Topic

Automation

Published

February 2025

Reading time

16 minutes

Vertical Software Is Having A Moment

Why vertical SaaS is causing industries to rethink software

Vertical Software Is Having A Moment

Download ArticleResearch

The perception of vertical software has changed substantially over the past decade. While there are many reasons to like vertical software, many have viewed it as the poor cousin of enterprise software, which has a one-size-fits-all approach and promises a larger addressable market and greater potential to scale. However, its challenges include fragmented technology stacks, shifting regulatory requirements and complex workflows. Today, segment-specific software isn’t just competing with enterprise solutions, it’s frequently outperforming them. The result is superior efficiency metrics, lower customer churn, and streamlined go-to-market motions.1

More than 40% of software companies are increasing their specialization in existing industries and almost a third are expanding to additional industries.2 Even the largest enterprise software companies have specialized their sales organizations and product features for verticals in which they have significant scale. Cloud giants Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform (GCP) prominently feature vertical industry solutions with dedicated sales teams, as do other large platforms like Salesforce, ServiceNow, Snowflake and Workday.3We believe the future of software is vertical, which is resulting in a reshaping of the software industry, creating significant opportunities for both established players and innovative startups alike.

The Ascension of Vertical SaaS

Vertical SaaS is outpacing traditional enterprise software growth by a significant margin. While enterprise software grew at 11.1% in 2023 with a projected CAGR of 9.6% through 2032, vertical SaaS is accelerating faster, with forecast growth rates reaching 12.3% to 15.2% through 2034.4,5,6,7 We believe this divergence signals a fundamental shift in the software industry, driven by several powerful market forces that are likely to amplify in the coming years:

1. Rising customer expectations mean that organizations are increasingly looking for tools that are preconfigured for industry-specific use cases, reducing implementation times and costs. Companies want tailored solutions that seamlessly integrate with both existing workflows and regulatory requirements. The limitations of horizontal solutions are apparent – companies with fewer than 50 employees now juggle an average of 16 different SaaS applications, creating unnecessary complexity and reduced productivity. 8 This fragmentation has created a compelling opportunity for vertical solutions to streamline operations.

2. The acceleration of digital initiatives has expanded the total addressable market (TAM) for vertical solutions– 91% of businesses are engaged in some form of digital initiative and 87% of senior business leaders say digitization is a priority.9 By simplifying workflows and increasing efficiency, vertical SaaS improves both the user and end customer experience. This has transformed vertical SaaS products from nice-to-have tools into essential business infrastructure, creating powerful product stickiness and sustainable competitive advantages.

3. While the traditional view is that vertical software TAM is smaller than horizontal, we believe that these companies can trade market size for market share. Vertical SaaS companies often achieve higher market penetration than horizontal SaaS owing to their specialized focus and targeted go-to-market strategies. For example, Shopify today powers close to 29% of all ecommerce websites. Some companies within vertical markets have even been able to achieve as much as 50%+ market penetration such as fitness management software platform Mindbody, which has captured a 61.5% market share.10,11

4. Vertical SaaS players have unlocked multiple powerful revenue levers that drive growth. By embedding themselves within core industry workflows, these companies can identify and capitalize on product expansion opportunities that may not be apparent to horizontal players. This deep industry expertise allows them to anticipate customer needs and develop complementary solutions that solve specific vertical challenges. This specialized approach translates directly to the bottom line – verticalization correlates with a 10-20% increase in year-over-year revenue growth for B2B businesses.12

5. The natural progression into integrated fintech solutions unlocks significant new revenue potential, with platforms typically seeing 2-5x increases in revenue, retention, and other metrics after embedding payments.13 These expansions make platforms increasingly essential to daily operations. This "land and expand" strategy is especially effective in vertical markets, where deep industry knowledge enables natural upsell and cross-sell opportunities.

6. The focused nature of vertical SaaS translates directly to operational efficiency. Research reveals a striking difference in sales and marketing efficiency: vertical SaaS players maintain an average S&M-to-revenue ratio of 17%, compared to 34% for horizontal vendors.14 This advantage stems from more targeted R&D spending, specialized sales teams, and focused customer support operations that better serve their specific market segments.

7. While these traditional growth drivers are compelling on their own, artificial intelligence (AI) is completely transforming vertical SaaS. Just as the rise of cloud computing revolutionized software delivery a decade ago, so we believe AI – particularly the recent LLM revolution – is fundamentally reshaping the vertical software landscape in three critical ways:

- Decreased software costs - AI has lowered software development costs, enabling solutions for previously underserved niches. An example is Spark, GitHubs’ AI-powered tool that automates the creation of web applications, allowing users to build custom apps using natural language prompts.

- Higher quality data insights - Vertical SaaS providers leverage specialized, proprietary data that better reflects industry patterns, resulting in more accurate and valuable AI models for specific use cases compared to horizontal solutions trained on broad datasets.

- Workflow efficiencies - By leveraging AI, vertical SaaS startups can automate complex workflows by reducing manual effort, improving efficiency, and enabling businesses to focus on higher-value tasks.

SaaS startups that effectively leverage AI tools as a system of intelligence to record and interpret data and then take actions based on that data will be the winners in this space. Customers want more than just a system of record. Capturing meaningful insights from the data and being able to act on them is how vertical software unlocks significant customer value, enabled by AI.

These growth drivers are secular and enduring, representing a fundamental shift in how software will be developed, sold, and deployed in the coming decades. We see great potential in players tapping into this space and believe these solutions will continue to outperform broader enterprise software offerings.

Typical Growth Paths

Our research on the growth of vertical SaaS players highlights a series of common steps that the most successful players have followed.

1. Find markets ripe for innovation – pursuing an industry that previously lacked access to software is the most common approach. These opportunities exist in traditional industries where digital transformation is just beginning to take hold.

2. Target an industry pain point – new solutions can arise by identifying underserved problems as horizontal players are often unable to offer comprehensive solutions. Tobi Lutke started Shopify as a solution to the challenges of building an online website. Similarly, Square was launched to address the issues of small merchants in accepting credit card payments.

3. Develop a multi-product platform – vertical SaaS platforms grow by leveraging industry expertise to expand into complementary products. By solving multiple sector pain points, they create natural upsell opportunities that deepen customer relationships and increase revenue per user, while becoming vital to daily operations.

4. Open up new revenue streams – starting with core software solutions, vertical SaaS players can expand into integrated payments and lending. This expansion is particularly powerful in verticals with significant payment volumes or underserved financial needs.

5. Incorporate AI to add value – AI takes vertical software solutions to the next level by increasing efficiency. When implemented properly, AI is the enabler that unlocks the data collected by vertical SaaS players.

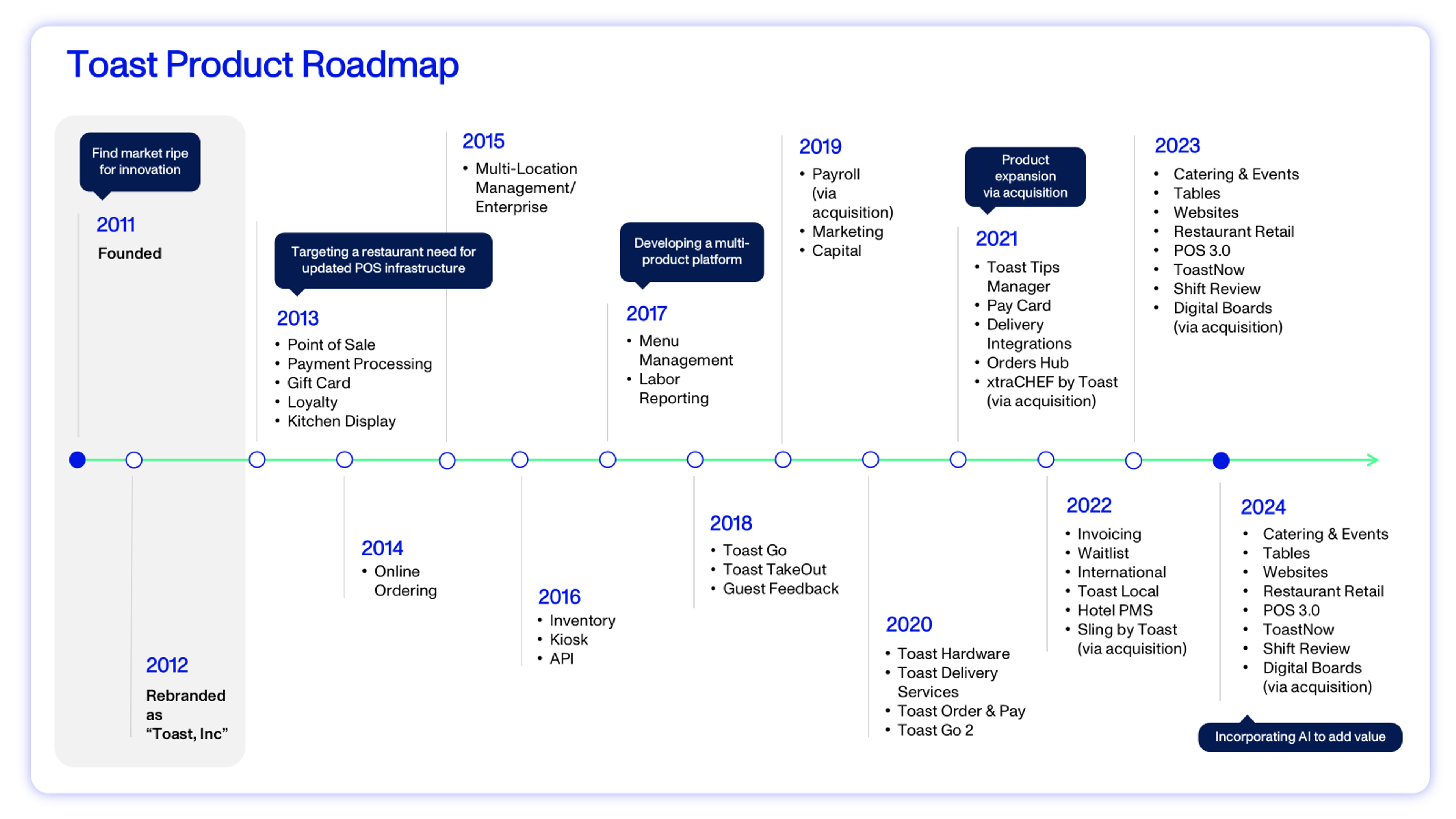

Toast, the Vertical SaaS Powerhouse, Proved It Could Be Done

Toast, the $12Bn operating system for restaurants, illustrates these principles in action. This is a crown jewel of the vertical SaaS industry, having successfully completed its IPO in 2021, and serving more than 113,000 restaurants in the US today. Toast has become the definitive case study for vertical SaaS success, demonstrating how theoretical advantages can translate into market dominance.

Targeting a Lagging Industry

Toast successfully targeted the restaurant industry which was notably behind in technology adoption. The industry was heavily reliant on legacy point-of-sale systems and manual processes when Toast entered the market in 2011.

Vertical SaaS players need to be able to identify when a market is ready for innovation. As more industries become modernized, companies are looking for tech-native solutions to solve industry pain points.

Identifying a Well-defined Underserved Market Need

Toast's all-in-one platform offered a comprehensive solution, addressing multiple pain points:

- Modernization: Toast provided a modern, cloud-based POS system, replacing outdated and inefficient legacy systems.

- Data-Driven Insights: Toast offered valuable data insights to help restaurants optimize operations and make informed decisions.

- Integration: The platform integrated seamlessly with other restaurant operations, such as inventory management, payroll, and online ordering.

Becoming a Multiproduct Platform

Toast's journey from a consumer app to a comprehensive restaurant operating system illustrates the power of the multiproduct platform strategy. Toast’s historical net revenue retention rates of 121% (2020-2023) prove that shifting from a point solution to a back-of-house management system was essential in ensuring a sticky customer base.15 The learning is clear: a solution that truly embeds itself within the day-to-day operations of a restaurant becomes indispensable.

The exhibit below highlights the rapid product expansion of Toast and shows some of the platform capabilities including payment processing, point of sale, kitchen display systems, built-in integrations, reporting, and handhelds.

Research

For any vertical SaaS company aiming to replicate Toast's success, it’s essential to uncover both unmet customer needs and critical points of interaction within their business operations.

Expanding TAM and Opening Up New Revenue Streams by Embedding Fintech

Toast exemplifies how vertical SaaS players can leverage fintech integration to expand their TAM and revenue opportunities. Toast has a 13% share of the arguably small 875K US restaurant market but has created greater opportunities because of their fintech integration.16

Toast's fintech strategy offers a masterclass in how vertical SaaS companies can dramatically expand their revenue potential beyond traditional subscription models. What began as a natural extension of their platform – payment processing – has evolved into their primary revenue engine, with fintech solutions now accounting for 82% of total revenue compared to 18% from traditional SaaS subscriptions.17 We believe Toast's fintech success demonstrates a crucial truth about vertical SaaS: becoming the operating system for a specific industry opens doors to revenue opportunities far beyond traditional software subscriptions.

Incorporating AI to Boost Customer Value

Toast's implementation of AI provides a concrete example of how AI is transforming vertical software. In an industry where less than one-third of operators currently use AI, Toast has positioned itself at the forefront of innovation.18 Its timing is impeccable – 71.6% of restaurant operators plan to adopt AI soon, with nearly 94% acknowledging its necessity to remain competitive in the evolving landscape of food service.19

Toast's AI initiatives demonstrate exactly how vertical players can evolve from systems of record to systems of intelligence:

- AI-powered writing assistant for restaurant email marketing, enabling smaller establishments to compete with larger chains.

- Sous Chef tool: an AI chat assistant providing actionable operational insights.

- Data-driven insights that transform raw data into competitive advantages.

AI will ultimately help vertical SaaS players like Toast to become a necessity, as the advantages gained from these tools will be key to remaining competitive.

Identifying the Next Vertical SaaS Opportunities

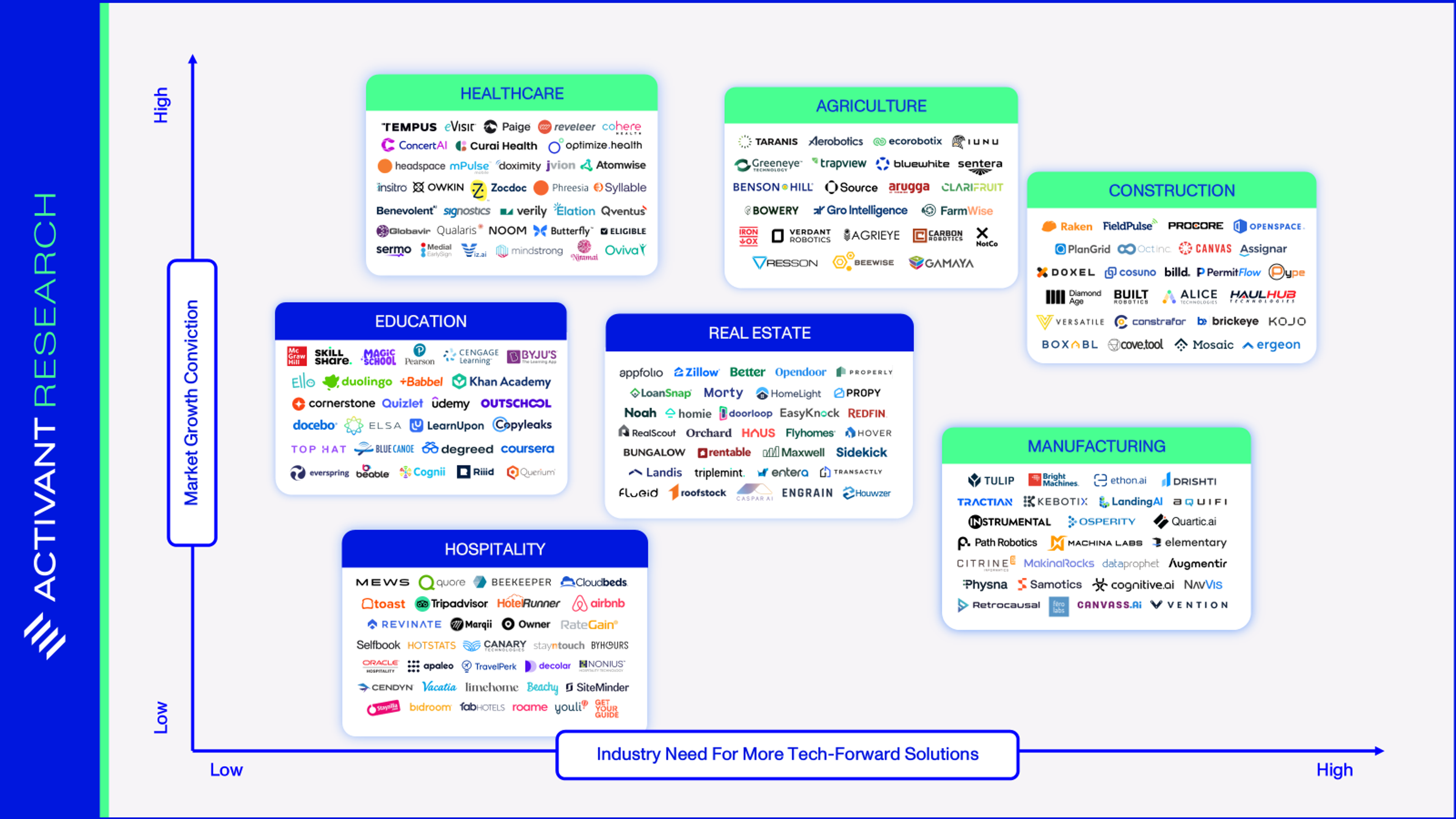

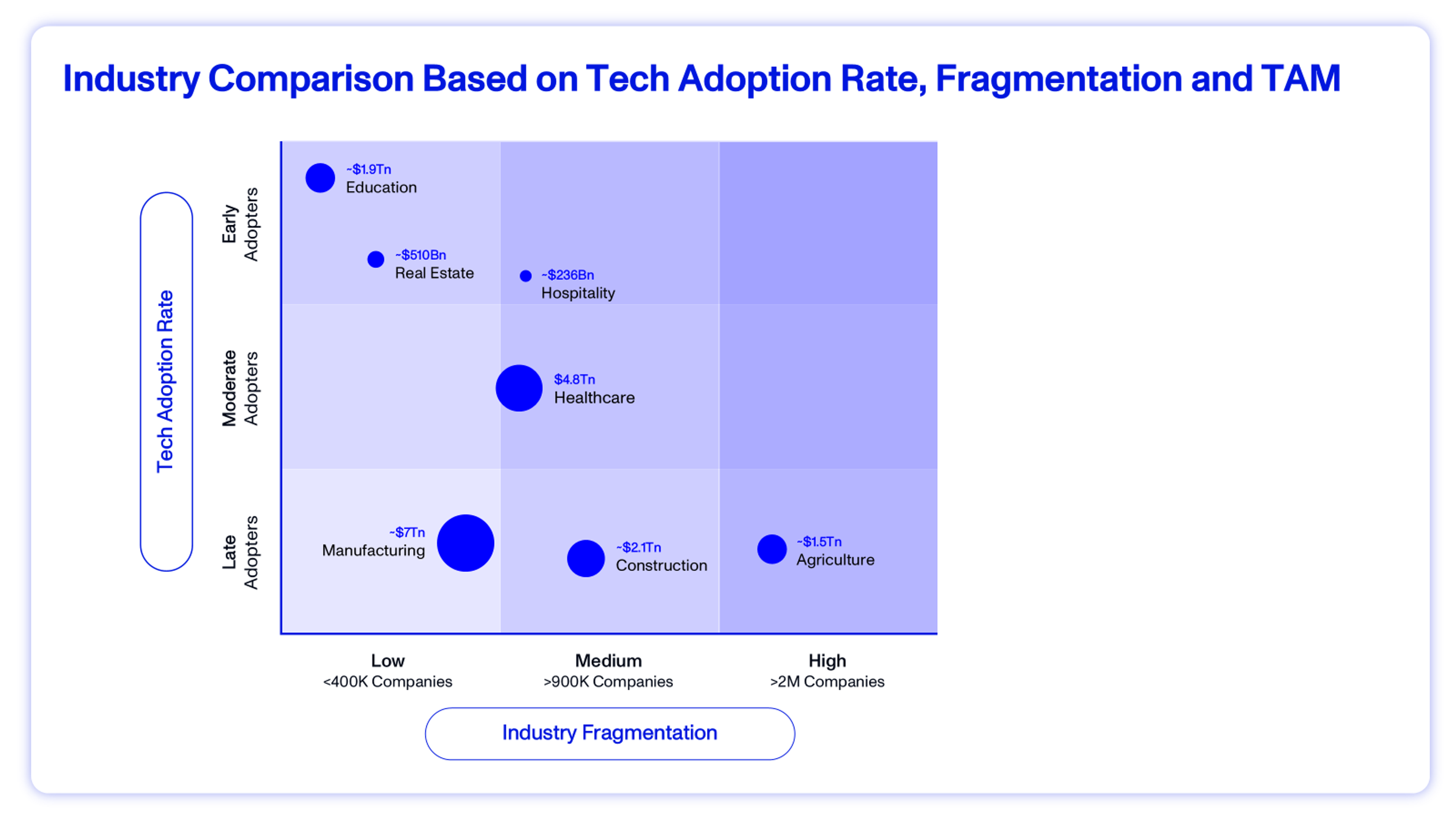

Having illustrated the potential of vertical SaaS, let’s consider which industries are primed for the next wave of disruption. Building on our discussion of market capture strategies, we've developed a framework to evaluate vertical opportunities based on three critical factors: industry fragmentation, current technology adoption rates and market size (TAM).

Not all verticals are created equal. Our research established that vertical SaaS companies have proven to be successful in fragmented industries. However, targeting an industry that is highly fragmented makes the go-to-market extremely difficult. The general rule still applies that greater revenue opportunities exist in large end markets. Lastly, when looking at tech adoption rates, industries that are late or moderate adopters are likely riper for disruption. Moderate adopters would be a sweet spot for vertical SaaS given that they have the infrastructure to be able to plug-and-play new software but are still behind the curve in terms of rapid industry modernization.

The chart below uses our framework to help us identify multiple areas that we believe are most ready for vertical SaaS solutions. The three markets that score highest on our criteria are construction, manufacturing, and healthcare, which we predict will experience a meaningful increase in vertical software adoption.

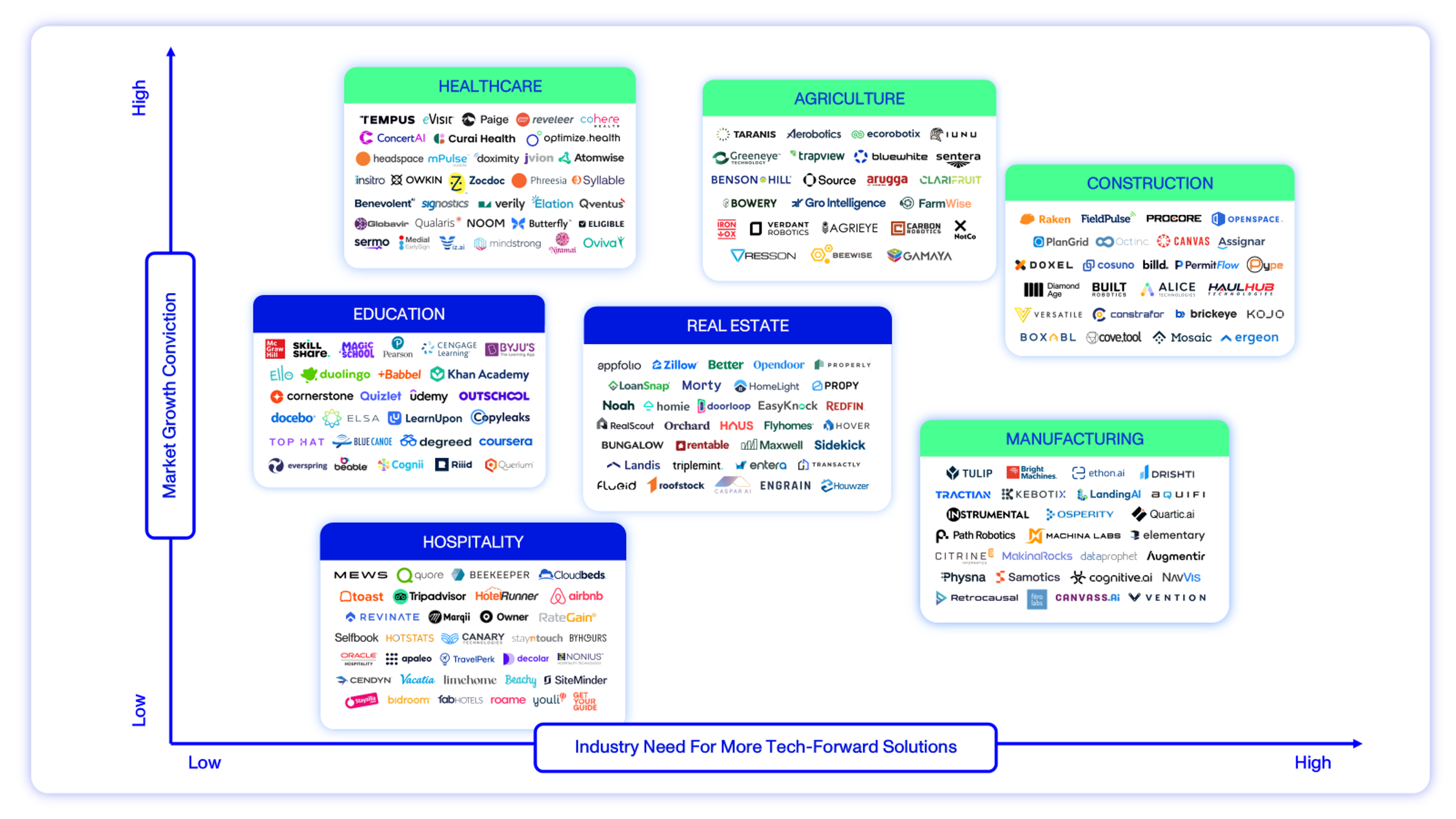

Research

This analysis helped us to create a market map showing the sectors with potential for increased software adoption.20 We believe that these industries will benefit from the next wave of AI-enabled vertical SaaS startups. However, this map is by no means exhaustive. Below we give some insights into each sector and highlight some of the startups that stood out to us.

Activant Market Map

Thesis Map

1. Construction presents the most compelling immediate opportunity. This market is reaching an inflection point with 70% of construction companies facing challenges in implementing new technologies, and 97% planning increased digital investment within three years.21,22 Success stories such as Procore, the listed ~$8Bn construction management SaaS, validate this market’s potential.

Interesting players: Raken is capitalizing on rapid digitization and rising customer expectations by transforming field operations and project management. Its mobile-first approach allows field workers to easily capture and share information directly from the job site. Alice Technologies offers an optimization platform for built construction. The ROI for the platform includes a 17% reduction in project duration and a 14% saving in labor costs. Doxel uses AI to automate progress reports for construction, allowing project managers to accelerate schedules by 11% on average. Versatile is bringing data-driven precision to construction through its use of machine learning and AI.

2. Manufacturing was largely bypassed by recent software innovation waves, and represents another significant opportunity. Our work on Industrial IoT and Industrial Intelligence found that there is a need for startups that can unlock insights hidden in operational data. Software players that have a clear use case for manufacturers and can effectively generate ROI will ultimately be the winners in the space.

Interesting players: Tulip Interfaces provides a platform that allows manufacturers to digitize their operations, improving efficiency and productivity. MakinaRocks provides machine learning solutions and an MLOps platform to accelerate and scale the industrial sector’s transition to AI. We are also impressed by Instrumental, which assists engineering and operations teams in finding and fixing product issues with data and AI.

3. Healthcare rounds out our top three, with more than 70% of US adults reporting that the healthcare system is failing to meet their needs in at least one way.23 Globally, the healthcare sector has seen some software adoption, but not enough to drive real efficiency. Often the problem does not lie in the technology itself, but rather the barriers to digital transformation, which McKinsey identified as culture and mindset, organizational structure and governance.24

Interesting Players: We’re excited about Curai Health, a virtual care company that uses AI to provide chat-based primary care at a lower cost. Qventus focuses on optimizing decisions in hospitals in real time by using AI to leverage historical and real time EHR to predict operational bottlenecks, recommend remedies and automate processes.

4. Agriculture is changing rapidly and embracing data and digital, particularly in markets with large commercial farms like the US, as highlighted in our work on Food and Agriculture Traceability. With 85% of farmers now implementing at least one precision agriculture technique, the sector is becoming increasingly data-driven.25 Success in this market will depend on solutions that can effectively organize and interpret operational data to drive efficiency gains.

Interesting Players: Activant portfolio company, Benson Hill, provides a crop design platform to aid the development of healthier and more sustainable food and ingredients. Verdant Robotics builds AI-powered smart sprayers that weed, thin, fertilize and deliver nutrients at millimetre level. Aerobotics provides intelligent tools for optimal perennial crop farming practices.

5. Real Estate is already a largely tech-forward sector. The PropTech revolution, which began with Trulia and Zillow in 2005-2006, has evolved significantly. We believe AI represents the next frontier, with McKinsey estimating potential value creation of $110-180 billion or more within the real estate industry.26

Interesting Players: Roofstock is an online marketplace for investing in rental properties that uses AI to analyze property performance and identify investment opportunities. Zillow is a leading real estate marketplace that offers services ranging from home and rental listings to mortgage financing. Better, an Activant portfolio company, offers a full-stack platform that spans mortgage, brokerage and insurance.

6. Hospitality presents mixed opportunities. While 60% of hospitality operators have dedicated digital transformation roles, 73% of operators agree that hospitality is behind other industries when it comes to digital transformation.27 Most industry technology adoption focuses on customer-facing solutions, rather than back-of-house operations.28 With two-thirds of operators using multiple technology suppliers, solutions that can consolidate operations while leveraging AI for personalization and cost reduction will likely capture significant market share.29

Interesting Players: Canary Technologies offers a hospitality management system that drives efficiency and enhances the guest experience. SiteMinder offers a platform that provides a comprehensive suite of tools for hotel distribution.

7. Education is a highly fragmented sector but has already experienced an uptick in software solutions. This was boosted by the pandemic and the subsequent adoption of online learning and remote work. Furthermore, large firms see employee upskilling and reskilling as a priority, aided by the widespread use of Learning Management Systems (LMS). The next wave of innovation will center on AI integration, particularly in adaptive learning platforms, content creation, administrative efficiency, and personalized learning experiences.

Interesting Players: Startups such as Elsa, an AI-embedded English language learning platform, are attractive to both schools and businesses, resulting in a sizeable market. Magic School provides various AI tools, including lesson planning, assessment creation, differentiation and communication, to assist teachers with their diverse tasks.

These sectors all offer opportunities for vertical SaaS solutions at varying stages of the digital transformation journey. While some industries like construction, manufacturing and healthcare present immediate opportunities due to clear pain points and market readiness, others like agriculture and education are building momentum for the next wave of adoption. What unifies these opportunities is timing – we believe the confluence of AI advancement, increasing digital acceptance, and growing demand for industry-specific solutions creates a unique moment for vertical SaaS expansion

Final Thoughts

As we reflect on the journey that software has been on over the past decade or so, we are optimistic about the future of vertical SaaS and the value that it will be able to deliver. Vertical SaaS companies are uniquely positioned to capitalize on the inevitable digitization of industries. By focusing on specific industry needs, these companies can offer tailored solutions, deeper customer relationships, and higher retention rates. As industries like construction, manufacturing and healthcare continue to digitize, we can expect a wave of successful vertical SaaS startups to emerge.

We’re just getting started with our research in this space – be sure to keep an eye out for more to come! As always, if you have a different view or are building in this space, we’d love to hear from you.

Endnotes

[1] Scale, These Misconceptions about vertical software need to fade away, 2023

[2] BCG, Your Software Customers Need a Tailored Industry Approach, 2023

[3] TechCrunch, Vertical AI: The next logical iteration of vertical SaaS, 2023

[4] Gartner, Market Share Analysis: Enterprise Software 2023, 2024

[5] Expert Market Research, Global Software Market Report and Forecast 2024-2023, 2023

[6] Cognitive Market Research, Vertical Market Software Market Report, 2024

[7] The Business Research Company, Global Vertical Market Software Market Research, 2024

[8] BetterCloud, State of SaaSOps, 2020

[9] Gartner, Digital Transformation: How to Scope and Execute Strategy, 2023

[10] Bessemer Venture Partners, Ten lessons from a decade of vertical software investing, 2022

[11] Datanyze, Mindbody, 2024

[12] BCG, Your Software Customers Need a Tailored Industry Approach, 2023

[13] Matt Brown Substack, The secrets to pricing payments in vertical software, 2024

[14] Main Capital Partners, Vertical versus Horizontal Software, 2024

[15] Seeking Alpha, Toast: Shaping Up Into A Real Winner, 2024

[16] Ibid

[17] Fractal Software, Lessons from Toast on Multiproduct Vertical SaaS, 2022

[18] Slang.ai, Slang.ai Announces New Survey Data About I Adoption and Interest in Restaurant Industry, 2024

[19] Ibid

[20] The level of industry fragmentation is based on the number of companies in the sector, as well as the market concentration of the largest enterprises in the space. The majority of this data was taken from Ibis World. The tech adoption rate is our own estimate that was guided by several sources including the Harvard Business Review & McKinsey. Lastly, the TAM for each sector was taken from various market research reports.

[21] IT Brief United Kingdom, Construction industry’s struggle with technology adoption, 2023

[22] Ibid

[23] Time, Exclusive: More than 70% of US adults feel the healthcare system is failing to meet their needs in at least one way, 2023

[24] Ibid

[25] Zipdo, Technology in Farming Statistics: Innovations Boosts Yields and Efficiency, 2024

[26] McKinsey, Generative AI can change real estate, but the industrymust change to reap the benefits, 2023

[27] Ibid

[28] Ibid

[29] Vita Mojo, The Digital Transformation of Hospitality Report, 2021

The information contained herein is provided for informational purposes only and should not be construed as investment advice. The opinions, views, forecasts, performance, estimates, etc. expressed herein are subject to change without notice. Certain statements contained herein reflect the subjective views and opinions of Activant. Past performance is not indicative of future results. No representation is made that any investment will or is likely to achieve its objectives. All investments involve risk and may result in loss. This newsletter does not constitute an offer to sell or a solicitation of an offer to buy any security. Activant does not provide tax or legal advice and you are encouraged to seek the advice of a tax or legal professional regarding your individual circumstances.

This content may not under any circumstances be relied upon when making a decision to invest in any fund or investment, including those managed by Activant. Certain information contained in here has been obtained from third-party sources, including from portfolio companies of funds managed by Activant. While taken from sources believed to be reliable, Activant has not independently verified such information and makes no representations about the current or enduring accuracy of the information or its appropriateness for a given situation.

Activant does not solicit or make its services available to the public. The content provided herein may include information regarding past and/or present portfolio companies or investments managed by Activant, its affiliates and/or personnel. References to specific companies are for illustrative purposes only and do not necessarily reflect Activant investments. It should not be assumed that investments made in the future will have similar characteristics. Please see “full list of investments” at https://activantcapital.com/companies/ for a full list of investments. Any portfolio companies discussed herein should not be assumed to have been profitable. Certain information herein constitutes “forward-looking statements.” All forward-looking statements represent only the intent and belief of Activant as of the date such statements were made. None of Activant or any of its affiliates (i) assumes any responsibility for the accuracy and completeness of any forward-looking statements or (ii) undertakes any obligation to disseminate any updates or revisions to any forward-looking statement contained herein to reflect any change in their expectation with regard thereto or any change in events, conditions or circumstances on which any such statement is based. Due to various risks and uncertainties, actual events or results may differ materially from those reflected or contemplated in such forward-looking statements.