Topic

Automation

Office of the CFO

Published

September 2024

Reading time

11 minutes

RevOps - The Road to Virtual Employees

RevOps Intelligence Tools

Authors

Aiden Benson-Armer

Intern

RevOps - The Road to Virtual Employees

Download ArticleResearch

Anyone considering how to effectively implement AI within their business with a strategic focus on improving revenue is confronted by a sea of options. Generic solutions like ChatGPT, Claude, and Gemini might come to mind, or maybe a larger solution like Salesforce or Oracle. But these are often not tailored to specific business needs and many small and medium-sized enterprises (SMEs) don’t want a whole suite of tools they don’t necessarily need. This is where Revenue Operations (RevOps) tools step into the spotlight. They integrate data and processes to align across sales, marketing and operations functions and can provide businesses with roadmaps for the introduction and integration of AI.

In this report, we build on the base of work in prior Activant research (Conversational AI , AI Agent Ecosystem , and 3rd Generation FP&A Tools) to explore what might be possible with RevOps AI in the workforce. We have three key beliefs stemming from our research:

1. We believe in the transformative potential of AI-driven RevOps platforms.

2. We see immense value in specialized point solutions that master specific aspects of revenue operations, such as automated lead management and conversational intelligence, offering targeted enhancements that surpass broader platforms.

3. We are excited about the rise of innovators developing AI employees and advanced conversational intelligence tools, promising to revolutionize traditional business models by replacing human roles with highly efficient, AI-driven virtual employees.

We are more enthusiastic than ever about the potential of a complete overhaul of the workforce, and it all begins by optimizing across the revenue cycle.

Optimizing Across the Revenue Cycle

RevOps strategically aligns sales, marketing, and customer success teams to drive revenue growth by optimizing processes, technology, and data across the sales cycle. RevOps intelligence platforms serve as central hubs, breaking down data silos between departments and providing significant cost-saving benefits by automating repetitive tasks and reducing labor costs. Prioritizing customer experience through RevOps tools fosters loyalty and satisfaction, which are crucial factors for long-term success.

Tackling the Greatest Challenges

According to Salesloft’s October 2023 benchmark survey, pipeline development remains the greatest challenge for revenue growth.1 55% of the respondents identified this as the greatest challenge, while 31% identified win rates, 24% focused on customer retention and expansion, and 13% prioritized sales capacity. RevOps platforms have the capabilities to mitigate these issues and will benefit from the adoption of pipeline-centric business models.

Complexities Grow With Size

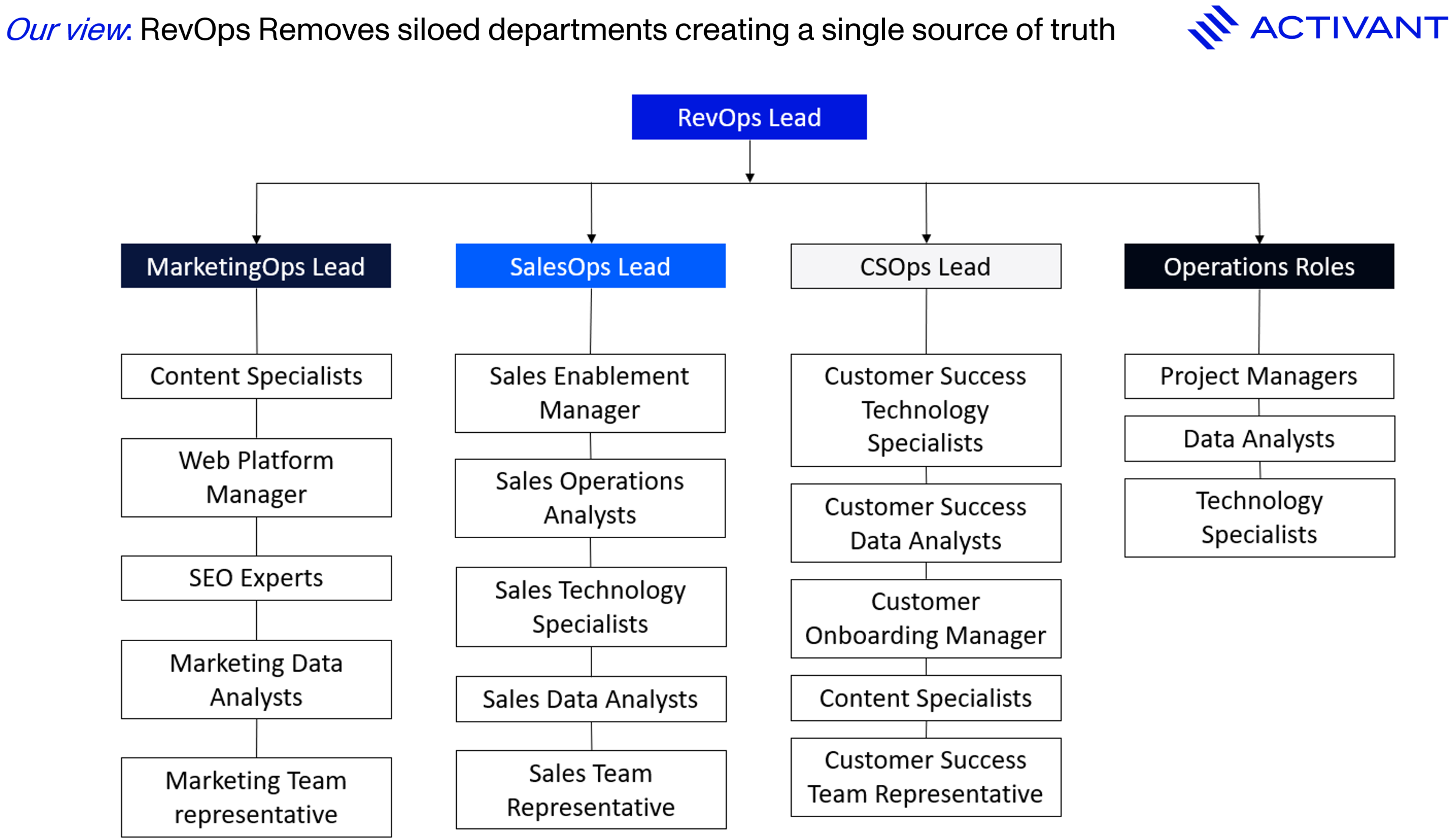

As organizations grow, so does the complexity of aligning departments. Many legacy companies have organizational structures a lot like the one shown in the diagram on the next page. The siloes created and the subsequent lack of coordination not only hinders performance but also exacerbates data management issues.

These legacy organizations typically suffer from five key pain points:

1. Lack of alignment between sales, marketing, and customer success teams.

2. Data silos and inefficient data management.

3. Manual and time-consuming processes.

4. Ineffective sales and marketing strategies not backed by the right data.

5. Lack of visibility and accountability between teams and departments.

Structuring Around RevOps

Creating a single RevOps lead within organizations can streamline operations, eliminate silos, and promote a cohesive, data-driven approach to revenue growth. This role is crucial for coordinating efforts across marketing, sales, and customer success teams, as highlighted in a Forbes report that shows RevOps emerging as the fastest growing job in the US as of December 2023, based on a LinkedIn jobs analysis.2

The simple exhibit below summarizes the organizational changes implemented.

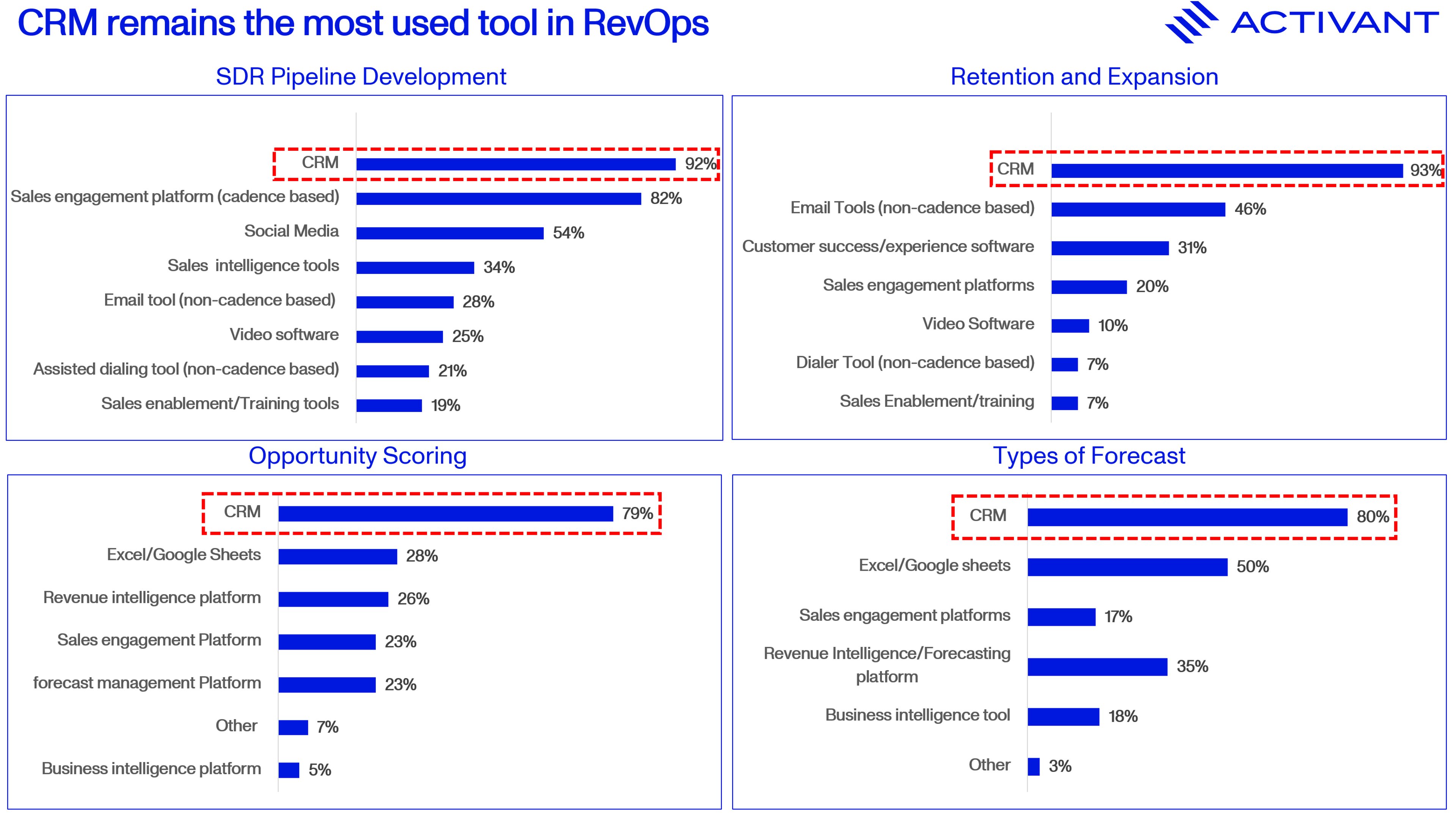

Impact of Legacy Systems

Legacy systems still dominate, clearly shown in Salesloft’s Revenue Engagement study.3 CRM remains the most utilized application for sales development, customer retention, opportunity scoring, and forecasting. The complexity and inefficiencies these systems bring necessitate a new approach, highlighting the potential for transformation.

We believe that the RevOps tech stack is a key component in assisting to upend legacy systems, priming the market for growth.

A Market Primed for Growth

The $3.7bn RevOps platform market is expected to grow to $18bn over the next decade at a CAGR of 17.3%.4 The SME and large enterprise segments are expected to grow at a CAGR of 19.4% and 16% respectively. The banking, financial services and insurance industries held the largest share of the global RevOps platform market in 2023, with expected growth of $3.2bn over the coming decade.

The healthy growth projected isn't surprising when one considers the benefits of implementing RevOps as seen in the diagram below.

The growth is more exciting when considering the strong market drivers:

1. Increased demand for data integration across business functions.

2. Need for improved efficiency and productivity.

3. Enhancement of customer experience and personalization demanded.

4. Growing importance of AI and machine learning implementation.

5. Shift towards data-driven decision making.

These market drivers, together with the proven benefits and our belief that RevOps is one of the most logical and effective ways to deploy AI in a company, make us bullish on the market!

AI is Turbo-Charging RevOps Growth

Gartner predicts that by 2025, 70% of all B2B seller-buyer interactions will be recorded or analyzed using AI, Additionally, 75% of B2B sales organizations will replace traditional sales playbooks with AI-based guided solutions.5 Goldman Sachs estimates that AI investment will approach $100bn in the U.S. and $200bn globally by 2025.6

Reinventing business models is crucial, evidenced by PwC’s 27th Annual Global CEO Survey, which found that 45% of CEOs doubt their company’s current trajectory will keep them viable beyond the next decade.7 Proactive steps to create value and stay at the forefront technologically have become increasingly important.

As 2024 progresses, the appetite for deal making has returned, spurred by decelerating inflation, expectations of interest rate cuts, and a record amount of dry powder. The EY CEO Outlook Pulse Survey shows 98% of CEOs plan to pursue a strategic transaction in the next 12 months,8 indicating the pent-up demand for deals. We refer you to our article where we look deeper into the acquisition market surrounding RevOps.

With a perfect storm on the horizon, RevOps is positioned at the forefront of the following potential critical market changes:

- Strategic AI implementation

- Increased CEO focus on strategic acquisitions

- Economic headwinds demanding efficiency

- Global surge in AI investment

These factors collectively place RevOps at the center of a transformative shift in market dynamics, offering substantial upside potential as businesses adapt and evolve.

Activant Market Map

In our Activant RevOps Market Map, we have broken out the key components and use cases of this diverse market, including marketing automation, conversational intelligence, sales enablement, sales engagement, conversational marketing, lead management, and CRMs.

Market Map

Revenue Operations

Platforms have continuously expanded their capabilities and the scope of what is possible, particularly incorporating AI to extend into new quadrants of the market.

RevOps Tech Stack

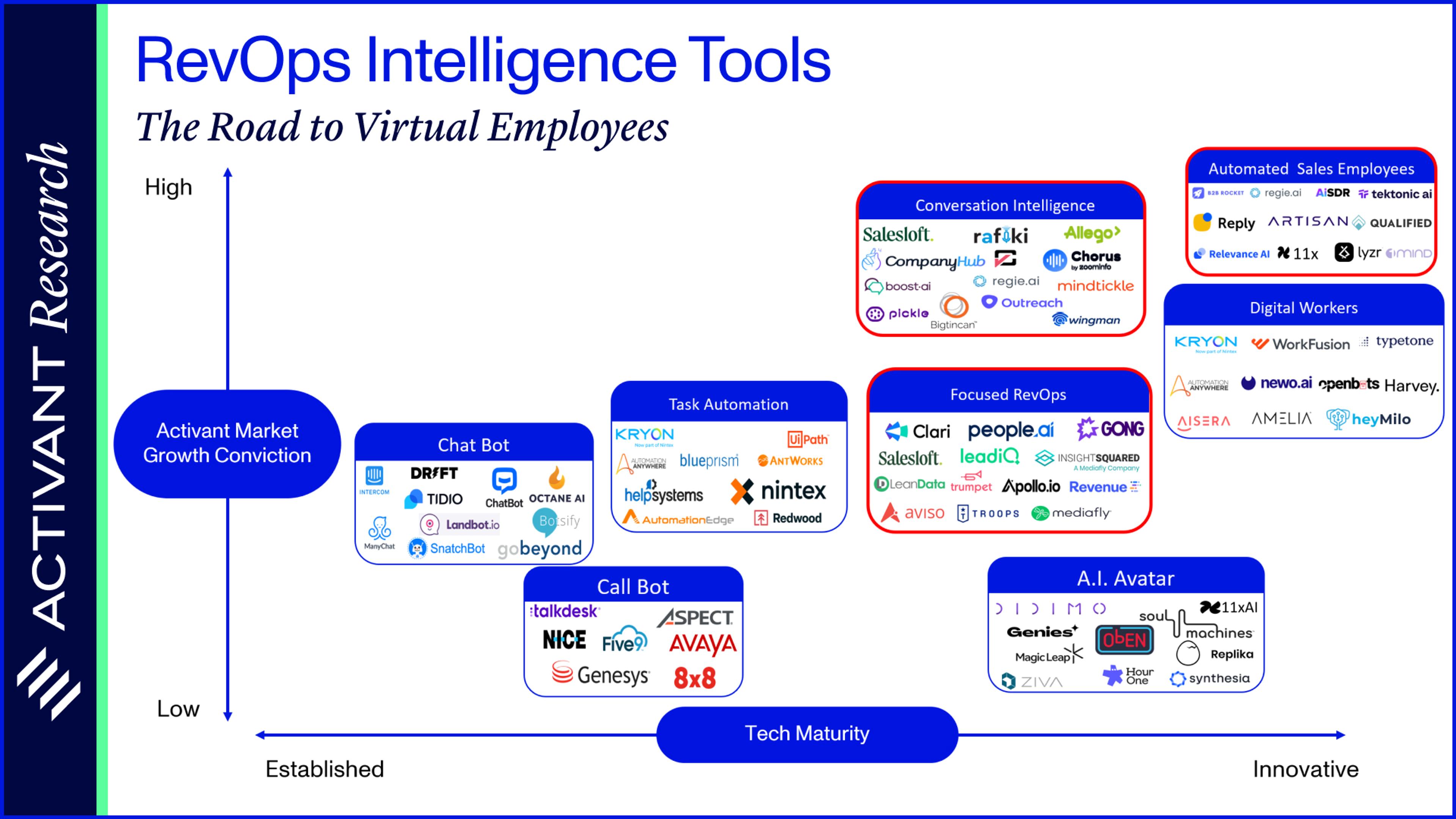

It is always challenging to try to simplify complex landscapes into neat boxes arrayed along discrete axes. We will be the first to acknowledge that legacy platforms and products are always innovating and evolving. We have considered the RevOps Tech Stack in terms of the product capabilities – from legacy products to more innovative ones – and our conviction in their market growth potential.

Thesis Map

The RevOps Tech Stack

The landscape is characterized by fierce competition with numerous players overlapping functionalities. The established giants like Oracle and Salesforce are constantly evolving their offers and acquiring emerging technologies. There are emerging players that dominate certain areas, such as Gong (conversational intelligence), Conversica and Drift (conversation automation), Clari (RevOps and intelligence) and Salesloft (sales engagement). What we are most excited about, however, are those companies that appear to be on the cusp of changing the relationship between AI and employees. It is still very early, and our thesis remains speculative, but we see the potential for a complete overhaul of organizations and their workforces with RevOps leading the way through the implementation of AI automation. The next logical step — automation of entire employee’s roles — where we find not only a chatbot or AI agent but, eventually, a complete “virtual employee” operating indistinguishably from human counterparts.

Before we jump to conclusions and predict a radical shift overnight, it is helpful to revisit some prior Activant research and understand the pace of change in the RevOps landscape driven by AI.

Changing RevOps Landscape

Our work on Conversational AI and the Future of Customer Service highlighted a shift towards replacing customer service teams with AI, potentially automating up to 50% of calls and creating $40bn in the U.S. and $100bn globally. Startups like Resemble.ai, Lyrebird, and iSpeech are creating nearly indistinguishable voice clones. Companies like Synthesia, Replika, Soul Machines, and UneeQ are developing lifelike digital humans that interact seamlessly with users.

Our research on AI agents — Towards the AI Agent Ecosystem — showed that while LLM-enabled software can handle complex tasks autonomously, human intervention is often necessary. We saw companies like Relevance.ai, Fixie, and Thousandbirds building platforms for AI agents.

Our research on RevOps platforms revealed a third perspective, emphasizing the ongoing expansion of automation capabilities. Consequently, RevOps is exploring AI employees, exemplified by innovators like 11x, which aims to replace Sales Development Representatives with AI avatars billed hourly like human employees. This novel approach indicates that RevOps is poised to transform the relationship between AI and employees, although it is early in the journey, and our thesis remains hypothetical.

The Road to Virtual Employees

This road to “virtual employees” is a move from AI assistants to AI employees. Our Activant thesis map, shown below, highlights the key segments of the market and arrays these against our view on tech maturity and our conviction in the market growth potential. We find conversational intelligence, focused RevOps, and automated employees to be the three segments most interesting for investment.

Thesis Map

Road to Virtual Employees

Innovation occurs across the spectrum, but we think about the potential evolution across three pillars within RevOps: Innovators transforming the sales cycle, outstanding point solutions offering best-in-class solutions, and all-in-one solutions addressing a broad array of RevOps needs.

Innovators Transforming the Sales Cycle

These players are working on the development of automated or virtual employees in the “automated employee” and “conversation intelligence” segments on our thesis map. Companies like 11x, Qualified, and Relevance.ai, Docket.ai, Regie.ai and Lyzr.ai have developed outstanding conversational intelligence tools. All six are changing the perception of RevOps and challenging how business can be done.

Each brings a unique value proposition, whether it’s replacing human roles, enhancing real-time engagement, providing hyper-personalization, streamlining document workflows, or automating content creation. Innovators are at the core of enhancing the RevOps narrative.

The RevOps space is being disrupted by generative AI-powered agents. These agents excel in deep research, pulling insights from various data sources, and use advanced reasoning to craft hyper-personalized outreach. When these agents interact with other agents handling marketing, customer service, and products within an organization, they gain critical intel that helps sales teams position products more effectively, leading to higher conversion rates.”

Siva Surendira, CEO & Founder, Lyzr.ai

Point Solutions

Point solutions like LeadIQ (automated lead management), Dooly (sales enablement), and Conversica (conversation intelligence) focus on specific aspects of revenue operations, driving measurable improvements through specialized tools. These companies excel in their niches, making them attractive targets for larger platforms seeking to enhance their capabilities. For example, Mediafly has acquired over six companies, including most recently InsightSquared, to build out its RevOps platform.

All-in-one Platforms

All-in-one platforms like Revenue.io(sales engagement), LeanData (revenue operations), and Apollo.io (sales engagement) integrate various capabilities into a single solution, simplifying revenue operations for businesses. These platforms address the rising costs and complexity associated with managing multiple SaaS products.

Consolidation in the market addresses a significant challenge for businesses: managing the rising costs associated with multiple SaaS products. According to a survey by Zippia, businesses spend an average of $2,623 on SaaS per employee annually, with each employee using more than 8.3 SaaS apps.9

Expansion from point solutions to all-in-one platforms will occur as evidenced by Gong, which was initially focused on conversation intelligence and has expanded its suite by acquiring companies like Vayo, Wingman, and Scribis Technology, enhancing its features and boosting its valuation to over $7 billion. This strategy reinforces Activant’s 3rd-generation FP&A Tools research thesis that investing in consolidation is key to future market success.

Conclusion

For too long, RevOps has been either an afterthought or deemed too complex to implement effectively. As a result, companies often face inefficiencies and missed revenue opportunities. With the increasing adoption of AI, these challenges are becoming even more pronounced. It’s time for organizations to prioritize RevOps, making it the foundation of their business strategy to streamline operations, enhance sales effectiveness, and drive sustainable growth. Given the close ties with AI, we are excited about the innovation and growth that will inevitably transform the RevOps landscape.

The future will see not only an increase in sales-side agents but also the emergence of buy-side agents, who will curate recommendations by interacting with multiple sales agents to find the best fit for buyers.”

Siva Surendira, CEO & Founder, Lyzr.ai

If our work resonates, if you're building in the space, or if you have a different perspective, please reach out – we’d love to hear from you!

Endnotes

[1] Salesloft, 2023 State of Revenue Engagement Benchmark Survey, October 2023

[2] Forbes, Revenue Operations is the fastest growing job in America, December 2023

[3] Salesloft, 2023 State of Revenue Engagement Benchmark Survey, October 2023

[4] Future Market Insights Inc., RevOps Platform Market Size, 2024

[5] Garner, Market Guide for Revenue Intelligence Platforms, 2023.

[6] Goldman Sachs Research, AI investment forecast to approach $200billion globally by 2025, 2023

[7] PwC, Global M&A trends in health industries, 2024

[8] EY, CEO Outlook Pulse survey, 2023

[9] Zippia, 30 SAAS Industry Statistics [2023]: Trends + Analysis, 2023

The information contained herein is provided for informational purposes only and should not be construed as investment advice. The opinions, views, forecasts, performance, estimates, etc. expressed herein are subject to change without notice. Certain statements contained herein reflect the subjective views and opinions of Activant. Past performance is not indicative of future results. No representation is made that any investment will or is likely to achieve its objectives. All investments involve risk and may result in loss. This newsletter does not constitute an offer to sell or a solicitation of an offer to buy any security. Activant does not provide tax or legal advice and you are encouraged to seek the advice of a tax or legal professional regarding your individual circumstances.

This content may not under any circumstances be relied upon when making a decision to invest in any fund or investment, including those managed by Activant. Certain information contained in here has been obtained from third-party sources, including from portfolio companies of funds managed by Activant. While taken from sources believed to be reliable, Activant has not independently verified such information and makes no representations about the current or enduring accuracy of the information or its appropriateness for a given situation.

Activant does not solicit or make its services available to the public. The content provided herein may include information regarding past and/or present portfolio companies or investments managed by Activant, its affiliates and/or personnel. References to specific companies are for illustrative purposes only and do not necessarily reflect Activant investments. It should not be assumed that investments made in the future will have similar characteristics. Please see “full list of investments” at https://activantcapital.com/companies/ for a full list of investments. Any portfolio companies discussed herein should not be assumed to have been profitable. Certain information herein constitutes “forward-looking statements.” All forward-looking statements represent only the intent and belief of Activant as of the date such statements were made. None of Activant or any of its affiliates (i) assumes any responsibility for the accuracy and completeness of any forward-looking statements or (ii) undertakes any obligation to disseminate any updates or revisions to any forward-looking statement contained herein to reflect any change in their expectation with regard thereto or any change in events, conditions or circumstances on which any such statement is based. Due to various risks and uncertainties, actual events or results may differ materially from those reflected or contemplated in such forward-looking statements.