments. Any portfolio companies discussed herein should not be assumed to have been profitable. Certain information herein constitutes “forward-looking statements.” All forward-looking statements represent only the intent and belief of Activant as of the date such statements were made. None of Activant or any of its affiliates (i) assumes any responsibility for the accuracy and completeness of any forward-looking statements or (ii) undertakes any obligation to disseminate any updates or revisions to any forward-looking statement contained herein to reflect any change in their expectation with regard thereto or any change in events, conditions or circumstances on which any such statement is based. Due to various risks and uncertainties, actual events or results may differ materially from those reflected or contemplated in such forward-looking statements.